Omega’s Canyon-1H stuns with strong oil flow in addition to gas

Omega was pleasantly surprised by the strong oil flows at its Canyon-1H well. Pic: Getty Images.

- Omega Oil & Gas records strong flow rates of oil and gas from its Canyon-1H horizontal well

- Result indicates the Canyon project hosts material oil and gas plays that can produce at commercial rates

- Peak production of 452bpd of light oil and 600,000scfd of gas achieved during flow testing

Special Report: In a surprising twist, Omega Oil & Gas has recorded strong flows of oil in addition to gas from its Canyon-1H horizontal well in Queensland’s Taroom Trough rather than the expected gas with associated petroleum liquids.

The well flowed at a peak rate of 452 barrels of light 49.5 degrees API oil and 600,000 standard cubic feet of gas per day from a 650m horizontal section in the target Canyon Sandstone reservoir.

Negligible levels of carbon dioxide and other impurities were noted.

Omega Oil & Gas (ASX:OMA) said this translated to a 24-hour sustained rate of 987bpd of oil and 1.45 million standard cubic feet per day (MMscfd) of gas from a 2000m lateral. This equated to a gas equivalent flow rate of >7.3MMscfd or an oil equivalent rate of 1228bpd.

Importantly, it demonstrates that the company’s Canyon project area hosts a material oil play in addition to a material gas play that can produce at commercial rates.

The strong well performance also draws parallels to top-tier unconventional US shale basins.

Gas flare while testing Canyon-1H. Pic: Omega Oil & Gas

Oil upside

“I’m delighted to announce the outstanding results of Omega’s successful flow test of our Canyon-1H well. While we were anticipating commercial flow rates of a large-scale gas play, we have discovered an additional large-scale oil play,” managing director Trevor Brown said.

“The primary objective of the program has now been achieved by demonstrating what we believe will be commercial hydrocarbon flow rates from our attractive acreage area.

“Producing oil from this well test provides huge upside to our pre-drill position. Omega’s Canyon project now has two very attractive commercialisation pathways to be further appraised.

“To obtain such strong flow rates from a relatively short horizontal indicates that our development wells will be strong producers.”

He added that the successful application of horizontal drilling and fracture simulation provided an important, high-quality data set indicating the Canyon project contained an extremely exciting play of significant scale poised to play a large role in Australia’s energy future.

In an investor webinar Brown said that while the company always knew Canyon-1H would be liquids-rich, it just did not imagine that it would be such good quality liquids and reservoir conditions at the depths it was dealing with.

“We are in fact seeing really good responses from the reservoir flowing liquid oil at reservoir conditions, at good rates … and that is an indicator to the geoscientists that this is a really big workable system with big volumes,” he added.

Brown also noted that the company was not dropping the gas by simply adding the oil.

Chief technology officer of well testing advisor Revo Testing Technologies, Darryl Tompkins, said the results were very encouraging as the bottom hole pressures, production rates and decline trends indicated a strong correlation to what was typically encountered within the more prolific unconventional liquids-rich basins in the US.

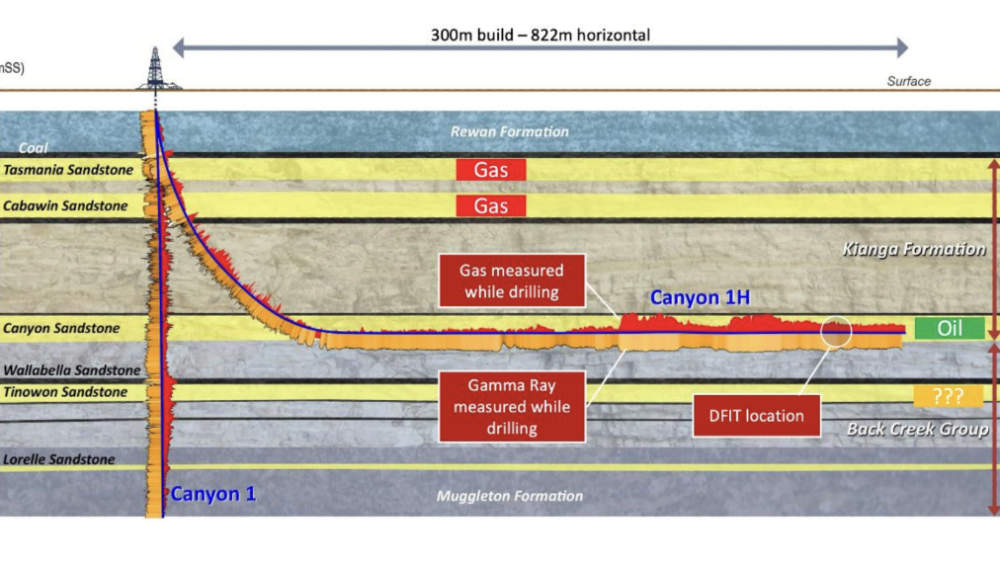

Canyon-1H well diagram. Pic: Omega Oil & Gas

Canyon-1H well diagram. Pic: Omega Oil & Gas

Production testing

Following a successful fracture stimulation program encompassing nine stages over a 650m horizontal section, the flow test started with clean-up flow son March 13, 2025, and concluded when the well was shut in on March 23, 2025.

The liquid-rich nature of the hydrocarbon fluids and favourable reservoir conditions allowed the company to model long-term well performance over a shorter test period than originally planned.

Stable sustained flow rates of 321bpd of oil and 0.472MMscfd of gas were recorded with a wellhead pressure of ~1339 psi.

Future development wells will be drilled to lateral lengths of 2000m or greater with a completion optimised for the fluid system.

Canyon-1H is currently shut-in with OMA noting that wellhead pressure is building up rapidly, which provides further evidence of favourable reservoir conditions.

Next steps

OMA is now working through the data and will develop a detailed plan on the next steps for the project over the coming weeks.

This will focus on further delineation and derisking of the resource and may include further scaled-up horizontal test wells in H2 2025.

The company may also put Canyon-1H on an extended production test.

Analysis is underway to verify liquids commerciality over next few months while a resource booking is expected in H2 2025.

Discussions are underway with interested oil and gas parties on development pathways including ongoing partnering discussions.

In the investor webinar, Brown added that Canyon-1H well was optimised for the production of gas and not for liquids.

“There are now many avenues that we can use, both in terms of the design of the well, the completion and frac design that will optimise for the oil that we now have,” he said.

“That’s another way in which we will be able to improve the rates from each of the wells.”

Brown also flagged the potential to reduce development costs over time much like they had in the US.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.

Related Topics

UNLOCK INSIGHTS

Discover the untold stories of emerging ASX stocks.

Daily news and expert analysis, it's free to subscribe.

By proceeding, you confirm you understand that we handle personal information in accordance with our Privacy Policy.