‘Bitcoin is unstoppable’, ‘the floodgates are open’ – bullish sentiment abounds post ETF approvals

Clark Kent's younger, stupider brother's needlessly dramatic entrances were getting annoying. (Pic via Getty)

Now that SEC chief Gary “You Win This Round” Gensler has rubber stamped 11 spot Bitcoin ETFs on a momentous day for magic internet money, what happens next?

Are Lambo factories working round the clock on production and delivery for all crypto bros and broettes?

Hold your horsepowers – despite some wild predictions this thing could be a slow burn.

Maybe even something of a nuthinburger for BTC’s price at first.

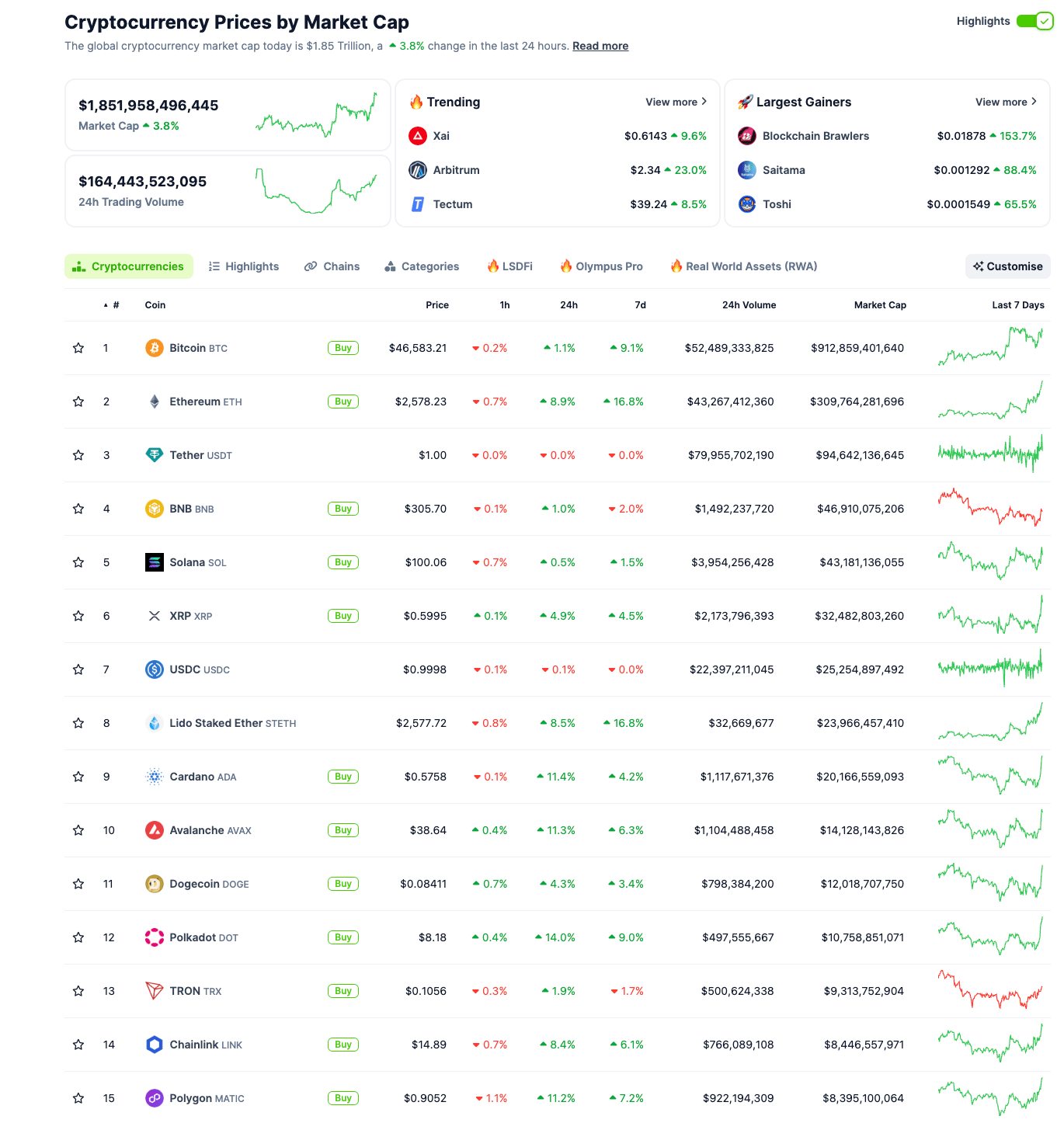

Let’s take a look at how price action’s been shaping up for the top cryptos since the official (definitely not fake this time) SEC approval landed this morning, courtesy of CoinGecko’s data.

A “sell the news” occurrence was predicted by many in the space upon ETF approval. That hasn’t eventuated at this point. That said, price action isn’t exactly ripping off faces yet, either.

Bitcoin might need to chug a case of Prime, or ingest something performance enhancing, if it wants to get a hurry on towards Samson Mow’s ridonculous “US$1m BTC within days” target.

That said, the ETF trading isn’t open in the US yet – American traders are largely readying for bed as we type, or returning videos, thinking about business cards and plotting Paul Allen’s murder.

Don’t forget – there is a supposed US$2 billion of liquidity apparently waiting to quickly flow into BlackRock’s ETF alone, in the first week.

Interestingly, though, it’s actually Ethereum and several of the biggest altcoins in its vast ecosystem that are outperforming on the Bitcoin news.

In fact, Josh Gilbert, market analyst over at eToro, says as much, noting a “muted reaction to the acceptance so far, given the false acceptance yesterday and the general expectation that the SEC would issue an approval after a decade-long campaign.

“Instead, we’re seeing positive price action from Ethereum, the next crypto likely in line for a spot ETF. ETH is now playing catch-up after underperforming bitcoin in 2023.”

Who else is saying what?

Aside from X-platform froth, Coinhead’s inbox is overflowing with commentary emailed directly to us about what the ETF approvals means for Bitcoin and crypto broadly, so let’s start there…

Nigel Green – CEO of deVere Group

Green and deVere Group are long-term high profile cryptocurrency advocates. He says:

“This approval by the financial regulator of the world’s largest economy is a landmark moment for Bitcoin and the wider crypto market and boosts prices in the long-term, even if there’s a sell-off in the near-term.

“The approval of Bitcoin ETFs represents a resounding institutional validation of the cryptocurrency, marking a departure from its initial reputation as a speculative and volatile asset.

“One of the primary catalysts for the anticipated surge in Bitcoin prices is the massive influx of capital that is expected to follow the approval of ETFs.

“On a tidal wave of investor enthusiasm, we wouldn’t be surprised if Bitcoin hits $60,000 this quarter – and higher moving forward throughout the year.”

Note: That prediction there is pretty bullish, but for even wilder Bitcoin price crystal balling, you’ve gotta read this > ETF Riders, Raging Bulls

Adrian Przelozny – CEO of Independent Reserve crypto exchange

“This is monumental for the industry,” Przelozny told Stockhead.

“The approval of the Bitcoin spot ETFs provides the industry and digital assets with validation and legitimacy, increasing the accessibility and confidence in the overall market.

“For the major digital assets such as Bitcoin and Ethereum, this is likely to bring about greater market stability in the coming years. However, time will tell if we’ll see shallower troughs between bull and bear markets.

“For many years we’ve talked about and seen increased participation from institutional investors. With the approval of the Bitcoin spot ETFs, the floodgates are open. The increased accessibility and confidence is going to see tens of billions of new dollars enter the market.

“I expect very bullish price action for Bitcoin over the next 24 months.”

“Globally, the regulators are going to follow the lead of the markets such as the US, UK, and Singapore. We’re going to see more jurisdictions, such as Australia, bring in licensing regimes for the crypto industry, and provide regulatory certainty, which will lead to further growth in confidence and demand.”

Yoni Assia, CEO and co-founder of eToro exchange

“The term ‘watershed moment’ can be a cliche, but in the case of today’s bitcoin ETF news, it could not be more justified.

“For 15 years, bitcoin has been growing in prominence as an asset class amongst retail investors, while in a reversal of traditional roles, institutional investors have remained largely on the sidelines waiting for traditional finance rails to be put in place.

“Today’s news provides an answer for institutional demand for bitcoin. It’s good news for crypto markets and supportive of our belief that bitcoin is an unstoppable technology.

It is digital gold and taking a long term view, I believe that it represents the intersection of finance, economics and technology.

“I believe that the majority of ordinary investors will want to continue to buy and hold real BTC.”

Sergey Nazarov – Chainlink co-founder

Chainlink, a bridging tech for real-world data to the world of blockchain, is one of the crypto sphere’s most well known and widely adopted crypto projects and tokens. Here’s what it’s figurehead thinks about today’s news:

“Bitcoin ETF approval has made it clear that traditional financial institutions have a significant role to play in determining how the crypto markets evolve.

“This was evident when PayPal launched the ability to buy certain cryptocurrencies, and some banks started offering crypto custody.

“The approval of the Bitcoin ETF will lead to an influx of traditional large top-tier financial firms like BlackRock and Fidelity, which will likely actively participate in the crypto markets.”

Jonathon Miller – MD, Kraken Australia exchange

“Today’s approval is a milestone moment for Bitcoin and cryptocurrencies more generally. An ETF makes Bitcoin accessible to a much broader range of investors and signifies tacit acknowledgement that the crypto asset-class is here to stay.

“Kraken is delighted that CF Benchmarks, a wholly owned subsidiary, is the benchmark provider for many of the ETFs listed today. As a constituent exchange of the index used to benchmark the performance of the ETFs, Kraken will have an integral role in ensuring that ETF shares are valued accurately to the Bitcoins that the ETF holds.”

Caroline Bowler – CEO, BTC Markets exchange

“The [SEC’s] approval of 11 bitcoin ETFs in the US marks a pivotal moment for the cryptocurrency landscape.

”Fidelity Digital Assets described BTC as an “entry point for traditional allocators” to gain exposure to the asset class. We can expect to see liquidity follow utility into this sector.

“Locally, it provides greater context for the ASX to list a spot bitcoin ETF. This further opens cryptocurrency to both retail and institutional investors via a traditional financial product. It is also reasonable to assume that this will expand crypto markets in general, as liquidity follows utility. So while this is an historic day for the industry, the impacts will be increasingly felt over time.

“The SEC’s ETF approval and the approaching bitcoin halving collectively weave a robust narrative for BTC in the first half of 2024.”

Brett Tejpaul – head of Coinbase Institutional

“The approval of these spot Bitcoin ETFs is a pivotal moment in the evolution of the cryptocurrency market. With major asset managers bringing the world of digital assets to millions through this regulated product, these ETFs are set to catalyze industry growth, unlocking trillions in new capital.

“This development not only signifies a significant step towards mainstream acceptance but also sparks innovation that will reshape the financial landscape itself.”

Ben Rose – general manager, Binance Australia exchange

“The approval illustrates a new level of acceptance, maturity and mainstreaming of the crypto market, providing the industry with more credibility and potential for further innovation.

“While it is not easy to anticipate the scale of new entrants and market dynamics, it is useful to note that the introduction of gold ETFs in 2004 led to seven years of positive price action after that. Coupled with the Bitcoin halving event this year, these events could provide a dynamic market for Bitcoin.”

Pav Hundal – lead market analyst at Swyftx exchange

Meanwhile, another local crypto exchange, Swyftx told Stockhead earlier today that early trading volumes on Swyftx are currently well up on the corresponding period yesterday.

Hundal noted:

“Early trading on Swyftx is up over 125% this morning and very close to 90% of bitcoin trades are buys. Aussies are clearly speculating that the ETF approvals are a landmark moment for digital assets.

“The SEC decision is unlikely to upend the market overnight but over time we expect this to reduce Bitcoin’s volatility and increase pressure on prices.

“You can’t underestimate the significance of Bitcoin commanding a place in the portfolios of clients at the world’s biggest asset managers.

“It doesn’t really matter whether you see Bitcoin’s future as an investable asset or a means of payment or something between the two, this is big news.”

Agreed.

A bit more from around the blocks

We took a quick scout round Elon Musk’s platform for a few more choice takes…

Inafamous whistleblower Edward Snowden here…

#Bitcoin ETFs were (finally) just approved for trading tomorrow, after ten years. Maybe the politics in Congress around cryptocurrency will get better once they realize it's backstopping pension funds and retirement accounts.

— Edward Snowden (@Snowden) January 10, 2024

El Salvador’s Bitcoin volcano-spruiking president…

The IMF and BlackRock have nothing on @nayibbukele pic.twitter.com/FGpLIV3TiY

— Vandelay ₿TC Industries ⚡ (@VandelayBTC) January 10, 2024

Seeing prediction from Bloomberg that there could be 4 billion in buys tomorrow for Bitcoin. Huge if true.

— Lark Davis (@TheCryptoLark) January 10, 2024

The SEC has such disdain for Crypto….yet here they are approving ETF's today.

In the end, it's money that talks. Always.

TradeFI is going to rape and pillage.

— Bob Loukas 🗽 (@BobLoukas) January 10, 2024

And this from crypto-focused US journo Laura Shin, regarding some commentary from SEC commissioner Hester Peirce, who has consistently advocated for these ETF approvals, despite her boss Gary Gensler’s consistent roadblocking:

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.