Aus Merchant: Sydney startup launching business-to-business crypto platform

AusMerchant founders Sean Tolkin (left) and Mitchell Travers. (Supplied)

A Sydney start-up is emerging from stealth mode to help high-end Australian retailers accept cryptocurrency payments in a safe and legal manner consistent with modern accounting standards.

Aus Merchant has already seen its “minimum viable product” offering used by 15 merchants this year, including Sydney “dream car supplier” Scuderia Graziani, whose clients have used crypto to buy a dozen different sports cars in the first half of 2021, including a $663,000 2019 Lamborghini Aventador.

It plans to launch the platform more broadly within the next three months, along with a crypto managed investment scheme.

Chief executive Sean Tolkin, 29, and managing director Mitchell Travers, 26, founded the now 15-person company last year after meeting through Sydney’s boating scene.

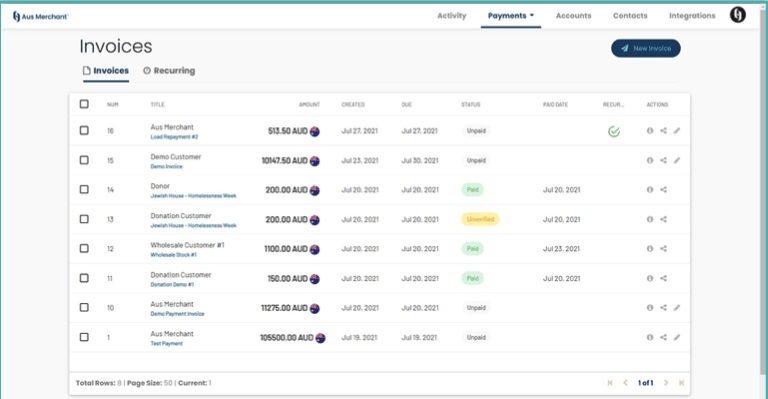

The company’s blockchain back-office platform allows businesses to generate invoices for crypto payments in Australian dollars, in a format that easily integrates with Xero‘s (ASX:XRO) cloud accounting platform.

“In the Australian market, all of the existing exchanges don’t really tailor their product to be business-to-business,” Travers told Stockhead in a Zoom call late last week.

“I see an immense opportunity to transition businesses integrating with the digital blockchain-based infrastructure, leveraging the technology and accepting cryptocurrency as payment.

“We focused on accepting the lowest hanging fruit, which is luxury goods dealers, real estate, boat dealers,” he said.

Around three to seven of these core 15 merchants who have been testing the platform have regular transaction volume, including a law firm.

“This week it’s been real-estate agent after real-estate agent (asking), ‘we want to sell a house for crypto — how do we do it?'” Tolkin said.

Those merchants would run into inefficiencies and lost profit trying to sell large amounts of crypto on an Australian exchange, Travers said.

Aus Merchant aggregates liquidity from several over-the-counter sources so merchants don’t have to worry about pricing or complicated order books.

Aus Merchant uses a popular institutional-grade platform, Fireblocks, for storing its clients’ crypto.

“Aus Merchant never has access to our customer’s private keys,” Travers explained. (For those new to crypto, a private key is how users control their crypto assets).

“What happens is we generate a vault, which can host up to 150 different cryptocurrencies for each customer, unique addresses for all of them. And the private key is split into three parts — one is held by IBM in a secure server, one is held by Microsoft in a secure server, and the final part is held by Aus Merchant in our console interface.”

Transactions can be seen in Aus Merchant’s portal, which provides an Australian cost basis for each invoice, Travers said.

The clean look of its simple interface was inspired by Uniswap, the leading decentralised exchange.

For now, the platform is just focused on accepting payments in Bitcoin, Ethereum and the leading ERC-20 stablecoins, Travers said.

“So that invoicing solution allows for the merchant to not to have to worry about the volatility of cryptocurrency, they get their Australian dollars. After receiving the payment in crypto we do a block order conversion for them, for the exact amount on the invoice.”

And the list of transactions are easily exportable into Xero’s platform in AUD, Travers said.

“Really all they’re doing is benefiting from accessing this new sort of market of high net worth individuals who’ve made a bunch in crypto.”

Individuals looking to spend their crypto do have to undergo seamless know-your-customer (KYC) procedures, said Travers, who previously worked for KYC company Brontech.

While some crypto enthusiasts take pride in skirting the rules, Aus Merchant is focused on doing everything in a legally compliant way.

Accounting made transparent

But as crypto becomes more mainstream and “layer two” solutions dramatically reduce transaction fees, businesses may eventually want to integrate their books with digital assets, Travers said.

Crypto makes possible something called “triple-entry accounting” — each entry on a business’s books can be linked to the transaction on the blockchain, providing proof that it actually occurred.

The setup is quite a different system than crypto exchanges, which generally hold all customer funds in just a handful of wallets, with the exchange’s internal software keeping track of who owns what.

Each Aus Merchant client has its own crypto wallet with its own deposit address. As an anti-fraud measure, they can only withdraw funds in Australian dollars to their own bank accounts.

Eventually, Aus Merchant would like to offer its clients access to the high-yield opportunities available in decentralised finance, but for now, most aren’t comfortable holding crypto on their books.

Still, the platform makes it easy for a company to pay its employees in crypto.

“Aus Merchant is trying to help transition crypto into an essential piece of the digital economy, and away from becoming just a speculative asset,” Travers said.

The company also has a managed investment scheme for its clients that it launched at the beginning of this month, which is already up 50 per cent, Travers said.

“Part of the benefit is that we’ve got a wealth of crypto experience in our business, so we’re able to ease that transition for people, and make them comfortable, and trust our technology.”

Aus Merchant is also working to let its clients offer NFTs (non-fungible tokens) to their customers.

They worked with Jewish House during a recent fundraising drive for Homelessness Week so the charity could accept crypto, with major donors getting a free NFT badge.

Young entrepreneurs

While Travers is the technical lead of the operation, Tolkin has been working to build the team, find talent, organise the company, allocate roles and find clients.

He has run other businesses before, in commercial property and boat maintenance and management.

Tolkin said that while the company has been funded out of their own pockets, they have received some inquiries from investors and are open to the idea.

“It’s an exciting time for us. We’re going strong enough, we’re well-funded, but I’d definitely put on the record that with the right partner, there’s an opportunity,” he said.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.