Adoption in El Salvador doesn’t pump Bitcoin, but Musk makes X-rated token jump

The Bitcoin 2021 conference in Miami drew thousands over the weekend. (Getty Images)

Not even El Salvador potentially adopting Bitcoin as legal tender has been able to boost crypto prices.

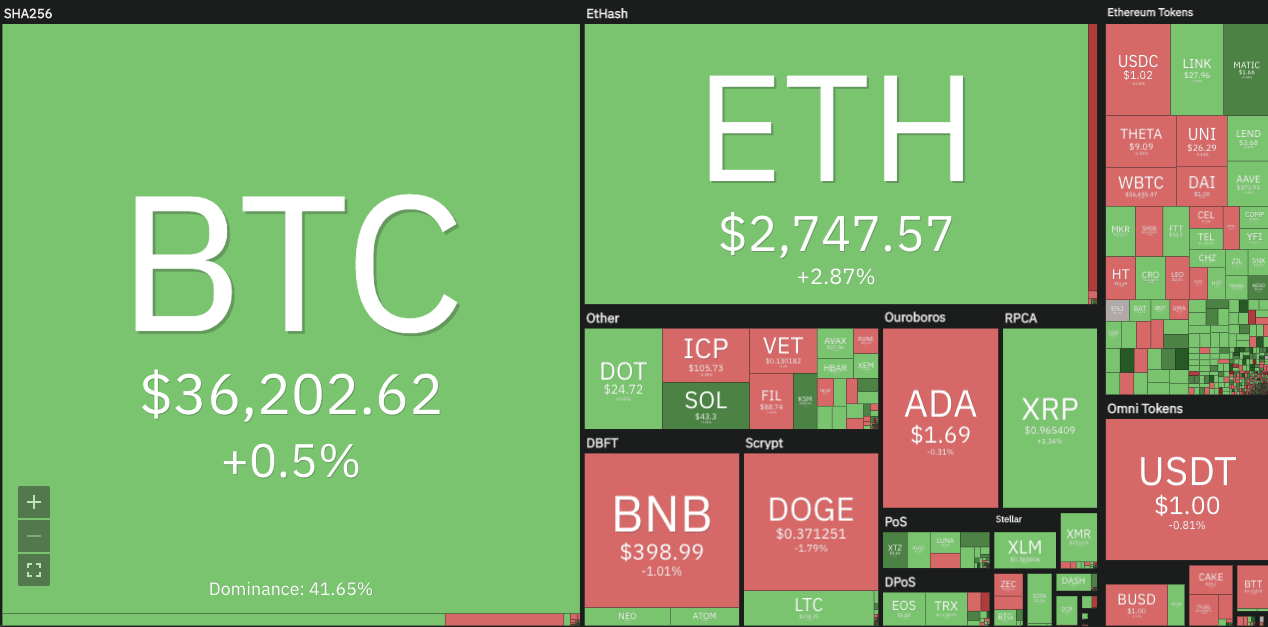

BTC was trading for US$36,230 ($46,870) at 11.25am AEST today, up 0.6 per cent from 24 hours ago but down from US$37,600 the same time Friday. The possibility of a Bitcoin “death cross” remained very much in play.

Ethereum was changing hands for $2,755 ($3,560), up 3.4 per cent from Sunday but about the same as Friday.

The overall crypto market was up 3.3 per cent to US$1.72 billion, according to Coingecko. Waves, Tezos and Fantom have been the biggest gainers, up 16.5, 12.1 and 12 per cent, respectively.

Just 12 of the top 100 coins were down. Privacy coin Pirate Chain was the worst laggard, falling 4.6 per cent in the past 24 hours.

Musk pumps Cumrocket

Meanwhile, an X-rated token known as Cumrocket was trading about triple its value from last week after being spruiked by Elon Musk.

Used to pay for buying NSFW NFTs and content on adult websites, Cummies — as they are known — were changing hands for US12c this morning. They had reached a one-month peak of US21c in the immediate aftermath of this tweet on Saturday night (Sydney time):

–>

— Elon Musk (@elonmusk) June 5, 2021

A Musk tweet on Friday that went over some people’s heads at the time in retrospect likely indicated the eccentric billionaire had developed an interest in the token.

Canada

USA

Mexico— Elon Musk (@elonmusk) June 4, 2021

At 12c, Cumrocket has a market cap of US$153 million, making it the No. 252 crypto.

El Salvador set to adopt Bitcoin

On Sunday, El Salvadoran President Nayib Bukele announced, via a recorded video message to the Bitcoin 2021 conference in Miami, that the small Central American country would move to make Bitcoin a legal currency, alongside the US dollar. (El Salvador abandoned its own currency in 2001).

#Bitcoin has a market cap of $680 billion dollars.

If 1% of it is invested in El Salvador, that would increase our GDP by 25%.

On the other side, #Bitcoin will have 10 million potential new users and the fastest growing way to transfer 6 billion dollars a year in remittances.

— Nayib Bukele (@nayibbukele) June 6, 2021

The proposal must still be passed by the legislature but Bukele’s New Ideas party holds a supermajority there. With the president of Congress adopting the “laser eyes for 100k” Bitcoin meme on his Twitter profile, passage seems assured.

It’s less clear what passage of the bill would really mean, however. Bitcoin is already legal in El Salvador, along with most countries, and people and businesses can choose to accept it if they wish.

According to the Bank of England, “Legal tender has a narrow technical meaning which has no use in everyday life. It means that if you offer to fully pay off a debt to someone in legal tender, they can’t sue you for failing to repay.”

Some speculated online that if El Salvador deems Bitcoin a currency, that would change accounting and tax implications for other standards for other countries.

The cryptocurrency could also potentially make the remittances that account for 20 per cent of El Salvador’s GDP cheaper. For the 70 per cent of El Salvador’s 6.5 million people who lack bank accounts, receiving international transfers can cost 10 per cent or more of the transaction.

Still, Bitcoin transaction fees were averaging US$5.50 recently, and were as high as US$60 in April. Mobile payments company Strike is working with El Salvador and could use the Lightning Network to reduce fees.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.