Bitcoin soars to nearly $40k in epic short squeeze, amid report Amazon to accept BTC

Getty Images

A few days ago Amazon’s founder flew into space on a dick-shaped rocket — now the e-commerce giant seems intent on sending Bitcoin into orbit.

The original cryptocurrency posted double-digit gains this morning to finally break out of the range it had been trading in for weeks, following an unconfirmed report that Amazon would accept crypto for payments before the end of the year.

BTC had a strong close to the week to finish at over US$35,000 for the first time in three weeks at 10am AEST (midnight UTC), and then pumped to nearly $US40,000 an hour later in an apparent short squeeze.

LOL, WTF just happened to #bitcoin! Almost hit 40k!!!! Bears in total disbelief at this point

— Lark Davis (@TheCryptoLark) July 26, 2021

Over 887,000 derivatives traders had seen positions totalling over US$1 billion liquidated in the past 24 hours, according to Bybt, with over US$704 million of that occurring in the past hour.

That’s the most liquidations since June 22, when $1.1 billion in positions were liquidated – mostly longs. Today 92 per cent of the positions liquidated were shorts.

On Binance, there was a massive US$8,000 spread between the spot price of Bitcoin and the price of Bitcoin futures. The BTC/Tether perpetual futures contract spiked from US$38,000 to US$48,000 in one massive green candle at 11am AEST, while spot BTC “only” jumped to US$39,500.

Short story of today’s binance fuckery

– got out of a long at 35300

– got short at 36300 and out at 37k

– short order got filled at 39.4 and got liquidated at 46k $btc $bnb #BinanceFutures #usdThank you @cz_binance

— cryptochanakya (@cryptochanakyaa) July 26, 2021

An hour earlier, Bitcoin had spiked from US$34,725 at 9.30am AEST to US$35,350 at 10am AEST, for a strong close to the week. (10am Sydney time is midnight UTC).

#Bitcoin strong weekly close compared to recent weeks but still a long way off Bull Market volumes we saw in 2020 and 2021.

Next target, >$36,000. pic.twitter.com/NU7RjxtYIV

— Jason Pizzino (@jasonpizzino) July 26, 2021

Everything is breaking out.

Feel sorry for those selling at 30k or even worse waiting for 20k LOLAs weekly chart closed above 35k i just see bullflag, bullflag, bullflag.

SEND IT!#Bitcoin #VeFam #Vechain #Ethereum #Crypto #Altseason #Bullrun #Beartrap $btc $vet $alts $eth

— A P O L L O Ⓥ (@fookelon) July 26, 2021

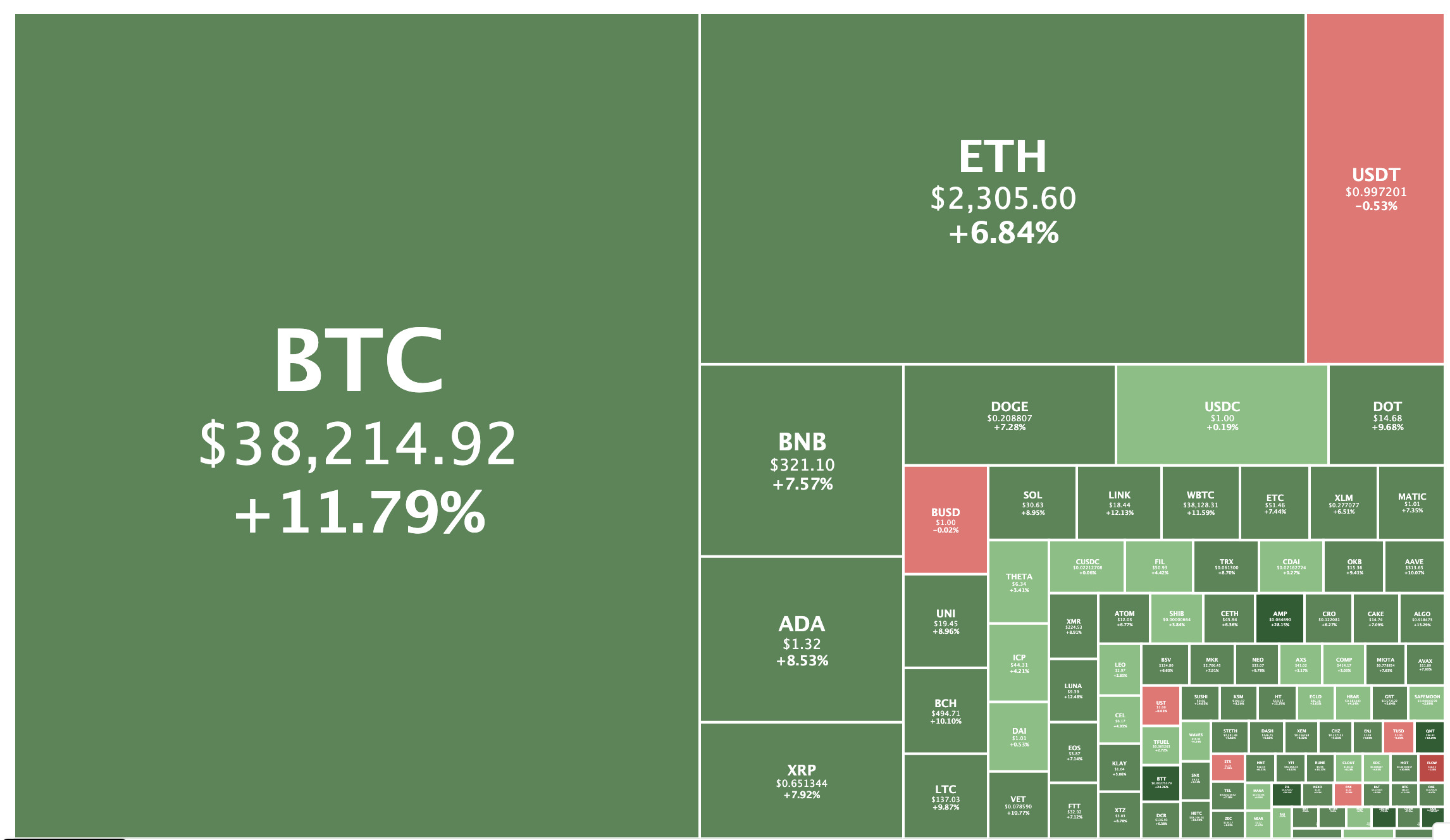

At noon AEST, Bitcoin was trading up 12.7 per cent to US$38,425 – its highest level since mid-June, when it briefly traded for over US$40,000.

Ethereum was changing hands for US$2,300, up 7.1 per cent.

Just four of the top 100 cryptos were in the red, most marginally. The worst performer was Flow, the blockchain for NFTs, which was down 7.3 per cent.

Axie Infinity was trading at US$40.47, up 3.8 per cent for the day and 111 per cent for the week.

It’s now the No. 48 crypto and yesterday reached an all-time high of US$49.20.

Lesser-known gaming tokens My DeFi Pet, Illuvium and Faraland were all at all-time highs as well.

Amazon to accept crypto?

Amp was the best-performing top 100 crypto, rising 26.4 per cent following the report yesterday that Amazon would accept Bitcoin payments before year-end. (Amp is used to collateralise crypto payments, making them instantaneous for merchants.)

“This isn’t just going through the motions to set up cryptocurrency payment solutions at some point in the future – this is a full-on, well-discussed, integral part of the future mechanism of how Amazon will work,” an “insider” told London business newspaper City A.M..

“It begins with Bitcoin – this is the key first stage of this crypto project, and the directive is coming from the very top… Jeff Bezos himself.”

“Ethereum, Cardano and Bitcoin Cash will be next in line before they bring about eight of the most popular cryptocurrencies online,” she added.

“It won’t take long because the plans are already there, and they have been working on them since 2019.”

Amazon hadn’t confirmed the report, but told CNBC, “We’re inspired by the innovation happening in the cryptocurrency space and are exploring what this could look like on Amazon.

“We believe the future will be built on new technologies that enable modern, fast, and inexpensive payments, and hope to bring that future to Amazon customers as soon as possible.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.