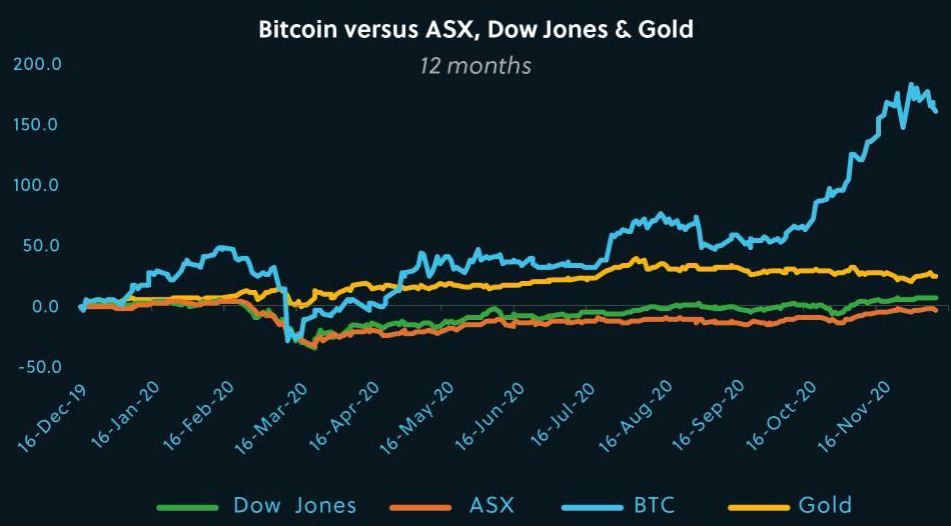

Bitcoin’s payday to Australian investors in 2020 has dwarfed returns from the ASX, US shares and gold

Pic: metamorworks / iStock / Getty Images Plus via Getty Images

- Bitcoin is up 226 per cent this year in Australian dollar terms

- ‘The popularity of cryptocurrencies…has been growing at unprecedented levels’

- Cryptocurrency’s outsized gains dwarf returns from ASX and US share indexes

The market leader in cryptocurrencies, Bitcoin has notched up a record-breaking return this year in Australian currency terms that has outpaced the gains on other assets including Australian and US stock indexes and gold.

After a volatile year of trading, Bitcoin was trading Wednesday at $31,084 ($US23,434), and is up 226 per cent for the year after starting 2020 at $9,524 ($US7,120).

The gains in US dollar currency for the year in Bitcoin are slightly higher at 229 per cent from January 1 to date.

Gold in Australian dollars is up 47 per cent this year since early January, but only 41 per cent for the year in US currency.

“The appreciation in the price of Bitcoin is arguably built on a greater acceptance of digital tokens as well as a burgeoning class of investors who are not wedded to a traditional view of what constitutes a good or bad asset class,” said Dan Petrie, chief information officer at financial data analysis firm Grafa.

In contrast, the US Dow Jones share index is up 6.4 per cent this year, and the ASX All Ordinaries basket of shares has risen 1.3 per cent.

Record low interest rates with cash deposits offering a return as low as 0.1 per cent, have spurred investors to seek better returns in equities and other assets.

Popularity of cryptoassets at unprecedented levels

The bull-run in cryptoassets has blind-sided many financial market participants who have been dismissive of cryptocurrencies, said Petrie.

“While volatility in Bitcoin has been widely reported on, the popularity of cryptocurrencies and subsequent applications of blockchain technologies within the wider digital economy have been growing at unprecedented levels,” he said.

In March 2020, a panic sell-off in equities over the spreading COVID-19 pandemic saw the value of share markets fall by as much as 30 per cent from January levels.

And, while equity markets had recovered most of their March losses by June, Bitcoin recovered quicker from its corresponding fall in the same period.

A resurgence in interest in digital currencies among a younger investor crowd has provided a strong tailwind for Bitcoin’s recent gains, said Petrie.

Since July, the strength of the crypto market surge has seen Bitcoin testing historical highs, outperforming stock markets and trading at higher volumes with stronger demand from non-sophisticated investors chasing greater yields, he said.

Another interesting aspect of Bitcoin’s price rally is that the crypto asset has become detached from other financial assets since September time.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.