Mooners and Shakers: Bitcoin rises on safe haven narrative as First Republic Bank tanks

Coinhead

Coinhead

While bleary-eyed, two-up-exhausted Aussies dragged themselves to work/desk in corner of bedroom, Bitcoin and the crypto market sprang out of bed ready for action this morning.

Is it slightly surprising to see BTC tick back above US$28k (at the time of writing)? Considering Wall Street indices closed in the red and the US Dollar Index is trying to pick itself up off the canvas, then that’s a yes.

🚀 Just minutes after US stock markets winded down their rough day, #crypto has had signs of life. With $BTC pushing for $28.5k & $ETH closing in on $1,900, these surges without reliance on the #SP500 are ideal for the market's independent sustainability. https://t.co/0XeNVf9Vaz pic.twitter.com/KeJ1408UiN

— Santiment (@santimentfeed) April 25, 2023

There’s a bit of news that might be working in crypto’s favour today, as follows:

• If you thought the banking crisis that saw the fortunes of SVB and Signature Bank dramatically dump last month had conveniently disappeared, think again. The embattled First Republic Bank has seen its FRC share price tank after an earnings report that showed it lost a large amount of deposits. FRB was the 14th-largest commercial bank in the US at the end of 2022.

As News.com.au reports, “the beaten-down California lender said on Monday that it lost more than 40 per cent of its deposits in the first quarter this year, intensifying concerns about its long-term prospects.”

The FRC share price has sunk nearly 50 per cent over the past 24 hours at the time of writing, while Bitcoin, which like gold has fared well from a “flight to safety” narrative amid US and global banking concerns this year, has jumped about 3% on the bank’s bad news.

#Bitcoin $BTC is up 2.4% in the last 90 minutes after @CGasparino breaks the news that bankers working with First Republic Bank $FRB "expect eventual govt receivership."

Price was $27,500 at the time of the tweet and is now $28,150. pic.twitter.com/aSjzFXiip6

— Matt Willemsen (@matt_willemsen) April 25, 2023

Bank Crisis Round 2:

– Markets tank 🤮

– Bitcoin surges 🚀Exaaaactly as predicted! 😲😱😲

— Bitcoin Archive (@BTC_Archive) April 25, 2023

• Microsoft and Google parent company Alphabet both reported Q1 results (beyond the Wall Street closing bell last night) that exceeded expectations, as Eddy “Market Highlights” Sunarto reports. This may have buoyed some faith in the flagging tech sector, which may have spurred the insomniac crypto market just a tad.

• Speaking of Google, it’s expanded its Google Cloud Web3 startup accelerator program, which now includes 11 blockchain firms. The program includes the following as participants: Alchemy, Aptos, Base, Celo, Flow, Hedera, Nansen, Near, Polygon, Solana and Thirdweb.

Additionally, blockchain analytics firm Nansen has announced it’s partnered with Google Cloud to provide real-time blockchain data for startups.

We are very excited to team up with @googlecloud in their Web3 startup program to provide real-time blockchain data 🚀

Web3 startups in the program get a free month of #NansenQuery & other benefits 🤝

Learn how it can help YOUR project succeed 💪https://t.co/xU3bZlkOiy

— Nansen 🧭 (@nansen_ai) April 25, 2023

Major US crypto exchange Coinbase has sued the US Securities and Exchange Commission, seeking clarity on crypto regulations.

Per a CNBC report, the exchange is asking a federal judge to force the SEC to divulge its answer on a petition Coinbase created in July last year, which questioned whether existing securities laws and rule-making frameworks should be applied to the crypto industry.

The Coinbase (COIN) share price rose about 1.46% on the news.

1/ Here's what you should know about the @Coinbase suit against the SEC.

This will move fast–unlike the @Ripple case.

This case begins in the appellate court, not the trial court.

There will be no discovery (depositions and document exchange), just briefing and a hearing.

— MetaLawMan (@MetaLawMan) April 25, 2023

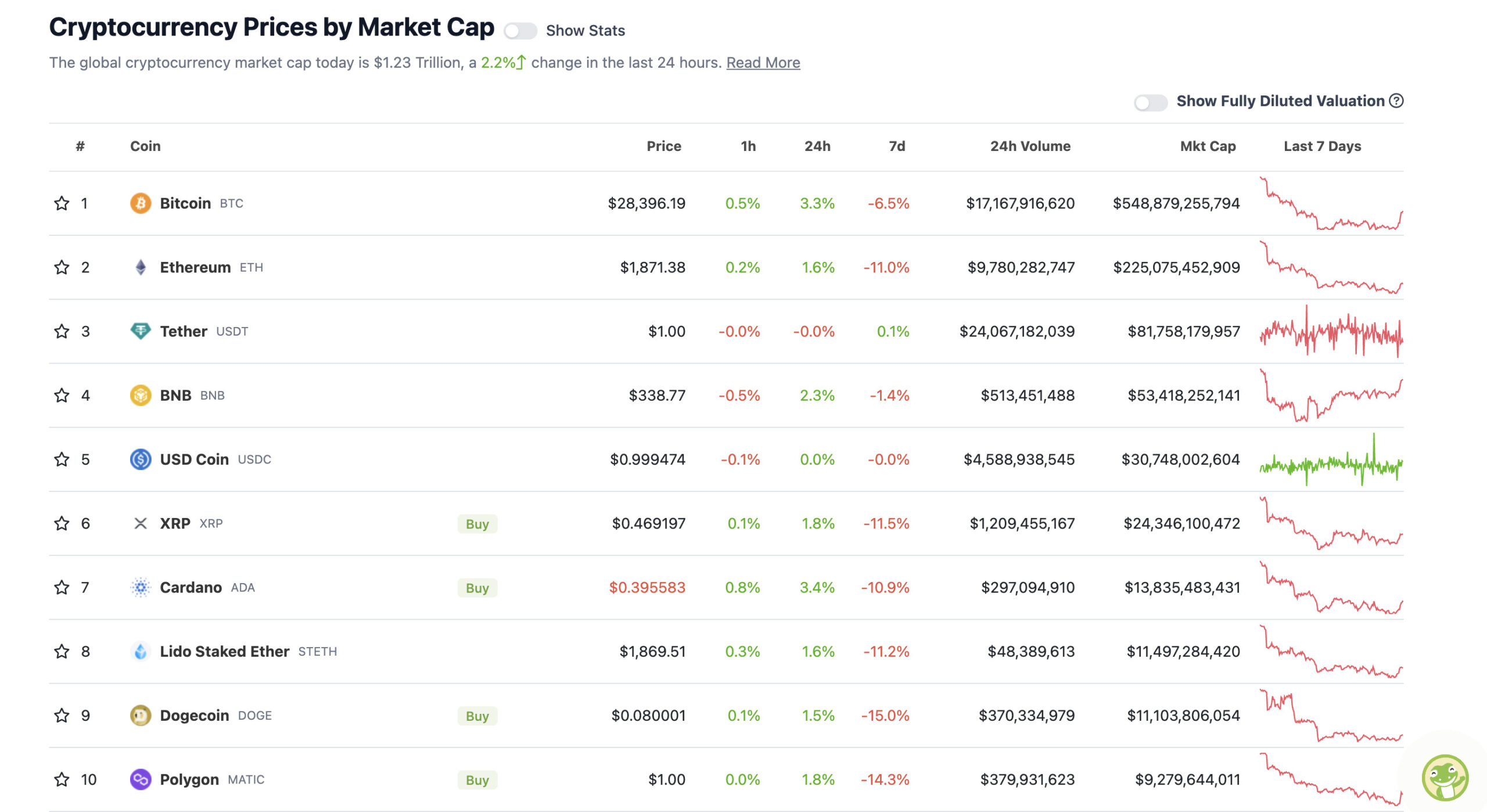

With the overall crypto market cap at US$1.23 trillion, up about 2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

A decent little recovery, then, from the crypto-market doldrums we’ve experienced over the past week or so. Can it sustain? Several crypto analysts have been forecasting a move lower, down to the US$25,200 level.

Dutchman Michaël van de Poppe and US trader Roman, however, haven’t been among the more bearish voices at present…

#Bitcoin isn't looking bad on the higher timeframes.

Healthy correction, and as long as #Bitcoin sustains above $25,300 it's likely we'll continue this rally towards $42,000. pic.twitter.com/y2gonXAV6D

— Michaël van de Poppe (@CryptoMichNL) April 25, 2023

$BTC.D 1D

Forming a perfect HS still. Giving confluence to the overall thought that risk has bottomed.$DXY attempting a miracle but I’ve said several times I’m expecting a bear flag rather than a DB.$BTC still holding bullish PA.#bitcoin #cryptocurrency #cryptotrading pic.twitter.com/Y32vFGS2KT

— Roman (@Roman_Trading) April 25, 2023

Some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS (11-100 market cap position)

• Injective (INJ), (market cap: US$652 million) +17%

• Radix (XRD), (market cap: US$1.06 billion) +13%

• Render (RNDR), (market cap: US$739 million) +13%

• Conflux (CFX), (market cap: US$659 million) +7%

• The Graph (GRT), (market cap: US$1.26 billion) +4%

PUMPERS (lower caps)

• Maple (MPL), (market cap: US$53 million) +20%

• TomoChain (TOMO), (market cap: US$75 million) +16%

• IDEX (IDEX), (market cap: US$58 million) +10%

SLUMPERS

• Pancake Swap (CAKE), (market cap: US$552 million) -7%

• Bitget Token (BGB), (mc: US$538 million) -3%

• Zilliqa (ZIL), (mc: US$490 million) -3%

• Toncoin (TON), (mc: US$3.3 billion) -1%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

This is the chart for First Republic Bank pic.twitter.com/TGgy4IXhIe

— Benjamin Cowen (@intocryptoverse) April 25, 2023

Unsurprisingly, Cathie Wood is pushing the Bitcoin “safe haven” line once again.

CATHIE WOOD‼️ #Bitcoin is now seen as the solution to banking problems. pic.twitter.com/nodRfcLoWU

— Bitcoin Archive (@BTC_Archive) April 25, 2023

Billionaire Investor Tim Draper is “100% sure” #Bitcoin will hit $250,000 by 2024. 🧐 pic.twitter.com/DhNfHZC4we

— Bitcoin Archive (@BTC_Archive) April 24, 2023