Blockchain analytics report: Institutional ownership of crypto ‘could flip retail’

Institutional crypto flip? Possible. (Getty Images)

Despite current uncertainty and bearish signs in the markets, a new report from blockchain analytics firm Nansen hints at continued growth in the crypto industry as 2022 progresses.

The analytics company has just released its State of the Crypto Industry Report 2021, shared with Stockhead, highlighting notable trends and insights gleaned from the past year.

Studying more than 100 million labelled crypto wallets and their activity on Ethereum, Polygon, Avalanche, and numerous other L1 and L2 blockchains, Nansen’s report also makes a few predictions for the year ahead.

The report breaks down five major trends: L1 and L2s, DeFi, NFTs, P2E/gaming and DAOs. “In 2022, expect to see all these themes strengthen,” writes Nansen CEO Alex Svanevik, adding:

“Multi-chain, DeFi, and NFTs are here to stay. In particular NFTs have already started the year strong, and we’ve only scratched the surface of their potential in gaming, art, and social networks.”

Here are some more key takeaways for the year ahead that we’ve gleaned from the report…

Overall 2022 outlook and predictions

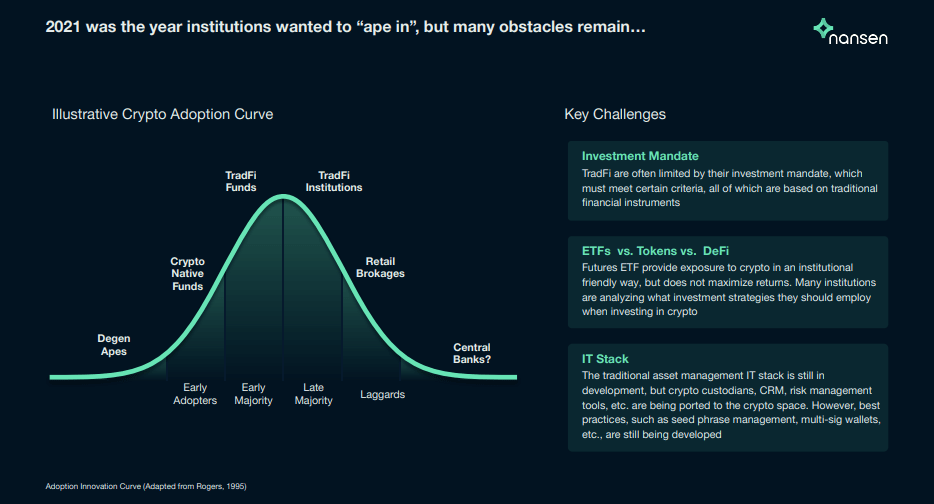

• Crypto ownership from institutional investors will boom in 2022, possibly flipping that of retail.

• Obstacles, however, still remain for adoption from institutions themselves. (See “Key Challenges” on chart below.)

• Demand for crypto assets will most likely outpace regulatory progress this year.

• “Inflation concerns and US Federal Reserve actions will act as a drag on the real economy, which can make crypto look more attractive by comparison.”

• Crypto lend/borrow and options will likely see further adoption by institutions as more of them explore this industry.

• Perhaps surprisingly, the report suggests “few companies will hold BTC directly on their balance sheet like Tesla or MicroStrategy”.

• However, the opportunity to pay using crypto “might finally make it into the mainstream”.

L1 and L2 blockchains

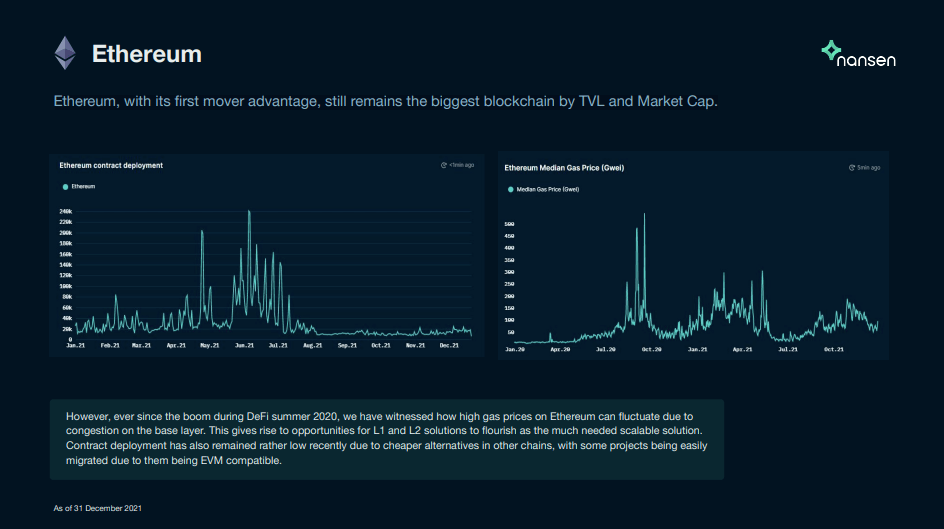

The Nansen report also indicates Layer 1 and Layer 2 blockchains should continue to do “particularly well” this year, with the main winners displaying the best-quality decentralised applications, ease of bridging and lower fees.

Ethereum’s “first-mover advantage” kept the popular L1 in the lead in 2021 by both market cap and TVL (Total Value Locked). Meanwhile, the Uniswap AMM/DEX was the most dominant application on Ethereum, responsible for more than 30 per cent of the gas consumed by “the top 20 entities”.

Notable statistics for some other major blockchains include:

• Polygon facilitates 300% more transactions than Ethereum, but the daily gas paid (in USD terms) is often less than 0.5% of gas fees paid on Ethereum.

• Binance Smart Chain’s daily active addresses are the highest among all L1s. At its peak in late November, the daily transactions on BSC hit 1,345% of Ethereum’s.

• Fantom Foundation announced a US$370m FTM grant program in September 2021, daily active addresses on Fantom increased 440%, and TVL went from ~$1B to over $6B in November.

DeFi, stablecoins, NFTs and gaming

Further key insights from the report on how crypto played out in 2021 include:

• DeFi grew 1,120% in 2021 based on TVL (Total Volume Locked).

• The value distribution of stablecoins showed that whale wallets with mote than US$1 million made up more than 50% of stablecoin volume through 2021, which has been steadily increasing.

• As the NFT market grew, the end of 2021 resulted in a total sales volume that surpassed 4.6m ETH (about US$17 billion).

• DAOs (decentralised autonomous organisations) gained popularity, with ConstitutionDAO setting records by raising US$47 million in the form of ETH from over 17,000 participants, showing the power of people coming together for a common purpose.

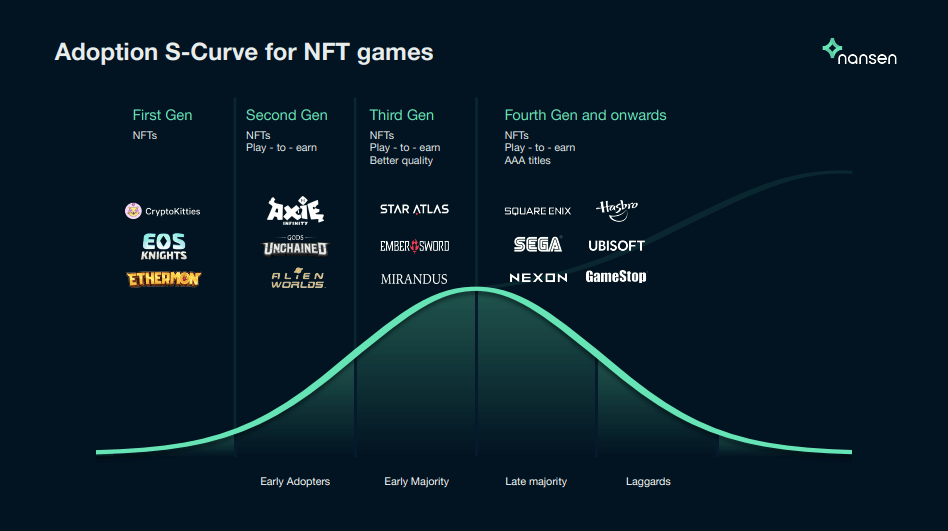

• Axie Infinity was the most popular play-to-earn game last year (no surprises there), which led at an annual revenue figure of $1.3 billion. At its peak on August 6, 2021, Axie generated $17.5 million in just one day.

• Gaming utility, NFTs and the metaverse, growing trends in 2021, will continue to grow according to indications from Nansen’s data and analysis. “We expect supply to catch up with demand and the best projects to emerge as clear winners.”

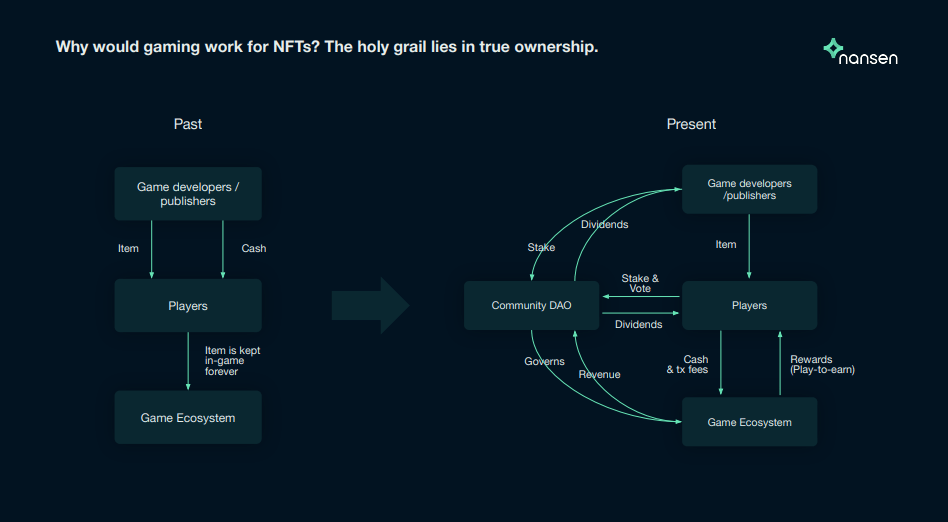

These two charts from the report give a nice breakdown of the adoption curve for the buzzy play-to-earn NFT gaming sector, and provide an explanation of the value shift from traditional gaming.

The report also makes note of Nansen’s “Smart Money” service, which allows users to track what the best DeFi and NFT players in the space are up to in real time.

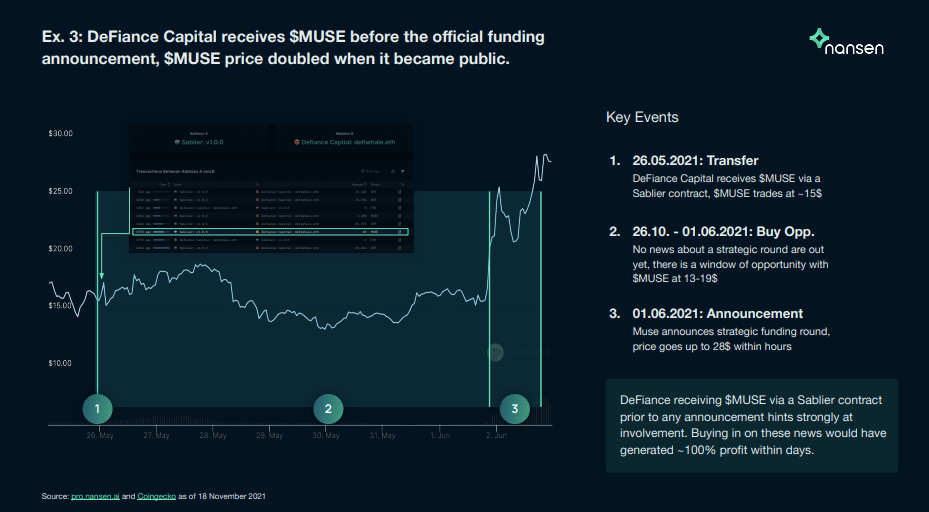

And Nansen cites a handful of examples from its real-time, on-chain analysis last year that might have proven to be valuable information to traders and investors. For example, one where DeFiance Capital received $MUSE prior to the official funding announcement, followed by a doubling of the token price upon public launch…

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.