There’s now US$5 trillion worth of Indian stocks you don’t own

News

News

Wall Street is not alone.

Over a fabulous, fun-filled 72 hours, the value of India’s stock market has passed $5 trillion by a fair few rupee – a milestone it hit on Friday and soared beyond on Tuesday, after a Monday market holiday.

To the delight of Delhi, overnight Tuesday both the NSE Nifty 50 and the broader S&P BSE Sensex added 0.4% to finish at record closing highs for a third straight session.

Indian technology firms and the financial sector led the buying after a fresh commitment to policy continuity from the just cobbled together coalition of Prime Minister Narendra Modi.

But the trajectory of the world’s fastest-growing major economy is not a recent development although it is being supercharged at an equity level by intensifying domestic inflows and the encouragement of global equities, led by Wall Street.

India’s benchmark NSE Nifty50 Index is headed for an unprecedented ninth-straight year of gains.

Now Delhi has joined New York, Shanghai, Tokyo and Hong Kong after topping the $5trn threshold last week, according to the calculations of Bloomberg.

But the shares of smaller and mid-sized Indian companies have also been attracting attention, and have in fact outperformed their larger capped brethren in the last few years, lifting their total share of India’s market valuation to about 40% or US$2trn.

The two blue-chip indexes hit all-time highs in the latest session – as did the Nifty100 small-cap index and the mid-cap index which ended Tuesday with gains of 1.1% and 0.50%, respectively.

The market was closed on Monday for a public holiday.

The latest all time highs come despite the International Monetary Fund (IMF) reporting that almost 30% – or 1 in every 3 dollars of global investments – end in the United States.

Before the arrival of COVID-19, the US only sucked up 18% of global investors’ money. In just a few years that’s almost doubled.

Good for Wall Street, bad for everyone else.

Everyone? Not quite.

Terrible for China. Painful for Emerging Markets in general, who are always in need of direct foreign investment.

But no problem apparently for India.

China used to get about 7% of the global pool of investment, the IMF says, but that’s more than halved since the pandemic and is now down to just 3%.

China is on the nose, as the latest round of sanctions against Chinese tech companies out of the the US and Europe have again underlined.

Yet, even though the country’s stock market has bounced from off its jumpy January lows, foreign investment flows have reversed, reflecting its numerous economic uncertainties and the ongoing worries about its property market and associated geopolitical risk.

That’s where India comes in, offering a stable, emerging alternative under a third term for Modi, making it a leading target for foreign investment, especially if interest rates begin to fall in the States.

India is young, educated, and starting to deliver across services, manufacturing, and consumption.

It has snapped past China as the most populous nation in the world.

And as China’s population ages, India boasts the world’s largest youth population, with 65% of people below 35 years old.

Importantly, this young population is far more educated than previous generations, with the youth literacy rate at roughly 90%.

This year, India should produce the most university graduates in the world, as well as the third largest group of scientists and technicians in the world.

Recently, multiple financial institutions have revised their GDP forecasts for India.

The International Monetary Fund increased its GDP forecast by 30 basis points to 6.8 per cent, citing the strength in domestic demand and an increase in the working-age population.

Astonishingly, it took India just five and a half months to grow the final US$1trn of companiy caps listed on its exchanges.

India’s stock market is now the fourth-largest worldwide as measured by the total value of listed companies. The Nifty 50 and BSE Sensex indexes are both more than 20% higher over the last 12 months.

The country’s economy is also on the up.

It’s expected to grow 7.6% in the 2024 financial year, with IMF executive director Krishnamurthy Subramanian describing it as “easily” the fastest-growing economy in the world.

Since India’s ruling Bharatiya Janata Party (BJP) secured the paper thin support from quasi-allies to knock up a working ruling coalition, (ensuring PM Narendra Modi’s return to power for a third straight term), local markets have been finding their feet. and then giving the new legs a run.

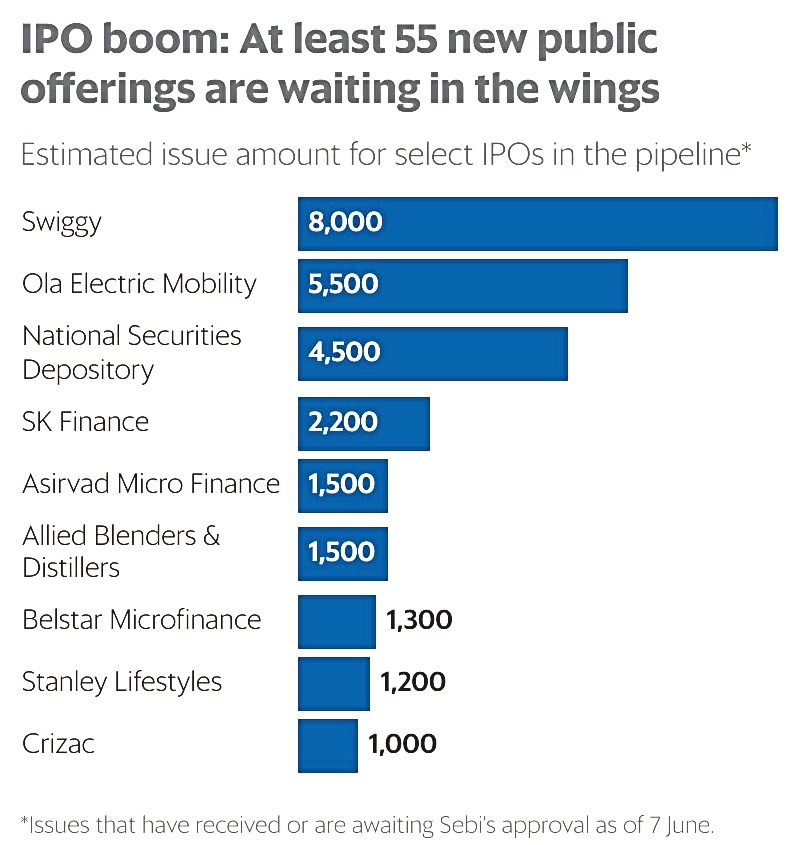

Perhaps this is best exemplified in the envious state of India’s IPO universe heading into the end of the financial year.

The Indian IPO market is expected to remain resilient despite the volatility and uncertainty of the election outcome.

In the upcoming months, 55 companies are planning to go public, raising over ₹68,000 crore.

Then there’s the headline Hyundai India IPO.

The South Korean carmaker reportedly filed a draft prospectus with the Securities and Exchange Board of India (SEBI) late last week, with Hyundai India looking to raise between US$2.5 to $3bn.

That’d place Hyundai’s Indian operations – its third largest source of revenue after the US and South Korean markets – somewhere between $22bn and $28bn.

Depending on how they go, the Hyundai IPO could be India’s biggest ever, eclipsing the $2.7bn IPO of the Life Insurance Corporation of India in July 2022.

After an initial moment of angst at Modi’s less-than-expected majority, his electoral victory, India’s resilient economic growth and the recent S&P Global Ratings upgrade of India’s outlook have made Indian equities the centre of a perfect storm of attraction.

The return of Modi has added further elan to the Indian market momentum, according to Goldman Sachs, where the message is Modi’s middle order remains stable – with most key ministers retaining their portfolios, which “broadly affirms policy continuity.”

“The main benefit to the market of the NDA’s re-election is policy predictability, which will influence how growth and equity returns pan out in the coming five years. We believe the government is likely to continue focusing on macro stability (i.e., inflation hawkishness) to inform policy,” Goldman says.

“With government continuity now in place, we believe the market can look forward to further structural reforms, giving us more confidence in the earnings cycle. Macro stability with rising GDP growth relative to real rates should extend India’s outperformance over emerging markets (EM) equities.”

S&P revised India’s GDP upwards to 6.8% for 2024-25, with headline CPI decelerating to about 4.5% for the year. Inflation currently is at 4.75%.

The rating agency says companies will perform better with earnings growth forecast through 2025-26, which remains 500 basis points higher than consensus.

“Our 12-month forward BSE Sensex target is 82,000, implying 14% upside.”

Unfortunately, there’s not many individual companies that offer significant exposure to India, making it difficult to invest in India from Australia, according to Stockd Down Under analyst and friend of the show, Nick Sundich.

Nick reckons the best way to invest in India on the ASX is via ETFs which have a focus on the subcontinent.

“And there’s not that many – for those who do not know, an ETF is an Exchange Traded Fund – you can buy them just like ordinary shares in an individual company, but instead of owning one company you own a portfolio of companies.

“One ASX ETF enabling ASX investors to invest in India is the BetaShares India Quality ETF (ASX:IIND). It purports to select the 30 highest-quality Indian companies based on a combined ranking of several factors such as existing profitability and earnings outlook.

“Another is the Global X India Nifty 50 ETF (ASX:NDIA) that tracks the Nifty 50 index, the key indices of the Indian stock exchange (ISE).”

And Malcolm Dorson, senior PM and head of Emerging Markets strategy from the Global X New York offices is bullish.

“In our view, India is the best structural growth opportunity in emerging markets (EMs), if not the world,” Malcolm says.

“As China’s growth ebbs and investors look for alternative growth markets, India has ‘a generational opportunity’ to become the new global growth engine.

“We believe India’s gross domestic product (GDP) can grow above 6%… for years to come.

“All up, the combination of the world’s largest general and youth populations, which provides a demographic dividend, coupled with a market friendly and democratically elected government, creates a powerful backdrop for stock selection and potential outperformance,” Dorson adds.

Global X India Nifty 50 ETF (ASX:NDIA)

Top Holdings As of 18 Jun 2024