How gold miners plan to use blockchain to track the precious metal

Mining

Mining

The gold industry is looking into the possibility of tracking the precious metal using blockchain.

The Perth Mint is already working with the London Bullion Market Association (LBMA) and two or three other parties to work out which technology is the best and if the gold industry will adopt it.

The LBMA is a wholesale over-the-counter market for the trading of gold and silver.

Blockchain is best known as the basis of cryptocurrencies such as bitcoin. But it has many other potential applications such as securing digital contracts and supply chain data.

The technology allows a publicly available, tamper-proof, traceable record of digital transactions that can be automatically logged in the physical world using radio frequency ID tags (RFIDs).

It’s already being used to track diamonds.

The Perth Mint holds some $3 billion worth of investors’ gold in its network of central bank-grade vaults in Perth.

“Currently we’re storing everything within our secure networks within the Perth Mint,” Perth Mint chief Richard Hayes told Stockhead on the sidelines of the Precious Metals Investment Symposium in Perth.

“We are obviously looking at blockchain, as many people are, because blockchain does represent a wonderful opportunity to be able to track movements of gold almost in real time rather than have somebody enter it in more traditional ledgers.

“So it’s a very quick easy way of harnessing technology to achieve very, very short or truncated settlement times between two people.

“For example, if I were to transfer an ounce of gold to you on the blockchain, it would then get settled through the blockchain and rather than be a T+2 or a T+3 settlement, which would usually apply to more traditional products — stocks, shares, cash — blockchain allows that to be settled in a much shorter time frame.”

Targeting millenials

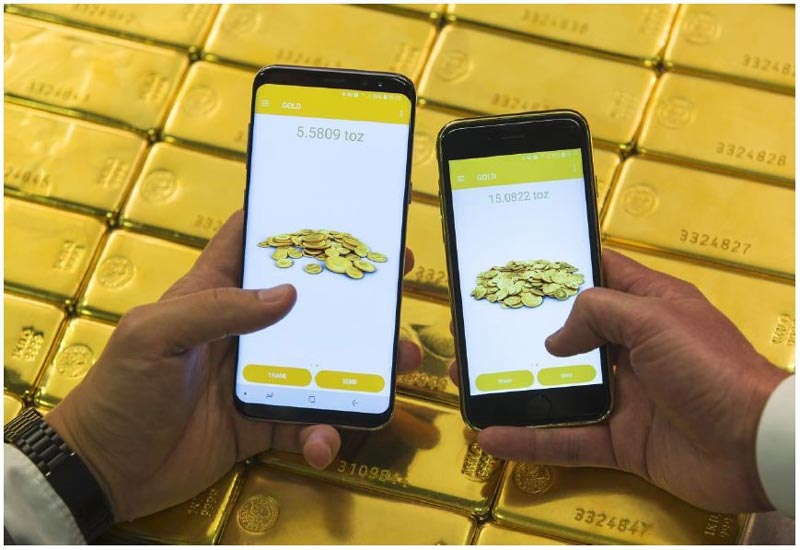

On Wednesday, the Perth Mint launched a new app called “GoldPass” aimed at getting millennials excited about investing in gold and making it easier to buy and sell the precious metal.

GoldPass gives retail investors the ability to securely buy, store and sell gold via digital certificates. It also allows the instantaneous transfer of gold to other approved GoldPass app users.

Joshua Rotbart, the founder of boutique precious metals trader J Rotbart & Co, believes the gold industry really needs to embrace blockchain.

“[The LBMA] wants to start implementing this both from a responsible gold initiative point of view but also to make sure everyone knows that the bars are real, the bars are authentic throughout the chain, throughout the transportation,” he told delegates at the Precious Metals Investment Symposium.

“To me that’s probably one of the most promising applications of the technology in the bullion industry.

“It’s good technology, you shouldn’t be afraid of it. It could cut down costs, it could cut down processing time, it could provide more assurance and more security for our industry.”

Mr Rotbart also suggests the gold industry and investors consider using cryptocurrency to buy and sell gold.

“It can be more efficient if you have either cryptocurrency settlement or other blockchain protocols,” he explained.

“There’s a protocol called Ripple for transferring and clearing funds – that’s one of the major things it can do very quickly, unlike bitcoin and cryptocurrencies.

“We had a client that had been selling metals steadily and we wired him the proceeds to his bank in North America, but then he said ‘listen I want to start getting it in cryptocurrencies.

“We looked at it at the time and processing times were two business days and fees of $80 per transaction. We moved down to processing times of 20 minutes and fees of $10. That’s what clients are looking at, they’re looking at speed, they’re looking of ways to transact quicker on weekends and so on.”

Aussie miners on board with blockchain

Miners like the notion of adopting blockchain technology, according to Mr Hayes.

The Perth Mint works closely with all Australian gold miners and gold miners in surrounding countries as well.

“The mining industry is very, very keen to make sure that its reputation is maintained and they do not want to be involved with scams and counterfeits,” Mr Hayes said.

“So there is a lot of support around this.”

While there aren’t any ASX-listed gold miners using blockchain yet, the technology is already starting to filter into the industry.

Toronto-based producer IAMGOLD revealed in April it had partnered with Tradewind Markets, a fintech that uses blockchain to speed up and streamline digital gold trading.