The gold price has staged a significant ~11% recovery from September lows Metals Focus says don’t get too excited – this most recent rally was partially sparked by ‘short covering’ Metals Focus is also bucking the trend with its bearish predictions for gold in 2023

Our Gold Digger column wraps all the news driving ASX stocks with exposure to precious metals.

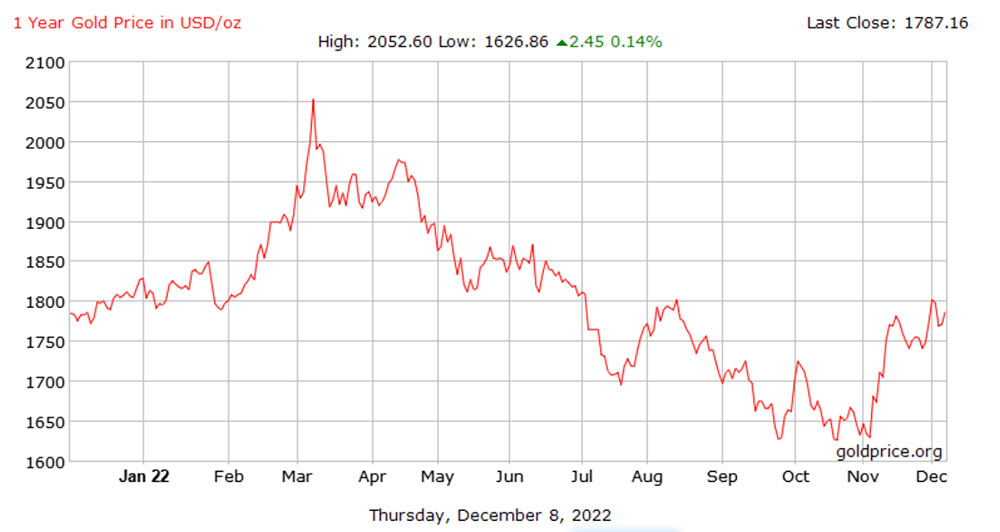

Over the last month, the gold price has staged a significant recovery from September lows.

After falling below US$1,620 on three occasions since September, the metal is trading near US$1,790 as we write, a recovery of nearly 11%.

Gold prices are now flirting with the US$1,800 level again as the dollar softens ahead of a key round of inflation data, OANDA analyst Ed Moya said this morning.

“It starts on Friday (US time) with an expected deceleration with wholesale price gains and later that morning the University of Michigan inflation expectations that are expected to remain steady,” he says.

“On Tuesday, we will get the November Inflation report that should see price pressures continue to ease and on Wednesday we get the Fed.

“The FOMC is expected to downshift to half-point pace but traders will care to see what they have to say about the trend of inflation and where rates could peak.”

Gold looks like it will find a home around the US$1800 level until we have better indications with the path of prices, Moya says.

“Key resistance remains the US$1830 level with decent support at the US$1750 region.”

Is this rally the real deal?

Pic: GoldPrice.Org

Metals Focus says don’t get too excited – this most recent rally was partially sparked by ‘short covering’

While recent momentum might suggest that gold is staging a structural turnaround into 2023, Metals Focus says this rally is “unlikely” to be sustainable.

It says much of the action has been exaggerated by the positioning of longs and shorts in the market before events, like a weak US CPI report, triggered short-covering or liquidations.

A short position is generally the sale of a stock/asset you do not own. Investors who sell short are betting the price of gold, for example, will decrease.

If the price drops, they can buy it back at the lower price and book a profit. But if the price rises and they’re forced to buy it back later at the higher price, they incur a loss.

‘Short covering’, in this case, refers to buying back borrowed gold to close out an open short position potentially at a loss, which forces the price even higher.

“Given the aggressive rate hikes this year, CME data suggests that money managers had maintained a net-short position on gold [expecting it fall] for ten consecutive weeks starting in early September. This in turn was led by the aggressive long positioning in the US dollar [expecting it to rise].

“Given the extended positioning both on the long side (for the dollar) and the short side (gold), much of the recent price moves in gold have been triggered by short covering rather than fresh buying,” Metals Focus says.

“To put this into context, gross money manager shorts (as of 29th November) have slumped by 60% since their peak of 11.7Moz at end-September,” Metals Focus.

“By contrast, gross longs have risen by just 16% during the same period.”

Bulls Vs Bears in 2023

Metals Focus is also bucking the trend with its bearish predictions for gold in 2023.

“We believe that this rally is unlikely to be sustainable as the yellow metal has to contend with rising real yields in 2023, which will raise the opportunity cost of holding gold and, in turn, undermine investor sentiment once the ongoing relief rally in global financial markets fades,” it says.

Bloomberg Intelligence senior macro strategist Mike McGlone says the opposite.

As do a slew of experts in our biblically long (but indispensable) Commodity Predictions For 2023 yarn.

So, who’s right? Only time will tell.

Winners & Losers

Here’s how ASX-listed precious metals stocks are performing:

Scroll or swipe to reveal table. Click headings to sort. Best viewed on a laptop.

Stocks missing from this list? Email [email protected]

CODE COMPANY 1 WEEK RETURN % 1 MONTH RETURN % 6 MONTH RETURN % 1 YEAR RETURN % PRICE [INTRADAY FRI] MARKET CAP ANL Amani Gold 50% 50% 0% 0% 0.0015 $35,540,162 CDR Codrus Minerals 48% 208% 130% 43% 0.2 $4,851,600 GMN Gold Mountain 43% 11% 67% -38% 0.01 $15,781,492 A1G African Gold 36% 4% -4% -39% 0.095 $14,580,381 PKO Peako 29% 19% -9% -26% 0.0155 $5,877,837 AL8 Alderan Resource 29% 29% -50% -73% 0.009 $5,204,395 CLA Celsius Resource 29% 64% -3% -10% 0.018 $24,045,265 AQX Alice Queen 25% 25% -50% -75% 0.0025 $5,500,625 LM8 Lunnonmetals 24% 26% 20% 165% 0.98 $108,777,366 CHN Chalice Mining 20% 55% 22% -23% 6.71 $2,370,672,322 POL Polymetals Resources 19% 28% 108% 67% 0.25 $10,295,673 EMC Everest Metals Corp 18% -10% -14% -36% 0.09 $8,833,948 NES Nelson Resources. 17% 17% -44% -71% 0.007 $4,120,160 RSG Resolute Mining 17% 9% -13% -34% 0.21 $357,830,788 BEZ Besragoldinc 15% 52% -9% -51% 0.06 $15,126,824 EMU EMU NL 14% 60% -47% -64% 0.008 $5,498,145 TMX Terrain Minerals 14% 33% -20% 0% 0.008 $6,177,517 MLS Metals Australia 13% 34% -25% 28% 0.051 $30,958,846 FAU First Au 13% -10% -65% -59% 0.0045 $4,283,970 RDS Redstone Resources 13% 50% 29% -36% 0.009 $6,631,492 ARV Artemis Resources 12% -3% -15% -64% 0.028 $36,176,878 BNZ Benzmining 12% -2% -22% -28% 0.47 $33,501,244 GBR Greatbould Resources 12% 3% 7% -30% 0.094 $39,749,984 REZ Resourc & En Grp 12% 6% -30% -55% 0.019 $9,496,310 KRM Kingsrose Mining 12% 20% 5% -14% 0.067 $49,666,750 GED Golden Deeps 11% -17% -38% -23% 0.01 $11,552,267 XAM Xanadu Mines 11% 11% 15% 20% 0.03 $42,367,806 CAZ Cazaly Resources 10% 3% -20% -26% 0.032 $12,270,119 GWR GWR Group 10% 16% -40% -37% 0.066 $21,200,299 RMX Red Mount Min 10% 10% -27% -39% 0.0055 $8,211,819 VKA Viking Mines 10% 57% 57% -42% 0.011 $11,277,843 E2M E2 Metals 10% 26% -3% -40% 0.17 $35,843,818 SMI Santana Minerals 10% 25% -14% 143% 0.74 $107,119,871 MHC Manhattan Corp 9% 0% -45% -54% 0.006 $9,157,672 PRX Prodigy Gold NL 9% 9% -25% -61% 0.012 $20,974,594 PUR Pursuit Minerals 9% 9% -37% -54% 0.012 $11,978,150 SRN Surefire Rescs NL 9% 0% -59% 9% 0.012 $17,394,998 GIB Gibb River Diamonds 9% 24% 24% -34% 0.062 $13,113,586 MVL Marvel Gold 9% 4% -31% -60% 0.025 $17,612,359 HAW Hawthorn Resources 8% 51% 30% 34% 0.13 $43,357,030 HAV Havilah Resources 8% 8% 16% 100% 0.33 $101,324,547 BGD Bartongoldholdings 8% 33% -5% -2% 0.2 $17,248,461 CDT Castle Minerals 8% 23% -16% 17% 0.027 $23,987,832 ASO Aston Minerals 8% 40% -27% -24% 0.095 $100,217,784 MTC Metalstech 8% 4% 6% 43% 0.415 $70,240,655 LEX Lefroy Exploration 8% -2% -7% -16% 0.28 $40,844,907 SFR Sandfire Resources 7% 47% -4% -5% 5.64 $2,402,811,753 MKG Mako Gold 7% 10% -44% -63% 0.045 $18,866,054 AUC Ausgold 7% 9% -16% 4% 0.047 $97,414,778 MEU Marmota 7% 4% -30% 7% 0.047 $48,704,826 MEI Meteoric Resources 7% 14% 14% 0% 0.016 $24,420,758 HXG Hexagon Energy 6% 6% -39% -78% 0.017 $8,719,570 M24 Mamba Exploration 6% 48% 70% -11% 0.17 $6,748,000 MM8 Medallion Metals. 6% 0% -40% -4% 0.17 $23,792,360 KCC Kincora Copper 6% 5% -27% -40% 0.069 $5,208,251 PNT Panthermetals 6% -10% -8% 0% 0.18 $5,535,000 NAG Nagambie Resources 6% 3% 42% 14% 0.075 $35,083,672 NXM Nexus Minerals 6% 19% -22% -65% 0.19 $58,581,596 CMM Capricorn Metals 5% 22% 25% 63% 4.69 $1,816,810,849 STN Saturn Metals 5% -10% -42% -50% 0.2 $25,979,835 TMZ Thomson Res 5% 11% -19% -66% 0.021 $17,183,972 AAR Astral Resources 5% 17% -17% -21% 0.068 $45,247,879 CYL Catalyst Metals 4% -5% -20% -45% 1.2 $118,147,378 MOH Moho Resources 4% 0% -33% -60% 0.024 $4,776,231 ALY Alchemy Resource 4% -34% 29% 145% 0.027 $30,629,983 BCN Beacon Minerals 4% 13% -10% -11% 0.027 $97,675,972 TBA Tombola Gold 4% -4% -51% -13% 0.027 $34,403,445 VMC Venus Metals Cor 4% -16% -27% -21% 0.135 $24,040,622 RND Rand Mining 4% -3% -2% -4% 1.4 $79,626,345 ANX Anax Metals 4% -5% -43% -40% 0.057 $23,977,295 AUT Auteco Minerals 4% 40% 16% -17% 0.059 $113,730,997 EM2 Eagle Mountain 3% -11% -61% -72% 0.16 $45,831,501 GSR Greenstone Resources 3% 28% -40% 14% 0.032 $31,162,790 MBK Metal Bank 3% 13% -32% -51% 0.034 $9,400,508 CEL Challenger Exp 3% 16% -18% -35% 0.18 $182,859,469 RED Red 5 3% 16% -51% -27% 0.185 $516,671,092 KIN KIN Min NL 3% -3% -3% -29% 0.075 $78,639,114 SLR Silver Lake Resource 3% 12% -18% -20% 1.315 $1,245,857,406 TAR Taruga Minerals 3% 26% 56% 15% 0.039 $26,523,661 VAN Vango Mining 3% 3% -22% -37% 0.039 $49,137,568 CBY Canterbury Resources 3% 0% -18% -52% 0.04 $5,360,941 KZR Kalamazoo Resources 2% -5% -32% -38% 0.21 $31,252,069 RMS Ramelius Resources 2% 18% -19% -34% 0.9675 $859,211,846 FAL Falconmetals 2% 18% -11% 0% 0.235 $41,595,000 NCM Newcrest Mining 2% 16% -13% -10% 21.07 $18,964,501,203 CST Castile Resources 2% 15% -22% -32% 0.1325 $32,656,828 X64 Ten Sixty Four 2% 7% -23% -23% 0.565 $127,900,249 SPQ Superior Resources 2% 2% 45% 263% 0.058 $96,969,564 EVN Evolution Mining 2% 35% -20% -27% 2.91 $5,321,547,325 AQI Alicanto Min 2% 20% -13% -50% 0.06 $26,682,817 WGX Westgold Resources. 2% -2% -39% -59% 0.7675 $374,161,957 HRN Horizon Gold 2% -2% -11% -16% 0.32 $40,058,125 CAI Calidus Resources 1% -9% -55% -39% 0.35 $153,276,097 AWJ Auric Mining 1% 4% -18% -30% 0.077 $7,226,036 TUL Tulla Resources 1% -1% -34% -25% 0.395 $79,234,130 SBM St Barbara 1% 27% -48% -54% 0.6325 $522,586,653 SSR SSR Mining Inc. 1% 15% -20% -11% 22.79 $420,984,332 CWX Carawine Resources 1% 7% -34% -52% 0.092 $18,107,207 AGG AngloGold Ashanti 1% 26% 15% -1% 5.56 $495,995,173 TBR Tribune Res 1% 31% 1% -18% 4 $209,872,308 RRL Regis Resources 1% 28% 4% 13% 2.02 $1,540,252,887 AAU Antilles Gold 0% 6% -51% -46% 0.037 $15,799,802 ADG Adelong Gold 0% -22% -77% -83% 0.007 $3,102,308 ADT Adriatic Metals 0% 17% 32% 17% 3.18 $695,740,426 ADV Ardiden 0% 33% -20% -20% 0.008 $22,680,851 AME Alto Metals 0% 1% -10% -34% 0.069 $39,377,704 AVW Avira Resources 0% -14% -25% -45% 0.003 $6,401,370 AYM Australia United Min 0% 0% -33% -50% 0.004 $7,370,310 BAT Battery Minerals 0% -11% -20% -69% 0.004 $11,700,969 BRB Breaker Res NL 0% 13% 49% -5% 0.305 $99,474,073 CGN Crater Gold Min 0% 0% 0% 0% 0.017 $21,063,474 CLZ Classic Min 0% -17% -93% -93% 0.01 $7,363,833 DCX Discovex Res 0% 0% -48% -37% 0.003 $9,907,704 DEX Duke Exploration 0% 0% -42% -71% 0.053 $5,587,240 DTM Dart Mining NL 0% -4% -7% -24% 0.065 $10,091,910 EMR Emerald Res NL 0% 3% -8% 4% 1.125 $670,853,861 ENR Encounter Resources 0% -3% 10% 18% 0.165 $58,661,754 FFX Firefinch 0% 0% -31% -24% 0.2 $236,248,644 G50 Gold50 0% 150% 28% -4% 0.25 $14,235,750 GCY Gascoyne Res 0% 0% -27% -37% 0.195 $83,082,880 GML Gateway Mining 0% 5% -48% -58% 0.063 $14,238,691 GMR Golden Rim Resources 0% -15% -47% -61% 0.033 $10,673,055 GRL Godolphin Resources 0% 0% -29% -47% 0.082 $10,416,511 GSN Great Southern 0% -20% 3% -34% 0.04 $23,213,136 KAU Kaiser Reef 0% 3% -15% -8% 0.17 $22,795,003 LRL Labyrinth Resources 0% -6% -32% -51% 0.017 $15,720,602 MAU Magnetic Resources 0% 3% -39% -43% 0.8 $183,609,905 MI6 Minerals260 0% 22% 2% -19% 0.44 $94,600,000 MOM Moab Minerals 0% -10% -67% -70% 0.009 $6,478,653 NAE New Age Exploration 0% 20% 0% -18% 0.009 $12,923,090 NPM Newpeak Metals 0% 0% 0% -33% 0.001 $9,096,667 NSM Northstaw 0% 1% -48% -68% 0.098 $11,772,446 NST Northern Star 0% 16% 25% 17% 10.92 $12,659,525,075 OAU Ora Gold 0% -14% -45% -54% 0.006 $5,905,388 OZM Ozaurum Resources 0% 0% -59% -45% 0.072 $5,019,552 PF1 Pathfinder Resources 0% 0% 0% 79% 0.5 $28,984,082 PGO Pacgold 0% -7% -40% -31% 0.39 $21,435,108 PNM Pacific Nickel Mines 0% 1% -15% -7% 0.071 $25,441,389 PNX PNX Metals 0% 25% 0% -14% 0.005 $22,220,289 QML Qmines 0% -14% -18% -50% 0.18 $16,237,626 RML Resolution Minerals 0% -11% -20% -50% 0.008 $8,557,970 RVR Red River Resources 0% 0% -57% -59% 0.073 $37,847,908 S2R S2 Resources 0% 18% -7% -6% 0.165 $60,668,725 SBR Sabre Resources 0% 0% 0% 0% 0.0045 $13,116,852 SI6 SI6 Metals 0% -17% -38% -44% 0.005 $8,224,670 SIH Sihayo Gold 0% -20% -20% -75% 0.002 $12,204,256 SKY SKY Metals 0% 0% -45% -50% 0.05 $18,839,174 SVG Savannah Goldfields 0% -18% 0% -6% 0.18 $31,067,719 TLM Talisman Mining 0% 8% -18% -7% 0.14 $26,283,530 TRY Troy Resources 0% 0% 0% 0% 0.0295 $62,920,961 TSO Tesoro Gold 0% 1% -46% -53% 0.035 $34,719,327 WCN White Cliff Min 0% -11% -6% 0% 0.016 $11,214,050 WMC Wiluna Mining Corp 0% 0% -58% -77% 0.205 $74,238,031 FEG Far East Gold -1% -18% 66% 0% 0.54 $70,067,757 CHZ Chesser Resources -1% 7% -22% -38% 0.074 $44,109,233 ERM Emmerson Resources -1% -1% -24% -56% 0.074 $40,308,524 TGM Theta Gold Mines -1% -8% -18% -59% 0.074 $45,806,671 MEK Meeka Metals -1% 14% 6% 52% 0.067 $72,597,407 GUL Gullewa -2% -3% -12% -21% 0.06 $11,722,386 IVR Investigator Res -2% 0% 1% -24% 0.051 $66,858,183 MXR Maximus Resources -2% -4% -32% -25% 0.043 $13,394,042 SVL Silver Mines -2% 14% 8% 5% 0.205 $277,743,911 PRU Perseus Mining -2% 17% 13% 42% 2.205 $3,104,141,267 SFM Santa Fe Minerals -2% -8% -20% -27% 0.08 $5,825,503 MGV Musgrave Minerals -3% -11% -37% -46% 0.195 $110,318,360 OKR Okapi Resources -3% -10% -35% -57% 0.175 $25,784,237 AAJ Aruma Resources -3% -7% 1% 3% 0.069 $10,516,421 PRS Prospech -3% 13% -23% -54% 0.034 $3,002,152 KSN Kingston Resources -3% 8% -31% -46% 0.097 $40,318,405 BC8 Black Cat Syndicate -3% 7% -24% -45% 0.32 $68,780,536 TTM Titan Minerals -3% 27% 34% -4% 0.095 $136,893,499 GOR Gold Road Res -3% 23% 32% 21% 1.74 $1,915,159,490 KTA Krakatoa Resources -3% 2% -9% 11% 0.059 $18,959,045 ALK Alkane Resources -3% 0% -34% -18% 0.6375 $377,239,333 MZZ Matador Mining -3% 33% -22% -62% 0.14 $45,705,571 NVA Nova Minerals -4% -13% 17% -44% 0.68 $142,569,666 BYH Bryah Resources -4% 8% -33% -47% 0.027 $7,593,844 KAI Kairos Minerals -4% -13% 13% 4% 0.027 $51,066,431 IDA Indiana Resources -4% 0% -7% -9% 0.052 $25,417,851 SAU Southern Gold -4% -7% -32% -54% 0.026 $6,933,183 ADN Andromeda Metals -4% 23% -44% -70% 0.048 $149,280,405 AZS Azure Minerals -4% -25% -26% -29% 0.24 $71,812,413 PNR Pantoro -4% -11% -60% -63% 0.12 $222,352,572 HCH Hot Chili -4% 4% -19% -53% 0.95 $112,278,494 KCN Kingsgate Consolid. -4% -3% 5% -1% 1.65 $369,605,157 KCN Kingsgate Consolid. -4% -3% 5% -1% 1.65 $369,605,157 LYN Lycaonresources -4% 23% -30% -4% 0.345 $11,192,375 A8G Australasian Metals -4% 0% -34% -53% 0.225 $9,263,361 BGL Bellevue Gold -4% 47% 30% 42% 1.12 $1,204,656,457 HRZ Horizon -4% 16% -48% -47% 0.066 $41,107,850 YRL Yandal Resources -4% 0% -43% -72% 0.11 $17,358,339 LCL Los Cerros -5% 52% -33% -67% 0.041 $33,638,546 KAL Kalgoorliegoldmining -5% 1% -9% -31% 0.1 $7,743,460 OBM Ora Banda Mining -5% 3% 147% 29% 0.079 $114,170,844 TAM Tanami Gold NL -5% 3% -26% -41% 0.039 $43,478,591 TRM Truscott Mining Corp -5% 15% -19% 30% 0.039 $6,519,125 DEG De Grey Mining -5% 11% 17% 13% 1.235 $1,974,876,147 GMD Genesis Minerals -5% 2% -22% -15% 1.185 $487,598,702 HMX Hammer Metals -5% 3% 24% 60% 0.072 $60,710,144 AWV Anova Metals -6% 6% 42% -6% 0.017 $27,167,601 VRC Volt Resources -6% -11% -11% -35% 0.017 $62,070,782 NWM Norwest Minerals -6% -9% 25% -37% 0.05 $10,883,262 RXL Rox Resources -6% -13% -48% -57% 0.165 $30,270,210 ASR Asra Minerals -6% -30% -56% -27% 0.016 $23,428,185 HMG Hamelingold -6% -16% 23% 14% 0.16 $17,600,000 M2R Miramar -6% -1% -10% -55% 0.094 $6,644,084 BTR Brightstar Resources -6% -21% -35% -68% 0.015 $10,989,432 AXE Archer Materials -6% 1% -8% -44% 0.655 $166,808,029 IGO IGO -6% -4% 23% 47% 14.97 $11,275,717,736 BNR Bulletin Res -7% -20% -35% 36% 0.1075 $30,722,066 BMR Ballymore Resources -7% -13% -28% -36% 0.14 $13,484,444 PDI Predictive Disc -7% 17% 11% -18% 0.205 $356,023,550 SVY Stavely Minerals -7% 41% -43% -59% 0.205 $66,205,704 CY5 Cygnus Gold -7% -14% 179% 144% 0.475 $81,189,273 CXU Cauldron Energy -7% -16% -29% -66% 0.009 $5,467,899 MKR Manuka Resources. -7% -10% -37% -58% 0.13 $60,184,628 NML Navarre Minerals -7% -15% -35% -45% 0.039 $53,201,529 RDN Raiden Resources -7% -24% -41% -69% 0.0065 $10,754,786 TCG Turaco Gold -7% 21% -39% -57% 0.052 $22,241,267 AGC AGC -8% -9% -26% -32% 0.061 $4,266,819 STK Strickland Metals -8% 10% -32% -29% 0.046 $66,097,492 GTR Gti Energy -8% -21% -42% -59% 0.011 $16,560,319 ICL Iceni Gold -8% 86% -15% -43% 0.11 $15,383,571 XTC Xantippe Res -8% -21% -45% 10% 0.0055 $40,726,149 AM7 Arcadia Minerals -8% -6% 2% 32% 0.245 $11,674,473 WAF West African Res -9% 6% -16% -13% 1.12 $1,149,055,362 TIE Tietto Minerals -9% -4% 84% 75% 0.745 $825,838,530 KWR Kingwest Resources -9% -3% -75% -86% 0.031 $9,578,712 GBZ GBM Rsources -9% -25% -55% -64% 0.041 $21,947,858 ZAG Zuleika Gold -9% -5% -38% 0% 0.02 $10,431,013 BMO Bastion Minerals -10% -5% -59% -73% 0.057 $5,770,413 LCY Legacy Iron Ore -10% 19% -17% -24% 0.019 $121,729,698 SMS Starminerals -10% -12% -52% -66% 0.065 $1,922,700 ARL Ardea Resources -10% -5% -19% 84% 0.9 $154,352,495 BBX BBX Minerals -10% 13% -55% -58% 0.07 $35,530,668 MRZ Mont Royal Resources -11% -11% -41% -58% 0.17 $13,011,707 TG1 Techgen Metals -11% -15% -47% -51% 0.085 $4,653,661 RDT Red Dirt Metals -11% -23% 2% -29% 0.4625 $199,740,395 GNM Great Northern -11% -20% 0% -33% 0.004 $6,836,204 IPT Impact Minerals -11% 14% -11% -39% 0.008 $19,850,964 SLZ Sultan Resources -11% -27% -47% -56% 0.071 $5,913,192 ARN Aldoro Resources -11% -23% 32% -37% 0.27 $30,486,326 DCN Dacian Gold -12% -15% -39% -36% 0.115 $146,016,113 MRR Minrex Resources -12% -12% -7% -10% 0.038 $41,224,965 WWI West Wits Mining -12% -6% -38% -53% 0.015 $30,675,565 FG1 Flynngold -12% -22% -25% -45% 0.097 $6,213,922 MCT Metalicity -13% 0% -13% -62% 0.0035 $12,222,138 KNB Koonenberrygold -13% 4% -11% -47% 0.082 $6,212,028 GSM Golden State Mining -13% 15% -22% -46% 0.047 $5,733,696 MDI Middle Island Res -14% -29% -69% -48% 0.05 $6,120,911 WRM White Rock Min -14% 10% -37% -68% 0.079 $18,689,062 CTO Citigold Corp -14% -14% 0% -33% 0.006 $17,001,955 PGD Peregrine Gold -15% -13% -13% 6% 0.38 $14,725,718 SNG Siren Gold -15% 3% -49% -39% 0.175 $20,461,958 AMI Aurelia Metals -15% 38% -54% -65% 0.145 $173,241,210 RGL Riversgold -15% -34% -17% 60% 0.029 $27,418,564 GAL Galileo Mining -15% -17% -41% 333% 0.91 $182,803,057 ICG Inca Minerals -16% -10% -74% -72% 0.027 $13,022,757 ZNC Zenith Minerals -16% -9% -31% 9% 0.255 $89,585,217 CPM Coopermetals -17% -21% -40% 39% 0.25 $10,255,000 FML Focus Minerals -17% 9% -5% -31% 0.175 $50,147,763 PUA Peak Minerals -17% -17% -58% -63% 0.005 $5,206,854 MAT Matsa Resources -18% -3% -29% -27% 0.037 $16,474,185 G88 Golden Mile Res -18% 5% -52% -57% 0.023 $4,910,154 DRE Dreadnought Resources -20% -12% 132% 100% 0.088 $270,486,616 NMR Native Mineral Res -21% -31% -25% -49% 0.135 $15,612,729 MEG Megado Minerals -23% -40% -62% -57% 0.04 $5,500,000 AVM Advance Metals -25% -25% -31% -47% 0.009 $4,338,397 THR Thor Mining PLC -25% -33% -54% -57% 0.006 $8,653,277 MTH Mithril Resources -33% -40% -50% -81% 0.003 $10,290,816 DTR Dateline Resources -34% -39% -69% -44% 0.045 $23,172,565

Wordpress Table Plugin

You might be interested in