Queensland’s new era turns focus to rare earths, silver, gold and energy developers

Mining

Mining

Special Report: A new dawn in Queensland with the election last weekend of the Liberal National Party’s David Crisafulli as premier following nine years of Labor rule will have the mining sector cautiously optimistic about a friendly shift in policy settings.

The Sunshine State is already one of the top mining jurisdictions in Australia and the world, known for its status as the top met coal exporter globally and one of the top gold and copper producing regions in the country.

It’s also a major gas hub with the promise to make a significant dent in the east coast’s looming energy supply shortages, with potential to become a heartland for rare earths, zinc, silver and more.

BHP (ASX:BHP) boss Mike Henry again took a swipe at Queensland at the mega miner’s AGM last week, criticising its attractiveness as an investment destination in comments made to media after the Brisbane investor pow wow.

But that is purely related to a budget patching coal royalty hike only impacting that sector, operating since 2022 and legislated earlier this year by the previous Miles Labor Government.

When it comes to the rest of the mining sector, there is strong cause for optimism that a pro-development government will support new discoveries to come to market as the industry cycle turns bullish.

We combed the quarterly reports of a number of Queensland explorers in the mining, oil and gas fields to look at who could lead the next wave of major mining projects in the State.

Red Metal’s key achievement in the September quarter involved the launch of its maiden inferred resource for the Sybella rare earth elements discovery, a new deposit style near the copper and gold hub of Mt Isa thought to be competitive with other low grade forms of rare earth deposits like ionic clays.

That maiden resource contained 4.8Bt of magnet rare earth oxide mineralisation grading 302ppm neodymium and praseodymium, also known as the light magnet rare earths, and 28ppm dysprosium and terbium, the key heavy magnet rare earths.

Met test work to optimise the processing method for the weathered granite deposit is ongoing, with a share purchase plan recently tripled from $2m to $6m after heavy oversubscriptions that showed the unique pull of RDM’s Sybella in a tough capital market for commodities.

Elsewhere across its portfolio, RDM announced drilling at the Gidyea copper-gold project, funded with the help of a $240,000 collaborative grant from the Queensland Government, with results due this month.

It was also supported via a $150,000 collaborative grant from the Queensland Government for heritage surveying, site preparation and drilling at a standout stratigraphic gravity target at the Lawn Hill zinc-lead-silver and copper-cobalt project, while a successful magneto-telluric trial mapped conductive stratigraphy in early stage work at the Brunette Downs copper-cobalt project in the NT.

RDM spent a healthy $2.77m on exploration and evaluation in the three months to September 30, closing the quarter with $8.88m ahead of its capital raise.

RDM also holds 44% of Maronan Metals-owned silver deposit of the same name.

Its big successes in the three months to September 30 came at the drill bit.

Standout intercepts included 23.32m at 5.0% lead, 175g/t silver (310 g/t Silver Equivalent), including 12.57 metres at 5.5% lead, 277g/t silver (412g/t Silver Equivalent), including again 2.57 metres at 11.1% lead, 702g/t silver (960g/t Silver Equivalent) and including also 0.71 metres at 22.1% lead, 1520g/t silver (2021g/t Silver Equivalent).

There’s more where that came from, building confidence in the Maronan model, with that “bonanza” 1520g/t hit – the highest grade silver found at the project to date – putting more clarity around high grade silver found in the footwall in nearby holes.

Maronan has committed $750,000 to fast tracking permitting and mine development studies, likening the deposit to Broken Hill and Cannington – one of the world’s largest silver mines – just 90km to the south.

MMA spent ~$2.2m on exploration and evaluation with $7.76m in the bank at September 30.

Also demonstrating Queensland’s potential to host stunning rare earths potential, Ark Mines delivered an expanded exploration target for its Sandy Mitchell project of 1.3-1.5Bt at 1250-1490ppm monazite equivalent in the September quarter.

That portends a basket of high value heavy minerals of between 15.6-22.3Mt.

AHK also updated its mineral resource estimate in the quarter, with a measured 71.8Mt at 1732.7ppm MzEq setting the scene for a major future operation.

Monazite is a rock type that contains not only industrial mineral sands used in ceramics and pigment production, but also rare earth metals used in permanent magnets – a modern technology used in EV motors, wind turbines, aviation, defence and more.

Sandy Mitchell’s mineralisation is contained in the first 12m from surface and the resource covers just 4.5% of an interpreted anomaly, with test work showing it can produce a high-grade rare earth concentrate.

A scoping study is being prepped ahead of a proposed pre-feasibility study, giving insight into Sandy Mitchell’s economic potential.

“While the updated MRE exceeded our expectations for both the grade and size of mineralisation, it still forms just a small subset of the broader Exploration Target we announced in July,” AHK exec chair Roger Jackson said.

“Sandy Mitchell is not only a unique Rare Earth and Heavy Mineral gravity beneficiated sand project, but it has the potential for world class scale.”

AHK had $641,000 cash in hand at September 30.

QX has plenty of irons in the fire, extending from lithium brine projects in the USA to iron ore in the Pilbara. But with gold and copper prices on a tear, the explorer’s focus has been sharpening on its Drummond Basin gold assets in Queensland, a domain where 8.5Moz has been found by other miners.

Gold trenching is being planned at Big Red, where previous trenching has returned high grade gold results including 9m at 5.9g/t. QXR believes mineralisation remains open along strike and under cover.

Two gold mines on its grounds shut when bullion was fetching less than $500/oz. It’s now going at over $4000/oz.

Earlier stage copper-gold-molybdenum projects are in QX’s pocket as well.

QXR finished the quarter with $179,000 in cash and $106,000 in liquid investments, but received firm commitments for a $1m placement after the end of the September quarter.

Gas firms in south Queensland were fired up, literally, by news of a well flare from Shell in the Taroom Trough, which brought eyes to the emerging unconventional onshore gas exploration district.

Sitting in the region with a far smaller corporate heft is Omega, which started appraisal of the horizontal well at its Canyon-1H project in the September quarter.

The well drilled to a total distance of 4616m, with 1147m of new well drilled after re-entering a pre-existing Canyon-1 vertical well, with 822m drilled into the Canyon Sandstone when the rig was released on October 28.

The data will be analysed before fracture stimulation is undertaken in Q1 2025.

A 15-year potential commercial area declaration has been made over the 1056km2 area of the ATP2037 and 2038 licences, containing evaluation plans for geological and commercial activities with a total estimated cost of $5.5m.

“The successful drilling of Canyon-1H during September and October has proved that horizontal wells can be drilled into this part of the Taroom Trough and the excellent signs of gas and condensate from the reservoir during drilling bode well for the upcoming frac and flow test due to take place in Q1 2025,” Trevor Brown, named managing director and CEO of OMA during the quarter, said.

“The well has penetrated an attractive reservoir interval that is now available to be tested and enable us to achieve the primary aim of the program, i.e. testing whether the Canyon Sandstone can flow at potentially commercial rates. I am very happy with the results of the Canyon-1H drilling program.

“Our efforts are now firmly focussed on finalising the design and preparations for our fracture stimulation and flowback program. I look forward to a successful test program in Q1 2025 which will be the culmination of a very significant appraisal program aimed at opening up a large, new producing basin in Eastern Australia.”

OMA has $14.43m in the bank.

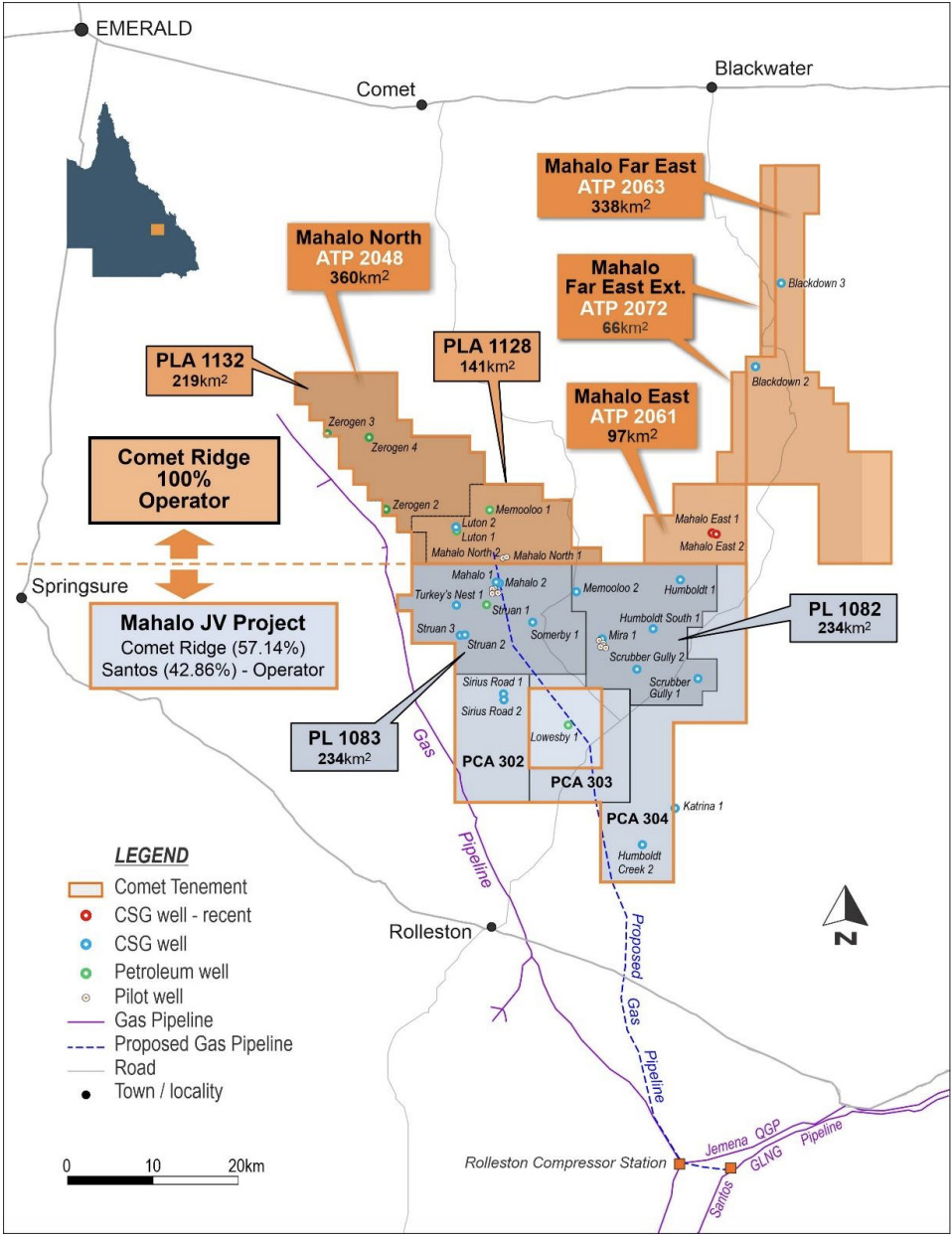

COI is nearing JV investment committee approval for its Mahalo gas hub with senior JV partner Santos, while it also progresses to FEED with Jemena on a connection to the Queensland Gas Pipeline and uses a $5m grant from the Queensland Government to primarily fund pilot work at its Mahalo East project.

There is a vertical well which hit 7.2m of net coal with better than modelled permeability was successfully completed in October.

A lateral well began in late October, intercepting the vertical well and drilling through the target Aries coal seam.

At the same time, permitting and environmental approvals for Mahalo North are progressing, while a dataroom process is ongoing for shopping project equity and development funding.

“The early indications from the recently drilled Mahalo East 1 vertical well are very encouraging and provide additional development confidence for the Mahalo Gas Hub,” MD Tor McCaul said.

Comet Ridge currently owns 57.14% of the Mahalo JV, where McCaul said an internal assurance review had recommended progressing to front-end engineering and design.

Also reporting its quarterly on Thursday was Queensland shale oil and vanadium proponent QEM.

Located at Julia Creek, inland of Townsville, QEM boasts a resource containing 6.3MMbbl of 1C oil resource, with the 2C resources recently increased 32% to 94MMbbl, and 2.87Bt of ore at 0.31% vanadium pentoxide in inferred resources, along with an indicated 461Mt at 0.28% V2O5.

A scoping study in the September quarter put a $791m capex bill on the project, which would take five years to pay back at a post-tax NPV8 of $1.1bn and IRR of 16.3%.

But it would produce 10,571t V2O5 and 313 million litres of fuel for 30 years at US$5.80/lb V2O5 and $0.59/L.

Test work, drilling and the potential classification of the project as a Coordinated Project due to its significance to the region, State and Commonwealth are on the horizon, with the latter declaration expected in Q4 2024 or Q1 2025.

At Stockhead we tell it like it is. While Red Metal, Maronan Metals, Ark Mines, QX Resources, Omega Oil & Gas, QEM and Comet Ridge are Stockhead advertisers, they did not sponsor this article.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.