Australia is one of the strictest nations for crypto regulations: study

Coinhead

According to a new study, Australia is one of seven countries that currently have the strictest regulations for crypto.

That’s keeping in mind, however, that regulations for the industry in this country are still under review and development. The Albanese government is currently conducting an audit of the space with its “token mapping” exercise.

The research was conducted by Luxembourg-based finance broker Forex Suggest, which broke down the regulatory landscape of digital currency around the globe. It specifically analysed OECD (Organisation for Economic Co-Operation and Development) nations with each awarded a score out of five based on the following factors:

• If they allowed cryptocurrencies to be owned.

• If they require a licence to operate a crypto business.

• If their central bank is working on a cryptocurrency project.

• If cryptocurrency capital gains are taxed.

• If cryptocurrencies are widely accepted to purchase goods.

Here’s how the nations shaped up, with countries ranked #1 deemed to have the tightest crypto regulations:

The seven top-ranking countries on this list are all developing central bank digital currencies (CBDCs). In fact, the Reserve Bank of Australia and its partner, the Digital Finance Cooperative Research Centre, recently released a whitepaper that indicates it’s moving ahead with its CBDC pilot and that it expects that to be completed midway through 2023.

The countries sharing third place on the Forex Suggest list apparently don’t require crypto businesses to register with the government or qualify for a licence, which the study suggests is a lack of oversight that could potentially harm investors.

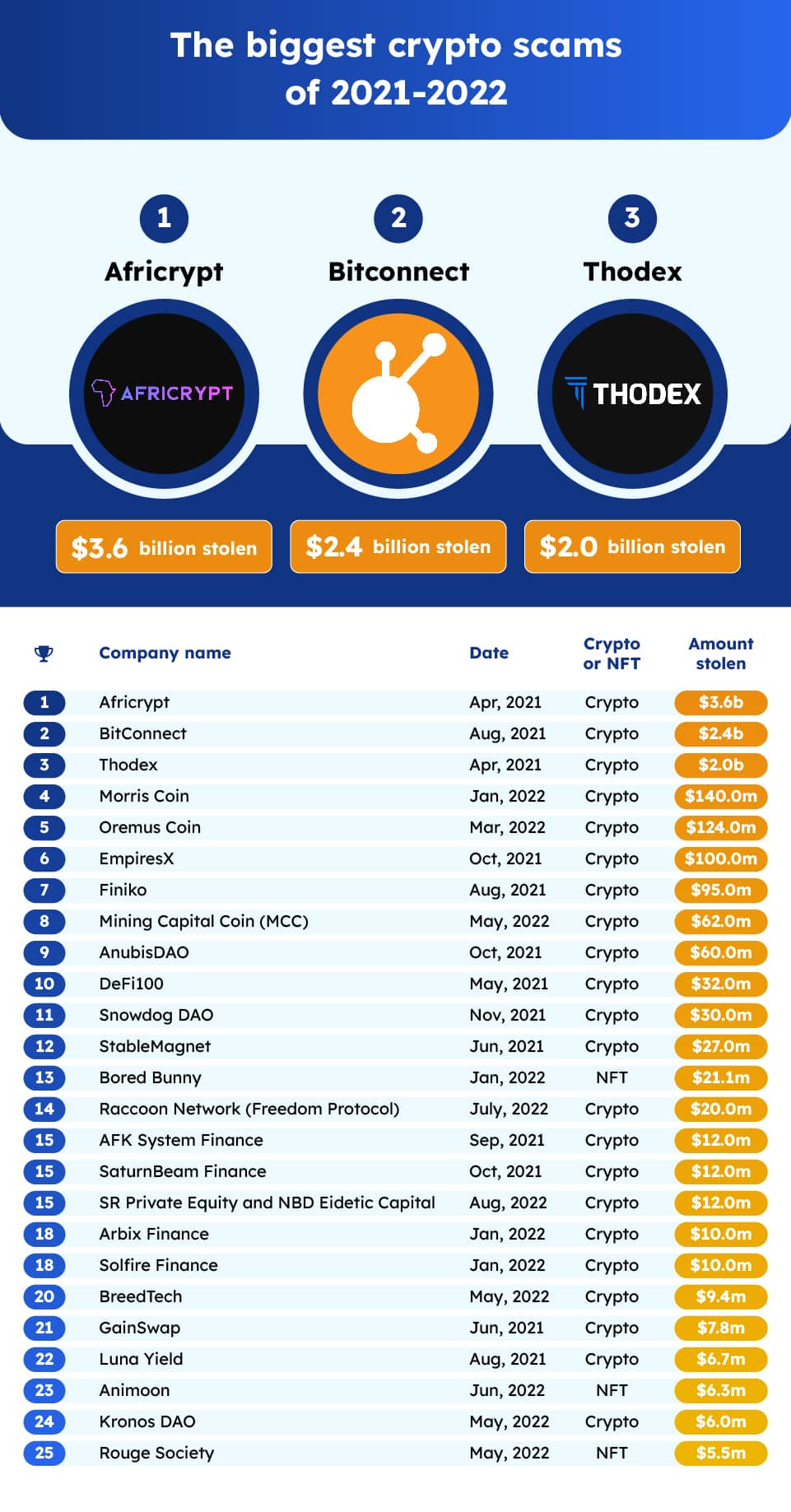

And speaking of harming investors, the study also delved into the murky world of crypto scams, listing the 25 largest from the past couple of years totalling more than US$8.8 billion worth of stolen funds.

Usurping the infamous Bitconnect, the leading rorter was Africrypt, a South African crypto-investment firm that suckered in wealthy investors with promises of 10% daily returns before claiming they’d been hacked. The young founders allegedly funnelled an estimated US$3.6 billion in Bitcoin into their own wallets, before apparently “vanishing” according to reports. It’s an as-yet unresolved story and investigation.