FREE WHELAN: Improvised democracy vs reruns of monetary policy

Experts

Experts

In this Stockhead series, investment manager James Whelan, managing director Barclay Pearce Capital Asset Management, offers his insights on the key investment themes and trends in domestic and global markets. From macro musings to the metaverse and everything in between, Whelan offers his distilled thoughts on the hot topic of the day, week, month or year, from the point of view of a professional money manager.

Morning all.

Another absolutely wonderful weekend just gone and if you get the perfect run of Tigers winning at Leichardt, Swans winning in Adelaide and Port losing anywhere then you’re on the right footing for another great week closer to EOFY.

Thanks to our friend and League legend Jonathan Thurston for stopping in last week to talk a little shop and provide insight into resilience and work ethic.

Here we are, not holding a football which I forgot to bring with me that day.

We improvised.

Now, back to work…

It’s RBA week and as usual we only every look to the view of head of Aussie Economics at the CBA, Gareth Aird, for the prediction. (His note is not only publicly available but recommended reading if you want to stay in the loop of what’s happening in Australian economics. He’s a man of the people.)

The meeting will be a straight “no change” but August is live. Of note was discussion around the $300 energy rebate and how inflationary that would be.

I quote here:

“On that score, the Governor does not consider the rebates to have shifted the outlook for consumer demand or inflation. Indeed the Governor stated, “If you think about the $300, or the $75 a quarter, off your electricity bill, are people going to go out and spend big on that? I really don’t think so. It is different than giving someone $300 and saying, ‘Here’s $300.’ I think, at the margin, it’s not really going to have much impact in the second‑round sense …….. I think psychologically, they (i.e. people) think of that differently.”

Have to also agree here.

$300 straight in my pocket will probably get spent on something inflationary (remember Covid) but $75 a quarter is probably going to the right place.

FYI the CBA team see the rebates as shaving two-thirds of a percentage point off Q3 2024 CPI. That’s handy for the disinflation yarn.

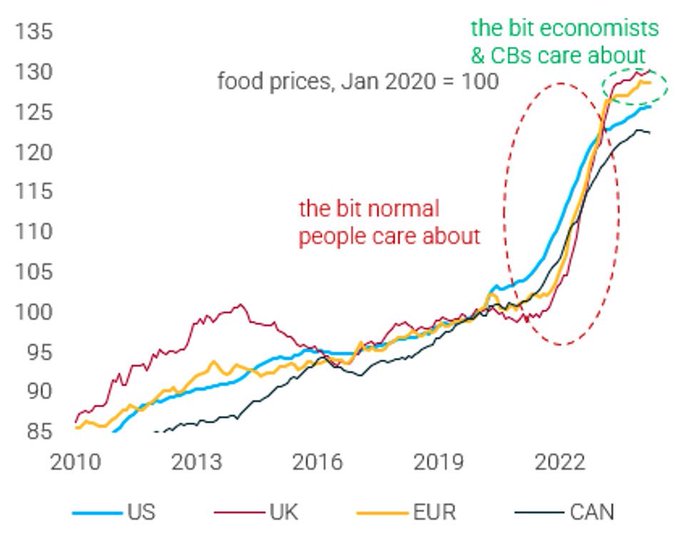

And just a reminder of what the inflation story is all about by using a graph from some of the larger economies in the world:

Food prices, common base to 2020. Courtesy GlobalData. TS Lombard.

Sometimes you need to remember what’s actually happened.

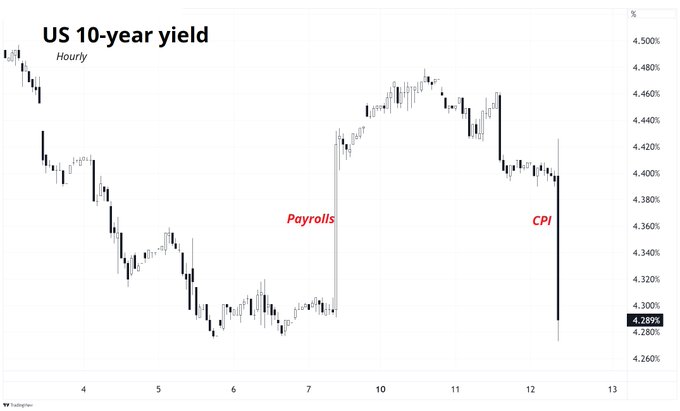

And what happens if you worry about each data point. Payrolls and CPI out in the US recently and took yields on a ride:

Segue time: This guy explains it perfectly what happens if you measure inflation using wider data points.

🇬🇧🚨‼️ When the government says they have lowered inflation to 2% that’s what they mean.

That’s a scam … pic.twitter.com/jhfd2yLEEC

— Lord Bebo (@MyLordBebo) June 8, 2024

Including the UK, (don’t be that guy) and it’s an absolute debacle.

The comedy act of UK politics keeps me entertained at the best of times and my running joke “David Cameron has a lot to answer for” stays true to its satiric anchor.

Rishi Sunak is ill-equipped for the “sleeves up, modern age man” look of UK politics and every scene in which he tries to relate to people is laughable.

All of these things are connected: he left a D-Day Ceremony early (a sin) so he could get back to England for a PRE-RECORDED interview, an interview in which he apologised for being late and that the Ceremony “ran over”, then in the interview he said he came from humble beginnings and used not having Sky TV as an example of that.

Where do they find these people?

We have a Labour victory well factored in, please reach out for ideas off the back of it.

France, oh my.

How it started… this was the result of the recent European Election divided up by department. The national Front (National Rally or NR) won pretty much every department. This is like Trump winning everything except DC.

Macron called an early election. “Le Snap”, if you will.

Plenty out there think that’s opening the door for the National Front to sweep it. (“He’s daring voters to do it.”)

I believe they’re wrong. I’ve done some radio spots with Louis-Vincent Gave (runs a very sharp macro research house called Gavekal) and he’s always been 1000x ahead of me (which is a low bar at the best of times but still…)

His views are here and I back this take all the way. Macron is bleeding the small parties out financially.

However, the chances of French default have gone way up, as evidenced by the cost to insure against it. (The higher your insurance premium, the higher the calculated chance of disaster. Build a house in a flood zone, for example, and find out how much you pay for flood insurance if you can.)

There’s a chance Macron doesn’t do as badly out of this as some yell about. The French voting system is funny anyway with the two rounds of voting.

I’ll have some ideas ready to go this week for those in the space.

UK is July 4th, France is July 7th for results.

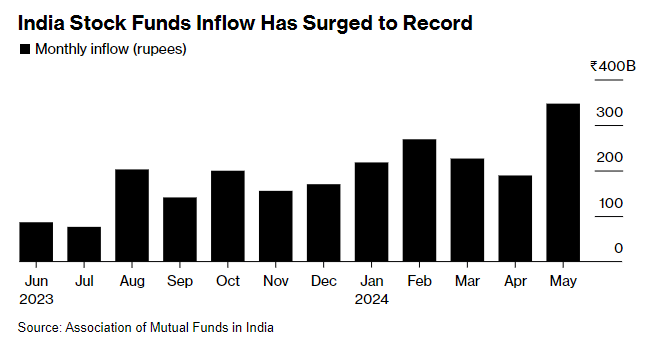

Beware these headlines because it’s talking about dollar values on a well-rallied market. Of course the dollar numbers are going to get bigger.

However, a well-rallied market, supported by a small handful of names that’s gasping at fresh highs on thin volume doesn’t fill me with a great deal of confidence.

New money is not being pushed in at the same rate as recently and I’ll be monitoring for a change to that view.

India is resolved, get involved(er). Elections done (finally) and we’re back to business. Best way to get access is via NDIA, Global X’s Nifty 50 ETF.

Buy on even the most moderate of dips.

Stay safe and all the best,

James

The views, information, or opinions expressed in the interview in this article are solely those of the writer and do not represent the views of Stockhead.

Stockhead has not provided, endorsed or otherwise assumed responsibility for any financial product advice contained in this article.