Bitcoin options markets confront $1.5bn expiry

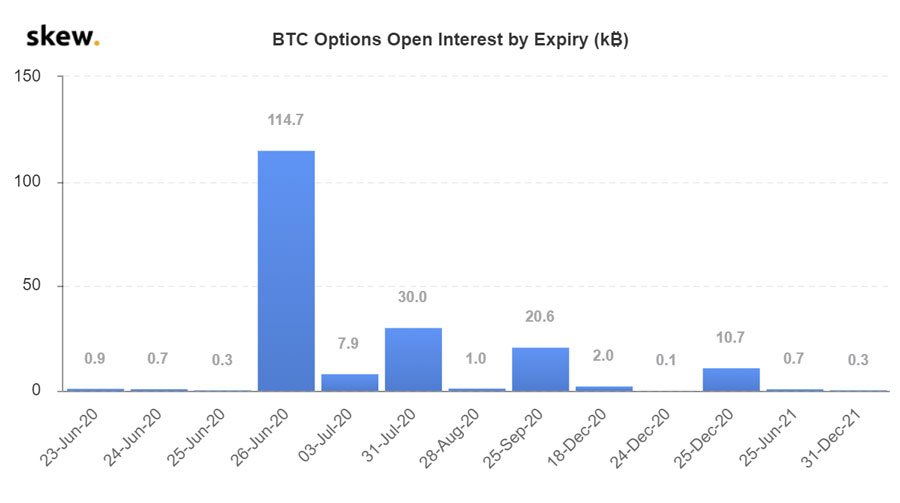

On June 26, 114,000 Bitcoin (BTC) options worth over $1.5bn will expire. How will the largest options expiry in BTC’s history affect the market?

An options contract gives the owner the right to buy or sell an asset at a set price in the future. The strike price is the value at which the asset can be bought or sold.

As we draw closer to expiry, traders can influence BTC’s value through buying or selling on spot markets. This will shift prices closer to their strike.

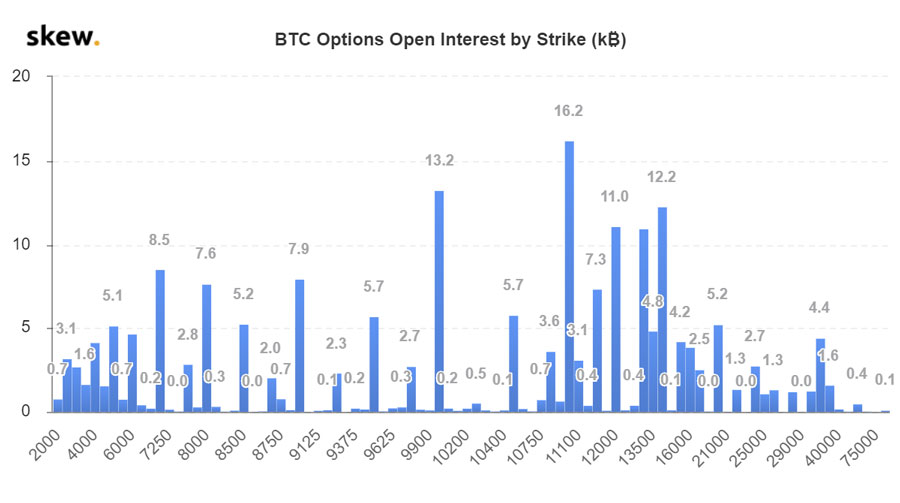

Open interest (OI) represents the total amount of options contracts that have yet to settle. Data from skew.com shows OI is grouped between $US11,000 ($15,987) and $US14,000 (20,348).

To profit on these options, BTC’s price will need to be at or above the strike when the contract expires. The higher BTC’s value is above the strike, the greater the profit.

BTC’s price will need to rise above its current value of $US9,300 for option holders to profit.

As expiry draws nearer, investors may trade BTC to move prices closer to their strike. This process, known as pinning, can directly influence spot markets and cause volatile price movements.

Singapore-based Delta Exchange has reported a large amount of call options (right to sell) being sold between $US10,000 and $US11,000. This could form an area of resistance on spot markets. If bullish traders are to profit, they will need to push through this resistance.

Open interest on options markets

Funds flowing into BTC derivative markets are directly responsible for the historic expiry event. Week on week, OI in these markets continues to break records.

Panama-based exchange Deribit reached an all-time high OI of $US1.3bn this week.

The exchange gained popularity for exposing retail traders to BTC options.

The Chicago Mercantile Exchange (CME) prevents this audience from trading on its exchange due to the high minimum trade sizes. CME therefore represents the trading activity of institutional investors.

OI on CME’s BTC options reached $US441m on Monday, an increase of $US78m. As money continues to flow into CME, we may see OI on its BTC options market overtake Deribit.

BTC market movements

Since mid-June, BTC Markets data shows BTC has moved in a tight $280 range between $13,585 and $13,865. This was until Monday June 22, when the digital asset broke out above $14,000. However, prices couldn’t be sustained at this level.

Increased selling pressure forced prices down 5.7 per cent to BTC’s weekly low of $13,188.

BTC lost 0.5 per cent of its market value this week. As a result, the total digital asset market capitalisation sits at $380m. BTC’s dominance is 64.4 per cent.

Ethereum outperforms Bitcoin

Since January, Ethereum (ETH) has outperformed BTC. The asset boasts an 85 per cent gain compared to BTC’s 32 per cent.

Despite ETH mirroring BTC’s recent drop, the second largest digital asset posted a 1.6 per cent weekly increase. ETH’s market value is currently $340.

Speculation links ETH’s strong performance to the upcoming launch of Ethereum 2.0.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.