Lode spreads antimony wings with Montezuma purchase

Mining

Mining

Special Report: Lode Resources has boosted its already impressive critical mineral exposure by signing a heads of agreement to acquire 100% of the Montezuma Antimony Project in Tasmania.

The project complements Lode Resources (ASX:LDR) large and high-grade antimony exploration portfolio in the New England Fold Belt, NSW’s most prolific province for the metal, creating a formidable antimony division within Lode and on the ASX.

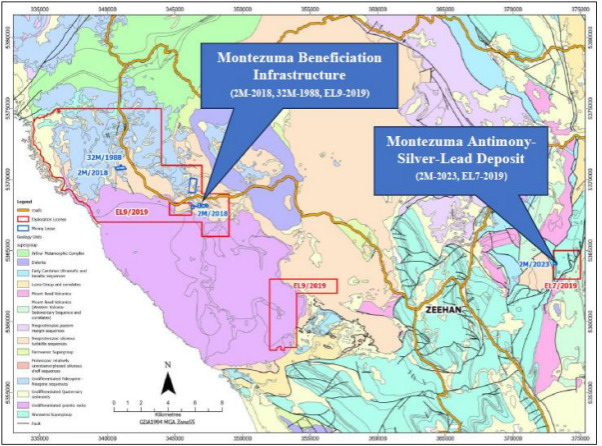

In Tasmania’s premier West Coast Mining Province, Montezuma includes an antimony-silver-lead deposit with initial development, advanced metallurgy, significant mining equipment and beneficiation infrastructure all in place.

Exploration highlights from Montezuma include surface grab samples of up to 24.5% antimony and 3,050 grams per tonne (g/t) silver; diamond drill core samples of up to 20.3% antimony and 1,990g/t silver; and development face samples of up to 21.4% antimony and 2,478g/t silver.

Metallurgical test work on Montezuma ore is well advanced with 90% of antimony recoveries achieved, producing a saleable product of the important critical mineral.

Antimony is a key component of technology that powers modern economies, from defence to clean energy applications like photovoltaic solar panels and lithium batteries, smartphones and semiconductors, as well as fire retardants, which are in increasing demand due to improving safety standards.

Like many other critical minerals its supply has been controlled by China, which imposed a ban on its export that came into effect on September 15 this year.

Since then, prices have more than doubled to more than a record US$25,000/t.

That’s triggered a run on ASX juniors with antimony prospects, with Australia hosting the world’s fourth largest reserves.

Lode is already in ongoing antimony R&D funding discussions with local and international institutions, including those representing major western governments.

The Montezuma acquisition follows Lode starting exploration at recently granted exploration licence areas which include the historical Magwood antimony mine in the New England Fold Belt.

Magwood was Australia’s primary producer of antimony from 1941 to 1970, with recorded grades reaching up to 62%. It’s just one of 19 antimony prospects that have been recently identified within Lode’s 100% controlled exploration licence areas, EL9662 and EL9319.

At 1021km2 EL9662 is the largest exploration area in the New England Fold Belt and sits within Lode’s strategic antimony exploration portfolio of 1914km2.

The Montezuma acquisition also complements Lode’s high-grade silver portfolio as the white metal continues its upward price trend.

Assays are due shortly from the Webbs Consol project, where drilling at the Castlereagh prospect has been completed.

Payment to private company Ten Star Mining and other sellers includes a $50,000 deposit, $200,000 cash and 10,000,000 fully paid ordinary shares in at $0.10 per share on completion of the acquisition.

Up to 6,000,000 fully paid ordinary shares at $0.10 per share will be paid after certain conditions are met, among them a JORC Resource and an antimony offtake agreement for a minimum of 85 tonnes.

Access to Montezuma is via the Zeehan, known for its lead and silver, only 14km to the west and it lies between other established mining centres such as Rosebery (zinc, copper, lead), Renison Bell (tin) and Henty (gold).

This article was developed in collaboration with Lode Resources, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.