Guy on Rocks: Yellowcake – if it’s good enough for Greta, it’s good enough for Guy

Experts

Experts

Guy on Rocks is a Stockhead series looking at the significant happenings of the resources market each week. Former geologist and experienced stockbroker Guy Le Page, director, and responsible executive at Perth-based financial services provider RM Corporate Finance, shares his high conviction views on the market and his “hot stocks to watch”.

A strong rally in precious metals coincided with a weakening USD index which closed at 111.83 for the week.

Gold had a strong week finishing up US$13 to US$1,656/oz for a 6% gain while silver rebounded to US$19.28/oz from US$18.30/oz.

Platinum was up 3.7% to US$931/oz while palladium closed up US$18 to US$1,941/ounce.

Copper closed at US$3.38/lb and is forming a bottom according to Mercenary Geologist Mickey Fulp, who believes the spot price is close to the highest cost quartile all in sustaining cost for copper producers.

Equities also had a strong week responding to an article in the Wall Street Journal that postulated that the FED might go a little slower on rate rises over the next quarter in response to a sluggish housing. The Dow Jones closed at 30,082 up almost 5% for the week while the volatility index, the VIX, closed at 29.6 down over 6% for the week. The Nasdaq finished at 10,860 up 5.2% with the TSX-V up 12 points to 593 up 2.1%. Liquidity however was still very low at 15-16m shares per day over the previous week. I must say the TSX-V is not the powerhouse it was in the 2004-2009 resources boom.

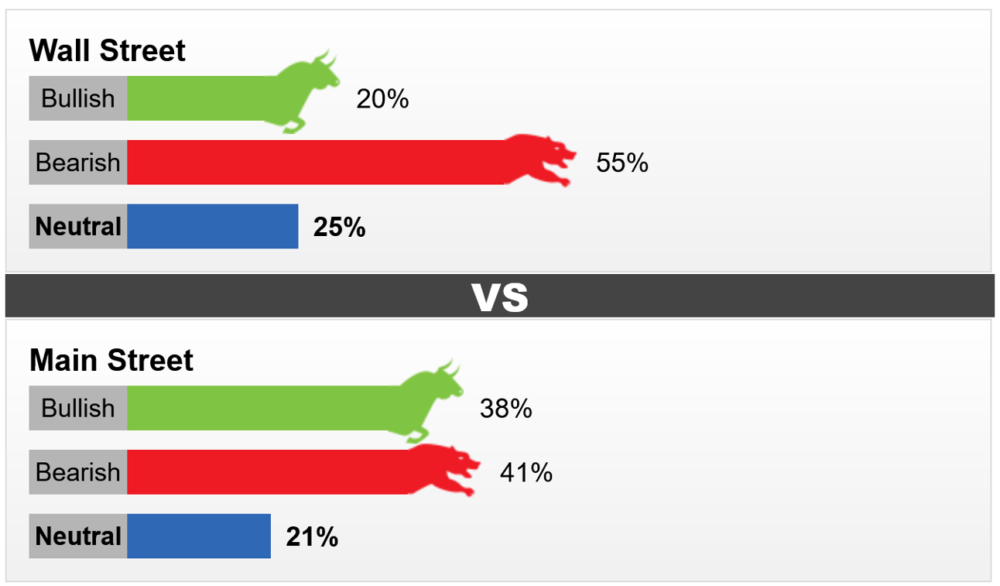

The Kitco News Weekly Gold Survey showed (figure 1) Wall Street remained bearish on gold prices in the short term. The bears were marginally ahead of the bulls in the retail space.

Not surprisingly, gold ETFs have seen strong outflows, and there may be more to come before the rate cycle peaks somewhere between 4.5% and 5.5%.

It appears that China has taken its focus off the coronavirus to some extent judging by the recent 19th Party Congress with an emphasis on “high quality development” and “common prosperity”.

One of the key goals is modernisation of the Chinese economy. As the developed world slips into recession, Chinese expansionist policies may well put a floor under metal prices in the short to medium term.

One of the great Doomsday Preppers Nouriel Roubini, CEO of Roubini Macro Associate and professor at the NYU Stern School of Business, believes that the US is likely to slip into a recession by the end of the year with a decade of “Stagflationary Debt Crisis the likes of which we’ve never seen before.”

He recommends “… short-term government bonds and inflation-indexed bonds, gold and other precious metals, and real estate that is resilient to environmental damage.”

I have just come back from the ASX Connect conference in Busselton (Southwest WA) organised by Vertical Events. Another worthwhile show with an absence of the distractions found at Diggers and Dealers in Kalgoorlie every August that can turn even good people bad (or in the case of the Diggers and Dealers attendees’ degenerates into bigger degenerates).

The Stockhead faithful need not be concerned as I normally look away when I am in the Palace Hotel, so I don’t get corrupted.

Some impressive presentations from the likes of Global Lithium Resources (ASX: GLV) who are developing the Marble Bar and Manna lithium project, Fenix Resources (ASX: FEX) on their iron ore cash cow at Weld Range and Chilean lithium developer Galan Lithium (ASX: GLN).

The cheapest stocks on the market look like the West African gold explorers so those brave punters who want to take a countercyclical investment could look at the likes of Cote D’Ivoire explorer Turaco Gold (ASX: TCG) (figure 2) exploring a highly prospective package of gold tenements within the Birimian Greenstone belt and covering over 8,000 square kilometres.

A solid presentation with plenty of near-term resource upside when the company decides to start publishing JORC resources hopefully in a better gold market in 2023.

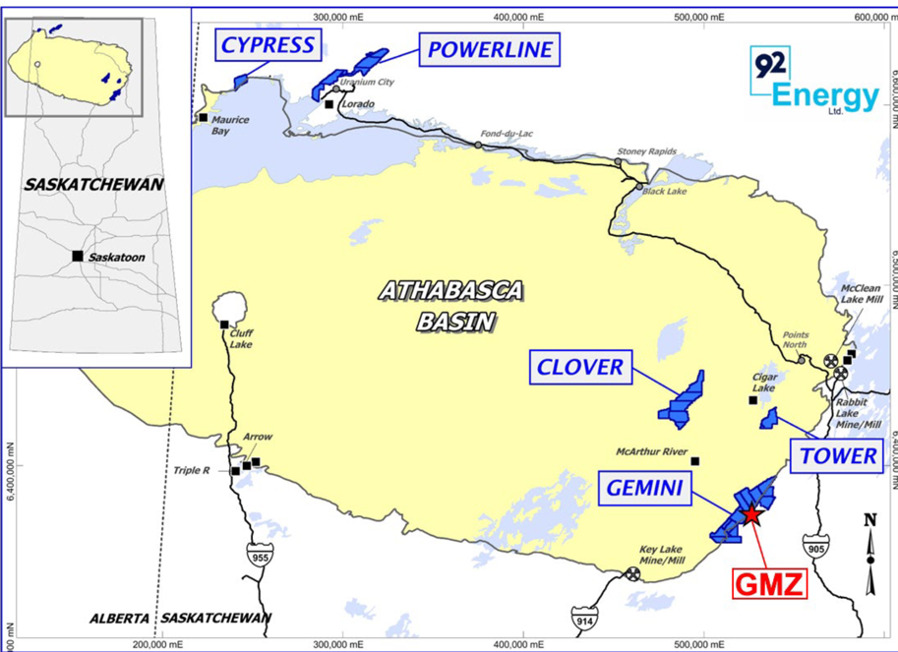

While the theme was very much around battery metals, in particular lithium and rare earths, the uranium sector I believe was somewhat underrepresented. However, Athabasca Basin (Canada) explorer 92e (ASX: 92e) and Bannerman Energy (ASX: BMN) who are developing the 3.5 million pounds per annum Etango Project in Namibia, did present at the conference and had some interesting insights into their projects as well as global developments in the uranium sector.

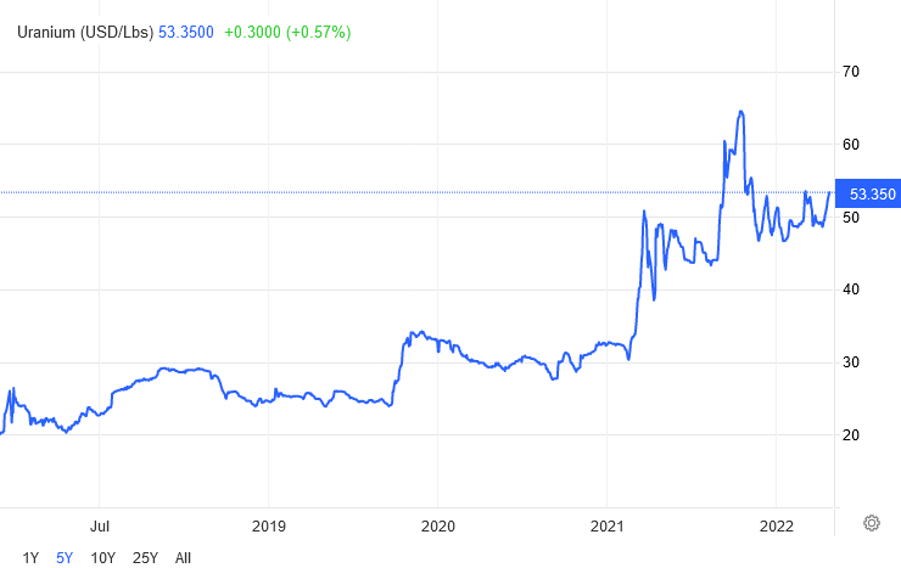

Uranium was up 4.5% last week as government policy gains momentum. Interestingly the big buyer of recent years, the Sprott Physical Uranium Trust, is still trading at a discount of just under 4% to its Net Asset Value. Good news is that Greta “Yellow Cake” Thunberg is now a true believer in uranium.

I can’t help thinking that the uranium price is building a new base (figure 3) before a breakout well above US$65/lb however the pool of ASX and TSX-V listed uranium developers/explorers remains small.

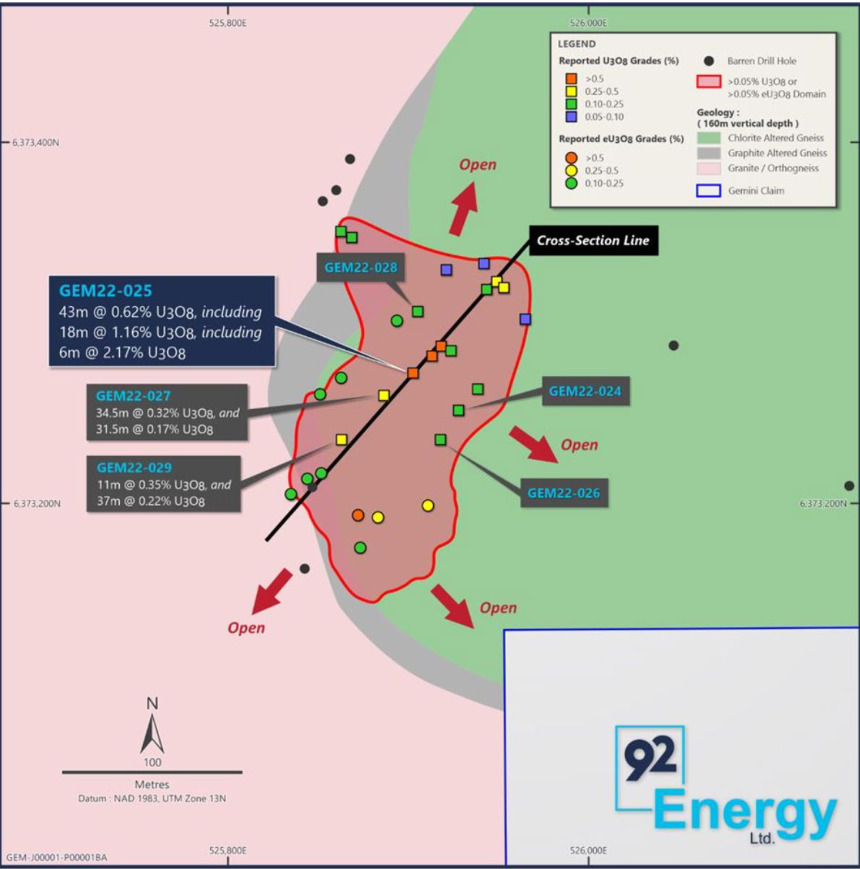

Managing Director and CEO Siobhan Lancaster from 92e (ASX: 92e) made an impressive presentation at the ASX Connect Conference last week. The company holds a total of five 100% owned uranium projects in the Athabasca Basin (Canada) (figure 5) with lead prospects with Gemini, Tower, and Clover situated close to Cameco’s Cigar Lake and Macarthur River mines.

Grade is king in the mineral exploration and mining business and the Athabasca Basin has a history of high-grade uranium mines.

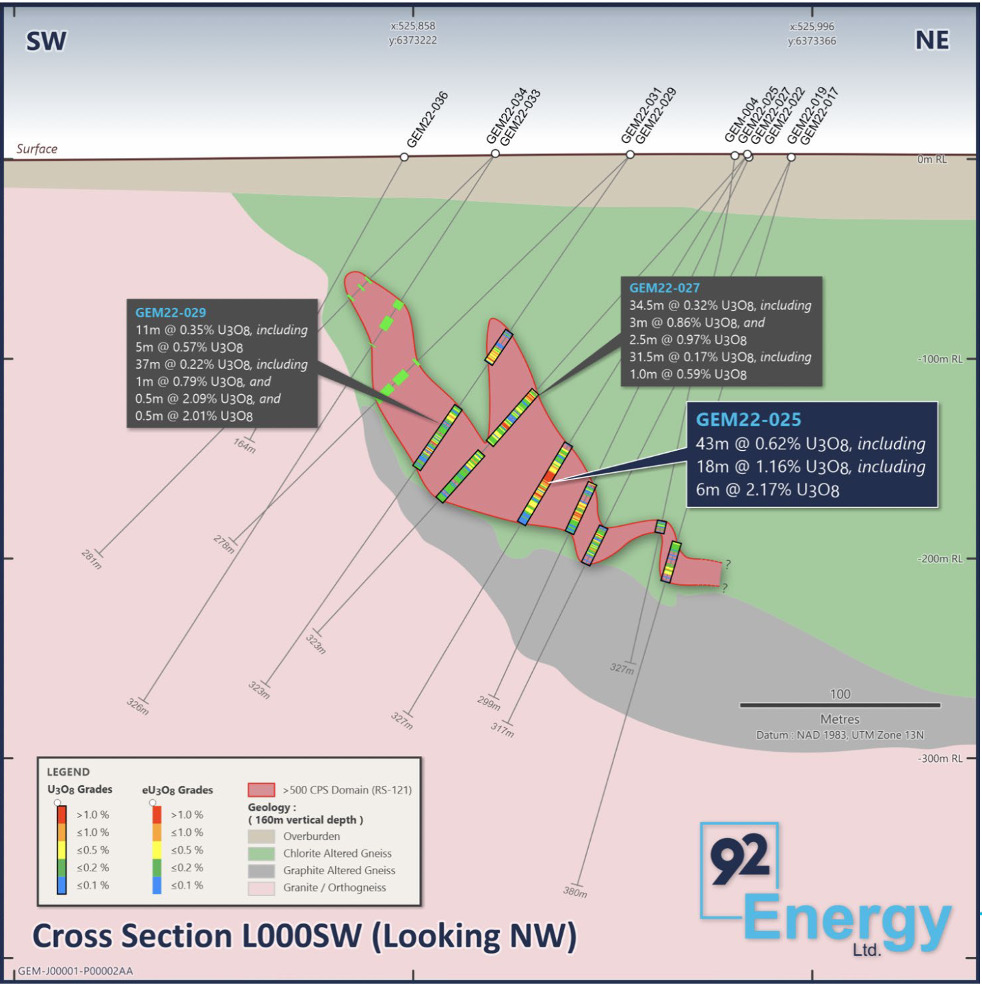

Drillholes GEM22-027, 029 intersected thick zones of composite uranium mineralisation drilled including;

Hole GEM22-029 intersected;

Mineralisation remains open to the North, East and South (figure 7). Overall, the last campaign from June to August this year was a great success with over 80% of drillholes at the GMZ intersecting mineralisation over 500ppm U3O8.

Detailed geophysics is due to get underway shortly with a winter drill program that will no doubt look to infill and step out from the known areas of mineralisation.

The ASX Connect presentation is well worth a view, and this stock could be a standout explorer as the uranium cycle gains momentum. With over $10 million in cash and an enterprise value of around $40 million this will definitely be one to put on the watch list for those who love a bit of yellow cake or have yellow fever. The latter condition can be interpreted in more than one way of course. I have never had a dose of the latter but thanks for asking…

At RM Corporate Finance, Guy Le Page is involved in a range of corporate initiatives from mergers and acquisitions, initial public offerings to valuations, consulting, and corporate advisory roles.

He was head of research at Morgan Stockbroking Limited (Perth) prior to joining Tolhurst Noall as a Corporate Advisor in July 1998. Prior to entering the stockbroking industry, he spent 10 years as an exploration and mining geologist in Australia, Canada, and the United States. The views, information, or opinions expressed in the interview in this article are solely those of the interviewee and do not represent the views of Stockhead.

Stockhead has not provided, endorsed, or otherwise assumed responsibility for any financial product advice contained in this article.