Crypto news: Miami offers Bitcoin yield to citizens; analysts predict BTC dip before running higher

Coinhead

Coinhead

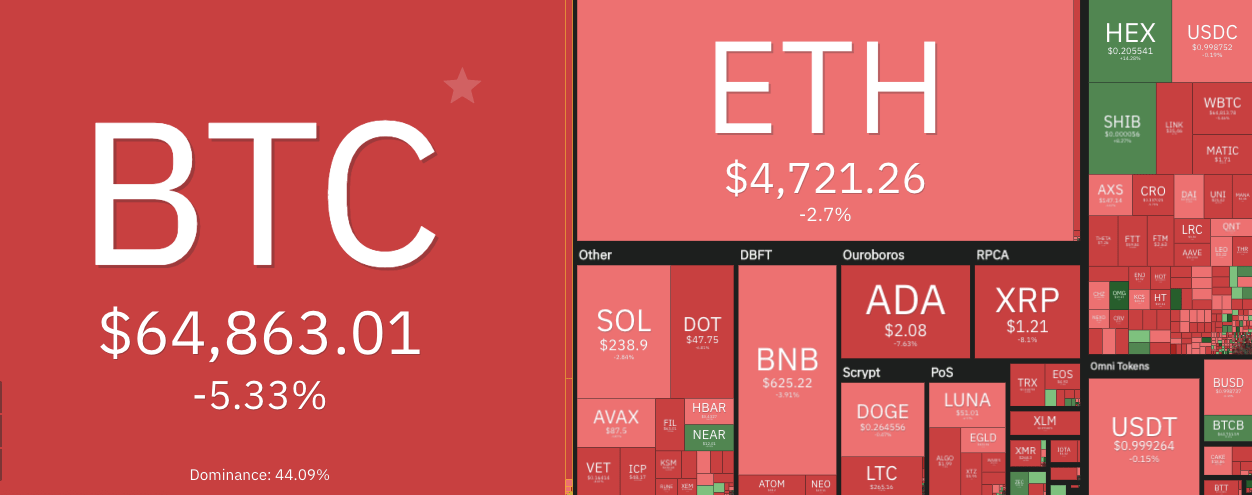

It might be a red-letter day for Bitcoin fans in Miami, but today’s just a red one overall in the crypto market. So far, at least.

At the time of writing, the entire crypto market cap is down about four per cent over the past 24 hours, sitting back under the fabled US$3 trillion mark by about six billion.

Every coin in the top 10 has lost momentum today, with Cardano (ADA), XRP and Polkadot (DOT) all down about five to seven per cent just at the moment.

It’s a similar tale moving down CoinGecko’s top 100 (by market cap) list, although there are a few outliers here and there, including: Kadena (KDA) +12.5%; OMG Network (OMG) +15%; and Mina Protocol (MINA) +36%.

Bitcoin (BTC), meanwhile, the crypto market’s general health barometer, could be in for a bit of a dip if it doesn’t crack the US$66K mark soon and turn it back into support, believes Michaël van de Poppe.

In his latest BTC analysis on YouTube, the Dutch crypto trader and analyst said “$66K is the level we need to break through if we want to see upwards momentum”.

Based on his technical analysis, he inferred he’s inclined to believe Bitcoin might reach somewhere around that level, but then see another corrective move back down to around $62K-63K before Bitcoin needs to “make another decision”. Lose that, and then US$58K is the next major level of support.

Even if we get a further corrective movement and we're not reaching $90K or $100K in the coming 50 days, the cycle still looks bullish.

A lengthening cycle would be a great thing for #Bitcoin.

Stepping away from the 4-year cycles.

— Michaël van de Poppe (@CryptoMichNL) November 11, 2021

The analyst also pointed to the contrarian idea that a corrective period for Bitcoin in the 50Ks for most of the rest of this year is a distinct possibility, as opposed to the “Moonvember” and December “blow-off top” so many have been predicting.

“Everyone is expecting this quarter to be massive,” Van de Poppe said, “but what if we get a corrective period instead, before a quarter one [2022] explosion in the market and top out in Q2.”

Analyst Bitcoin Charts was also looking at a potential BTC breakdown, albeit in the very short term…

$BTC 4H chart#Bitcoin has a higher high in price, with a lower high on the RSI/MACD. This is a bearish divergence, which signals a possible trend reversal down.

Invalidation: Higher high in price and the RSI/MACD.#BTC pic.twitter.com/26gGWMst0s

— Bitcoin Charts (@charts_bitcoin) November 10, 2021

Meanwhile, Dr Jeff Ross of Vailshire Capital Management, a Colorado-based investment adviser service, has a bullish outlook for the remainder of the year, which aligns with much of the sentiment still currently floating about Crypto Twitter.

#Bitcoin technical update: Price consolidation in the mid-range of a strong 8+ year bull channel. RSI rising, but has much further to go before being overheated.

Macro: Bullish

To news: Acting well

On-chain: BullishOpinion: Expected price surge over coming 2-4 months. #HODL pic.twitter.com/2ehrRX7pN6

— Dr. Jeff Ross (@VailshireCap) November 11, 2021

https://twitter.com/naiiveclub/status/1458849969545244672

The US city of Miami, led by its Bitcoin and crypto-touting mayor Francis Suarez, is planning to offer a “Bitcoin yield” to its citizens – earned from the staking of its MiamiCoin cryptocurrency.

Suarez, who spoke to the US crypto news outlet CoinDesk, proudly said: “We’re going to be the first city in America to give a Bitcoin yield as a dividend directly to its residents.”

Wow.

The City of Miami just announced they are going to give a Bitcoin dividend to every citizen that sets up a digital wallet.

“We’re going to be the first city in America to give a bitcoin yield as a dividend directly to its residents." – @FrancisSuarez

This is incredible.

— Pomp 🌪 (@APompliano) November 11, 2021

As reported by Stockhead, MiamiCoin was introduced in August this year and has already earned more than US$21 million in the past three months for the city, which hopes to become America’s premier crypto hub.

Suarez noted during a CoinDesk TV interview that if you were to annualise that revenue, it would equal roughly one-fifth of Miami’s total annual tax revenue of US$400 million.