You’re an average Australian – what should your super balance be now?

Pic:Getty Images

- Why some people will need more retirement savings than others

- Ways to get women’s super balances back on the right road

- Tips for boosting your super balance for a comfortable retirement

Ever wondered what the super balance is for the average Australian by age? Does having enough money to retire have you tossing and turning at night? You’re not alone. Surveys have found concerns about having enough retirement savings is a major worry for Australians.

A quick overview

In 1992, under former Prime Minister Paul Keating’s Labor Government, the compulsory employer contribution scheme for superannuation or super was introduced.

The scheme was a move aimed at both ensuring Australians had enough income for a comfortable retirement and to reduce the burden on social welfare.

Today, super is compulsory for all people working and living in Australia who earn more than $450 per month.

The Australian Government dictates minimum amounts that employers must contribute to the super accounts of their employees on top of their income.

The amount is currently 10% of an employee’s income and has been legislated to rise in half per cent increments each year until it reaches 12% in 2025.

Employees are also encouraged to make voluntary contributions, including diverting their wages or salary income into superannuation contributions under salary sacrifice arrangements.

People can make additional voluntary contributions to their superannuation and receive tax benefits for doing so, subject to certain limits.

Super benefit payments may be a lump sum or an income stream (pension) or a combination of both.

The age for which people can access super varies depending on your year of birth but ranges from 55 for those born before July 1, 1960 up to 60 for those born after June 30, 1964.

Super balance for the average Australian by age

We could write an article on the human drive to compare ourselves to others, known in psychology as social comparison theory.

But Stockhead is a financial site and sometimes as people we just need a little reassurance that we are on the right track or strategies to help get on track.

So, what is the super balance for the average Australian by age? This is difficult to accurately answer, but some numbers can provide guidance.

The Association of Superannuation Funds of Australia (ASFA), the peak body for super, has a SuperGuru calculator where you enter your birth year, and it calculates how much you should have in your fund today for a comfortable retirement.

But what is recommended by age is again different to the average, which is often skewed away from a typical member.

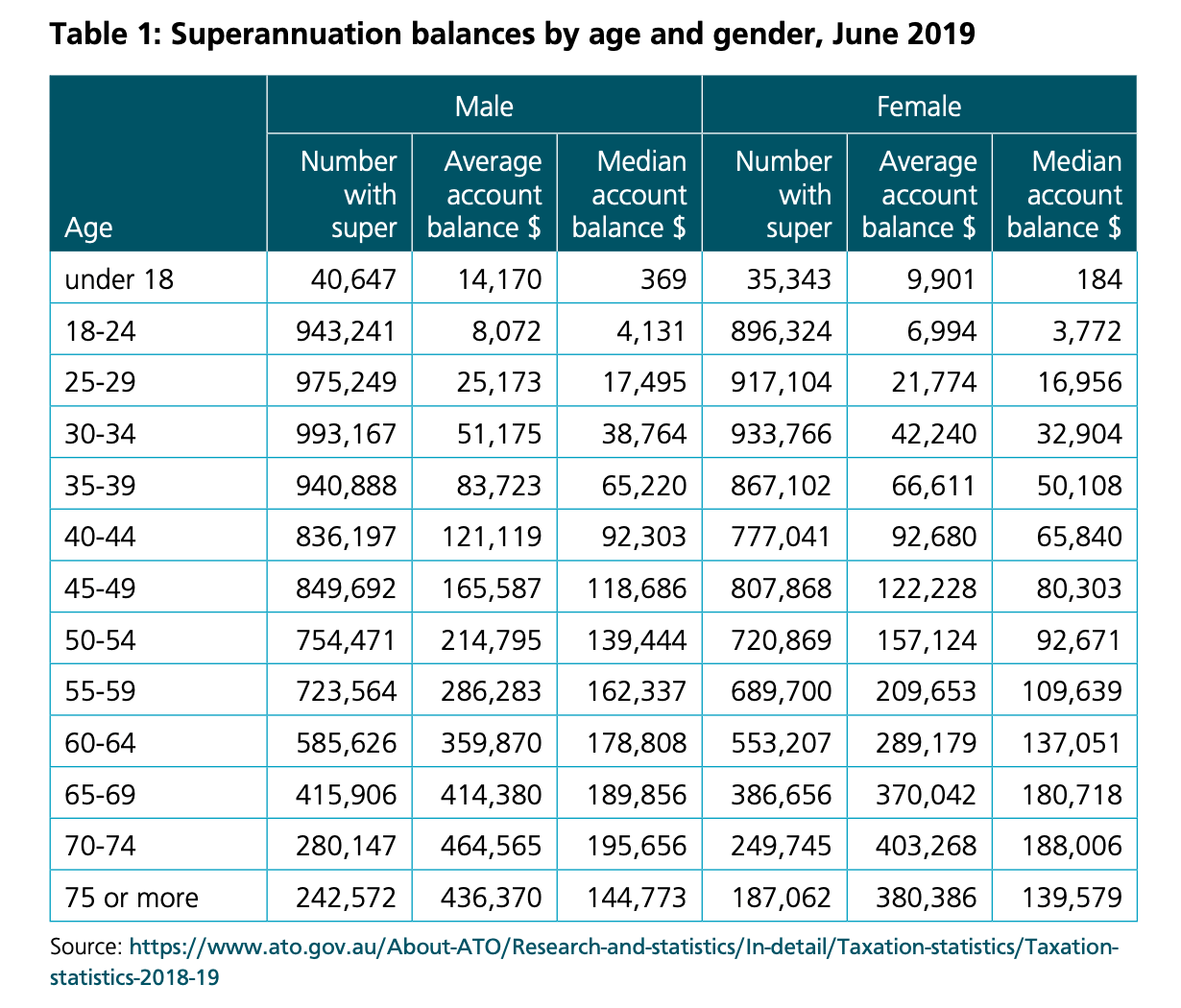

CEO Dr Martin Fahy told Stockhead median (where 50% of those have less and 50% have more) superannuation balances are often more useful and the preferred measure depending on the context.

Fahy said the ASFA publishes both average and median balances but tends to focus on median balances as they are the most relevant for the “average person”.

What you really need

While knowing how you compare to others may fulfil your curiosity, how much retirement savings you need can be more complex.

What constitutes a comfortable retirement for one person can be different to another, while what assets a person may own may also have an influence on funds needed.

If you own your own home and don’t have to pay rent, you may not need as much. Also, what are your retirement lifestyle plans? Do you want to be heading on regular overseas holidays or joining the grey nomad brigade in a Winnebago around Australia?

Have you also thought about associated costs of growing older such as medical or aged care? Are you planning on working at all during retirement?

Many seniors are wanting to do some work and have much to offer the workforce – think about the movie The Intern. One of my dad’s best mates and journalism mentor of mine still writes regular columns for his local news.

“The detailed budgets enable individuals to consider what sort of lifestyle they want or need in retirement,” Fahy said.

“Some expenditure in retirement is discretionary, particularly that relating to leisure, but many items involve necessities.

“The majority of retirees own their own home and living costs do not vary to any great extent around Australia.”

Getting women’s super on track

Women often take on the primary care role for child raising or other family commitments such as elderly parents. While making an enormous contribution to society and the economy, taking time out from their careers for this unpaid work takes a toll on women’s super balances and long-term financial security.

But Fahy said there are ways a couple can help keep a woman’s super balance growing if they take a break from work or reduce hours for any reason.

“This is known as a spousal contribution, and not only does the woman’s super get a boost but it can be tax-effective for their partner,” he said.

“The partner is eligible for a tax offset if they contribute up to $3,000 to the women’s super as an after-tax payment (non-concessional contribution), and the woman earns $40,000 or less a year.”

He said if earnings are under $37,000 a year a maximum tax offset of $540 applies. A partner can also split their pre-tax super contributions (concessional contributions).

“Contribution splitting or super splitting means a partner can pay up to 85% of these contributions into the woman’s super account instead of theirs, once a year.”

Other super boosting tips

Fahy said making contributions out of pre-tax personal income is a very effective method of boosting super savings.

“This can be done by way of salary sacrifice contributions made on your behalf by your employer, or by claiming a tax deduction for personal contributions that you make,” he said.

“Caps apply to concessional contributions and the tax advantage varies with your income, so talk to your fund or your financial adviser before making a contribution.”

He said there is also the superannuation co-contribution. If you’re a low or middle-income earner and make personal (after-tax) contributions to your super fund, the government may also make a contribution (called a co-contribution) up to a maximum amount of $500.

He said amount of government co-contribution you receive depends on your income and how much you contribute. There also are a number of other criteria that determine eligibility which you can check out on the ATO website.

The boost to the superannuation guarantee will also help ensure more money in your fund come retirement. Fahey said for a person on $70,000 a year, the Superannuation Guarantee increase from 10% to 10.5% of wages will add another $350 a year to their superannuation.

“For a person currently aged 30 and assuming retirement at age 67, this will lead to a boost in eventual retirement savings of around $16,600 in today’s dollars,” Fahy said.

“The SG is legislated to reach 12% through annual 0.5% increases, so the increase from 10% to 12% for the person on $70,000 a year will add $1,400 a year to their super and around $66,400 in today’s dollars to their retirement balance.”

And after now knowing the super balance for the average Australian by age, you can continue your social comparison theory journey by reading how does your net worth stack up?

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.