Nasdaq Wrap: Wall Street notches best week in 2024 as Nvidia rebounds; but will the Fed spoil it all?

Nasdaq Wrap

Nasdaq Wrap

Nasdaq Wrap is our weekly look at the highly influential, tech-heavy Nasdaq 100 index – movers and shakers over the past seven days or so, talking points and a brief look at what’s ahead.

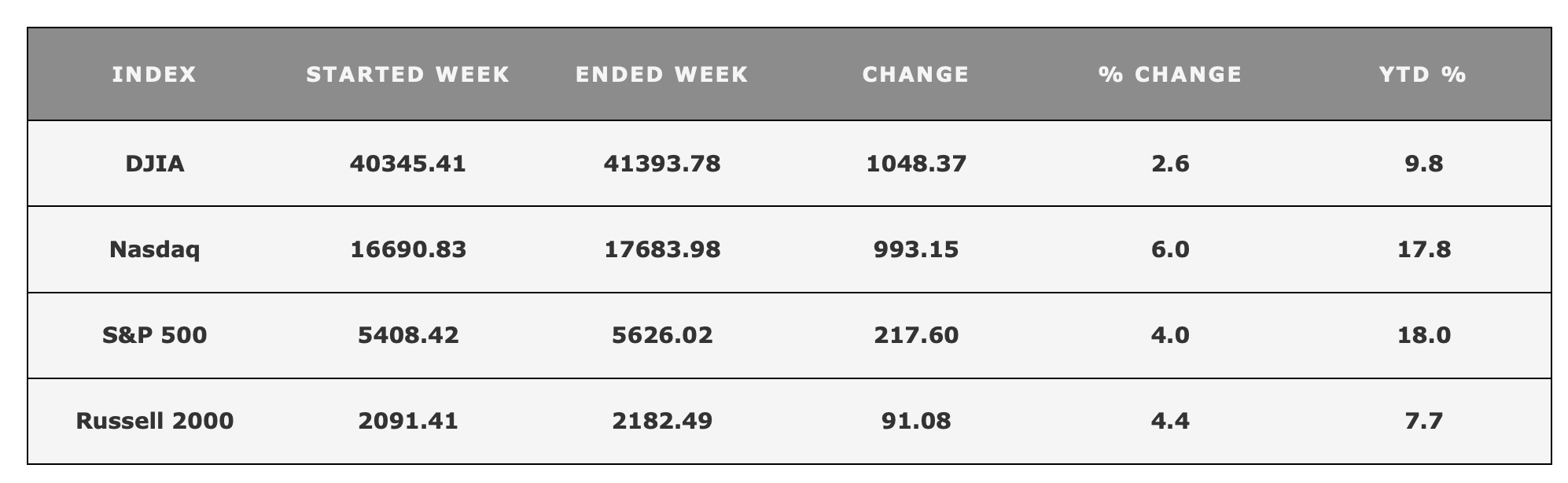

After hitting a bump the previous week, both the S&P 500 and Nasdaq Composite saw their largest weekly gains in 2024.

Sentiment improved markedly last week, with the CBOE Volatility Index, or “fear gauge”, dropping by 20% to about 16.5. A VIX level of 16 usually indicates the market expects lower fluctuations in stock prices over the short term.

The rally comes just right before the Federal Reserve’s policy meeting, where a decision on interest rates is set to be announced on Wednesday, September 18 (US time).

To summarise, the week started with traders focusing on the Consumer Price Index (CPI) report on Wednesday, which was the final key data before the Fed’s decision.

The report showed a welcoming trend, with US inflation easing to a three-year low in August as consumer prices rose just 2.5%, down from 2.9% in July.

While this gives the Federal Reserve room to cut interest rates this week, a more modest 25 basis-point cut is expected instead of a bigger 50-basis point cut.

“The data strengthened expectations for a 25-basis point rate cut, with the market now pricing in an 85% chance,” said Erik Boekel at DHF Capital.

Further good news came on Thursday when the Producer Price Index (PPI) for August came in at 2.4%, slightly below the 2.5% forecast and matching July’s figure.

The Fed monitors the PPI closely as it reflects price pressures at the factory level before they reach consumers.

Following this data release, market expectations shifted, increasing the odds of a 50-basis point cut.

According to the CME FedWatch Tool, investors now see a roughly 49% chance of the larger cut, up from just 15% on Thursday.

This shift in expectations contributed to another market rally on Friday, boosting stock market gains for the week.

Strictly speaking, a 25 basis point cut isn’t really news. Markets have long expected this, even if they didn’t get the timing exactly right (with many initially predicting the first rate cut as early as March 2024).

But this anticipation has been a major factor driving stock market gains over the past 18 months.

Some strategists believe a 25 basis point cut would actually be more prudent than a 50 basis point cut, because the Fed Reserve, they say, shouldn’t be making a larger cut without clear signs of recession or a financial crisis.

“For everyone who’s asking for a 50 basis point cut, I think they should really reconsider the amount of volatility that would cause in short-term funding markets,” Yardeni Research’s Eric Wallerstein told Yahoo.

“It’s just not something the Fed wants to risk.”

Another reason to not go for 50 is the message it would convey – that the Fed must know something that the rest of us don’t.

However, in the event the Fed decides to go for the bigger cut, small caps could get a “significant rally”, says Eric Johnston at Cantor Fitzgerald.

Either way, rate cuts in general are positive for markets, especially when the Fed is cutting rates without the presence of a recession.

Data shows that historically, when the Fed eased policy without an accompanying recession – such as in 1966, 1984, 1995 and 1998 – markets have performed well after the first rate cut.

Nvidia (NASDAQ:NVDA)

Nvidia was a standout performer last week, bouncing back by 14% following a big slide the previous week.

The rally came after CEO Jensen Huang said demand for Nvidia’s high-tech products is “so great” its customers are “tense”.

“Everyone wants to be first and everyone wants to be most,” Huang said, referring to the “more emotional customers” who view Nvidia’s technology as 21st-century gold.

Huang elaborated that the demand for Nvidia’s technology – ranging from components and infrastructure to software – is so high that it creates a strong emotional response among clients.

He also said that Nvidia’s technology “directly affects” the financial performance of major customers such as Amazon, Meta, and Alphabet.

Huang’s comments came after Wall Street initially reacted negatively to Nvidia’s August 28 earnings report, which led to a more than 20% drop in shares over concerns about the company’s ability to maintain its exceptional revenue growth.

Adobe Inc (NASDAQ:ADBE)

Adobe was one of the worst performing big tech stocks last week after a 9% one-day drop.

The stock’s price succumbed to weak guidance, which overshadowed its better-than-expected earnings and revenue for the August quarter.

Adobe’s forecast for the November quarter disappointed investors, with revenue predicted to come in between US$5.50 billion and US$5.55 billion, versus Wall Street’s expectations of US$5.6 billion

Also, investors were looking for more updates on Adobe’s AI plans, which many believe were not adequately addressed.

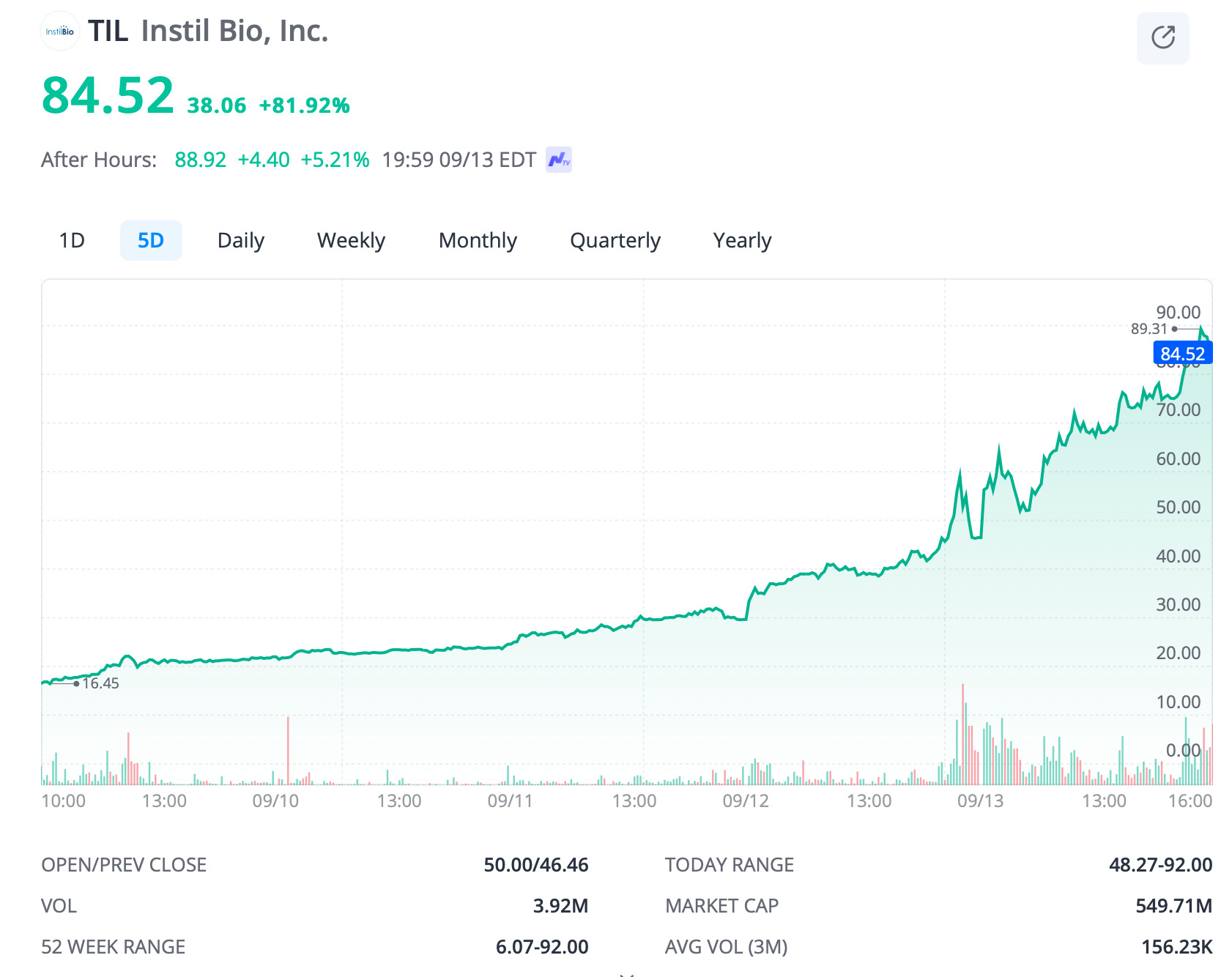

Instil Bio (NASDAQ:TIL)

Here’s one stock you’ve probably never heard of before.

Instil Bio is a biotech that focuses on developing and commercialising cell therapy, or T cells treatments for cancer.

The company’s shares surged by 500% last week in response to growing excitement about its shift in focus to a new bi-specific antibody, IMM2510, which targets both PD-L1 and VEGF immune checkpoints.

The excitement around IMM2510 is partly due to its similarity to ivonescimab, a Chinese-developed drug which has shown strong results in treating cancer and has already been approved in China.

Positive results from a study comparing ivonescimab to the leading cancer drug Keytruda have excited investors.

Although Instil Bio hasn’t started clinical trials with IMM2510 yet, the excitement around similar treatments has driven up the company’s stock.

Analysts see potential for IMM2510 to become a major cancer therapy.

Trump Media & Technology Group (NASDAQ:DJT)

Donald Trump’s media group jumped 12% on Friday after the former president stated he has “absolutely no intention of selling” his stake once the lockup period expires late next week.

The lockup period prevents insiders from selling their shares after an IPO, which in DJT’s case is scheduled for October 20, 2024.

But there was some controversy when Nasdaq suspended trading of the stock twice on Friday because of erratic trading activity.

Trump accused Nasdaq and the SEC of colluding to halt trading for “political reasons”, claiming it hurt the stock’s performance.

The shares surged by as much as 25% earlier, but closed the day up only 12% after the halts.

Trump threatened to move the stock to the New York Stock Exchange and promised to hold Nasdaq and possibly the SEC accountable.

Join a community of dedicated traders who demand an advanced investing app – and get it. Sign up today and claim your welcome rewards, start investing in the US market with $0 brokerage*, tap into the convenience of 24-hour trading, harness the power of real-time data, and test your strategies risk-free with our Paper Trading.

The Federal Reserve’s meeting and rates decision will dominate headlines this week.

Aside from that, US investors will also see important economic data, including housing market reports and retail sales, which could also move the market.

Retail sales data will be out on Tuesday, and the Fed’s interest rate announcement, along with Powell’s press conference, will be on Wednesday (US times).

Key company earnings reports are also due from FedEx, General Mills, and Lennar.