Breaking Out: This water services player is flowing in the right direction

Pic via Getty Images

Breaking Out is a technical analysis-fuelled, short ‘n’ sharp take on chart-busting ASX stocks. Each week, Steve Collette – head of Collette Capital in Melbourne – narrows in on something that’s caught his eye.

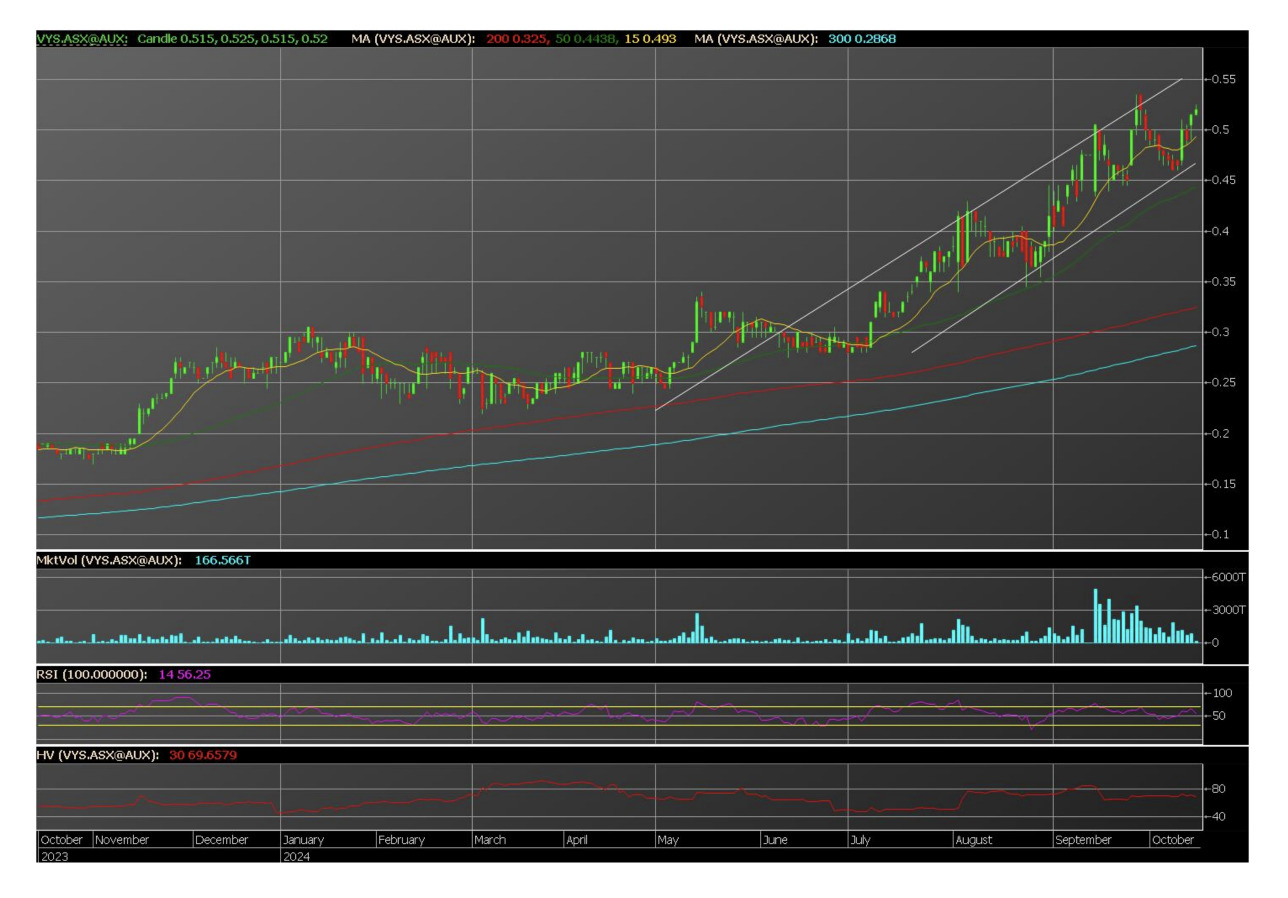

Vysarn (ASX:VYS)

Vysarn is in the water business. It’s all over it, in fact.

Water-management consulting, dewatering, groundwater management and hydrogeological drilling are just some of the services the company offers through its suite of divisions and subsidiaries.

And what’s more, it has one of the best charts on the ASX.

It would have been yours for only 10c at the start of 2023 and since then, the rate of gain has only been increasing.

At the time of writing, VYS is trading at around 50c – for a market cap of ~275m – up from around 27c at the start of 2024.

There are enough observers declaring it to be ‘expensive’ to make both sides of a market, which every uptrend needs.

The chart below shows just one year’s worth of price action, and one can see that after consolidating gains between the early 20s and 30c through the first half of 2024, the stock pushed on to create a new base at around 27.5c and then commenced the current uptrend in earnest as we moved into FY25.

VYS has a formidable mouthpiece in the form of their MD James Clement, and a lean three-person board.

It recently raised a swag of cash for acquisition at 40c which was easily dealt with by the market – the stock having yet to trade below 43.5c since.

The company is in the right space, seemingly at the right time.

If you own this stock, the trend is your friend…

Collette Capital offers IMA services to wholesale clients only.

The IMA has returned 18.41% p.a. net of any fees as at end September 2024 since January 2015. Learn more at www.collette.capital

Collette Capital is a Corporate Authorised Representative (CAR: 128443) of Sanlam Private Wealth ( AFSL 337927 ), and only provides general advice.

Collette Capital advise that they and persons associated with them may have an interest in the above securities.

The views, information, or opinions expressed in the interviews in this article are solely those of the contributing author and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.