Bitcoin funds shrink; but big VCs, including a16z, are still well in the crypto game

A Bitcoin investment fund, last week. (Getty Images)

To say it’s been a rough few weeks for crypto is an understatement – some US$600 billion has evaporated from the overall market cap since just before the LUNA fiasco became a thing. Inevitably, crypto funds have shrunk somewhat, too.

In fact, crypto fund assets under management (AUM) last week fell to their lowest since July 2021, according to new data released by the digital investment group CoinShares.

Per the report, AUM held by digital-asset funds dropped to US$38 billion, with investors pulling out about US$143 million last week. It was the year’s second-largest outflow.

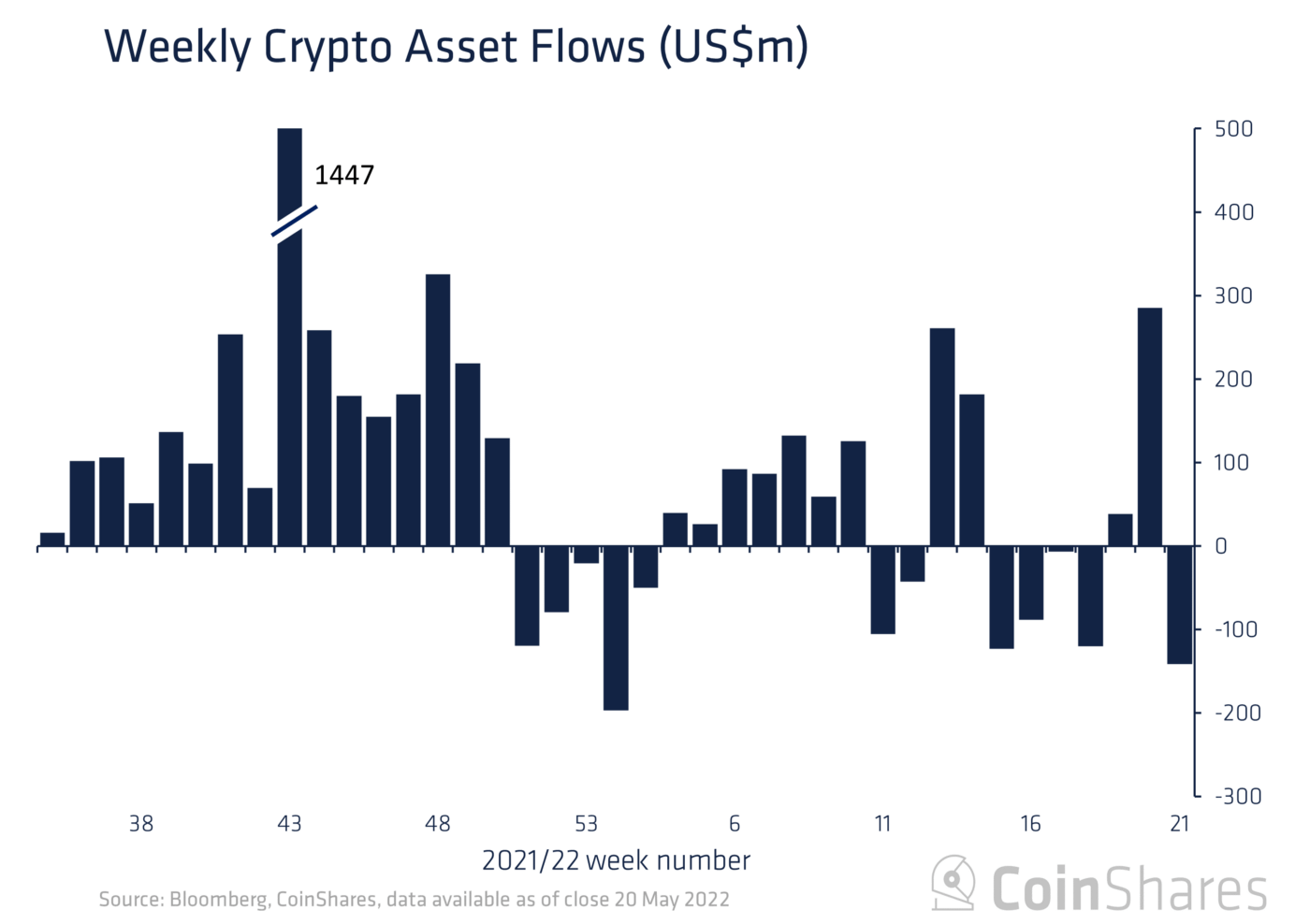

As you can see on the CoinShares chart below, it was a complete about-face compared with two weeks ago, when investor inflows were actually gushing in – a dip-buying spree amid the early stages of the Terra blockchain ecosystem implosion.

All in all, it’s a pretty good illustration of how fickle and reactionary crypto investors – retail and institutional – can be, and a reminder of the space’s volatility… not that you needed one.

According to the CoinShares report, Bitcoin-focused funds were hit the hardest, with US$154 million in outflows last week, jettisoning more than half of the US$299 million that flowed in the week prior to that.

After hitting as low as US$26,900 on May 12, Bitcoin (BTC) has since found a range somewhere largely between about US$29k to the mid $30k level. It’s changing hands for about US$20,300 at the time of writing.

There is one silver lining faintly glimmering within the CoinShares data, however, and that’s the fact that multi-asset (multi-crypto) investment products saw inflows totalling US$9.7 million last week.

This shows that crypto investors are looking to diversify their assets. This category has seen roughly US$185 million in inflows since the beginning of the year.

“We believe investors see multi-asset investments products as safer relative to single-line investment products during volatile periods,” noted James Butterfill, CoinShares head of research.

The most notable altcoin winners in this regard last week were Cardano (ADA) and Polkadot (DOT), which both saw investment inflows of US$1 million.

You can see the full CoinShares report here.

VC moves: a16z launches US$600m gaming fund

“We’re not turning back” ensures a singer on behalf of Andreessen Horowitz in its latest video pumping up its vast gaming investments.

And they’re putting their money where their mouths are. The prominent Silicon Valley venture capitalist firm, also known as a16z, is a humungous investor in the crypto/Web3 industry, and last week launched a significant gaming-focused fund – to the tune of US$600 million.

The firm’s inaugural gaming fund – Games Fund One – will invests across game studios, gaming-related consumer apps and infrastructure. Although this is a fund that ostensibly has a broad gaming focus, it’s certainly a welcome shot in the arm for the GameFi/metaverse narrative, given the investment presence a16z already has in these areas.

Last June, a16z pumped a whopping US$2.2 billion into the crypto space with its third crypto fund – the largest at the time, until Paradigm gazumped it with a US$2.5b one of its own in November.

“Having been investors in this space for more than a decade, it’s clear to us the industry has entered a new era, and there is no better time than now to build a fund focused on supporting the next generation of games builders,” reads the a16z blog post, written by team members Andrew Chen, Jonathan Lai, and James Gwertzman.

The company added that in the long run, it believes gaming infrastructure and technologies will be important building blocks of the metaverse. And it believes the latter represents an opportunity that could be much bigger than even the current $300 billion games-industry behemoth.

Notable gaming-industry investors in Games Fund One include David Baszucki, founder of Roblox; Jason Citron, founder of Discord; Marc Merrill, co-founder of Riot Games; Mike Morhaime, co-founder of Blizzard; Aleks Larsen and Jeffrey Zirlin, co-founders of Sky Mavis; Kevin Lin, cofounder of Twitch; Mark Pincus, founder of Zynga; and Riccardo Zacconi, founder of King.

Further recent blockchain-gaming raises

Gaming and GameFi is certainly one of area of the crypto industry that still appears to be garnering plenty of VC interest, as it has done for a good year now – even if retail investing into crypto has lately cooled to near freezing across the board.

Here are just a few other eye-catching recent raises in the sector…

• N3TWORK Studios, a San Francisco-based company founded by mainstream gaming industry veterans, last week raised US$46 million in a Series A.

According to a press release, the round was led by Griffin Gaming Partners, with participation from Kleiner Perkins, Galaxy Interactive, Korean Investment Partners, Floodgate and LLL Capital.

The funding will help the studio develop and produce its first two crypto-gaming titles – Legendary: Heroes Unchained and Triumph.

N3TWORK Studios Raises $46M in Series A Funding https://t.co/OuWYAyRRg9

— Tech Company News (@TechCompanyNews) May 20, 2022

• The co-founder of US-based video livestream service Twitch, Kevin Lin, is continuing to develop and grow his new blockchain gaming company, Metatheory, raising US$24 million.

Some of the usual suspect crypto-focused VCs led the funding round, including Andreessen Horowitz, Pantera Capital and FTX Ventures.

We’re long-term bullish in web3 at FTX Ventures and continue to support and invest in stellar teams through rocky mkts.

Proud to invest in @kevinlin’s @MetatheoryInc games studio alongside friends @Tocelot and @veradittakit 🚀🎮https://t.co/XoMsFVSuPR

— Amy Wu (@amytongwu) May 21, 2022

• FreshCut, a Polygon-based, short-form gaming content ecosystem, last week announced it and its ecosystem partners together raised US$15 million in funding.

Some of the more notable investors included Polygon, Animoca Brands, Galaxy Digital, Hashed, and Republic Crypto, as well as Twitch co-founder Kevin Lin (see above) and co-founder of the popular “battle royale” game PUBG, JJ Redick.

.@freshcut, a short-form #gaming content ecosystem, today announced it has raised $15M in funding to accelerate the Transformation of #Web3 Gaming Content Ecosystem. The raises were led by @GalaxyInteract, Animoca Brands, and @RepublicCrypto.

Read more: https://t.co/gWqGZ7nlwr— Animoca Brands (@animocabrands) May 18, 2022

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.