Apollo’s Moonshots: Solv Protocol’s new convertible vouchers will let projects raise funds more efficiently

Getty Images

David Angliss, an analyst with Australia’s leading cryptocurrency investment firm, Apollo Capital, shares the fund’s weekly take on what’s happening in the fast-changing and volatile cryptocurrency space.

An Aussie-cofounded DeFi platform has expanded its line of financial NFTs, and they’re already gaining traction in the crypto space, David Angliss says.

Solv Protocol in January rolled out convertible vouchers, a new fundraising solution for projects to leverage their own native tokens to raise funds.

They’ve already been used by leveraged trading platform Perpetual Protocol and Unslashed Finance, Angliss says.

Convertible vouchers function similarly to convertible bonds and help DeFi projects raise money in a more efficient manner, according to Solv.

A number of massive decentralised autonomous organisations (DAOs) have the majority of their assets in their native tokens, with a fraction in liquid assets such as stablecoins.

To raise funds, “they can either borrow against those native tokens to get some more liquidity, or they can sell their native tokens at a discount and have those tokens locked up,” Angliss says.

“Both have their downfalls.”

A DAO borrowing against its native tokens runs the obvious risk of liquidation if that collateral drops too low, Angliss says.

But selling native tokens at a heavy discount in exchange for a vesting period isn’t very capital efficient, Angliss says. To put it simply, it’s an expensive way to raise funds.

(Projects of course could also simply sell their native tokens on the spot market, but that’d obviously diminish the value of their tokens).

Solv’s solution

“So what Solv has done, is they’ve created what’s called a convertible voucher, that allows projects to raise funds without selling their native token at all,” Angliss says.

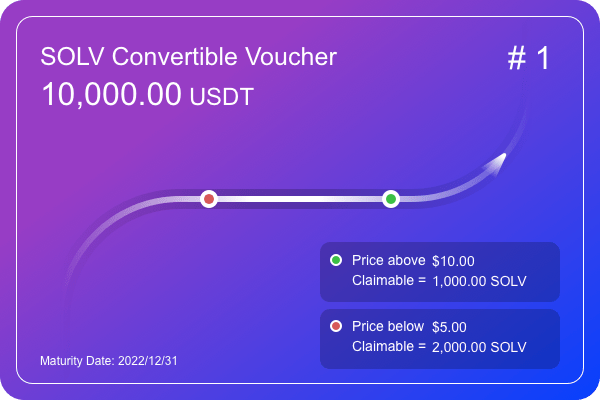

A DAO that wants to raise funds could use Solv to mint an NFT containing some of their native tokens, specifying a maturity date, nominal value and a price floor and a price ceiling.

“At maturity, if the native token price falls within the predetermined price range of the bond, the convertible voucher will execute like a zero-coupon bond,” Angliss says.

“So there’s an APY figures that’s applied to the voucher, over the course of the period, that the purchaser of the voucher will receive in full once maturity is reached.”

Payment could be made in stablecoins or native tokens, as the issuer decides.

But if the price falls outside the bond’s range at maturity, then the convertible voucher converts into a redemption voucher for investors to claim some of the underlying tokens. If the price is higher than the bond’s ceiling they would get fewer tokens; if it’s lower than the floor they’d get more.

Essentially the DAO would be taking a share of the profit if the value of their token has skyrocketed and partially reimbursing investors for their loss if their token has plummeted.

It’s a fundraising method very similar to convertible bonds (debt that can convert to equity), which Afterpay used last year to raise A$1.5 billion. But it takes just a minute to mint these NFTs.

DeFi insurance protocol Unslashed Finance last month used Solv to raise $1 million in 100 minutes, with its three-month convertible voucher that guaranteed at least an eight per cent annusalised return in Tether.

For investors, it is a good way to get a competitive yield with more limited downside than they would with most DeFi products, Solv says. Of course, the upside is also more limited than it would be from simply buying tokens outright.

Solv was co-founded by Yan Meng of Melbourne and Ryan Chow of Singapore.

convertible vouchers are novel financial instruments generated from NFT. We love NFT infrastructure and we appreciate the successes in building these new models. https://t.co/jCCIexmXz0

— Miko Matsumura (@mikojava) February 12, 2022

The convertible voucher is at least the third financial NFT on the market – Uniswap v3 also uses them to track liquidity positions and Solv also allows projects to issue vesting vouchers.

“We foresee more use cases coming from NFTs, from a DeFi perspective,” Angliss says.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

For more crypto news, follow the author on Twitter, Stockhead’s crypto-themed Twitter account, and its Facebook page.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.