Apollo’s Moonshots: Leveraged on-chain trading platform Thales Market, Tracer Dao launch

Getty Images

David Angliss, an analyst with Australia’s leading cryptocurrency investment firm, Apollo Capital, shares the fund’s weekly take on what’s happening in the fast-changing and volatile cryptocurrency space.

Houston, we have liftoff.

Two of Apollo’s “moonshot” seed-round investments launched on Thursday, and David Angliss is enthusiastic about both.

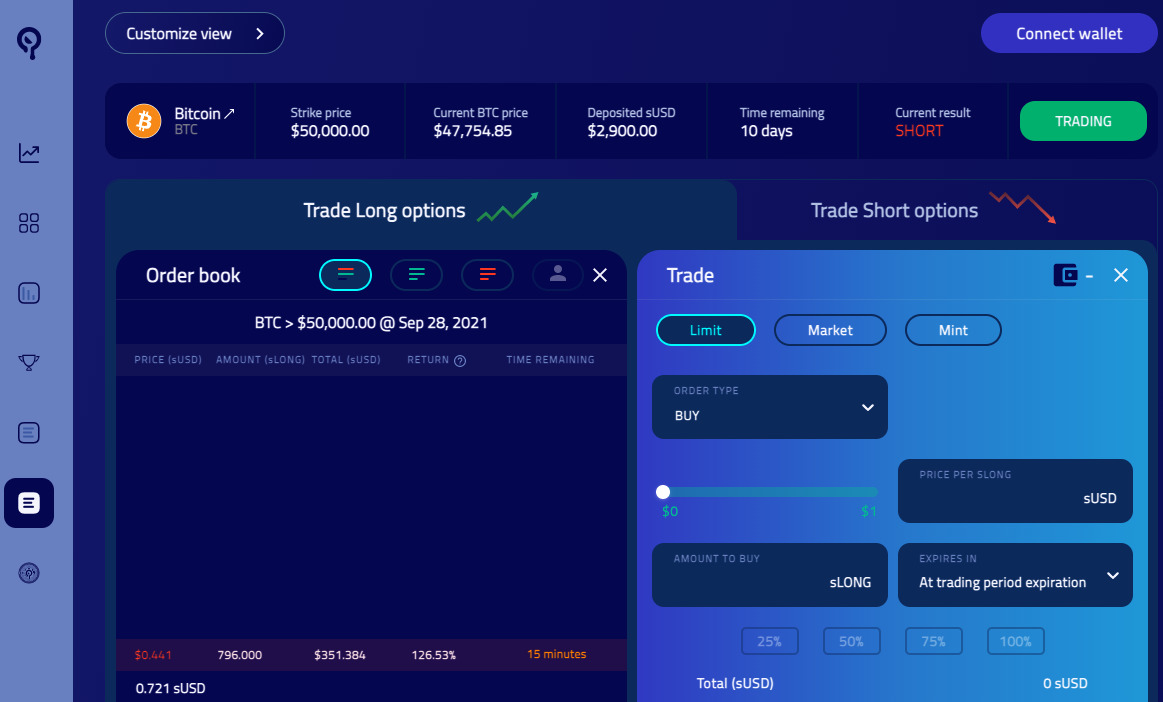

First, Synthetix spinoff Thales Market went live on Ethereum mainnet with its binary option trading platform.

“Have a look at the interface, it’s awesome,” he told Stockhead. “It’s got more than more than just predictions of Ethereum and BTC price, it’s got sport and stuff on it which is really cool.”

An airdrop of Thales tokens occurred last week to people staking Synthetix tokens. After making their debut on Thursday at around US$3.75, Thales tokens were trading on Friday for US$2.28, giving the project a fully diluted market of US$240 million.

Airdrops for staked SNX holders https://t.co/32avsCike6

— Apollo Capital (@ApolloCapitalAU) September 16, 2021

“The price is dropping quite a bit, because the airdrop they gave out was quite generous,” Angliss observed. “Naturally, people will take profits from that airdrop.”

There was also an incentivised liquidity mining program on Dodo Market, Angliss said.

$THALES is now trading on @BreederDodo

Trade now: https://t.co/FSwxWL08HH

⛏️ $THALES– $ETH LP incentives are also live, add LP to earn $DODO and $THALES rewards #JustDODOIt

— DODO DEX & NFT (@BreederDodo) September 16, 2021

Tracer Dao launch

Tracer DAO, which was developed by a Brisbane-based company called Mycelium, also launched its decentralised leveraged trading platform on Arbitrum One.

Tracer’s “perpetual pools” offer users leveraged trading without the risk of liquidation, according to the project.

Tracer on Friday was letting users take “power leverage” positions of 3x on BTC/USDC and ETH/USDC, with 10x leverage promised soon.

The platform lets users mint these leveraged tokens, which then rebalance.

Tracer Perpetual Pools has passed $5M TVL on @arbitrum network within the first 24 hours of release

Follow @tracer_stats for frequent updates. pic.twitter.com/CurGKHqzaq

— Tracer (@TracerDAO) September 17, 2021

TCR tokens were trading at US12.9c on Friday, a day after trade began. They had been volatile in their debut, reaching a high of US21.7c and a low of US9.8c. The project had a fully diluated valuation of US$129 million, according to Coingecko.

Apollo invested in July at A5.6c (US4.1c), Angliss said, adding that Apollo typically invests from $50,000 to $300,000 in a project.

The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.

Join our Cryptohead Facebook group to discuss all things cryptocurrency. Also, follow the author on Twitter as well as Coinhead, Stockhead’s new crypto-themed Twitter account.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.