Mandala CEO: Australian crypto traders are getting screwed

Last year was a mighty one for most facets of the crypto industry, particularly on-ramps. So how do Australian exchanges stack up to global counterparts? Based on at least one metric revealed to Stockhead by Joe Reiben, CEO of the Seychelles based Mandala Exchange, the answer is eye opening.

With about one in six Aussies now owning some form of cryptocurrency (as per Finder survey data), Australia has become one of the fastest-growing global crypto markets.

Recent major adoption from the likes of the Commonwealth Bank and the Australian Open, reflect the growing interest here, too. And there’s no shortage of reputable domestic crypto exchanges for Aussies to choose from to make safe entry (and exit) points.

But, while the likes of Coinspot, BTC Markets and others are undoubtedly well developed, when it comes to trading fees they don’t compare too favourably with many overseas-based crypto exchanges.

“The fees for spot trading are exorbitant in Australia for all of the major exchanges,” Mandala’s Reiben told Stockhead recently. “A lot of them are charging around 1% [on both buy and sell sides]… so I think typical Australian traders, big and small, are really getting screwed on the fees.”

A 10x discrepancy

Most traders in crypto are spot traders – a method where they set a price point for buying a certain amount of tokens, then leave the order until it fills at that price in the exchange order book.

And this would back up Reiben’s point that many if not most Aussie traders are copping a raw deal paying a 1% average spot-trading fee. The question is, how do things differ on exchanges based elsewhere?

“If you just compare it to Mandala our base fee for users with no token lockup and no volume requirement is 0.1%,: Reiben says. “So that’s a tenth of what’s required to be paid on most Australian exchanges.

“So, let’s say you’re a retail trader trading $100 worth of crypto a day – that’s $365 in fees a year at 0.1%. That may not seem like much, but if you’re trading $100 a day on our exchange, it’s only $3.65 in fees.”

“Extrapolate that out to someone trading tens or hundreds of thousands of dollars or more, then we’re also talking about a savings difference of maybe tens or hundreds of thousands of dollars in a year.”

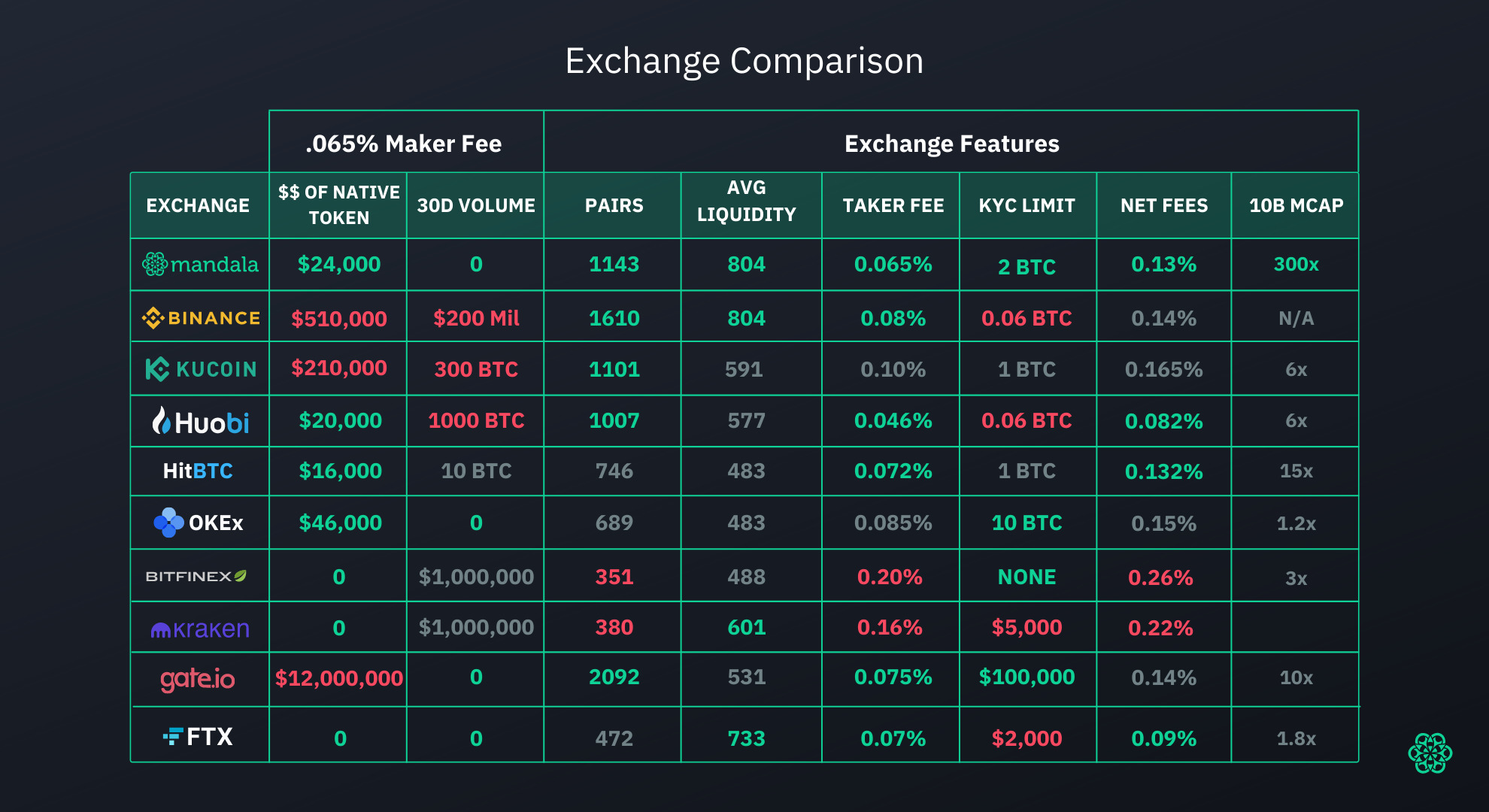

It should be noted that most exchanges, including Aussie ones, do bring down trading fees if a set amount of tokens are “locked up” in the exchange, but they’re still not touching 0.1%. Mandala’s trading-fee level actually falls as low as 0.065% with a token lock-up of about US$24k value.

Pic: supplied

Aussie exchanges could use more trading pairs, too

Reiben also notes that Australian exchanges are generally found lacking with their trading-pair offerings [assets that can be traded for each other on an exchange].

There are “only a few hundred pairs” on Australia’s biggest exchanges, he says.

Binance (1,610 pairs), Mandala (1,143), Kucoin (1,101) and Huobi (1,007), for instance, all have more than 1,000 trading pairs.

The reason a mid-tier exchange such as Mandala (50k user base, US$10m-$15m daily volume) is so high on that list, is because it formed a partnership with Binance Cloud about a year and a half ago, letting it not only benefit from Binance’s security, liquidity and deep order book, but also its broad spread of tokens.

And because it’s an independently run exchange, Mandala also has the ability to vet and bring in yet more cryptos.

The way forward for local exchanges?

Trading pairs aside, though, the biggest consideration for Aussie exchanges definitely seems to be the spot-trading fees discrepancy.

So, should they just consider lowering them to attract and retain more users? Mandala’s CEO thinks that’ll become more of a necessity than a question.

“I do see those fees as unsustainable for these domestic exchanges,” he says. “I think they’re going to need to either update and lower their trading fees markedly to keep up with the times as more and more platforms build out and there’s more competition.

“Either that, or simply risk getting left behind.”

You can learn more about Mandala’s competitive advantages, including its “Mandala Madness” monthly token-lockup lotto for users of all levels, here.

This article was developed in collaboration with the Mandala Exchange, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.