Bitcoin set to see biggest difficulty drop of all time on Saturday

Getty Images

Bitcoin will almost undoubtedly experience its largest downward difficultly adjustment in history this weekend following a crackdown in China that has led to a steep decline in mining hashpower.

For those new to crypto, Bitcoin transactions are bundled into blocks that are issued by miners who devote computing resources (“hashpower”) into solving mathematical puzzles.

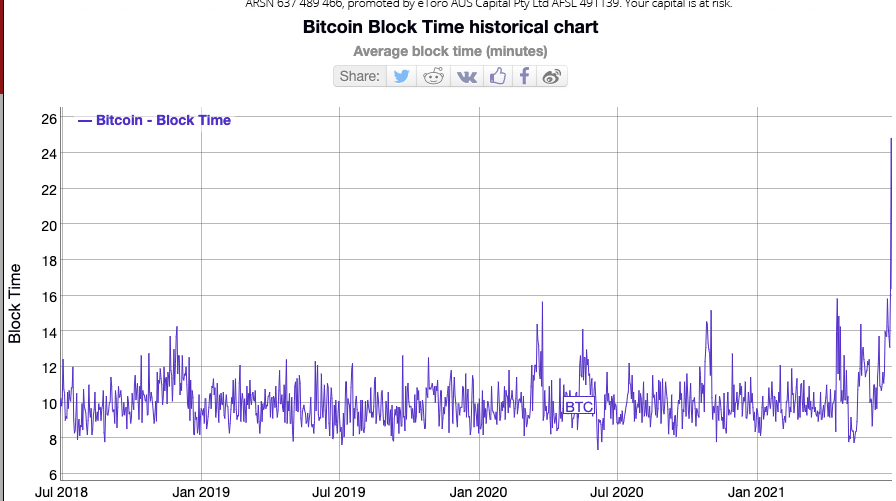

Because the computational resources devoted to cracking those puzzles is constantly changing, roughly every two weeks the Bitcoin network recalibrates to maintain an average 10-minute gap between blocks.

With China cracking down on the energy-intensive mining process, forcing miners to flee overseas, the hashpower devoted to mining Bitcoin blocks has plummeted to a 13-month low in the last two weeks.

That in turn has led to a big increase in block times, meaning that Bitcoin transactions take longer. On Sunday, Bitcoin blocks were taking an average of 24 minutes to issue — the longest since the very early days of Bitcoin in 2009.

On Tuesday, the average block interval was 15.6 minutes – still very high, by historic standards.

The current Bitcoin “epoch”, or 2016-block period, will end late Friday night or early Saturday, according to an online Bitcoin difficulty calculator. The difficulty of mining blocks is currently set to fall by 25 per cent, but could end up dropping even more.

Previously, the biggest downward adjustment in mining Bitcoin was an 18 per cent drop in 2011. (There have been bigger upward Bitcoin adjustments, including one of 300 per cent in 2010 and of 30 per cent in 2013).

The downward difficulty adjustment will mean increased profits for the miners that remain on the network.

“If you have a miner sitting in the closet, it’s time to fire it up,” tweeted Vailshire Capital Management CEO Jeff Ross.

once the difficulty adjusts, #bitcoin miners who remain on the network will see their profits increase as they capture market share. we will see the largest downward difficulty adjustment in bitcoin history, hopefully this friday, but could take longer.

— Alex Thorn (@intangiblecoins) June 28, 2021

Galaxy Digital Research said in a report that the events in China “have ultimately been a test of Bitcoin’s robustness, which the network has overwhelmingly passed.

“Blocks have slowed down, but they are still coming in. Hashrate is down, but the network is still secure. Prices have declined, but Bitcoin is a volatile asset.”

It will take several months for the dust to settle, Galaxy said, but ultimately “Bitcoin will have proven itself too strong for even the world’s largest nation to suppress”.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.