10 reasons you shouldn’t be sleeping on Bitcoin and crypto right now

Wakey, wakey – Doge just won't quit. (Pic via Getty Images)

That’s something of a click-baiting headline, but there’s meat here. With that in mind, it’s about time we pan-fried a Bitcoin-marinated (T)rump steak and served it to you medium-rare with a peppery altcoin jus.

Apologies in advance, but this is a big one…

You might’ve noticed Bitcoin and Ethereum – as dependable a pairing as you’ll find in investment portfolios brave enough to include crypto – have both been recovering well of late, with a bit of charts chop, naturally.

It’s a recovery from a lower-lip-trembling, roughly 25% total crypto market rout between the beginning of June and about July 5, when things – by the grace of almighty God Satoshi – began to turn back up again after hitting a near five-month low of US$53,600.

Bitcoin, at the time of writing, is pinballing between US$66k and $67k.

In fact, over the past week or so, there’s been a spike in crypto big caps, as you can see here, courtesy of CoinGecko. (Solana, XRP and even Dogecoin have also been performing particularly well in the top 10 cryptos by market cap.)

There are some reasons for this, and some definite reasons to pay attention right now to this oft-maligned-and-underestimated sector.

Let’s tuck in.

Wait… before we tuck, and before anyone writes in to complain that this article appears to be pushing a whoopin’ and hollerin’, MAGA-tastic, red-trucker-capped, ear-splattering, “fight, fight, fight” US Republican narrative… it should be pointed out that this occasional columnist is a mere spectator of the US election run-up, from a far-off land, aiming to present accurate listicle factoids without political bias. Popcorn in one hand, mobile phone displaying a heavily tapped crypto portfolio app in t’other. (See disclaimer at end of article.)

1. The ‘Trump bump’

Yes, it’s true – the GOP wants and (depending on what the Democrats do next) could very well get the single-issue crypto investor vote. Love him or loathe him – and there are few in between – Donald Trump has made this very apparent over the past few months.

And, according to the now-orange-pilled, orange-tinged, bloated, bullet-dodging presidential candidate himself, that exceedingly selfish, bag-pumping vote potentially represents something in the vicinity of 50 million Americans invested in crypto in some form or other.

Addressing a rally in Washington in late May, Trump said, among many other things, this:

Donald Trump declares “I will keep Elizabeth Warren and her goons away from your #Bitcoin” pic.twitter.com/SDmPGEFr5v

— Steven Budgen (bees84) (@ProofOfSteve) May 26, 2024

For some context there, prominent sections of the Biden government have, at times, been downright hostile to the crypto industry in America. Senator Elizabeth Warren, seemingly in strong cahoots with SEC chair Gary Gensler, has been at the forefront of this. Gensler, meanwhile has been leading the US financial regulator’s approach to the crypto industry via an enforcement-first strategy.

Warren has been building, in her words, an “Anti Crypto Army” to essentially attempt to neuter or completely take down the industry in America. It should be noted that this is a bi-partisan effort, but it’s Dems-dominant.

The complete dismissal of an entire industry by a powerful few in Washington has been staggering to behold, and sets the mind whirring about potential hidden agendas.

Crypto, as an industry and developing tech sector is certainly not without its flaws – it has more bad actors than an American Adult Film Industry Awards ceremony (probably). But it is bristling with innovators and cryptographic geniuses, too, along with millions of investors just trying to get ahead. And, as a growing niche of the tech industry with a short but compelling history of innovation in the country, it has the potential to create many, many US jobs.

The good news for crypto holders is, Warren and her cronies appear to be losing the fight – not only of hearts and minds, but in federal courts, too, with big wins for XRP and Grayscale and for the path-clearing of Ethereum spot ETFs.

But back to Trump. According to the prediction market/betting beast Polymarket, particularly ever since the failed assassination attempt on his life, Trump is odds on favourite to plonk his butt back on the Oval Office leather swivel chair come November. The likelihood of this outcome soared to 72% recently, according to the site. That said, the figure has pulled back to 65% in the wake of Biden stumbling out of the presidential race on Monday.

Trump’s messiah-like status among his followers only seems to be growing. A vocal Bitcoin sceptic when he was president, the worm certainly turned inside his opportunistic, mangled ear.

Speaking of opportunity, Trump will be speaking at a major annual Bitcoin conference in Nashville, Tennessee on July 27, which, as CoinDesk notes, firmly puts “crypto on the campaign trail” once and for all and will “mark a pivotal point for crypto”.

Another one.

There are even rumours (not presenting this or the tweet below as fact) circulating that Trump could look to add Bitcoin as a US currency reserve asset if elected president.

HUGE BREAKING: Trump to announce a USA #Bitcoin strategic reserve in Nashville – Sources

— Dennis Porter (@Dennis_Porter_) July 18, 2024

Asked recently why he’s now embracing the crypto community, Trump told Bloomberg: “If we don’t do it, China is going to pick it up and China’s going to have it – or somebody else, but most likely China.”

“China… China, China.”

So which crypto bro or broettes have been whispering sweet digital nothings into the one-time Bitcoin sceptic’s ear? This bloke, for one…

2. The Vance advance

The former POTUS last week officially announced his running mate. And that person, Senator J.D. Vance, is a Bitcoiner.

Let that sink in.

The potential Vice President of the United States is a ‘to the moon’ Bitcoin-‘hodling’ crypto investor and advocate, who, in a 2022 financial disclosure reported owning holdings in BTC through Coinbase valued in the vicinity of about US$250,000.

Vance, like Trump, is another controversial and polarising figure in the increasingly bonkers world of US politics. But then again, who isn’t?

Here he is talking about why SEC chair Gensler’s approach to regulating crypto is “the exact opposite of what it should be”.

Bitcoin is up $10,000 in 10 days.

Is it pricing in the likely new Administration? (President Trump + J.D. Vance)

Both out pro-crypto.

J.D. is knowledgeable about utility tokens and hates Gary Gensler. That’s about all you need to know.

Watch this: pic.twitter.com/jXLvdcouLo pic.twitter.com/oaMm0DZMix

— Colin Talks Crypto (@ColinTCrypto) July 15, 2024

Who else has been in Trump’s ear about Bitcoin and crypto? Other prominent Republicans including Vivek Ramaswamy, Cynthia Lummis and Tom Emmer to name a few.

3. Bye-din, hello… Harris?

The calls for Joe Biden to step down from the presidential race had been growing louder and louder – partly because those making the calls really had to speak up so he could hear what they were saying.

Given the current POTUS’s cognitive functionality has been noticeably trailing off, like one of his inscrutable sentences, his decision to stand down from the race couldn’t have come sooner for many a Dem.

Now the Democrats might actually stand a chance again. But… what might that mean for crypto if they were to retain power?

That’s a bit of an unknown at this stage, but one thing’s for sure – how could Biden’s officially endorsed replacement Kamala Harris, or any other nominee (aside from Elizabeth Warren) for that matter, be any worse for the crypto sector?

Biden has been just about the worst US president possible for the global cryptocurrency market, for instance outright vetoing crypto-positive bi-partisan bills and helping to foster “Chokepoint 2.0” – the coordinated, Warren and Gensler-fuelled attempt to neuter and de-bank the industry and make it nigh impossible for American crypto companies to operate within the US.

It’s very possible, however, that a new Democratic leader could take the opportunity to seize a more pro-crypto line, which might just nullify one of the under-the-radar aces up Trump’s sleeve. We shall just have to wait and see.

4. The Fink tank

For all the high-profile, vocal Bitcoin and crypto haters – such as Warren Buffett, much of the Biden administration, JP Morgan CEO Jamie Dimon, as examples – we’ve also been seeing a growing cohort of prominent supporters. El Savador’s president Nayib Bukele, MicroStrategy BTC bull standard bearer Michael Saylor, presidential candidate Trump and and, to a point, Elon Musk.

There are many more influential figures in one or the other of the two camps.

But probably the most influential figure of them all is Jim Cramer Larry Fink – CEO of the biggest, most far-reaching asset manager on the planet, BlackRock.

Here’s Fink going into bat for BTC on popular US financial channel CNBC last week, chatting to muppet-voiced analyst Jim Cramer – who, on Bitcoin and crypto, seems to flip-flop more than a pair of Havaianas in a heat wave.

Fink is still holding back a bit:

“#Bitcoin is an asset you buy when you BELIEVE there are countries that debase their currency…. And some do!”

You do not have to believe that the political currency you are forced to use is being debased, that is FACT.

pic.twitter.com/E5Dk9y5O28— Bram Kanstein (@bramk) July 15, 2024

In that clip, the BlackRock boss said he believes “Bitcoin is digital gold” and that he is “a major believer there is a role for Bitcoin in portfolios”.

“I couldn’t agree more” replied Cramer, adding “I changed my mind about it when you did.” (Before changing his mind back and forth several times since, and then solidifying his current opinion on Bitcoin one second after Fink finished speaking in this latest interview.)

BlackRock, by the way, led the institutional charge of BTC ETFs begrudgingly approved by the SEC earlier this year and with its US$20 billion+ IBIT ETF continues to dominate a couple of handfuls of big players (including Fidelity and VanEck) in that sub-sector in terms of size and inflows.

In just July alone, BlackRock purchased more than US$1 billion worth of BTC, including a $107 million acquisition just on July 18.

As for rival asset manager Fidelity, how’s this for an insane price prediction? Jurrien Timmer, Fidelity’s global head of macro, has claimed that Bitcoin could reach as high as… (Dr Evil music)… 1 billion dollars … by 2038.

Bonkers. Look, it’s something to do with Metcalfe’s law, apparently – “a networked financial asset’s value is equal to the square of the number of users in the network.”

Oh, and one more thing regarding Larry Fink… there are even some rumours circulating that Trump favours the high-profile money manager to become the next US Treasury Secretary.

Say whaaaat?

Can you imagine what that would do to the price of BTC?

5. For whom the Dell tolls…

Tech billionaire Michael Dell, the founder and CEO of Dell Technologies, is the latest to present his ticket and step on board the Bitcoin train.

There’s not much to say about that, other than the fact he’s another influential figure tweeting about it lately, in particular pointing to Larry Fink’s interest, but also expressing his fascination with the technology.

But the rumours are strong that either he himself, or his company, might be looking to invest heavily into the leading digital currency.

These tweets stoked that fire further…

This is a great account to follow @MeCookieMonster. Very entertaining pic.twitter.com/RJFcNpCXrN

— Michael Dell (@MichaelDell) June 21, 2024

#Bitcoin is Digital Scarcity.

— Michael Saylor⚡️ (@saylor) June 20, 2024

(Dell then retweeted Michael Saylor’s reply posting.)

6. ETFs a-gogo

We already mentioned the Bitcoin ETFs above, approved in the US earlier this year. A regulated, institutionally approved vessel for big-money investors to gain exposure to the the asset class – crypto’s bull goose currency and “digital gold”.

But an Ethereum ETF is up next, and then you can likely expect more of the larger “altcoins” to nab some ETF action, too. Solana for instance. Maybe XRP.

A few months ago a US Federal Court derailed the SEC’s efforts to block Ethereum ETFs from becoming a reality, which could in turn clear a pathway for some of these other altcoins to gain huge institutional exposure.

As of today, spot ETH ETFs are now, according to various media reports, able to launch on major US stock exchanges and begin trading. It’s a similar cabal of institutional players in that race to the BTC lot, with issuers including BlackRock, Fidelity, 21Shares, Bitwise, Franklin Templeton, VanEck and Invesco Galaxy. Probably Grayscale soon, too.

VanEck and 21Shares have also now filed for Solana ETFs and Grayscale, which is into a basket of various other altcoins, could be looking to flip those into an ETF index fund, according to the cryptoverse rumour mill.

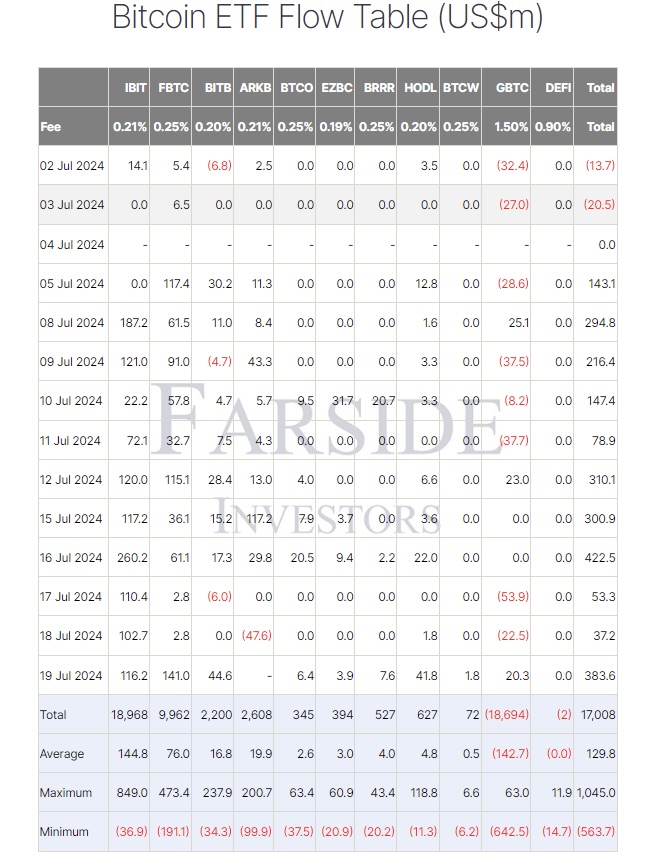

7. Bitcoin ETF inflows are improving

In fact, they’re doing more than that, they’ve been smashing it.

Described by US crypto media beast Cointelegraph as “a landmark achievement”, US Bitcoin spot exchange-traded funds (ETFs) have now cumulatively netted over US$17 billion in inflows (movement into the fund), setting a new record.

Per Cointelegraph: “According to data monitored by Farside Investors, the net inflows were driven primarily by BlackRock’s IBIT, which alone accumulated $18.968 billion. Fidelity’s FBTC also contributed significantly, with net inflows of $9.962 billion.”

8. Interest rate cuts are coming soon (probably)

Look, maybe not in Australia any time soon, but gaze further afield. Maybe we’ll catch up later.

Several European central banks – e.g. the European Central Bank for example – have been cutting their rates over the past few months.

But most importantly for crypto, the tea leaves are indicating that the US Federal Reserve is a strong chance to make its first interest rate cut in aeons in September.

The latest US Consumer Price Index data is showing inflation coming in at just 3%, cooler than expected, giving hope to the rates-cut narrative and pushing Jerome Powell and mates to speak in pleasantly dovish tones.

Ace. Because, rate cuts, we know, tend to have a positive effect, at least initially, on the likes of risky assets such as tech stocks and crypto.

Also, some time over the coming days, the US government is releasing further important macro data, including jobless claims, the initial Q2 GDP print, and the PCE inflation figures.

Depending on how those numbers spit out, they could very well further increase the chances of the Fed pulling out the big scissors.

9. Obscure metric says we’re looking good for a bull run

The Pi Cycle Top indicator. Heard of it? If you’re a crypto trader, or if you’ve been into Bitcoin for a while, then you no doubt will have.

According to Look Into Bitcoin, “the Pi Cycle Top Indicator forecasts the cycle top of Bitcoin’s market cycles. It attempts to predict the point where Bitcoin price will peak before pulling back. It does this on major high time frames and has picked the absolute tops of Bitcoin’s major price moves throughout most of its history.”

In fact, if there’s just ONE indicator you need to follow in crypto, it’s probably this one. It’s been stupendously accurate over the course of Bitcoin’s life and rhythms to date.

As “Nakamotolisk” here notes, “it’s kind of unscientific and hocus-pocus but it is a bit like a MACD”.

If this is the top, the Pi Cycle Top indicator will sort of have triggered in the same way it did in 2019. Pi Cycle is kind of unscientific and hocus-pocus but it is a bit like a MACD. If you use an actual MACD you’d see a signal here. pic.twitter.com/VY1MNk1LU6

— Nakamotolisk.eth (@Nakamotolisk) July 19, 2024

What’s MACD? That’s a more common trading technical indicator that stands for moving average convergence/divergence. Per Investopedia, it’s “a momentum indicator that shows the relationship between two moving averages of a security’s price”.

But as for the Pi Cycle Top Indicator, if you look at that post above, the idiot’s guide is this:

“It’s probably a good time to consider selling when the orange line moves super close to the green line. And probably definitely time when it crosses above it. Not financial advice.”

This indicator pretty much nailed the tops of the last two major crypto bull runs in 2017 and in 2021.

And after telling you all that, the good news here is? The orange line is still nowhere near the green line, meaning we have a ways to go for a potential crypto bull run to play out.

(But best keep a close eye on it, nevertheless.)

10. A history of post-halving supply shocks

Last but not least, we have… the post-Bitcoin halving period.

The Bitcoin halving. What’s that again?

Per the Coinhead “Cryptionary”:

An event scheduled into a blockchain protocol that serves to halve the reward of Proof-of-Work miners that operate in the network. Halvings reduce the rate at which new coins are created, effectively reducing the supply. The most notable “halving” event is Bitcoin’s and occurs every 210,000 blocks, or roughly every four years. In the past, Bitcoin halvings have subsequently resulted in price surges.

The most recent Bitcoin halving occurred in April, just a few months ago. Now, remembering the line that “past performance is not a guarantee of future results”, it should be noted that all prior three Bitcoin halvings have indeed resulted in stupendous crypto bull runs that have tended to last between 12 to 18 months.

And these have all kicked off in a big way, amid a “Bitcoin supply shock”, about five to six months past the actual halving date.

(Look, we know this all sounds a tad insane, but we don’t make the rules.)

Here’s crypto influencer and analyst Lark Davis with the final word on all this…

Bitcoin ETFs bought 18,544 #Bitcoin this week.

Meanwhile, miners only produced 2,250 $BTC.

That’s about 41 days of fresh supply, bought up in just 5 days of trading.

A massive supply shock is coming.

— Lark Davis (@TheCryptoLark) July 20, 2024

None of the information or opinions in this opinionated piece constitutes financial advice. The author holds Bitcoin, Ethereum, Solana, even a bit of Dogecoin and various other speculative altcoins.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.