Amp goes parabolic as crypto market falls 3.2%; Bitcoin ETF ruling delayed

Getty Images

The Amp cryptocurrency has jumped another 20 per cent to hit an all-time high, continuing a remarkable rally that has seen it leapfrog nearly 200 coins to become a top 30 token.

Amp was trading at US11.6c this afternoon, after reaching an all-time high of US12.1c overnight. At the start of the month it was changing hands at less than 4c, and for 0.6c at the start of the year.

The token has gone from the No. 224 crypto on May 16 to the No. 26 token this afternoon, just ahead of privacy coin Monero with a market cap of $US4.98 billion.

Launched just last September, Amp is an ERC-20 (Ethereum) token used to collateralise payments on the Flexa Network, which is integrated into payment apps such as Spedn. Flexa pays retailers instantly, while the transaction is still processing; if it fails or takes too long, Amp tokens that have staked as collateral are liquidated to cover it.

Amp’s gains have come after it was listed on US exchange Coinbase late last week.

$AMP makes the entire crypto space stronger. It transforms crypto to true currency. Imagine earning 45% APY ON your portfolio thru defi and never having to convert to fiat. People would literally be kajillionaires based on the amount tokens they have. #ampto5dollars

— HappilyEverHustle (@HustleEver) June 15, 2021

The fact that the whole market is down and $amp is up is adding fuel to the fire. More investors are flocking

— Fadi Bahri (@fadibahri) June 16, 2021

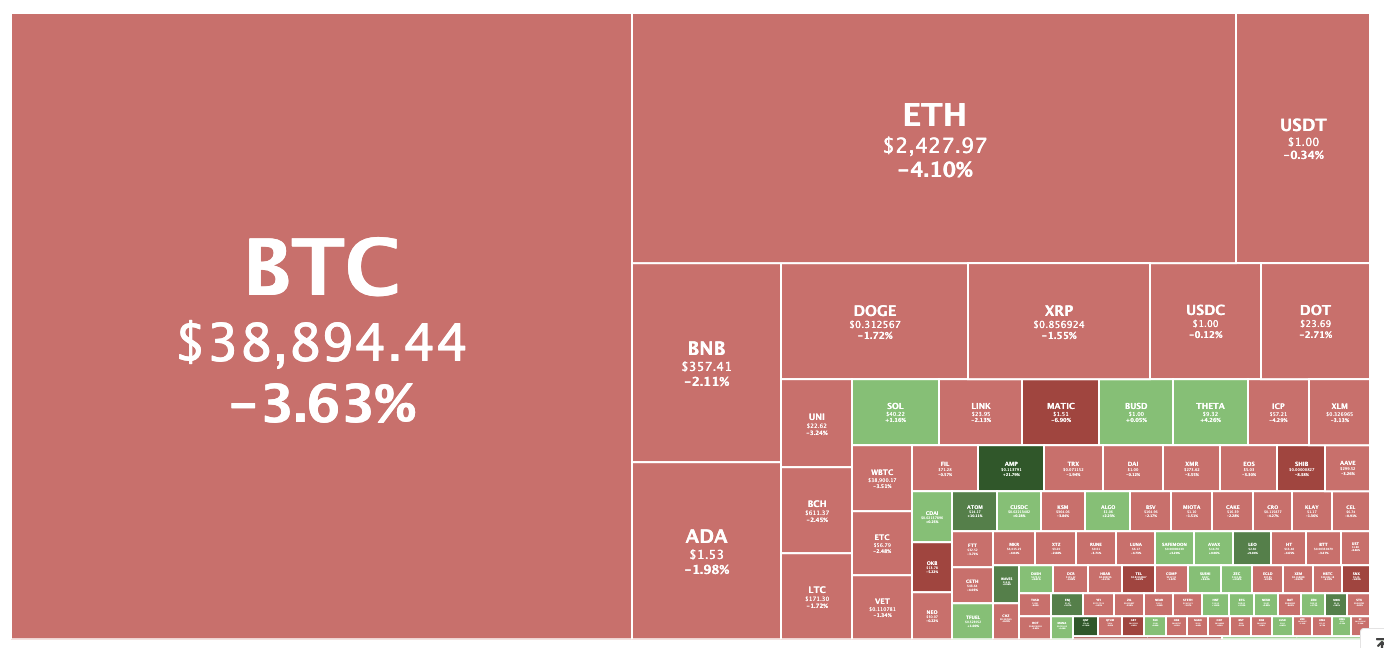

Market down 3.2%

Overall the crypto market was mostly in the red, with only 23 of the top 100 coins posting gains in the 24 hours to 3.52pm AEST.

Quant was up 15.9 per cent and Cosmos (ATOM) was up 10.1 per cent, the only other top 100 coins to post double-digit gains. The Quant token, used as part of the Overledger enterprise project to connect blockchains, had also hit an all-time high.

The worst decliner in the top 100 was Shiba Inu token, which fell 8.4 per cent after yesterday’s strong gains. Polygon (MATIC) was close behind, dropping 6.9 per cent.

Bitcoin was trading just under US$39,000, down 3.6 per cent from yesterday, having dropped under the US$40,000 mark around 8 o’clock last night.

Ethereum was changing hands at US$2,430, down 4.3 per cent.

Bitcoin ETF decision delayed

For a second time, the US Securities and Exchange Commission delayed a decision on whether to approve VanEck’s Bitcoin ETF.

Instead, the regulator solicited public comment on whether the trust and shares would be vulnerable to market manipulation.

About a dozen US firms have submitted plans for a Bitcoin ETF but so far none have been approved, due to concerns about investor protection.

The comment and rebuttal period will take the SEC’s decision on the VanEck fund into July and perhaps August.

If and when a Bitcoin ETF is approved in the US, it’s expected to bolster the crypto market and see significant inflows.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.