Bitcoin plummets nearly $2k in 30 minutes: ‘People are FOMOing in with leverage’

Getty Images

Cryptos are recovering this morning after Bitcoin fell nearly US$2,000 in less than half an hour, a possible sign that dangerous amounts of leverage are creeping back into the market as traders expect a big November.

BTC fell from just under US$62,000 to just under US$60,000, a two-day low, around 9.30am AEST. Many altcoins dropped even more.

Basically Bitcoin looks incredible here on most metrics, but leverage traders have gone out of control.

We won’t get sustainable price rises until that changes.

— Charles Edwards (@caprioleio) October 26, 2021

It’s simple, people are FOMOing in with leverage, some will fund in the coming weeks to keep their coins the rest will get flushed. Overleveraging is only delaying the inevitable.

— Jacob (@wellhat) October 26, 2021

Over 57,715 leveraged positions with a total face value of US$230 million had been liquidated, according to ByBt. That’s a six-day high.

We like the flush pic.twitter.com/7HQmHpwyp1

— Will Clemente (@WClementeIII) October 26, 2021

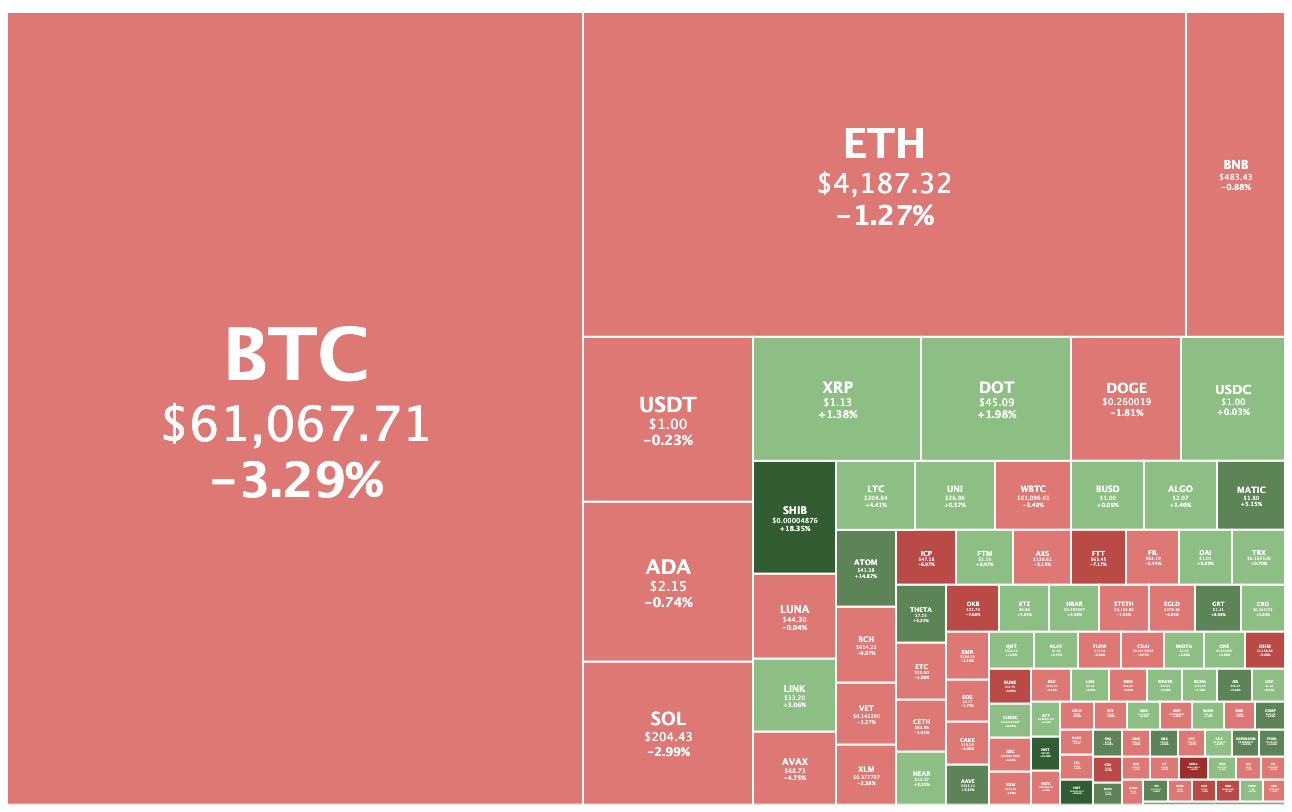

At lunchtime (Sydney time), Bitcoin had recovered to US$60,800, although that’s still down 3.3 per cent from where it was 24 hours ago.

The overall crypto market had fallen 1.7 per cent to US$2.58 billion, with Ethereum down 1.3 per cent to US$4,174.

Holo (HOT) was the biggest winner in the top 100, rising 19.5 per cent.

$HOT

After a long consolidation, it’s finally above the 200day MA ( green line ). If it manages to hold & close above the line then it’s going to #Holochain pic.twitter.com/eEDwAEZ94Z— Panda Ngapak (@davezcbx) October 26, 2021

Shiba Inu token had risen 16.9 per cent to US$0.00482, resuming its quest to overtake Dogecoin as the premier meme coin.

Helium, Cosmos, Enjin Coin and Theta Fuel were all up by double-digits as well.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.