Each Monday, Stockhead’s resident day trader gives us a peek at the highs and lows of his trading diary and hints at what might be coming this week.

Platform used: Marketech

Round Trip: A round trip is $10 up to $25,000 and then above $25,000, commission is at 0.02% in and at 0.02% out.

Rules of engagement: Never hold any positions overnight (unless forced) and try to avoid any suspensions (if possible). No shorting.

Monday April 4

Rain has stopped and sun is out. Market opens up with a bit of a roar. CBA finally stops doing its 11.00am thing but it comes in a bit later.

I had someone ask me over the weekend if I looked at all the technical information on the charts.

They had paid over $7,000 to do a course to learn about FX trading and had this software package and after a year of losing money, they had given up.

When I was explaining to them how I do it on the ASX majors, I had my phone on me.

It dawned on me that the screen chart view I get on my phone is so much better than the same one viewed on a computer screen.

So, I took some screenshots of what I saw today and I can’t recommend enough of ditching the computer view for a mobile phone view.

Imagine the freedom you now have!

For the person I was showing, they unfortunately have had their mind bent on whatever they learned from their $7,000 course, whereas I say, it’s better to learn and lose the seven grand than pay someone, who if they were any good, would just do it themselves.

So, when you see this actual screenshot, would you be a buyer or a seller?

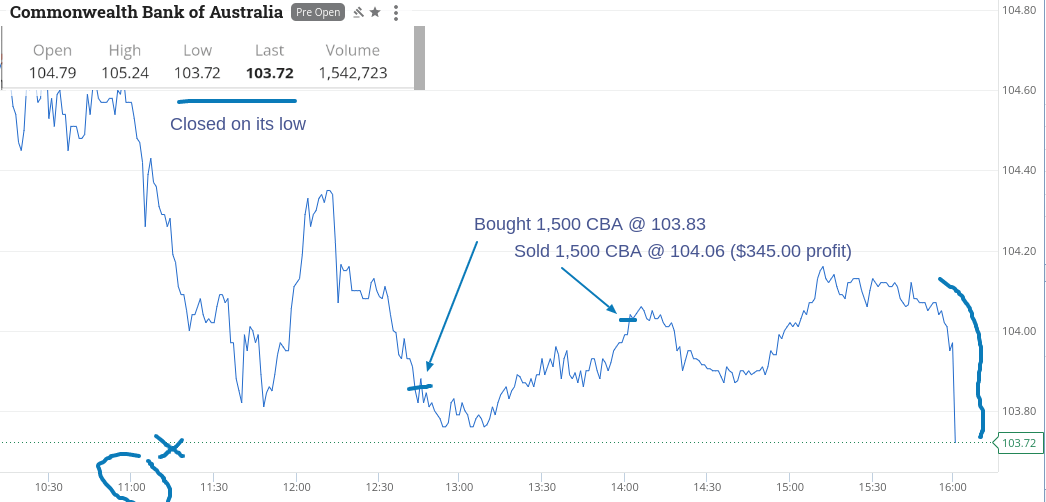

And when you see this screen shot would you be a buyer or a seller?

The answers to the questions look pretty obvious to me.

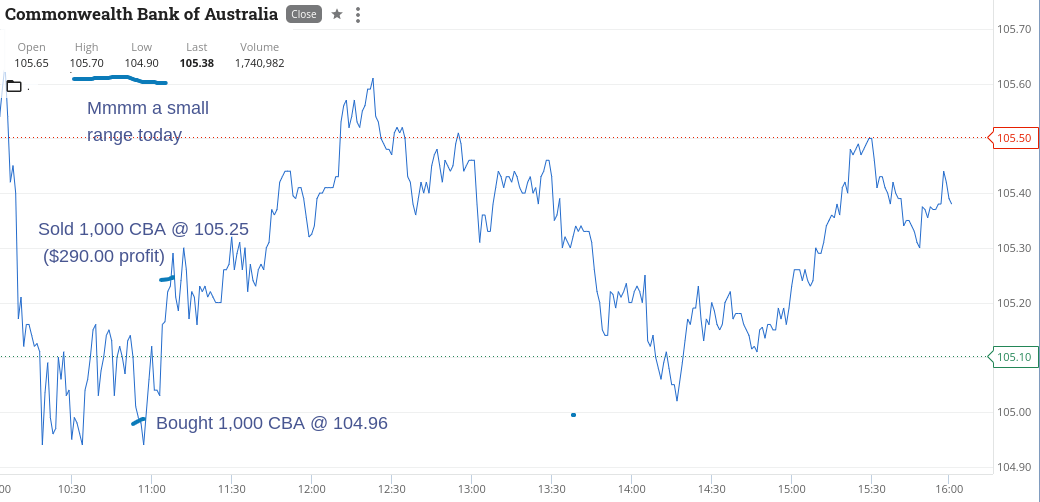

Why a major stock like CBA shows so much volatility I don’t know or really care.

The only support levels seem to be (when day-trading) the round numbers of $107, $106, $105, $104, $103 etc.

Anyway, I thought I should share this bit of information. Remember, size is not important.

It’s the winning that counts and preserving your capital to battle another day.

Up $345 on one CBA trade.

Recap:

Bought 1,500 CBA @ 103.83

Sold 1,500 CBA @ 104.06 ($345.00 profit)

Tuesday 5th April

Had one of those days today and missed the 11.00am special in CBA, so hope some of you didn’t get caught up like I did with some domestic chores.

So, was thinking that I will have to explain why I had a doughnut day and then low and behold, they fell to below $104.00 but by the time I fumbled around I had to pay $104.00.

Happy to take a quick turn, just to book something on the trade sheet.

Up $240 for the day, which was totally unexpected after my 11.00am miss.

Recap:

Bought 1,500 CBA @ 104.00

Sold 1,500 CBA @ 104.16 ($240.00 profit)

Wednesday 6th April

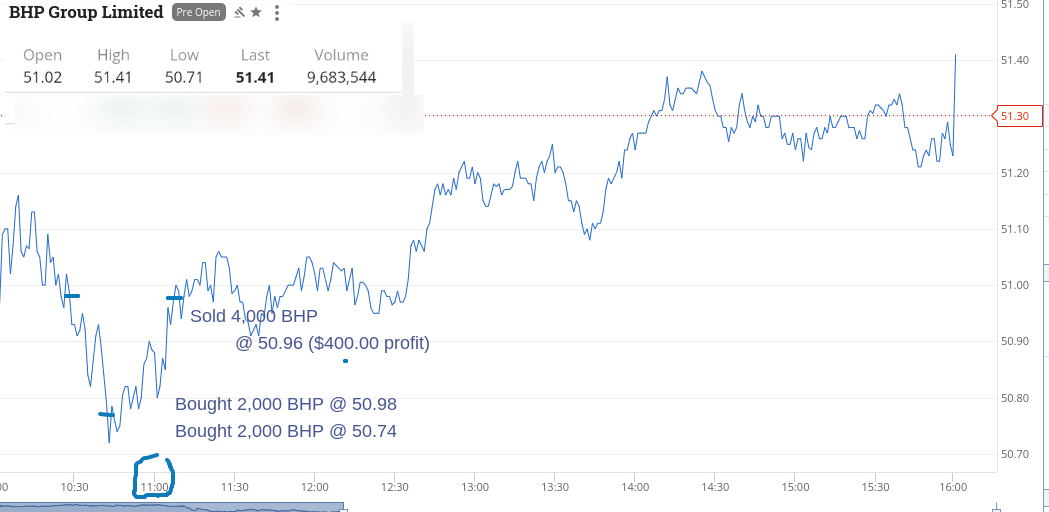

Different day today to yesterday. At 10.30am, my watch list was a sea of red. I figured most of the general market news on wars, bonds, Wall Street closing levels was already built in so, started to have a look around.

BHP, having been nudging $53.00 recently was hovering around $51.00, so decided to have a crack. Had to double down before 11.00am in them.

Rio was $120.00 recently and trading below $118.00 this morning, so also picked some up and put them on a sell limit of $117.95, just in case they tried to crack the $118.00 level.

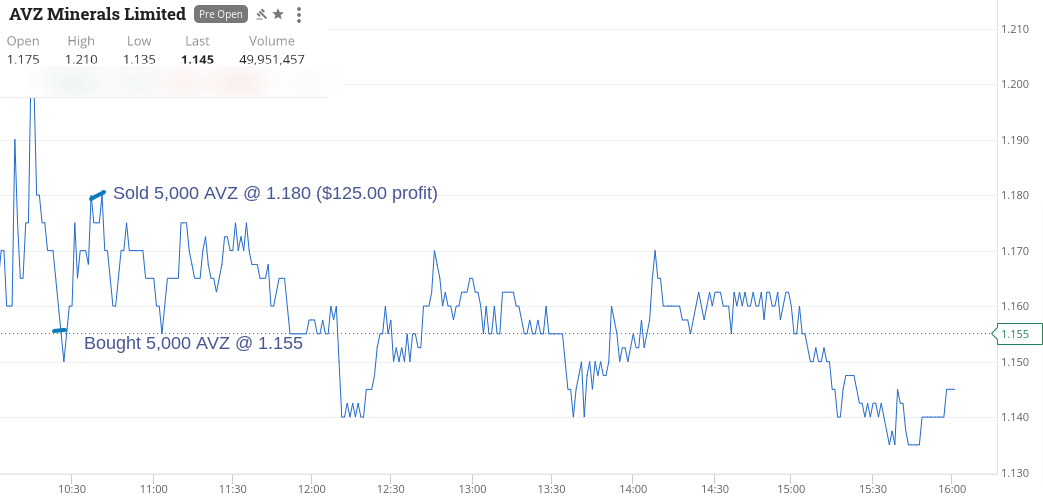

AVZ selling seemed a bit overdone to me having been in the $1.30’s earlier this week. Had a very quick and small turn on 5,000.

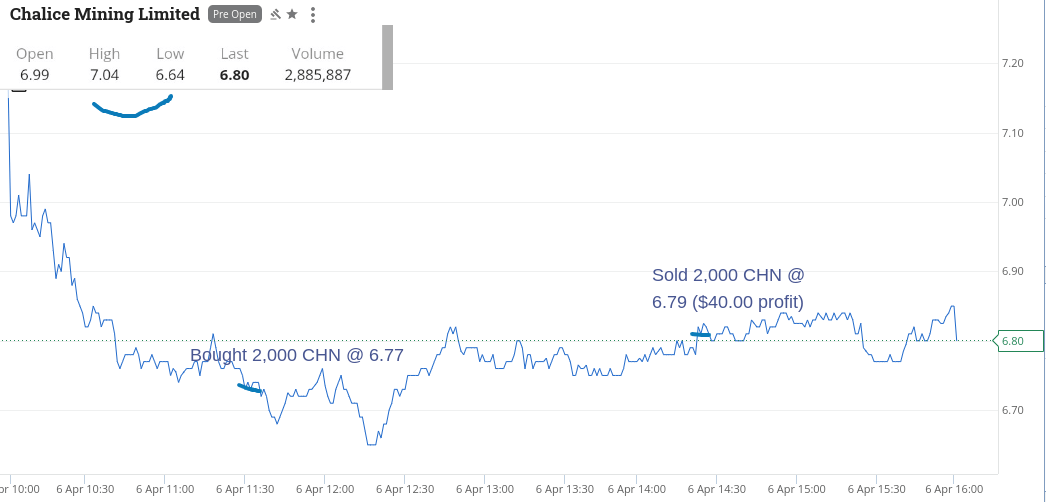

Then CHN were down 50c from previous trading levels and thought they may go back above $7.00, which they didn’t, so ended up just getting out above breakeven.

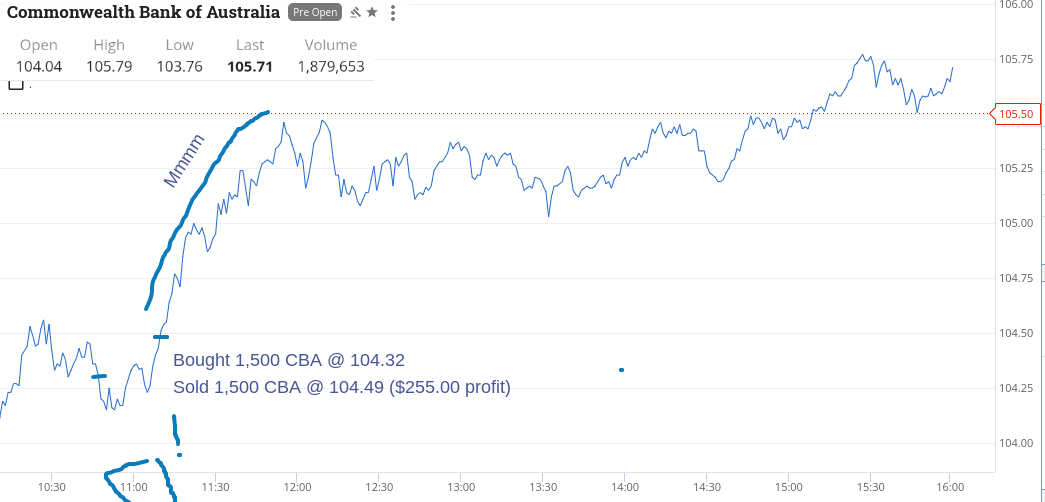

So, didn’t miss the CBA special today but did leave a tad more on the table, as they soared through $105.00 and kept going.

More than made up for yesterday’s weak effort at up $1,070 and rather excited to have achieved that!

Recap:

Bought 2,000 BHP @ 50.98

Bought 1,000 RIO @ 117.70

Bought 5,000 AVZ @ 1.155

Sold 5,000 AVZ @ 1.180 ($125.00 profit)

Bought 2,000 BHP @ 50.74

Bought 2,000 CHN @ 6.77

Bought 1,500 CBA @ 104.32

Sold 1,000 RIO @ 117.95 ($250.00 profit)

Sold 4,000 BHP @ 50.96 ($400.00 profit)

Sold 1,500 CBA @ 104.49 ($255.00 profit)

Sold 2,000 CHN @ 6.79 ($40.00 profit)

Thursday 7th April

Could only find one today and that was in Rio’s who had a bit of a swing around the $119.00 level.

Got in just before 11.00am and after being down $300 odd was happy to lock in a profit.

Of course they went higher before closing below the $119 level.

Up $250 and happy I got that locked in, as I was ready for a loss today!

Recap:

Bought 1,000 RIO @ 118.98

Sold 1,000 RIO @ 119.23 ($250 profit)

Friday 8th April

The stars lined up in CBA today. Not only did they crack $105.00 on the way down, but they also did it just before 11.00am. Really should have upped the size a bit but having hindsight is a great thing!

So, still nervous of getting caught out in real time and next week maybe the week.

Everything had short day ranges today, which I put down to being a Friday plus school holidays.

Plus $290 today and $2,200 gross or $1,801 net and ready for the weekend off, ahead of Monday’s opening.

Recap:

Bought 1,000 CBA @ 104.96

Sold 1,000 CBA @ 105.25 ($290.00 profit)