April Crypto Winners: Radix, Render and frog memecoin Pepe fool the bears

Getty Images

Another month bites the dust, so how did it fare for Bitcoin and the wider cryptoverse? Let’s see.

Look, it was no March 2013, or even anywhere near as good as March 2023. Still, it managed to scrape through in the green with a 2.81% gain for the leading crypto Bitcoin (BTC), which the market generally tends to use as an overall barometer of health.

“Sell in May and go away”? Based on the past two years as a form guide, you’d think that might be the play here. That said, if you believe the crypto market is on the cusp of another bull run, as it was back in 2019 and 2020 around this time of year, then you might need to be a little careful how seriously you take popular old finance-related adages.

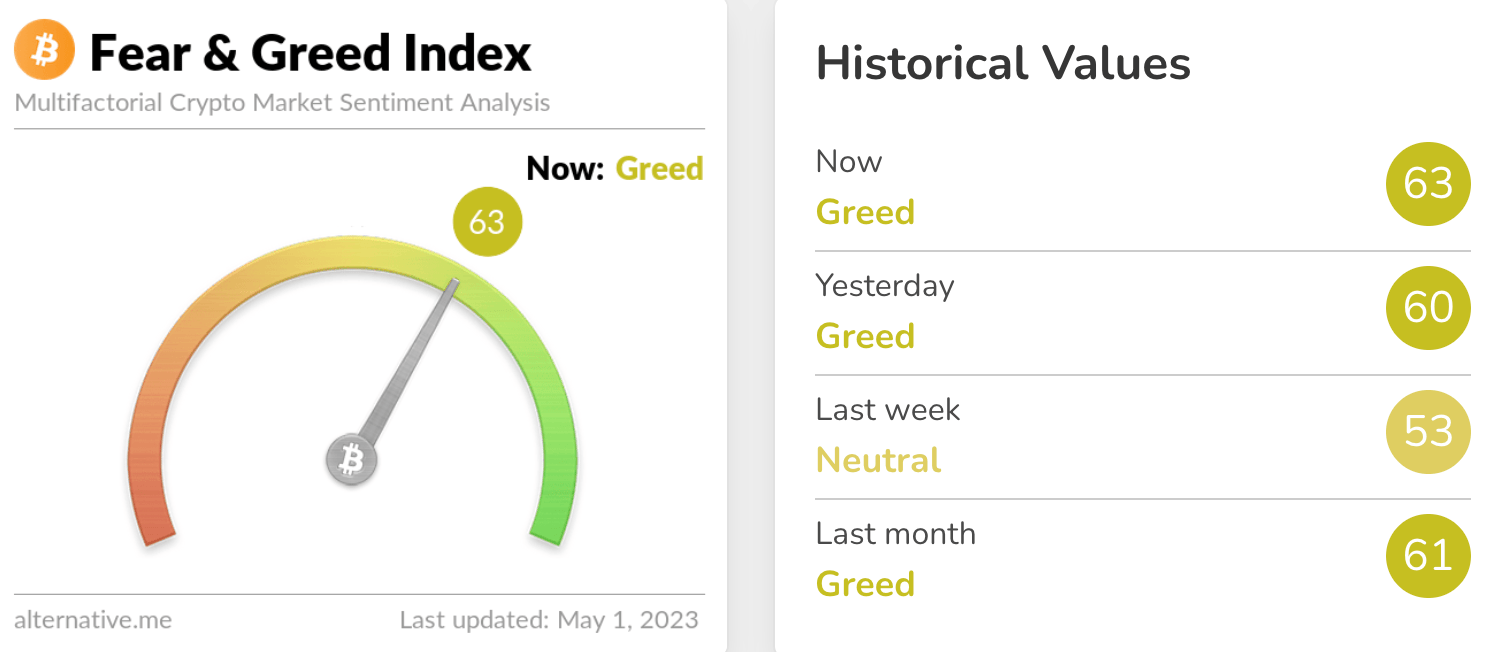

A check-in with the Crypto Fear & Greed Index , the market’s leading sentiment indicator, tells us there was plenty of ‘Greed’ floating about from Bitcoin and crypto investors in April.

And, while that metric has been a little choppy over the past week, there’s still plenty of FOMO about – especially at the frothier end of the market, judging by the recent interest in potentially making a fast buck from memey coins such as $PEPE.

Just a quick note on where the market’s at right now, before we take a quick look at what’s been performing over the past 30-odd days.

Bitcoin (BTC) has actually taken a sharp dip to about US$28,500 since we posted our Mooners and Shakers roundup this morning when it was sitting comfortably above US$29,200.

We’re struggling to ascertain a particularly good reason for that, other than the vagaries of market movements quite probably down to whale movements the average investing onlooker simply isn’t privy to.

The US government is in possession of a large quantity of seized Silk Road-era BTC and has expressed intent to dump it on the market in batches this year, so every time there’s a sharp dip like this, we wouldn’t be surprised if there’s some selling pressure based around that.

That said, as US trader/analyst Roman points out here, a relatively small dip down for BTC still aligns with his idea of consolidation before continuation. We shall see.

All going according to plan.

Odds are a long setup will occur within the next 5-7 days.#bitcoin #cryptocurrency #cryptotrading #cryptonews https://t.co/uZ2HN5cyAP

— Roman (@Roman_Trading) May 1, 2023

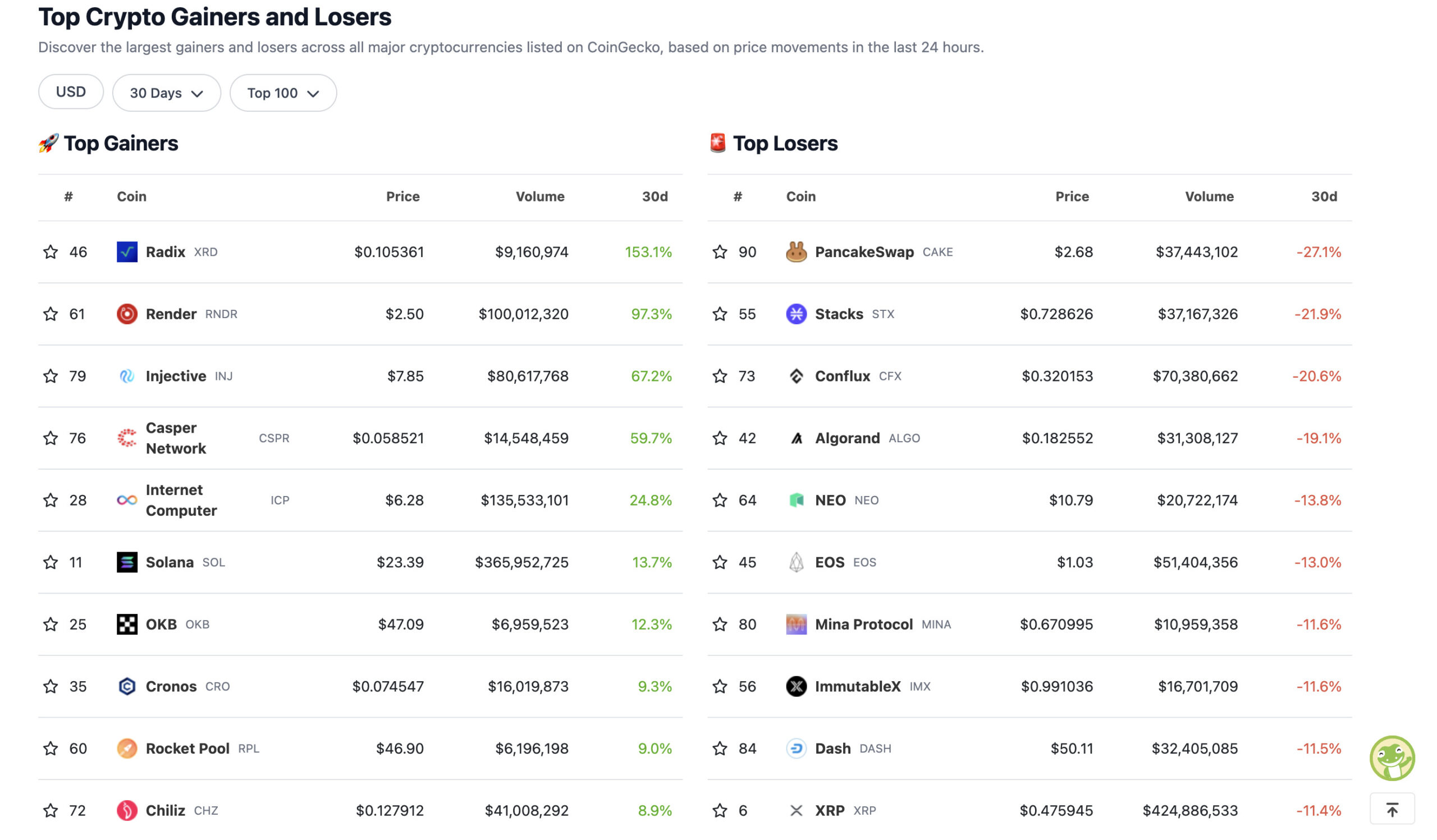

April’s 10 leading gainers in the top 100 (and some losers)

According to CoinGecko data…

Alright, then Radix. We’ll bite (at last). You’ve been popping up on daily gainz lists for the best part of the month just passed. So, what the bloody hell are you?

You’re, according to the Messari crypto intelligence outfit, a “public, decentralized ledger built to support the creation of decentralized applications, with a focus on decentralized finance (DeFi) use cases”.

You use a “new, sharded and atomically composable consensus algorithm called Cerberus to help secure the network while giving it theoretically unlimited linear scalability”.

Righto, so it’s a DeFi-app-enabling and scaling platform built on top of Ethereum. And it’s also apparently set to become a smart-contract platform its own right, with an overall aim to make web3 and DeFi development faster and more secure.

Additionally, it’s a proof-of-stake network, too, which means that holders of the native Radix token, XRD, can use it to help validate and secure the network while earning extra XRD rewards.

Why has it been having a great month, all of a sudden with a stupendous 153% gain? It appears there’s an impending upgrade for the Radix network happening in July, which has increased interest in the token. And that upgrade, dubbed Babylon, is set to launch on July 31, which will incorporate the aforementioned, Ethereum-compatible smart-contract capabilities.

“The Radix Public Network upgrade from Olympia to Babylon will occur on or about July 31st, 2023, paving the way for global Web3 and DeFi to finally exit the ‘tech demo’ stage with a mainstream-capable user and developer experience,” Radix stated in an official announcement earlier this month.

Babylon upgrade date confirmed: July 31st 2023.

The upgrade from Olympia to Babylon will pave the way for global Web3 & DeFi to finally exit the “tech demo” stage with a mainstream-capable user and developer experience.

Read more: https://t.co/XSRWWoLobE

— Radix – Radically Different DeFi (@radixdlt) April 11, 2023

There’s likely more to the surge, too, including a narrative around “liquid staking” of XRD, which will also be made available as a capability through the upcoming upgrade.

Radix’s upcoming Babylon mainnet will have native liquid staking. There won’t be a need for equivalent protocols mentioned in the article, e.g. Lido; as the Radix protocol itself issues you Liquid Stake Unit tokens after you stake. I think this is a firsthttps://t.co/YmYXI5p1sC

— Ben – Radix (@ben_xrd) April 10, 2023

You can learn more about how staking will work on the Radix network here.

Render runs, Injective injects

Other impressive gainers on the top 100 chart include Render (+97%), Injective (+67%) and Casper Network (+59%).

Render, a decentralised 3D graphics generator is creating some buzz for potentially being a protocol that could benefit from the burgeoning AI and metaverse sectors. It’s a protocol that aims to harness the power of high-performance graphics processing units (GPUs).

Essentially, the platform allows GPU owners to pass on their idle processing power to the distributed, decentralised Render network and earn passive income through RNDR tokens.

One of the main reasons for the April surge?

The Render community recently completed votes to change the architecture of the network. And in this case, that effectively means a migration from being an Ethereum-based protocol, shifting to the Solana blockchain, which is known for its fast speed and low transaction costs.

Risky move? Maybe, as the Solana blockchain has been beset with network-outage issues among other problems in the past, as Ethereum maxis would be quick to point out. That said, it’s still early stages for most blockchains and perhaps some of those teething problems for Solana are already being ironed out.

Injective, meanwhile, dubs itself “the fastest PoS layer 1 blockchain built for finance” and is backed by Binance, Pantera and the billionaire owner of the Dallas Mavericks NBA team, Mark Cuban.

It also recently announced some Solana-related news, with a partnership with a firm called Eclipse aiming to introduce what it describes as an interchain Solana Sealevel Virtual Machine (SVM) called Cascade.

It’s a bit bloody hard keeping up with all these protocol names and names for upgrades to the protocols, isn’t it? In any case, it’s to help enable the Injective tech throughout the Solana ecosystem.

Injective seems particularly confident in its own future…

We will will relentlessly build.

We will usher a new financial revolution.

We will conquer the Web3 world.

Together, we are unstoppable 🥷 pic.twitter.com/EIqpth9vao

— Injective 🥷 (@injective) April 29, 2023

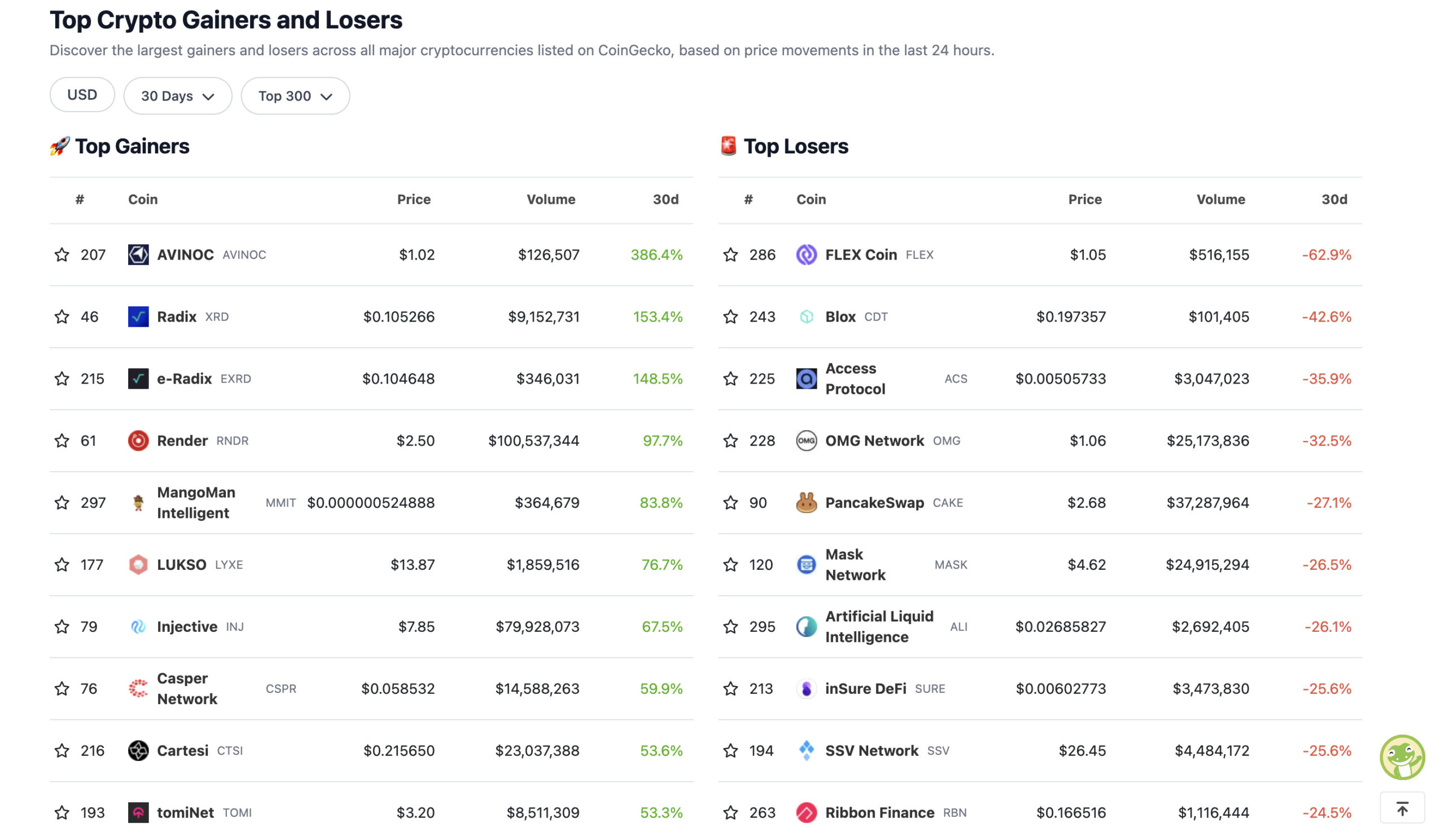

April’s 10 leading gainers and losers in the top 300

Zooming out a tad, here then, were the top 10 winners and losers from the top 300 cryptos by market cap, with thanks again to CoinGecko…

Just quickly… what’s Avinoc? It appears to have sprung out of nowhere this month, when in actual fact it’s been on the crypto scene for a good three years, apparently.

According to it, “the future of aviation is digital”, which leads us to expertly deduce it has something to do with the aviation industry. Our further amazing powers of reasoning and research led us to its website, where we learned that it’s a Hong Kong-based “tokenization company dedicated to integrating new technologies in aviation.”

Why’s it pumping? Good question. Perhaps it’s being successfully flogged over in the Middle East?

AVINOC CEO Gernot Winter successfully presented #VOO and #AVINOC to H.E. Engr. Sheikh Salem bin Sultan Al Qasimi, Chairman Department of Civil #Aviation Ras Al-Khaimah, #UAE (right) and Mohamed Al Banna, CEO of Lead Venture (middle) in #Dubai. 🤝 #realworldcryptoprojects #bizav pic.twitter.com/hfR9MotBHA

— AVINOC (@AvinocLtd) April 19, 2023

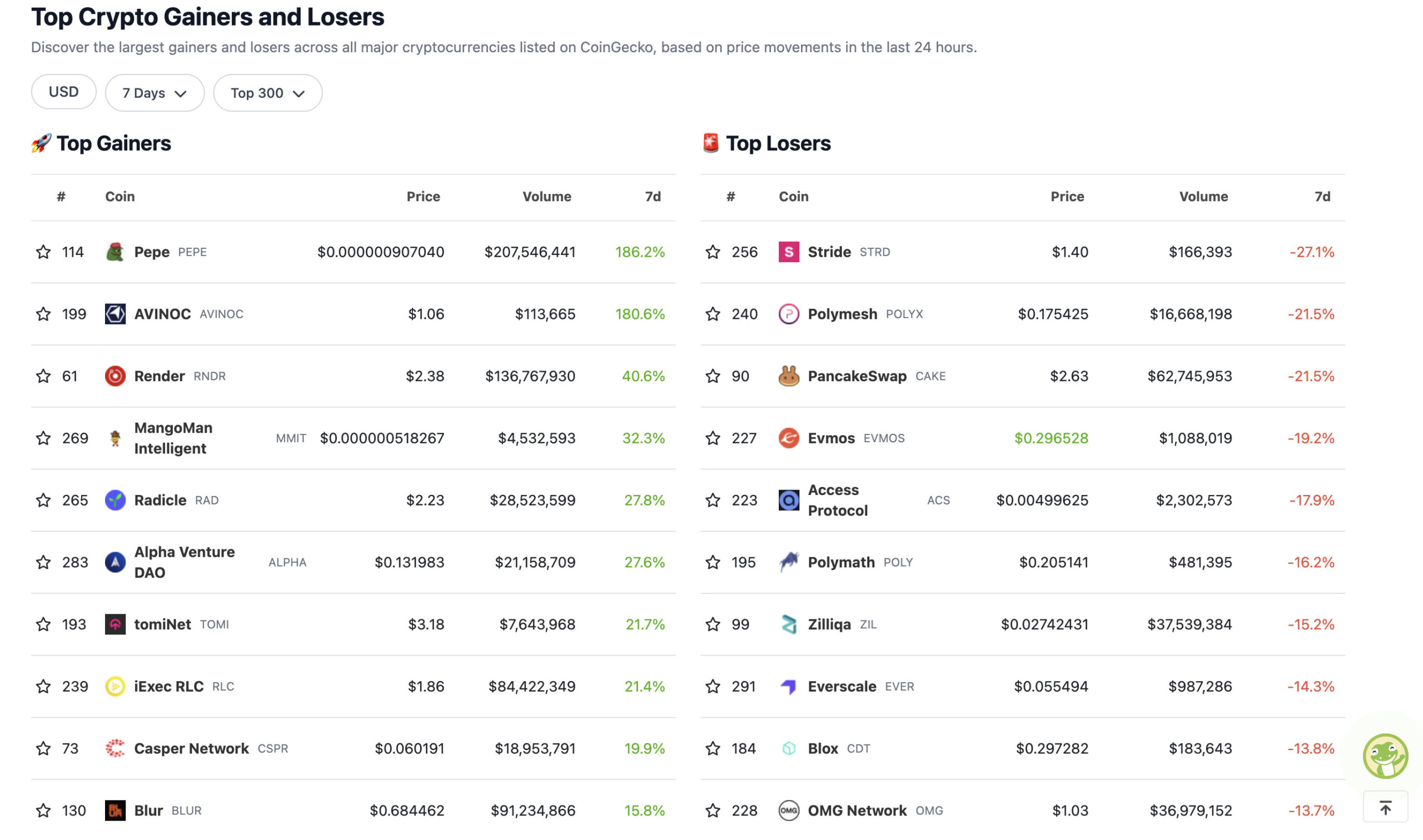

Meanwhile… PEPE

As reported earlier today in our Mooners and Shakers morning roundup, the Pepe the frog-themed memecoin Pepe (PEPE) has been on an absolute tear over the past day or so, and, as you see from the chart above, it’s up about 186% over the past seven days.

It was only created a couple of weeks ago, and only hit decentralised marketplaces such as Uniswap a short time after that, but the “most memeable memecoin in existence” is actually up a whopping 1,537% from it’s all-time low, according to CoinGecko stats.

It’s likely up considerably more than that, too, for those with the inside running on this thing, who clearly got in from the moment it launched.

People like the “Pepe Chad”, who was apparently able to buy an absolute shedload of the tokens for just $27 according to this Twitter account.

Note: this wallet is blacklisted and cannot sell

— borovik (@3orovik) April 30, 2023

Not exactly sure why the wallet seems to be blacklisted, however.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.