Bitcoin dips on Evergrande default update; WhatsApp tests crypto payments

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

Here we go again? The US stock markets opened trading today with an immediate dip amid news of Chinese property-developing giant Evergrande defaulting on dollar debt. Bitcoin has also stumbled, moving back below US$49k.

As has been well documented, the world’s most indebted developer (to the tune of about US$300 billion) has been struggling with an ongoing liquidity crisis that’s created a good deal of uncertainty across global markets for several months.

The news, then, is that major credit-ratings firm Fitch Ratings has declared Evergrande to be in its “restricted default” category. According to a New York Times article, this means the property company has formally defaulted but has yet to enter into any bankruptcy or liquidation process.

The question for crypto investors is, how will Bitcoin continue to react to these macro events… and might there be an element of this particular China-based FUD (fear, uncertainty and doubt) being somewhat “priced in” for the moment?

Creditors have known for months they have been in "default". Once again, ratings agencies behind the curve. #Evergrande https://t.co/ZrKz6HN4l0

— Coin Bureau (@coinbureau) December 9, 2021

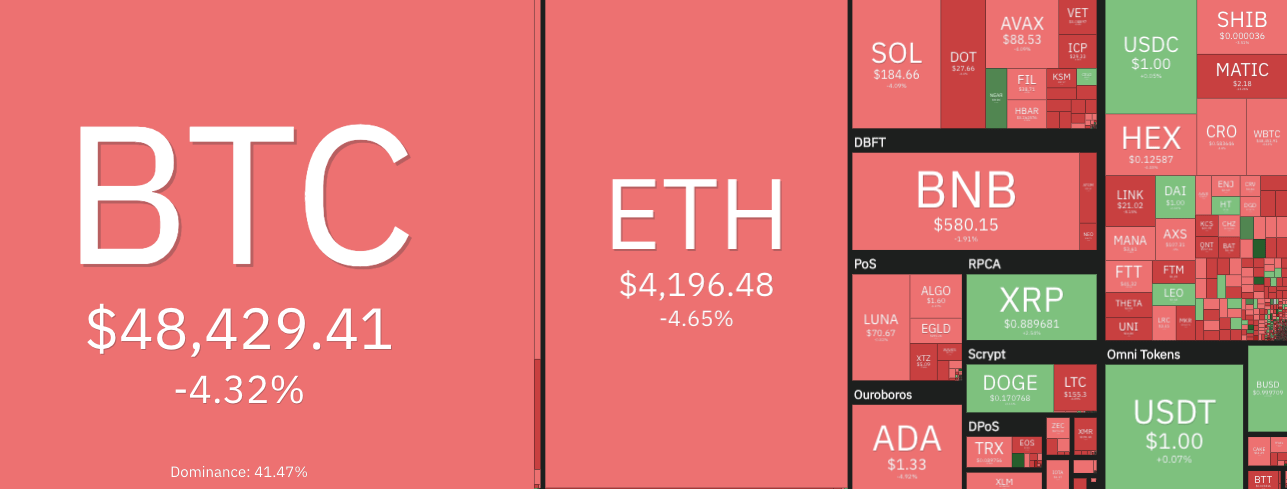

At the time of writing, the entire crypto market cap is sitting around US$2.4 trillion, according to CoinGecko data. That’s about a 4.2 per cent drop in the past 24 hours.

As the general pacesetter for the crypto market, all eyes are on Bitcoin (BTC), as usual. It’s dipped back below the US$50k level it seemed to be holding well, and is currently hovering around US$48.5k.

Polkadot (DOT) is currently the biggest daily loser in the top 10 by market cap, down about 7 per cent, while Polygon (MATIC), at no.14, has lost a decent chunk of its recent strong gains from the past few days. It’s currently down about 13 per cent compared with this time yesterday.

Looking down the top 100 it’s mostly red, playing in the -5 to -10 per cent territory. Two coins bucking the day’s trend, though , include gaming ecosystem Gala Games (GALA) +15%; and the layer 1 platform Near Protocol (NEAR) +10%.

Meta’s WhatsApp pilots instant crypto payments

Mark Zuckerberg’s Meta company is trialling instant crypto payments on WhatsApp using its Novi digital assets wallet, according to announcements.

Launching in the United States this week, as a pilot program only at this stage, a limited number of users will be able to make payments within WhatsApp using the Pax Dollar (USDP) stablecoin.

There's a new way to try the @Novi digital wallet. Starting today, a limited number of people in the US will be able to send and receive money using Novi on @WhatsApp, making sending money to family and friends as easy as sending a message. 💸💬 pic.twitter.com/dGz3lejri7

— Stephane Kasriel (@skasriel) December 8, 2021

According to Novi’s head of product Stephane Kasriel, the feature is accessible from within test users’ chat where they can select the amount to be sent. They’ll then see the receiver’s name and amount to be received. The process allows users to connect and use their debit cards.

Novi’s website claims that the new function will make sending funds with crypto and WhatsApp as “easy as sending a message”.

And what about security? Any potential issues there? Kasriel says the payments won’t affect WhatsApp’s end-to-end encryption.

Using Novi doesn’t change the privacy of WhatsApp personal messages and calls, which are always end-to-end encrypted. Learn more at https://t.co/t2QjnQHvHM.

— Stephane Kasriel (@skasriel) December 8, 2021

So then, is this a big deal? It potentially is, yeah. And that’s because WhatsApp reportedly has more than two BILLION monthly active users. This is just a trial run, but if it’s deemed successful by Zuck and his Meta mates… then we’re talking some serious crypto adoption.

WhatsApp is now officially testing crypto payments via the Novi wallet.

Eventually every messaging app realizes you can now move money instantly and inexpensively, just like you can communicate instantly and inexpensively.

— Anthony Pompliano 🌪 (@APompliano) December 9, 2021

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.