ASX Lunch Wrap: ASX in upbeat mood; Bitcoin marches higher amid US reserve plans

News

News

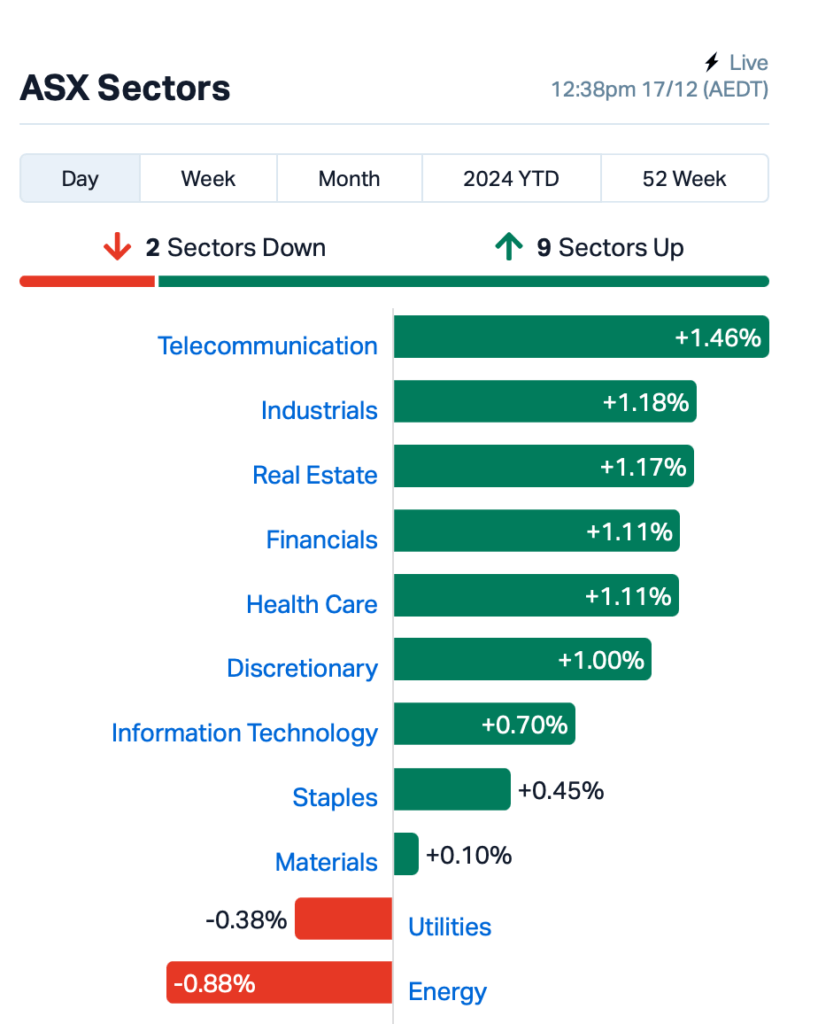

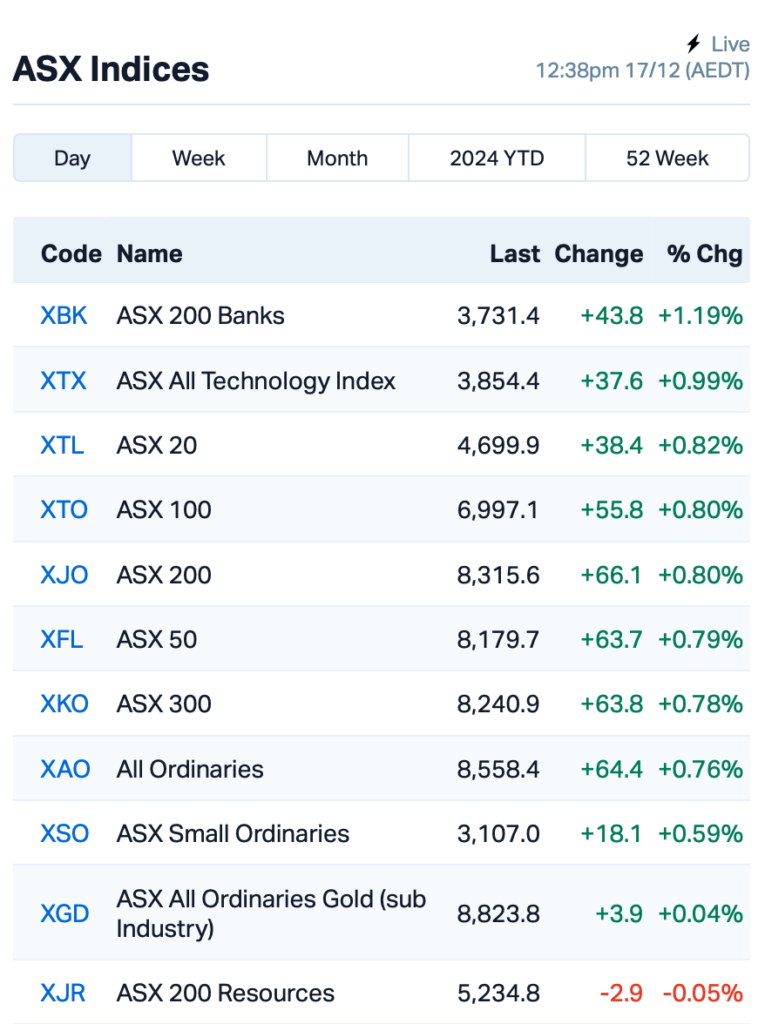

The ASX opened Tuesday in an upbeat mood, with the S&P/ASX 200 benchmark rising by 0.9% around lunch time in the eastern states.

Energy stocks, however, were the main drag on the index following a drop in the price of Brent crude, driven by concerns over weakening demand from China.

Bitcoin, meanwhile, surged to yet another record high, crossing the US$107,000 mark after Donald Trump reiterated plans for a US strategic reserve for the cryptocurrency.

There’s a proposed a bill that would have the US Treasury buy 200,000 Bitcoins annually for five years, aiming to accumulate one million BTC, or about 5% of the global supply, funded by profits from Fed deposits and gold holdings.

Back on the ASX, this is where things stood at about 12:40pm AEDT:

In the large caps space, Data#3 (ASX:DTL) dropped by 9% after the IT solutions provider revealed major changes to its partnership with Microsoft.

The company, which distributes Microsoft products in Australia, told investors that the changes would significantly reduce the incentives it can earn on its Microsoft Enterprise Agreements.

Star Entertainment Group (ASX:SGR) has announced another high-profile exit, with Kate Williams resigning from her role as deputy company secretary, just a day after Mark Mackay left his position as CEO of the Gold Coast casino. SGR’s shares were down 2.5%.

And, there’s a new listing on the ASX this morning.

Fruit-processing company SPC Global Holdings (ASX:SPG), formerly known as The Original Juice Co, returns to the ASX after it was delisted in 2005.

Here are the best performing ASX small cap stocks for December 17 [intraday]:

AXP AXP Energy Ltd 0.002 50% 4,734 $5,824,681 ECT Env Clean Tech Ltd. 0.003 50% 4,002,370 $6,343,621 CAV Carnavale Resources 0.004 33% 175,000 $12,270,655 VRC Volt Resources Ltd 0.004 33% 703,033 $12,476,034 GGE Grand Gulf Energy 0.003 25% 350,000 $4,900,774 VML Vital Metals Limited 0.003 25% 2,050,461 $11,790,134 MTC Metalstech Ltd 0.135 23% 398,796 $21,729,343 PNT Panthermetalsltd 0.011 22% 1,860,931 $2,118,138 SHG Singular Health 0.210 20% 4,848,816 $42,440,101 HHR Hartshead Resources 0.006 20% 485,362 $14,043,411 MEM Memphasys Ltd 0.006 20% 85,238 $8,815,407 BPM BPM Minerals 0.065 18% 169,247 $4,750,472 ERG Eneco Refresh Ltd 0.013 18% 54,000 $2,995,942 XPN Xpon Technologies 0.013 18% 37,000 $3,986,856 LIO Lion Energy Limited 0.020 18% 85,798 $7,686,851 TOY Toys R Us 0.068 17% 302,433 $8,773,205 AAU Antilles Gold Ltd 0.004 17% 103,519 $5,573,628 DVL Dorsavi Ltd 0.014 17% 1,595,323 $8,774,855 GDM Greatdivideminingltd 0.255 16% 55,000 $6,183,833 VTI Vision Tech Inc 0.046 15% 61,784 $2,201,459 CUF Cufe Ltd 0.008 14% 1,113,636 $9,356,724 HOR Horseshoe Metals Ltd 0.016 14% 920,356 $9,285,944

Environmental Clean Technologies (ASX:ECT) and ESG Agriculture have launched a joint venture, Zero Quest, to develop sustainable soil health solutions, including the COLDry Fertiliser, a low-emission alternative to traditional fertilisers. The venture has secured $300,000 in seed funding and will begin field trials across Australia and the Philippines to test the product’s effectiveness.

BPM Minerals (ASX:BPM) has completed its phase III reverse circulation drilling program at the Louie Prospect within the Claw Gold Project in Western Australia. A total of 11 holes were drilled, covering 1995 metres, targeting high-grade mineralisation at depth. The samples are now being assayed, with results expected early next year.

Dorsavi (ASX:DVL) has partnered with Secret Network to integrate privacy-focused blockchain technology with its wearable movement analysis devices. The collaboration will test how Secret Network’s encrypted smart contracts can secure data from dorsaVi’s devices. The project will also explore using Non-Fungible Tokens (NFTs) to protect and control access to movement data.

Here are the worst performing ASX small cap stocks for December 17 [intraday]:

Code Name Price % Change Volume Market Cap MTL Mantle Minerals Ltd 0.001 -33% 10,853,000 $9,296,169 VMT Vmoto Limited 0.075 -29% 2,364,905 $43,966,884 BUY Bounty Oil & Gas NL 0.003 -25% 20,000 $5,994,004 OCT Octava Minerals 0.140 -20% 2,125,395 $10,367,805 BUS Bubalusresources 0.110 -19% 160,797 $5,755,992 REM Remsensetechnologies 0.023 -18% 189,805 $4,644,071 SPG Spc Global Holdings 1.500 -17% 18,250 $347,367,388 ERA Energy Resources 0.003 -17% 1,054,148 $1,216,188,722 LNR Lanthanein Resources 0.003 -17% 19,600 $7,330,908 AGD Austral Gold 0.022 -15% 45,000 $15,920,095 PPY Papyrus Australia 0.011 -15% 412,158 $6,851,590 AVR Anteris Technologies 9.000 -15% 5,473 $214,599,628 RLF Rlfagtechltd 0.042 -14% 200,000 $11,445,238 ATH Alterity Therap Ltd 0.006 -14% 2,578,441 $37,242,353 GTR Gti Energy Ltd 0.003 -14% 225,999 $10,370,324 OSL Oncosil Medical 0.006 -14% 1,000,894 $32,246,061 RGL Riversgold 0.003 -14% 1,200,000 $5,696,119 STM Sunstone Metals Ltd 0.006 -14% 342,503 $36,049,325 WBE Whitebark Energy 0.006 -14% 82,400 $1,766,334 EM2 Eagle Mountain 0.010 -14% 2,227,270 $4,407,236 FCT Firstwave Cloud Tech 0.019 -14% 100,000 $37,697,411 LMG Latrobe Magnesium 0.020 -13% 1,913,763 $54,016,360 AEE Aura Energy 0.135 -13% 1,623,679 $128,101,676

Shares in Karoon Energy (ASX:KAR) fell nearly 8% after the junior oil and gas producer revised its production guidance downward. The company said it has shut down its Brazilian oil field, Bauna, after an “incident” involving its mooring system.

Tungsten Mining (ASX:TGN) is now the sole owner of the Northern Territory-based Hatches Creek project, having acquired the remaining 80% interest from GWR Group (ASX:GWR). TGN has issued 107.5 million shares to GWR Group, increasing GWR’s voting power in TGN to ~19.86%. TGN believes the project holds several high-grade polymetallic tungsten prospects and the potential for a significant high-grade tungsten deposit in an area that is largely underexplored, offering a chance to grow the resource.

Race Oncology (ASX:RAC) has received a $5.25 million R&D tax refund for FY24 through the Australian government’s R&D Tax Incentive program, which will be reinvested into driving the clinical development of its lead asset, RC220. It adds to the company also recently securing a binding guarantee for up to $20.08 million in overseas R&D activities over the next three years.

At Stockhead, we tell it like it is. While Tungsten Mining and Race Oncology are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.