Mooners and Shakers: Bitcoin flat amid confusing swirl of banking woes and positive US inflation data

Coinhead

Coinhead

It’s not boring at the moment, is it. Unless you can’t stand Bitcoin moving sideways for about 24 hours, that is. What’s on minds today? Fresh US PPI inflation data is in and Credit Suisse is the next bank of note on the brink.

The global financial and regulatory pot really is a soupy mess of ingredients at the moment, and it’s yet to be fully determined if it will be strangely, conversely palatable for Bitcoin and crypto investors, or just a pile of more disgusting slop to stomach for the rest of the year.

Considering murky conditions amid bank collapses, SEC crackdowns, and a possible anti-crypto “Operation Chokepoint 2.0” war being waged by the US government, things don’t look too tasty on the surface.

Some, however, tend to think a banking contagion is setting Bitcoin up for the kind of safe-haven, alternative-finance greatness it was originally intended.

2023 Bank Run 🏦🏃| The Rise of #Bitcoin #BTC #Bankcollapse pic.twitter.com/s5YSBKXMkA

— Kevin Svenson (@KevinSvenson_) March 13, 2023

So, what’s up with Swiss investment banking giant Credit Suisse then? Stockhead‘s very own non-fungible Eddy Sunarto can fill you in over at this morning’s Market Highlights, but in a nutshell, fears of a global banking contagion are spreading fast – particularly among those who still have traces of PTSD from the 2008 GFC.

“After the collapses of Silicon Valley Bank, Signature Bank and Silvergate in the last few weeks, it’s now Switzerland’s Credit Suisse (CS) that has investors worried,” writes Eddy.

“Unease about CS’ mounting problems has come to a peak, and now the bank is reportedly scrambling to raise fresh capital amid reports that the lender was seeking a Swiss government backstop.”

“If necessary, the SNB will provide $CS with liquidity." pic.twitter.com/pvl1ZZfZlQ

— ted (@tedtalksmacro) March 15, 2023

So while that’s a concern, here’s something positive for a potential Fed rate-hiking slowdown later this month. The US PPI (Producer Price Index) inflation data is in, and it’s not too shabby.

At 4.6%, it’s quite a bit lower than the expected 5.4% figure and, after fairly flat CPI figs earlier this week, adds further weight to the notion that the US Federal Reserve’s aggressive rate hiking is doing some sort of job… while, er, clearly contributing to breaking a few banks in the process.

“Powell to pivot?” asks Dutch trader/crypto analyst Michaël van de Poppe…

PPI comes in at 4.6%, while 5.4% was expected.

Massive miss, resulting into inflation coming down.

Powell to pivot? Atleast 25bps seems very likely (or no hikes with the banking issues).

Great signs!

— Michaël van de Poppe (@CryptoMichNL) March 15, 2023

The chairman of the board of Credit Suisse is called Mr. Lehmann.

We live in a simulation. pic.twitter.com/lydWKgV195

— Genevieve Roch-Decter, CFA (@GRDecter) March 15, 2023

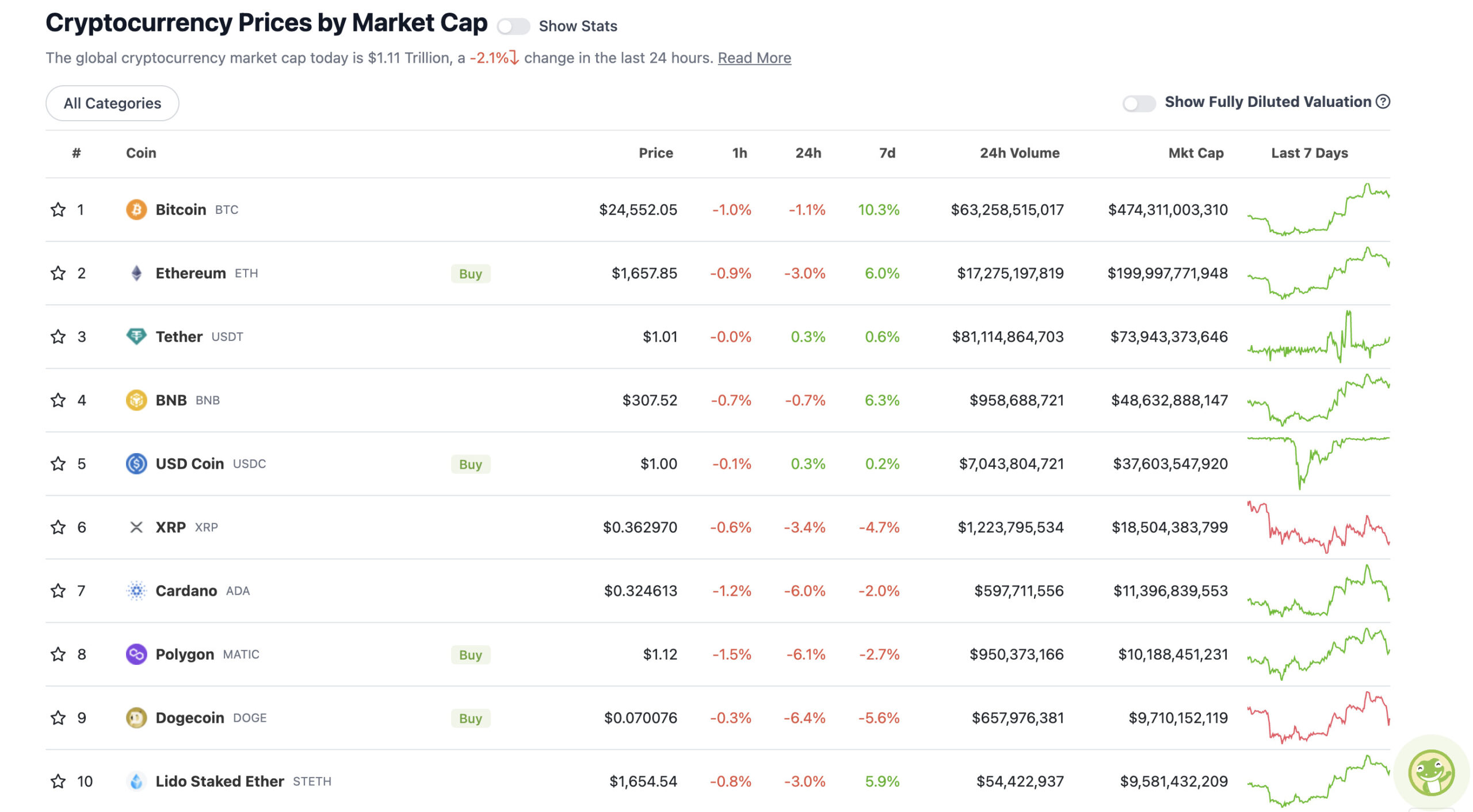

With the overall crypto market cap at US$1.11 trillion, down about 2% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

While USDC is now re-pegged and seemingly stable once again, Bitcoin and to a lesser extent Ethereum have also flattened out somewhat. Meanwhile top altcoins including Polygon, Cardano and Dogecoin are taking a bit of a hit today.

We haven’t talked about Lido Staked Ether (STETH) and why that made a recent surge into the top 10. It’s to do with the upcoming Ethereum Shanghai upgrade and the fact that staked ETH will be able to be unlocked for the first time, which will add liquidity into the broader Ethereum staking market. Lido is the top liquid-staking platform.

Lido Finance expects it will support staked ether withdrawals by mid-May

By @vishal4c https://t.co/4xr2SJaejl

— The Block (@TheBlock__) March 15, 2023

As for what happens next with Bitcoin, the next Fed FOMC meeting, which occurs on March 21-23 could well pump the market further – IF the Fed decides to pause it’s hiking or take a relatively soft approach with 25bp.

#Bitcoin: Don’t Rule Out Another Rally While Above $23,130

Why we could see another pump from $BTC while above $23,130 on the higher time frames. 👇https://t.co/KECzLgXSHm

— Justin Bennett (@JustinBennettFX) March 15, 2023

Sweeping a market-cap range of about US$8.3 billion to about US$405 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

PUMPERS

• GMX (GMX), (market cap: US$677 million) +5%

• XDC Network (XDC), (mc: US$441 million) +4%

• LEO Token (LEO), (mc: US$3.17 billion) +2%

• Toncoin (TON), (mc: US$3.6 billion) +1%

• Conflux (CFX), (mc: US$637 million) +16%

SLUMPERS

• Filecoin (FIL), (market cap: US$2.27 billion) -17%

• Lido DAO (LDO), (mc: US$1.97 billion) -16%

• Synthetix Network (SNX), (mc: US$838 million) -16%

• Maker (MKR), (mc: US$673 million) -13%

• Fantom (FTM), (mc: US$1.08 billion) -13%

Some pertinence and randomness that stuck with us on our morning moves through the Crypto Twitterverse.

Credit Suisse is on the brink of collapse… again…

They will need to be bailed out.

Such a move will pump markets big time because it will mean more monetary easing.

— Lark Davis (@TheCryptoLark) March 15, 2023

At this point it's clear that Jim Cramer is a government psyop designed to destroy the wealth of the baby boomer generation

He recently proclaimed his support for Credit Suisse $CS

— EllioTrades (@elliotrades) March 15, 2023

This isn't a shitcoin.

It's the second largest bank in Europe, $2.7 trillion BNP Paribas. pic.twitter.com/ZSNWH9LF7B

— Bitcoin Magazine (@BitcoinMagazine) March 15, 2023

Be clear: He couldn't and didn't explain why specifically 2% at all. He just danced around it with vague generalities about global consensus.

The emperor has no clothes. https://t.co/TGDJg0CD05

— Sven Henrich (@NorthmanTrader) March 15, 2023

This is institutional code for:

Start cutting rates and bring QE back. https://t.co/3ldbDLVZcf— Sven Henrich (@NorthmanTrader) March 15, 2023

https://twitter.com/twobitidiot/status/1635976628017803264