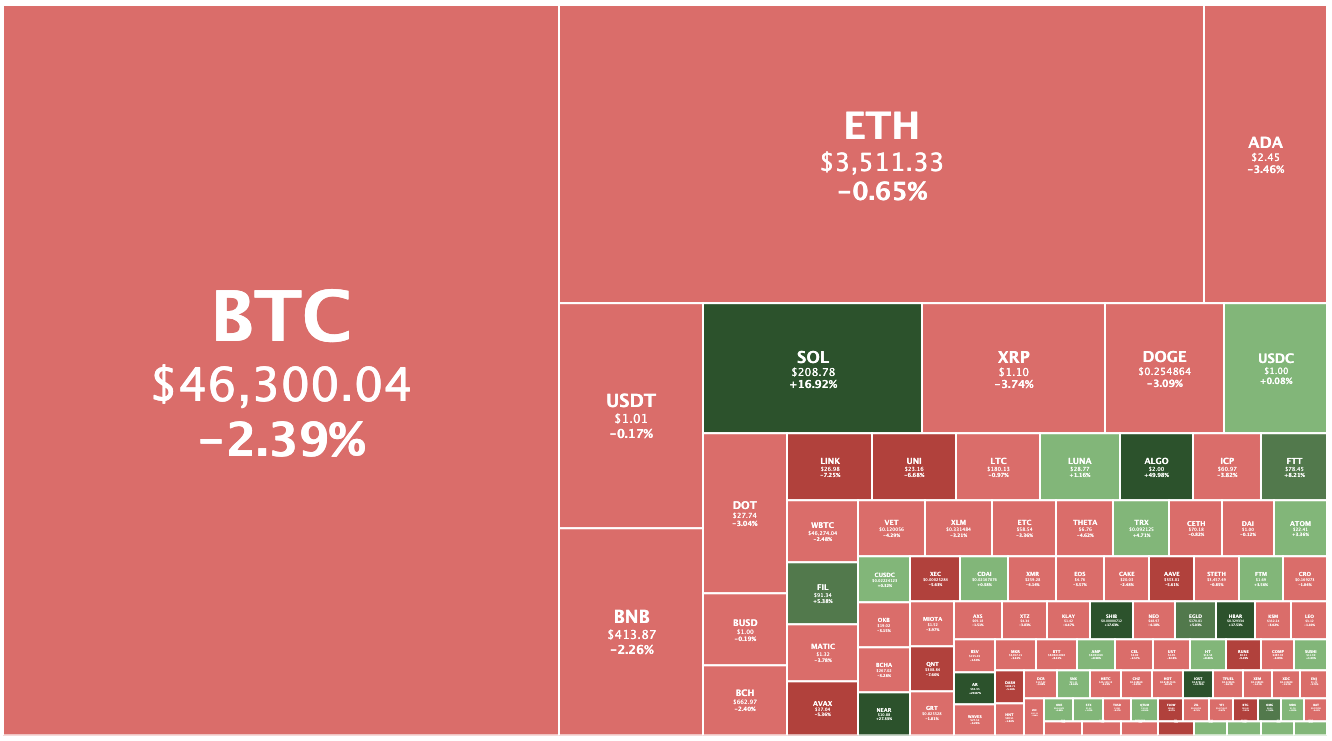

Algorand soars 59pc, Solana cracks $200 as L1 platforms keep surging; riches for dYdX users

Getty Images

Algorand has become the latest layer 1 blockchain to be re-assessed by the market, enjoying a massive pump as Ethereum‘s scaling woes continue.

The smart contract platform was up 59 per cent this morning to a more than two-year high of US$2, leapfrogging eight coins to become the No. 17 crypto.

There wasn’t any obvious single catalyst for the move, although the Algo was the subject of a positive tweet last night by Galaxy Digital chief executive Mike Novogratz. (Stockhead profiled the coin in July).

Solana meanwhile has continued its relentless march forward, cracking $200 and overtaking Ripple Labs’ XRP token as the No. 6 crypto.

It was up 18.6 per cent to US$207, and earlier this morning hit an all-time high of US$211 — just nine days after breaking the $100 barrier.

Other high-performance blockchain platforms were also on fire, even as Bitcoin edged lower.

IOST, the No. 77 crypto, rose 41.6 per cent to US7.7c.

Near Protocol, the No 35 coin, gained 24.6 per cent to hit an all-time high of $11.27.

Hedera Hashgraph, Harmony and Fantom were all up by between 10 and 15 per cent.

Layer 1 blockchains have been surging since late August, when Solana began its parabolic rise.

That success may be causing traders to look for the “next Solana”. There also may be a sense that the recent long-awaited launches of Ethereum scaling solutions Arbitrum One and Optimism has been underwhelming, causing the market to look at other alternatives.

dYdX airdrop riches

Bitcoin meanwhile was down 2.3 per cent to US$46,196, and Ethereum was down 0.8 per cent to US$3,500. Cardano had fallen 3.3 per cent to US$2.44.

Trading in the governance token for dYdX, a decentralised derivatives exchange on the Ethereum scaling solution Starkware, began overnight.

At lunchtime Sydney time the tokens were changing hands for $11.82, making them the No. 127 crypto.

Around 64,000 people who had used the exchange before July 26 were eligible for an airdrop between 310 and 9,529 tokens based on their trading volumes – although only around 30,000 half-bothered to claim before the deadline.

At current prices, users who simply traded US$1,000 to US$10,000 on dYdX are being rewarded with US$13,750 in tokens, while the 787 users who traded more than US$1 million received US$113,000 in coins.

gm future decamillionaires from @dydxprotocol airdrop

— Darren Lau (@Darrenlautf) September 8, 2021

Overall the crypto market was down 0.1 per cent to US$2.18 trillion.

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.