Bitcoin nears $US60,000 on Visa crypto adoption — so is expecting $US400k BTC by year-end too bullish?

Getty Images

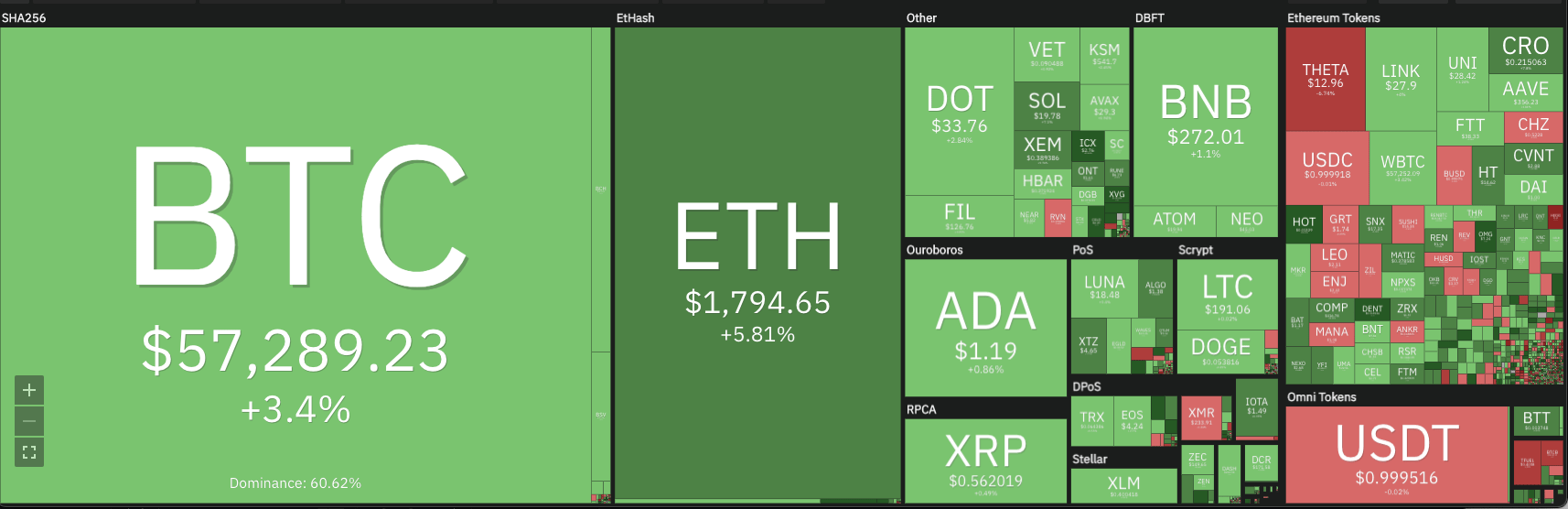

Cryptocurrency markets are a sea of green this afternoon after getting a boost from payments giant Visa.

Bitcoin gained more than $US2,000 in under three hours last night, hitting an eight-day high of over $US58,000 around 8.45pm AEDT, after Reuters reported around 6pm that the company would accept a stablecoin to settle payments.

Visa will accept the USD Coin, a project of Coinbase and Circle, to settle transactions made using Crypto.com’s credit card, Visa later confirmed. Crypto.com will send the USD coins, which are ERC-20 tokens pegged to the US dollar, to Visa’s address on the Ethereum network to settle card customer purchases.

USDC, one of the top stablecoins will now be used by Visa, to settle transactions on the network.

This is as big as it gets. Bullish news.

— Sumit Gupta (CoinDCX) (@smtgpt) March 29, 2021

Circle chief executive Jeremy Allaire tweeted that it “marks a major turning point in mainstream adoption of crypto”.

1/6 Major USDC news today – @Visa has become the first major payments network to support USDC as a native currency and settlement system on its network. This is massive news, and marks a major turning point in mainstream adoption of crypto. https://t.co/APZJpeJIJU

— Jeremy Allaire (@jerallaire) March 29, 2021

A milestone @visa today as we announce the first transactions settled w/ USDC.

Visa already moves billions of $$ across 200 markets in 160 currencies; now we can do so in any currency form factor.

Here’s a sample settlement file with our digital currency capabilities: pic.twitter.com/PtluZMvcjf

— Terry Angelos (@terryangelos) March 29, 2021

At 2.35pm AEDT, Bitcoin had lost a bit of ground from last night, trading at $US57,278 ($74,793) – still up 3.2 per cent from 24 hours ago.

Ether was changing hands at $US1,795 ($2,352), up 5.4 per cent in the past day.

Of the top 100 coins on Coingecko, 77 were up in the past 24 hours, and 21 were down.

Holo (HOT), a cloud hosting market for distributed applications, was the top performer, up 29.3 per cent to an all-time high of US1.3c, followed by Dent (up 26.6 per cent) and Icon (up 20.3 per cent).

Bitmax Token was the worst performer, falling 18.3 per cent to $US1.67. The token’s value has almost fallen in half from an all-time high of $US3.26 set over the weekend.

Solana, THORChain (RUNE), Kusama, LEO Token and Harmony (ONE) had also hit all-time highs in the past 24 hours, according to Coingecko.

$400k by year-end?

With institutional adoption deepening some Crypto Twitter users were back to making incredibly bullish predictions.

#bitcoin linear scale by epoch – Each epoch scale is 20x the prior one

1st draft – feedback welcome pic.twitter.com/Bu5i8Z3QIr

— ChartsBTC (@ChartsBtc) March 28, 2021

Bloomberg Intelligence analyst Mike McGlone last week posted a chart predicting BTC could peak at $US400,000 ($522,000) this year, based on its bull run in 2017.

#Bitcoin in Transition to Risk-Off Reserve Asset: BI Commodity — Well on its way to becoming a global digital reserve asset, a maturation leap in 2021 may be transitioning Bitcoin toward a risk-off asset, in our view. pic.twitter.com/Ycr1LSqEAJ

— Mike McGlone (@mikemcglone11) March 26, 2021

That’s an even bolder prediction than the Stock to Flow model that predicts $US288,000 BTC by December.

Scott Minerd, chief investment officer for Guggenheim Partners, also last year predicted $US400,000 Bitcoin, based on the Fed’s “rampant money printing” during the recession.

“It’s based on the scarcity and relative valuation such as things like gold as a percentage of GDP,” Minerd told Bloomberg.

“So … Bitcoin actually has a lot of the attributes of gold and at the same time has an unusual value in terms of transactions,” he said.

Serial Bitcoin entrepreneur Dan Held in a tweetstorm that this bull cycle seemed different than others.

18/ This Bitcoin cycle is different.

Never before has Bitcoin had such strong fundamentals against a macro backdrop (traditional financial system) that highlights exactly why Bitcoin is needed, the narrative is singular, and flows can easily come into Bitcoin.

— Dan Held (@danheld) March 27, 2021

Join our Cryptohead Facebook group to discuss all things cryptocurrency.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.