Fatfish strikes digital gold in crypto mine; sets sights on one bitcoin per day

Tech

Tech

Crypto mining stock Fatfish jumped by a third this morning after it announced the first results from its cryptocurrency “mining” venture in Malaysia.

Fatfish majority-owns a crypto mining venture, APAC Mining, which is now mining two bitcoins and eight Ethereum Ethers every week – worth about $20,916 and $5,216 respectively (at current prices).

Unlike regular money, digital currencies such as bitcoin aren’t issued by a central bank. Instead they’re generated through decentralised computing processes known as “mining”.

Computers collect pending digital currency transactions in a “block” and turn them into a mathematical puzzle for verification. Crypto miners use powerful computers to solve the puzzles, verify blocks and earn cryptocurrency as a reward.

The blocks are then added to a “blockchain” which is a publicly valuable ledger of all a cryptocurrency’s transactions.

Crypto mining is so popular that it has forced up the price of powerful computer chips (much to the frustration of gamers) — and even prompted thieves to steal computers.

FatFish’s (ASX:FFG) cryptomining is operating at 60 per cent capacity after a delay in electrical engineering work.

Full capacity is expected within in the next 30 days.

FatFish forecasts full production to bring in 170 Bitcoins and 690 Ethereum Ethers per year – worth $2.19 million.

“As the operation is still in its early stage it is too early to estimate its gross profit margin at this juncture but APAC Mining estimates that its current operation commands a healthy double digit gross profit margin,” the company said.

Investors were excited about the news. The shares traded up as much as 21 per cent at 4.4c before falling back to 3.9c.

That’s down from a 52-week high of 12.7c in January however.

Once the current batch of mining equipment is fully functional, APAC plans to buy more crypto mining equipment to add to its capacity, and build more server farms.

The miner said its goal is to mine one bitcoin per day in the near future.

“APAC Mining is currently in discussion with various service providers to secure new location and energy supply in Canada and Mongolia, in addition to its existing locations in Malaysia,” it said.

“APAC Mining is confident that the energy tariffs of all the locations it is securing are among the most favourable rates of the crypto mining industry.”

Volatility

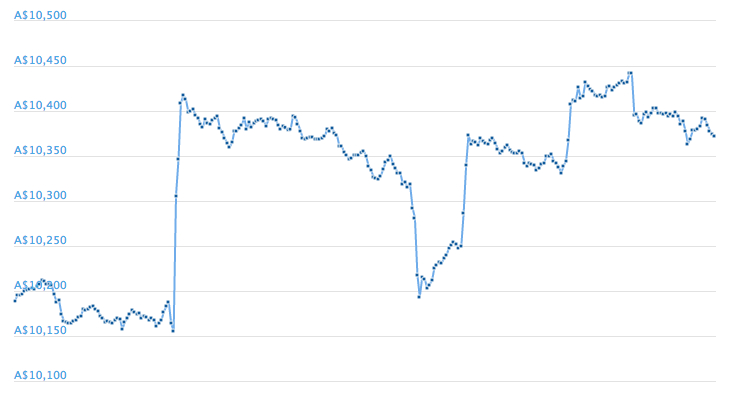

Today’s news comes as the crypto currency took a hit after news New York’s attorney general announced an investigation into major cryptocurrency exchange yesterday.

The bitcoin price fell 2 per cent to $10,155 in a matter of minutes but by Thursday was trading back above $10,400.

Volatility is no worry for the miner – sharing its bullish forecasts for the crypto market:

“It appears that the cryptocurrency market has stabilised and consensus by analysts seem to suggest that cryptocurrency is in a recovery trend,” it said.

“APAC Mining has performed a feasibility study on cryptocurrency prices and found that its crypto mining operation will remain profitable as long as Bitcoin is trading above $US4,000 and Ethereum Ether above $US250.”