Apollo’s Moonshots: Lyra Finance is making on-chain options trading easy

Getty Images

David Angliss, an analyst with Australia’s leading cryptocurrency investment firm, Apollo Capital, shares the fund’s weekly take on what’s happening in the fast-changing and volatile cryptocurrency space.

On-chain derivative platforms make up a big part of Apollo Capital’s portfolio and a promising Aussie project has just launched on Optimistic Ethereum.

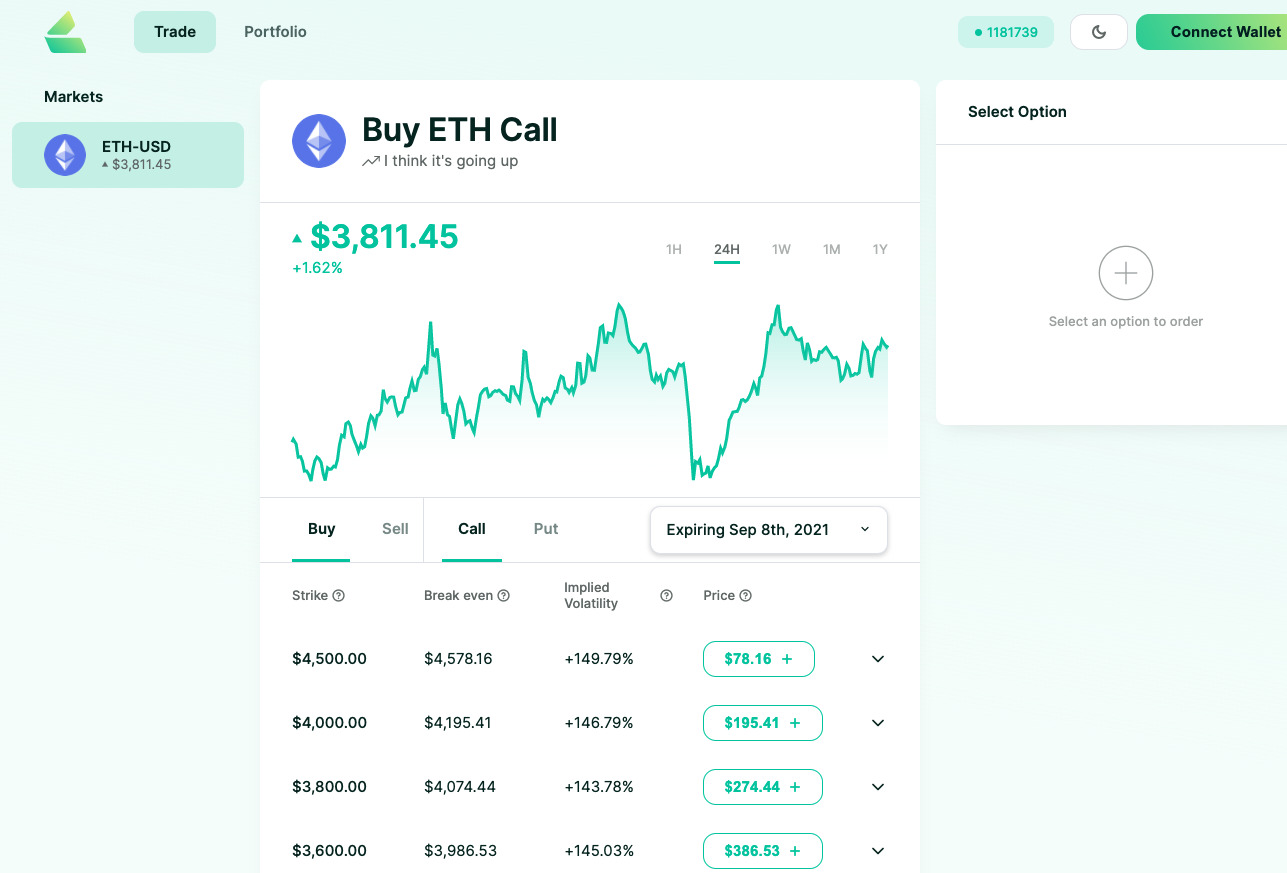

Lyra Finance offers simple, easy to understand options trading using Synthetix, although for now it is limited to just a single market, Ethereum.

Just did my first options trade on @lyrafinance, smooth as butter https://t.co/WoB11Za9O4

— Henrik Andersson (@phenrikand) August 25, 2021

“So Apollo is really excited about this one,” David Angliss says. “It combines the best of a traditional options market with crypto’s two big strengths, which is scalability, composability.”

In other words, other crypto projects will be able integrate Lyra’s options functionality into their platform, just as Lyra is built on Synthetix. The idea of “Money Legos” that all fit together is one of the ideas that most excites people in the DeFi community.

“What’s so awesome about Lyra is it’s very, very user friendly,” Angliss says. “The UI [user interface] is incredibly simple — it is creating products for end-users that would have never thought about entering options trading or derivatives trading as a hobby or as an interest, just because the knowledge gap being too great and traditional derivates products being too complicated to understand.”

The six-member project was founded by two young University of Sydney graduates, Nick Forster and Michael Spain, with core contributions by classmates Sean Dawson and Dominic Romanowski.

Apollo was one of several investors in a $3.3m million capital raising Lyra held in July, led by Framework Ventures and ParaFi Capital, two of the biggest venture capital firms in DeFi.

In the first 3 days of our controlled launch we saw over 500 unique addresses make over 800 trades on the Lyra trading platform.

It’s great to see so much interest and excitement from the community at this early stage.⭐️ pic.twitter.com/ThYw3N5KXf

— Lyra (@lyrafinance) August 29, 2021

Angliss says that Apollo sees room for multiple players in the on-chain derivates space and is bullish on the whole industry category.

“So we’re more than happy to get behind projects that we like. And it’s also an Australian founded project as well.”

Arbitrum One launch

Meanwhile, last week also saw the launch of Arbitrum One, an Ethereum scaling solution that’s a direct competitor to Optimism and was actually forked from the project.

“These things have been a long-time coming,” Angliss says.

With congestion on mainnet Ethereum causing gas (transaction) fees to soar, many users have essentially been priced out of the market and flocked to other platforms such as Binance Smart Chain, Polygon, Avalance and Solana, Angliss says.

OffChain Labs, the New York company behind Arbitrum One, also last week announced it raised US$120 million in a Series B funding round from investors led by Lightspeed Venture Partners.

Billionaire Mark Cuban, Polychain Capital and Alameda Research also took part.

“The mainnet launch means that the public can now interact with the decentralised apps on Arbitrum,” Angliss says.

Arbitrum can handle more transactions per second than Optimism, Angliss says, and should help lure users back to Ethereum.

“It’s always just marketing and how you can get users to use a platform, because people are always going to use what’s cheapest, what’s fastest and most secure,” he says.

“And it seems there’s always a different project that’s winning the race, and then an update will happen with another chain or project, and you change the game completely.

“It’s just such an exciting time to be in the space, really.”

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.