What the ETF? Which ‘lucky dozen’ ETFs managed to outperform amidst Omicron fears?

Pic: Stevica Mrdja / EyeEm / EyeEm via Getty Images

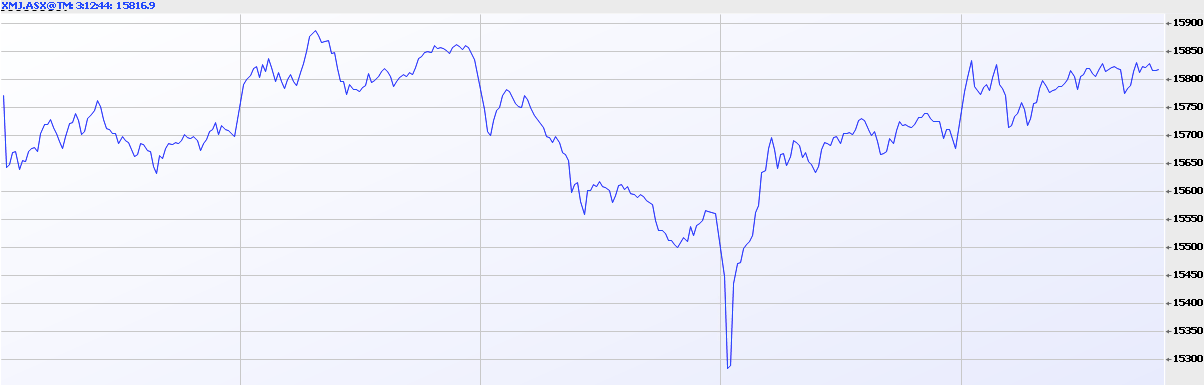

Despite yesterday’s rebound the ASX is still 1% lower than a week ago thanks to global fears about the Omicron variant of COVID-19, but a dozen ETFs defied the trend.

In the past week the top fund is VanEck Vectors China New Economy ETF (ASX:CNEW) which tracks the performance of the top 50 companies listed in mainland China.

Its top two holdings are Ping An Insurance and local liquor giant Kweichow Moutai — both making up over 10 per cent each.

While it has fluctuated this year in conjunction with diplomatic tensions between Australia and China, it is in positive territory in the past year and has nearly doubled in the last five years.

The next two are the SPDR S&P®/ASX 200 Resources Fund (ASX:OZR) and the BetaShares Australian Resources Sector ETF (ASX:QPR) which track the top resources stocks in Australia.

The resources sector has proved relatively resistant to the market jitters this week, sitting in slightly positive territory compared to a week ago.

Another performer of note was the BetaShares Managed Risk Global Share Fund (ASX:WLRD).

This fund invests in 1,500 global shares and monitors share market volatility, applying a “handbrake” to reduce the impact of fluctuations by selling equity index futures contracts.

| Code | Company | Price | %Wk | %Yr |

|---|---|---|---|---|

| CNEW | VanEck China New | 9.72 | 3 | 9 |

| OZR | SPDR 200 Resources | 12.61 | 3 | 6 |

| QRE | Betashares Asx Res | 7.09 | 2 | 8 |

| WRLD | BETA MANAGED RISK GL | 16.75 | 1 | 24 |

| MVR | VanEck Resources | 30.18 | 1 | 3 |

| IXI | iShs Global Cons ETF | 86.36 | 1 | 11 |

| IVV | iShares S&P 500 ETF | 653.28 | 0 | 32 |

| IXJ | Ishs Glob Health Etf | 119.83 | 0 | 20 |

| QUS | Beta SP500 Equal ETF | 44.12 | 0 | 19 |

| VHY | Vngd Aus High Yield | 63.29 | 0 | 9 |

| NDQ | Betasharesnasdaq100 | 36.62 | 0 | 34 |

| SYI | Spdrmsciauselecthdy | 29.76 | 0 | 5 |

Top yearly performers

Despite the dour week for ASX ETFs amidst fears about the Omicron variant, the sector is still in a positive shape with 20 ETFs up 20% or more in the last 12 months.

BetaShares’ Geared US Equities (ASX:GGUS) is still on top with a 64% gain in 12 months.

The majority of the other ETFs have a global focus, particularly on US shares.

But there are a handful with an ESG focus and a couple of sector specific funds – ETF Securities’ Battery Tech & Lithium ETF (ASX:ACDC) and BetaShares Global Cybersecurity ETF (ASX:HACK).

| Code | ETF | Price | %Mth | %Yr |

|---|---|---|---|---|

| GGUS | Beta Geared US EQ | 38.55 | 4 | 64 |

| HACK | Beta Global Cyber | 10.97 | 5 | 39 |

| NDQ | Betasharesnasdaq100 | 36.63 | 11 | 34 |

| IVV | iShares S&P 500 ETF | 653.34 | 8 | 32 |

| IOO | Ishs Global 100 Etf | 106.06 | 7 | 29 |

| QHAL | VanEck Qual Hedged | 42.52 | 3 | 28 |

| VESG | VNGD ETHI INTL SHS | 78.22 | 6 | 27 |

| WXOZ | SPDR World Ex Oz | 44.96 | 6 | 26 |

| MOAT | Vaneck Us Wide Moat | 104.97 | 5 | 26 |

| VGS | Vngd Intl Shares | 106.18 | 6 | 26 |

| ETHI | Betasustainability | 13.32 | 7 | 24 |

| QLTY | Beta Quality Leaders | 25.82 | 8 | 24 |

| WRLD | BETA MANAGED RISK GL | 16.75 | 8 | 24 |

| INIF | InvestsmartAuIncFund | 3.01 | -2 | 23 |

| INES | Investsmart SHS fund | 3.88 | 1 | 23 |

| WXHG | SPDR World Ex Oz Hdg | 30.02 | 1 | 21 |

| QMIX | SPDR MSCI WORLD QMIX | 26.35 | 6 | 21 |

| ACDC | ETFS Batt Tech Lith | 95.23 | 4 | 21 |

| WCMQ | WCMQualityGlobalGrow | 8.92 | 6 | 21 |

| ESGI | Vaneck Esg Internatl | 30.45 | 4 | 20 |

SUBSCRIBE

Get the latest breaking news and stocks straight to your inbox.

It's free. Unsubscribe whenever you want.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.