Hot Money Monday: Why the ‘Santa rally’ delivers ASX’s December gift that keeps on giving

Experts

Experts

Anyone who’s been around the block a few times in the stock market knows about the so-called ‘Santa rally’ – the tendency for markets to gain some momentum as we roll into the end of the year.

And, as eToro points out, this isn’t just some vague market folklore.

According to fresh data from the broker, the month of December has historically delivered some sweet returns for the ASX 200, and this year’s shaping up to be no different.

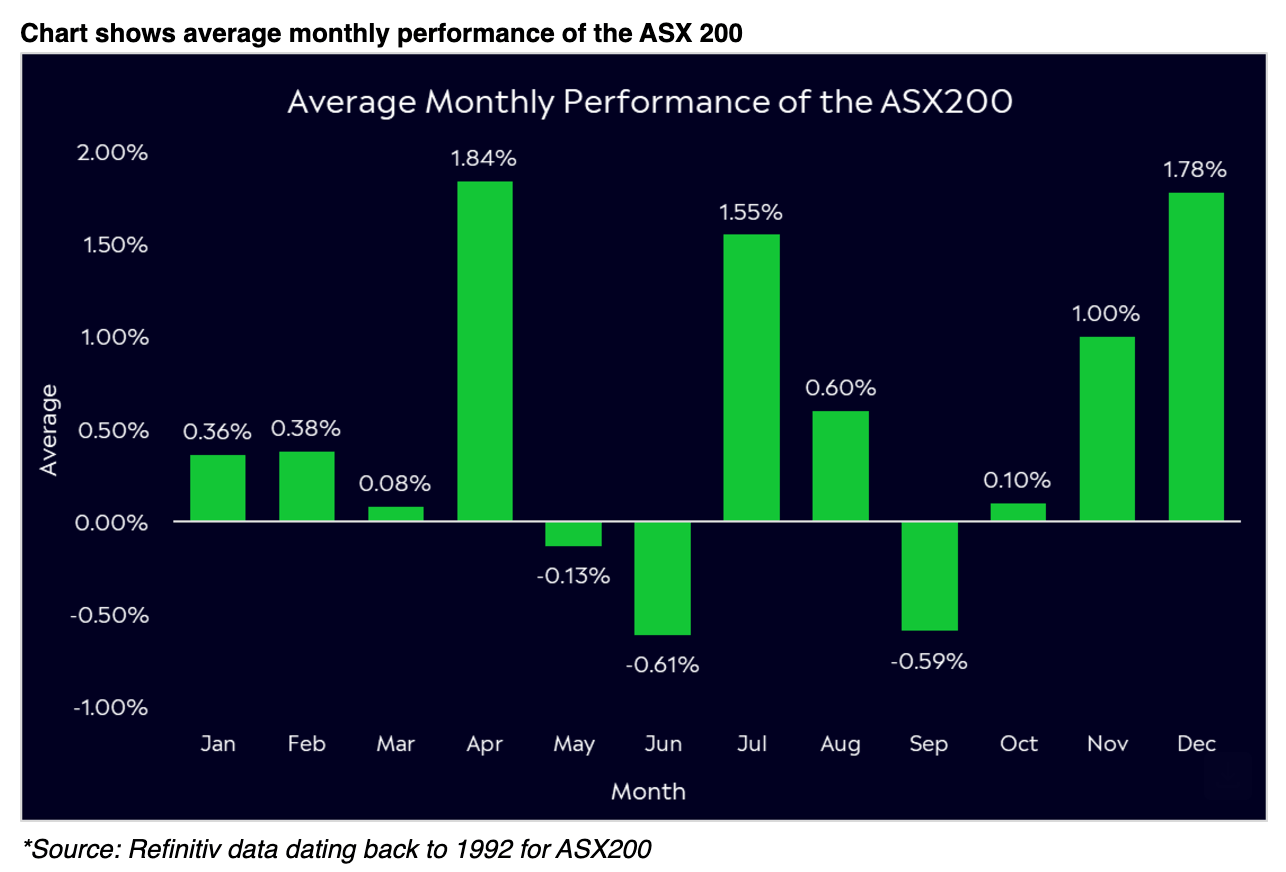

The ASX 200 has averaged a solid 1.78% return in December over the last 50 years.

That’s more than double the average monthly return for the other 11 months of the year, which clocks in at just 0.42%.

If that’s not enough reason to crack open another cold one, here’s another stat to think about:

December typically accounts for 29% of the ASX 200’s annual gains. To put it simply, almost a third of the year’s profits often come in this final month.

But the Santa rally isn’t just a homegrown phenomenon, and before you wonder if we’re all getting too carried away, let’s take a look at the numbers in a global context.

Across 14 major stock markets worldwide, including the ASX, December returns average 1.63%, which makes up 23% of the annual gains for global markets.

Aussie investors have it a little better than the rest, at 29% of the annual returns.

“Although past performance does not guarantee future returns, December has historically been a strong month for stock markets around the world, including the ASX 200,” said eToro analyst, Josh Gilbert.

“This is reflective of what experienced investors know as the Santa rally.”

There are a number of potential reasons behind this seasonal boost, said Gilbert, such as optimism around the new year and the ‘January effect’ of new investor allocations.

In other words, the view of investors positioning for the year ahead is one of the key drivers for the Santa rally.

So the December rally is more than just a chance for quick gains. It’s about setting the stage for the year ahead as it’s the month when investors start thinking about positioning for the next 12 months.

“Christmas may have already come early for some investors this year, with new record highs for the ASX 200, Bitcoin, and the S&P 500 all before December,” said Gilbert.

“But, that seasonal joy doesn’t look to be over as we head into 2025″, and the stage for markets remains positive, said the eToro analyst.

For those holding on to your ASX 200 stocks, now’s the time to sit tight and enjoy the ride, he added.

The data doesn’t lie: if you’re in for the long haul and stay invested through December, there’s a good chance the Santa rally will deliver a nice bonus to your returns.

“It’s clear that retail investors who miss out on this period may not maximise their yearly returns.”

Now read > 2025 in the eyes of mining bigwigs Bill Beament and Simon Lawson

This story does not constitute financial product advice. You should consider obtaining independent advice before making any financial decision.