Mooners and Shakers: FTX drama continues with bankruptcy filing and hack claim; Crypto market teeters

Coinhead

Coinhead

Another week, more drama for the crypto market? If there’s one thing we’re sure of right now, it’s that. FTX is well and truly in the toilet now, and fear is starting to spread about contagion affecting a couple of other exchanges, too.

What are the other exchanges on nervy investors’ minds? We’re hesitant to contribute to the speculation of something so significant. But we will say that Cronos (CRO) – the Crypto.com exchange utility token – has been dumping so far today.

Needless to say, though, careful consideration of how and where you’re storing any crypto investments would be prudent – now more than ever.

Let’s do a quick update on some of the latest facts surrounding the FTX fiasco.

It’s official. SBF, aka Sam Bankman-Fried, has fried the crypto market. Certainly for the moment anyway.

FTX, once one of the top three crypto exchanges in the world and worth US$32 billion at its peak, over the weekend filed for Chapter 11 bankruptcy proceedings, with what is alleged to be more than a US$10 billion hole in its balance sheet.

And this bankruptcy includes a whole raft of other subsidiary companies as well, including FTX US, Alameda Research and several other entities.

To make matters worse, reports have also swirled around hackers (or potential insiders) draining largely what was left of the funds in FTX wallets – some US$600 million. This unfortunately leaves little hope that creditors, including retail investors, will ever see their FTX-deposited funds again.

Yikes and double yikes.

If you're wondering WTF happened overnight…

• $600m left FTXs wallet

• FTX's telegram said it was a hack

• The Site/App are infected

• Blackhat theft at ~450m

• FTX rescued ~200m

• soBTC on Solana has lost peg (-77%)

• and more.Hacker or inside job? 🤔

— Edgy – The DeFi Edge 🗡️ (@thedefiedge) November 12, 2022

Unfortunately, due to the wide reaching tentacles FTX has all over the crypto industry in terms of partnerships and investments, the chance of another “crypto contagion”, meaning further financial fallout across the space for those with deep ties to FTX, is very high.

We’ve already seen one potential casualty – crypto lender BlockFi – which might be showing early signs of going under due to its heavy exposure to FTX. On Friday, BlockFi decided to suddenly halt all withdrawals from its platform, with very little transparency as to why.

And this came two days after they said, via Twitter, that everything was okay with them and that it was business as usual.

As you may be aware by now, FTX has been headquartered in the Bahamas, with – reportedly – Sam Bankman-Fried and about nine other staffers all sharing/living in the same multi-million-dollar penthouse compound. There are rumours about romantic links between some of them, too.

SBF and Alameda Research CEO Caroline Ellison, for instance, are said to have been in a relationship, according to this CoinDesk article. Not an incredibly important part of the story, granted, but it does add some extra colour to it.

Sam's penthouse "The Orchid" in the Albany exclusive community is now listed on the market for sale — $39,500,000https://t.co/6TsURzyEZg pic.twitter.com/fZ2pY4ujCh

— Autism Capital 🧩 (@AutismCapital) November 13, 2022

BREAKING: FTX bought $74 million of real estate in the Bahamas this year – The Block

💥WITH YOUR MONEY! 🤨

— Bitcoin Archive (@BTC_Archive) November 13, 2022

Anyway, per another major US-based crypto media source, Cointelegraph, SBF, along with FTX co-founder Gary Wang and director of engineering Nishad Singh are understood to be “under supervision” by the local authorities in the Bahamas.

Meanwhile, “a source familiar with the matter” reportedly told the media outlet that the three former FTX executives, along with Ellison, have been looking for ways to flee to Dubai. Ellison is currently rumoured to be in Hong Kong.

Dubai is commonly thought to be something of a safe haven for Americans seeking to avoid sentencing – fugitives, essentially. And that’s because there is no official extradition treaty between the UAE and the US.

However, the UAE does actually have a legal-assistance treaty with America, so perhaps it’s more likely high-profile figures such as SBF would be detained and sent back to the US.

In any case… it’s a developing, gossip-fuelled story, and there have been all sorts of rumours bandied around about Bankman-Fried’s whereabouts and plans, including fleeing to Argentina via his private jet.

SBF and other leading FTX execs being effectively restricted to the Bahamas while police investigate all circumstances seems the most credible situation at this point.

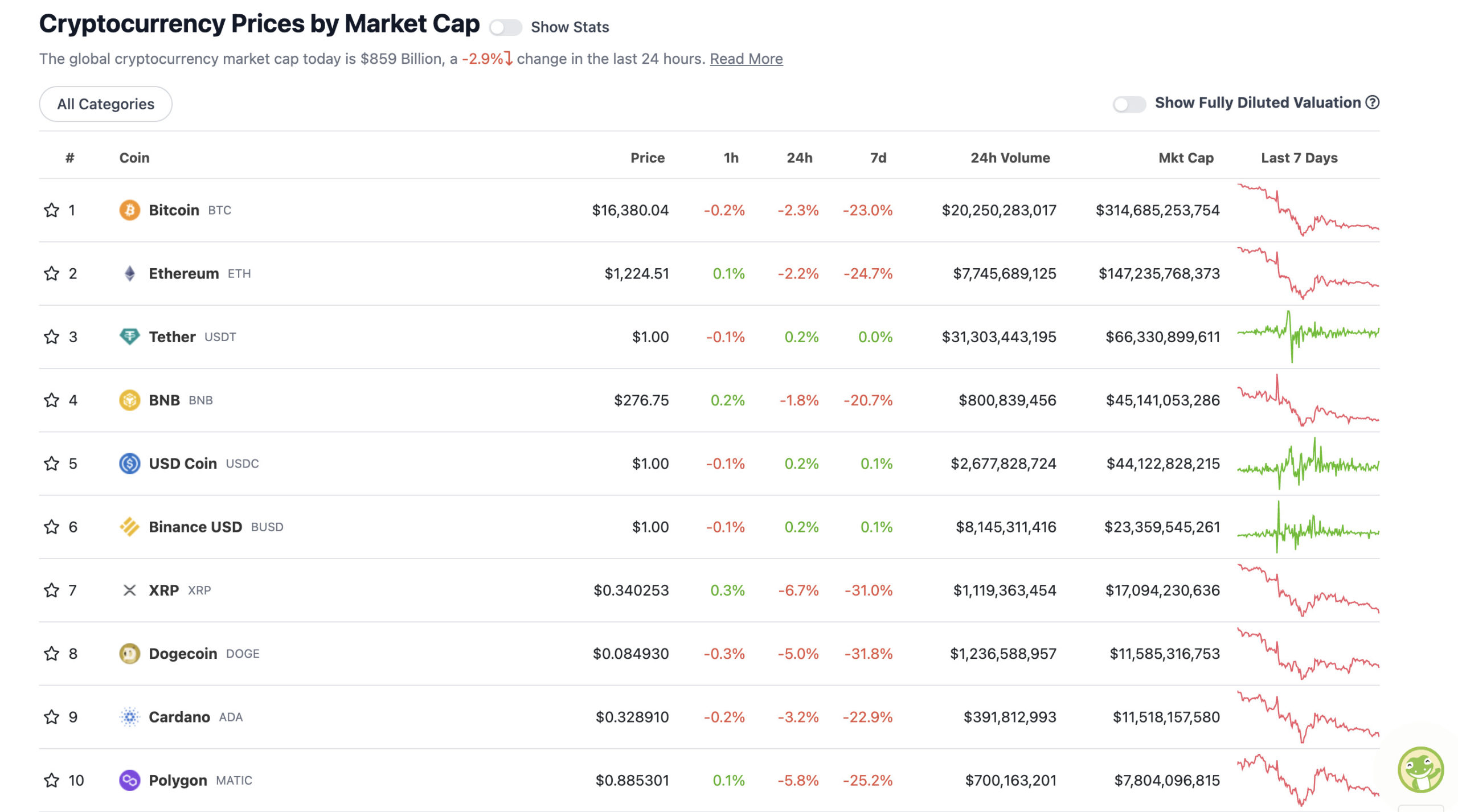

With the overall crypto market cap at US$859 billion, down 3% since this time yesterday, here’s the current state of play among top 10 tokens – according to CoinGecko.

It’s a similar story right across the crypto majors over the past week since this whole FTX fiasco blew the market to pieces.

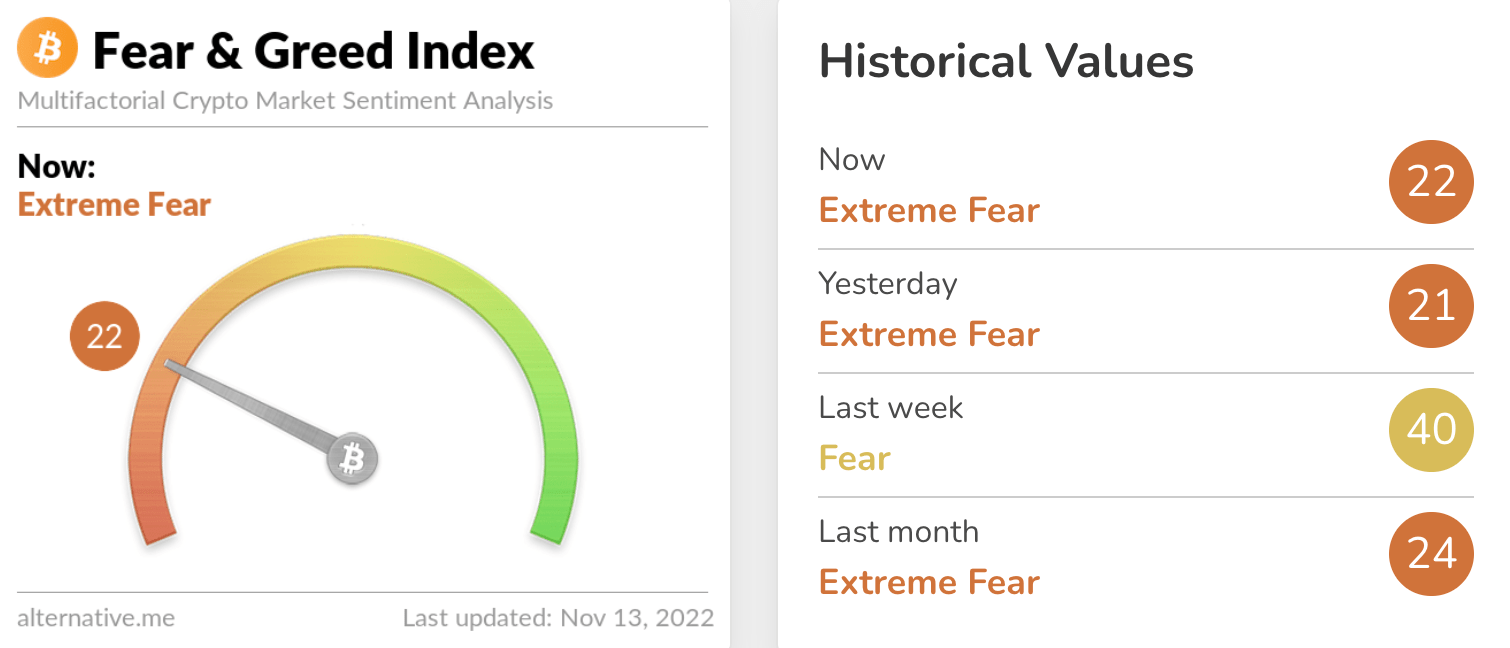

Heavy double-digit losses across the board over the seven-day timeframe. The daily price action suggests a slowdown, but the reality is the extreme fear is palpable right now as the contagion concerns swirl.

Predictions of an absolute crypto bottom might be best placed in cold storage at this stage, until the dust has a chance to settle further.

#BTC would need to drop an additional -35% from current levels to match it’s average historical Bear Market retracement depth of -84.5%$BTC #Crypto #Bitcoin

— Rekt Capital (@rektcapital) November 13, 2022

Sweeping a market-cap range of about US$6.7 billion to about US$312 million in the rest of the top 100, let’s find some of the biggest 24-hour gainers and losers at press time. (Stats accurate at time of publishing, based on CoinGecko.com data.)

DAILY PUMPERS

• Trust Wallet (TWT), (market cap: US$825 million) +34%

• dYdX (DYDX), (mc: US$325 million) +27%

• Axie Infinity (AXS), (mc: US$773 million) +8%

• KuCoin (KCS), (mc: US$739 million) +7%

• The Open Network (TON), (mc: US$2.4 billion) +7%

DAILY SLUMPERS

• Cronos (CRO), (market cap: US$1.57 billion) -21%

• Evmos (EVMOS), (mc: US$402 million) -11%

• WhiteBIT Token (WBT), (mc: US$670 million) -11%

• Solana (SOL), (mc: US$4.85 billion) -10%

• Radix (XRD), (mc: US$496 million) -9%

• Chiliz (CHZ), (mc: US$1.07 billion) -7%

What is going on?! pic.twitter.com/J5bAfyZbNo

— Coin Bureau (@coinbureau) November 13, 2022

A selection of rumour, gossip, randomness and pertinence that stuck with us on our morning moves through the Crypto Twitterverse…

NEW: 🇺🇸 FTX collapse similar to Enron's fraud

– Larry Summers, ex-Treasury Secretary— Bitcoin Archive (@BTC_Archive) November 13, 2022

BITCOIN? WORRIED? No. I am a Bitcoin investor as I am an investor in physical gold, silver, & real estate. I am NOT A TRADER or flipper. When BITCOIN hits new bottom, $10 to $12 k? I will get EXCITED, not worried. I bet against the Fed,Treasury, Biden, & bet on G,S, & Bitcoin.

— Robert Kiyosaki (@theRealKiyosaki) November 11, 2022

Goodness me, I’ve lost so much trust in people this week in this space. Not that I had much to begin with. https://t.co/sdaBZTSW8j

— Ben Simpson (@bensimpsonau) November 13, 2022

FUD starting to circle about Cryptodotcom and Gatedotio. Maybe everyone is just being paranoid, maybe not…

Are you willing to take the risk?

— Lark Davis (@TheCryptoLark) November 13, 2022

Coinbase just moved 691k $ETH to other Coinbase wallets, but the receiver wallets look like user wallets, not transactions between Coinbase hot wallets.

It could be transactions between Coinbase users. Will keep you posted.https://t.co/EYxq07OUFM pic.twitter.com/yFpv5nkg7z

— Ki Young Ju (@ki_young_ju) November 13, 2022

https://twitter.com/ByzGeneral/status/1591796531925258240

https://twitter.com/cobie/status/1591648810820071424

I’m over all these people only coming out now to say how they find SBF to be bullshit.

What’s the point of talking about your bullshit radar being on after 1 week of the event and wasn’t being vocal as @Bitboy_Crypto calling it prior the event.

Save your split milk— Eunice D Wong 🦄 (@Eunicedwong) November 13, 2022