Altcoins make double-digital gains in July

How to invest in cryptocurrency in Australia (Image: Getty)

Bitcoin (BTC) is on track for its first positive weekly gain since late May.

The digital assets showed market strength as its value increased 2.2 per cent on Monday. This took BTC’s price to $13,430.

Sentiment was bolstered by a $180 price increase on Wednesday. However, hopes of further bullish price movement were squashed as prices tumbled 1.9 per cent on Thursday. It closed at $13,298.

BTC’s price is correlated to movements on major stock markets. Thursday’s losses are tied to heightened pandemic concerns, triggering losses on US stock markets.

Other markets

BTC’s price movement caused a flurry of activity across BTC Markets, with other digital asset seeing double-digit gains.

Chainlink (LINK), a decentralised oracle network, experienced a 34 per cent price increase. LINK, now valued at over $9, is a bridge between blockchain networks and other internet-based data feeds.

The breakout is attributed to growing popularity of decentralised finance (DeFi) projects. DeFi seeks to provide anyone with a smartphone affordable and secure blockchain based financial services.

Market capitalisation of DeFi projects have increased fivefold over 2020.

Remittance and cross-border payment network Stellar gained over 27 per cent this week. The network’s native token, the Lumen (XLM), posting an impressive 13.5 per cent performance on Wednesday alone. XLM current sits at 12.39c, just 1.09c off its yearly high.

XRP, the fourth largest digital asset by market capitalisation, joined the rally. Its price increased over 13 per cent since Monday. The asset is now valued at 29.02c.

Wednesday’s 10 per cent gain is XRP’s largest single-day performance since mid-March.

Due to market growth, digital assets total market capitalisation rose $25bn to $395bn. BTC dominance has come down to 62.9 per cent. This is a result of Ethereum (ETH) increasing its market capitalisation across the past 7-days.

BTC Derivative markets

Volatility on BTC’s Options markets reached its lowest value in over a year. It reached 46 per cent on July 3.

Volatile markets give options traders more incentive to enter the market. The greater the price swings, the greater chance of profit.

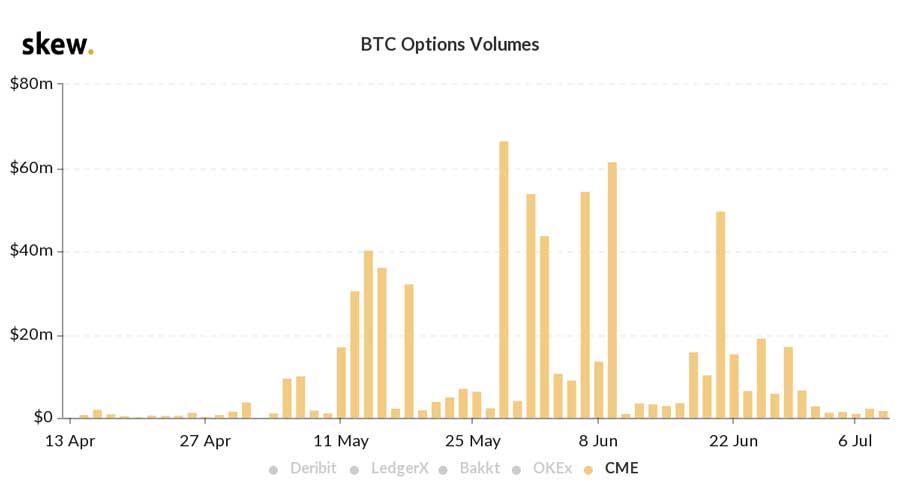

Options volume on the Chicago Mercantile Exchange (CME), representing institutional investor activity, has dried up in July. This shows that market conditions aren’t currently favourable to traders.

However, data from analytics firm skew reveals that funds continue to flow into CME’s options market. Open interest on this market risen $US16m over the past fortnight.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.