As crypto market deflates, FTX and Opensea raise millions at billion-dollar valuations

Getty Images

Even as the air slowly goes out of Bitcoin and Ethereum, institutional investors are pouring money into crypto institutions, with FTX and Opensea the latest to benefit.

FTX Trading overnight announced it had raised US$900 million in a Series B funding round, valuing the two-year-old company that owns Blockfolio and the crypto derivatives exchange FTX at US$18 billion.

More than 60 investors participated, including Sequoia Capital, SoftBank, Paradigm, Ribbit Capital, Sino Global Capital, Multicoin and the Paul Tudor Jones family. It’s the biggest funding round for any crypto exchange and makes FTX Trading one of about 30 “decacorns” (privately held startups worth at least US$10 billion).

“M&A is going to be the most likely use of the funds,” chief executive Sam Bankman-Fried, the 29-year-old crypto billionaire, told the Financial Times.

He named Goldman Sachs and Chicago Mercantile Exchange owner CME as possible acquisition targets (!!!) once FTX has realised his ambition of overtaking rivals Binance and Coinbase.

According to Coinmarketcap, FTX today is the sixth-biggest crypto derivatives exchange by recent volume, behind Binance, OKEx, Huobi Global, CoinTiger and Bybit.

It says it has over 1 million in daily users and over US$10 billion of daily trading volume, with revenue up tenfold this year. It has paid millions for high-profile sports sponsorships, including US$135 million for naming rights to the arena where the Miami Heat basketball team plays.

“We started out as a new derivatives exchange two years ago, and this round will help us continue to build out a bigger and broader vision for what FTX could become,” Bankman-Fried was quoted as saying in the announcement.

Opensea raises US$100m at US$1.5 billion valuation

Also overnight, Opensea announced it had raised US$100 million in a Series B funding round led Andreessen Horowitz (a16z) that values the leading NFT marketplace at US$1.5 billion.

Announcing our Series B. We’ve grown the @opensea team to over thirty people now. Here’s the background story (1/9): https://t.co/hbmVaqTDbx

— Alex Atallah (alexatallah.eth) (@xanderatallah) July 20, 2021

NBA star Kevin Durant, Creative Artists Agency co-founder Michael Ovitz, actor Ashton Kusher, Eventbrite co-founder Kevin Hartz and Shopify chief executive Tobias Lutke participated, along with Coatue Management.

Launched in 2017, Opensea sold $160 million in digital assets in June alone, and says its volume growth in the first half was up 45x from the prior six months.

Opensea is currently live on Ethereum, Polygon and Klaytn, and said it would expand to Flow and Tezos “in the coming months”.

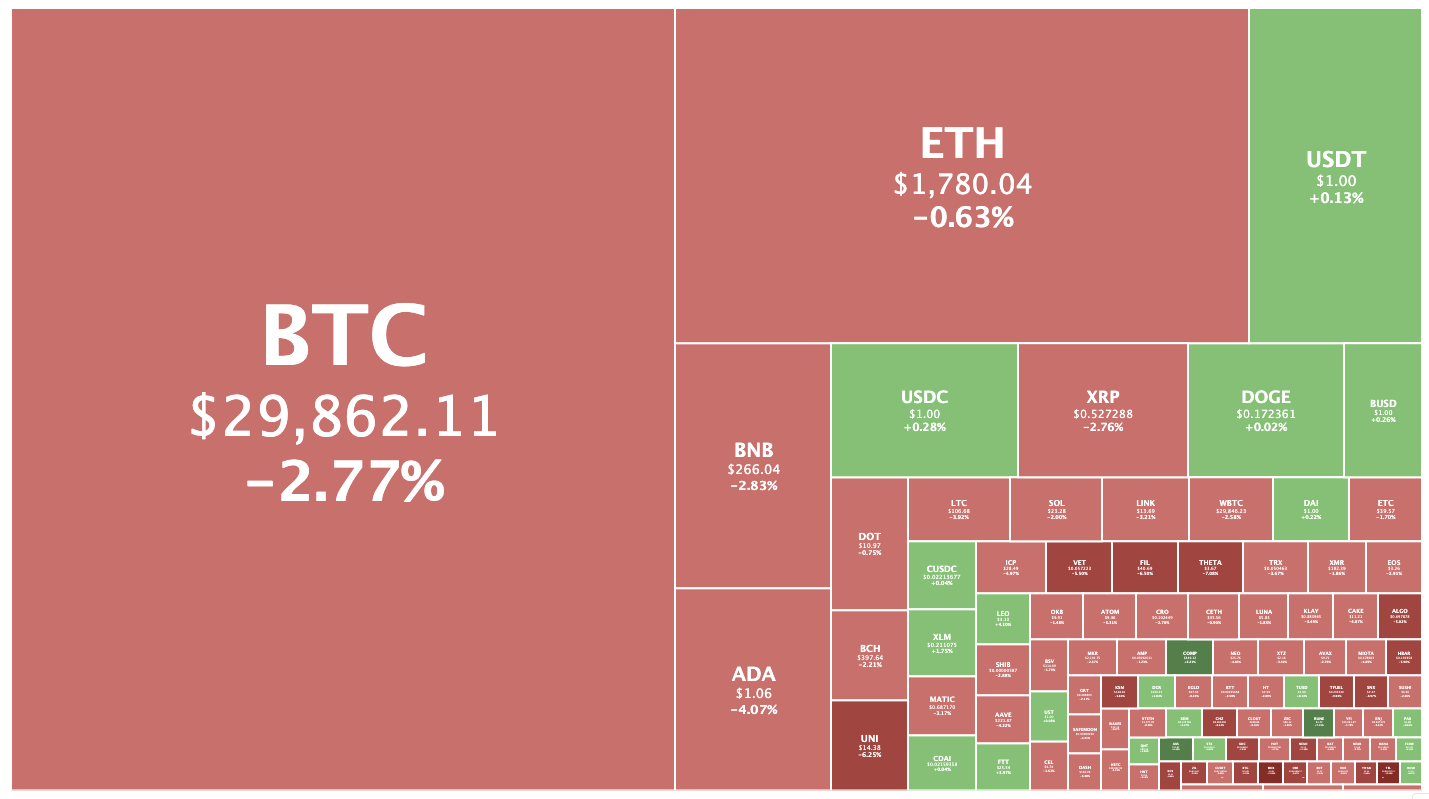

Crypto markets lower

Meanwhile, the crypto market has overall dropped 2.0 per cent to US$1.25 trillion, with Bitcoin falling 2.4 per cent to US$29,850.

“There’s nothing good about what I’m seeing right now, but 1) there hasn’t been that much volume, and 2) we still haven’t created a lower low,” wrote analyst Bitcoin Charts.

“Breaking below 30k is pretty significant, but the fact that we haven’t seen a massive amount of volume come in yet, *COULD* be a good sign. Keep in mind, this was a 2+ month range we were in, so it could take time to see capitulation, ultimately creating a lower low.”

Bitcoin was likely to keep going down until there’s “some sort of bullish divergence” or a bullish move “with conviction”.

BTC was close to wiping out its gains for the year, having begun 2021 in the low US$29,000 level.

“If the large volume going through our OTC desk right now is anything to go by, sophisticated investors see this as a great opportunity to buy more bitcoin and other major cryptocurrencies,” said Adrian Przelozny, chief executive of Sydney-based exchange the Independent Reserve.

Ethereum was flat at US$1,788.

A few coins were up, however, led by THORChain. The cross-platform exchange token rose 12.1 per cent after a horror couple of days following a US$5 million hack.

Axie Infinity was second, up 7.7 per cent to US$16.75 per cent.

FTX Token, used by the aforementioned FTX exchange, was up 5.4 per cent.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.