Bitcoin funding rate hits 4-month low; crypto market up 3.3%

Getty Images

Crypto bears are heavily shorting Bitcoin’s recent rise, derivatives data indicates, leading bulls to hope they get squeezed sometime soon.

The funding rate for Bitcoin perpetual futures on Binance hit a four-month low of negative 0.011 per cent around lunchtime Sydney time, according to Coinglass. That means that so many traders were short Bitcoin that they had to pay longs to maintain their positions, rather than the more typical reverse scenario.

Negative funding rate. Leverage still high. Volume still thin. Perfect recipe #Bitcoin

— Juanito Escarcha (@DrEscarcha) January 12, 2022

The funding rate on Binance turned back to positive later in the afternoon, however.

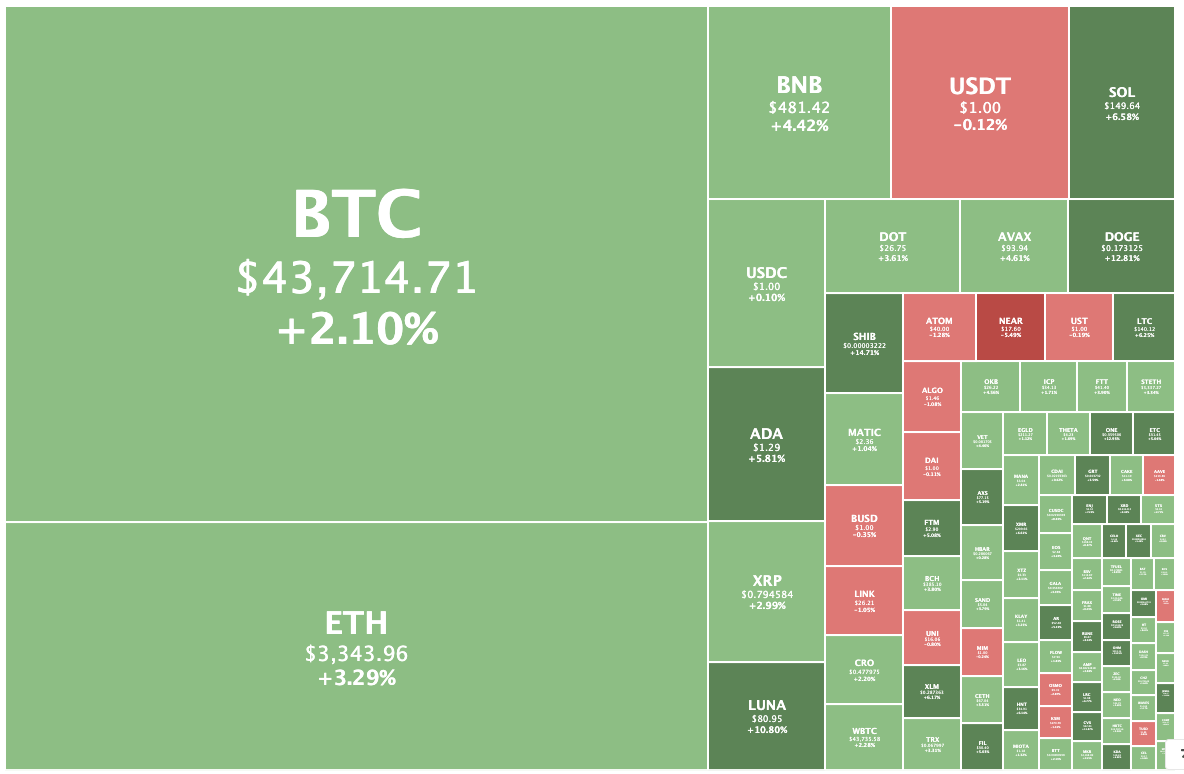

At 4.50pm AEDT, BTC was trading at a seven-day high of US$43,667, up 2.2 per cent from yesterday.

Ethereum was changing hands at US$3,340, up 3.4 per cent.

Crypto market up 3.3%

Overall the market stood at $2.2 trillion, up 3.3 per cent from yesterday, with just a handful of coins in the red.

Shiba Inu was the biggest gainer in the top 100, rising 13.7 per cent to 0.003215c.

Olympus, Dogecoin, DeFi Kingdoms and Harmony were all up around 13 per cent.

Near Protocol was the biggest loser, falling 4.7 per cent to $17.77 after several days of strong gains and record highs.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.