Page 3 Guy: Even the most Vulcan-like investor would cry over the disappearing AMZN

Experts

Experts

In this less brand new corker of a Stockhead series, The Strawman himself, Andrew Page shares his insight, ideas and annoying (albeit excellent) idiosyncracies worth a gander at in your local or global market.

A top equities analyst, fantastic dresser and decent market commentator, Pagey is the founder and managing director of Strawman.com. I think he’s actually pretty dreamy:

Amazon (NASDAQ:AMZN) will be hacking away at a few more jobs again at some point in early 2023.

That’s the latest from CEO Andy Jassy, putting out the word of warning in a Thursday missive to staff last week.

It comes after AMZN publicly confirmed layoffs, the day before, when Jassy spoke of more “role reductions as leaders continue to make adjustments.”

Last month, the site Christian likes to buy stuff from – Amazon.com – put up a pretty unmistakably white flag that costs kinda might eviscerate its quarterly profit guidance. Sales are down. Labour, supply and delivery expenses are up.

The e-commerce hero’s bleak forecast applies to this very frenzy from Halloween, Thanksgiving, the various black and blue Friday and Monday’s… and into Christmas.

On May 31st, 1999, Barron’s published a story predicting the demise of Amazon.

Shares were trading around $3 at the time.

Of course, had you bought shares then you would have since generated a 3112% return.

Put another, way you’d have $1 million for every $30k invested.

Hindsight is, of course, 20-20.

At the time, the ultimate success of Amazon wasn’t so obvious — after all, it was bleeding cash and would report a $720 million net loss in 1999.

But get this: even if you possessed foresight beyond that of most mortals, and loaded up at $3 per share, you would have seen your investment lose 90% in the following two years…

Out of interest and after enjoying some truly phenomenal growth during the pandemic, Amazon has, like its once indomitable namesake, begun to burn at the edges.

All-seeing CEO Jeff Bezos has struggled to smother costs as inflation and rising interest rates have sent all kinds of the wrong smoke signals to investors.

The company has slowed the rollout of new facilities, leased out some warehouse space and enacted a hiring freeze in parts of its business.

On Friday 28th October, after the company put out a gentle profit warning on the very retail season we’re now entering, the share price collapsed circa 20%.

Even the most Vulcan-like investor would have had a hard time not breaking down into a quivering, gibbering mess after such a brutal, drawn-out and occasionally calamitous drawdown.

And thus, as the quivering giberrer Prince Of Denmark correctly points out – ay, there’s the rub. (Or simply to say yep, this is the cause of problem – the rash.)

So, even for the very best stocks, blood-curdling drops and prostate-clenching reversals are par for the course we’ve chosen.

Intellectually, financially …definitely emotionally and most absolutely psychologically.

Even when you’re right, you’re never totally right or always right.

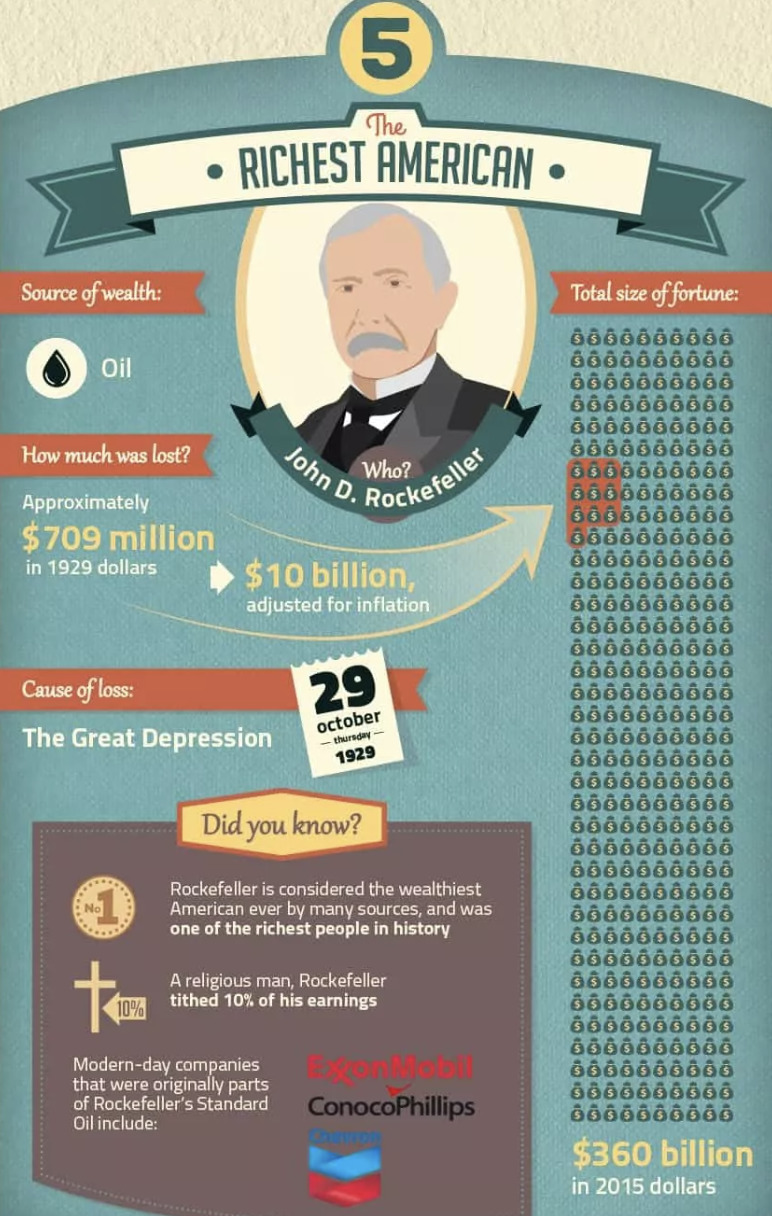

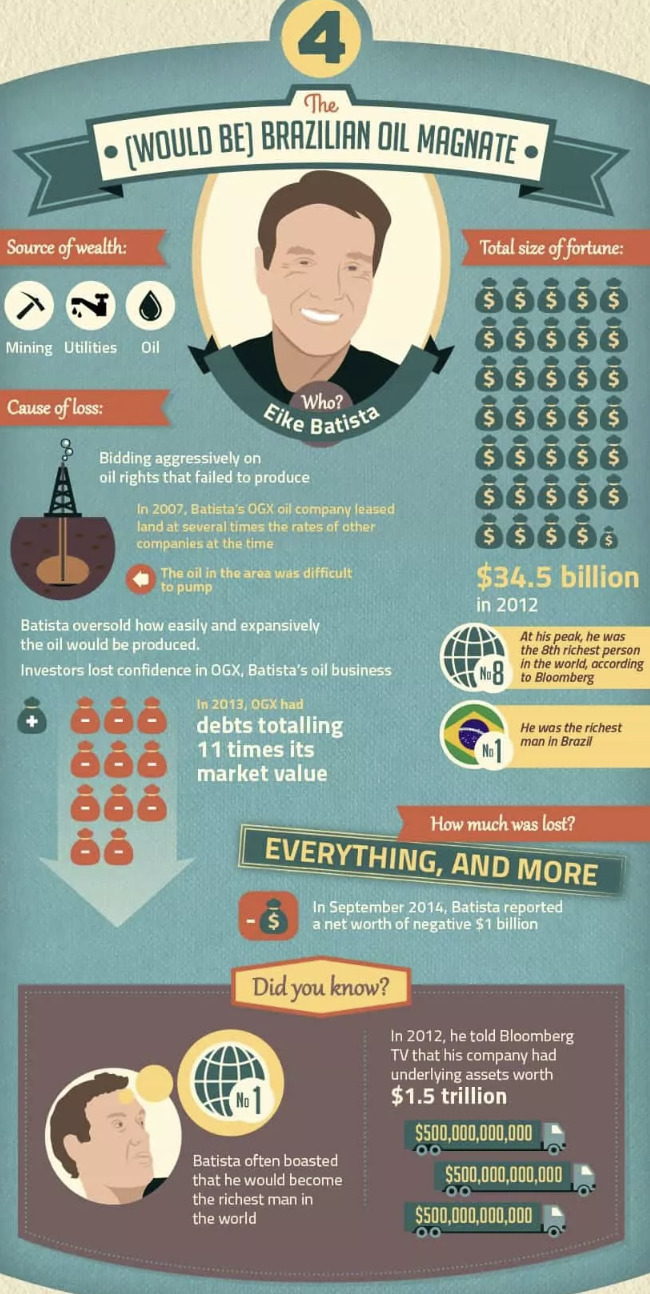

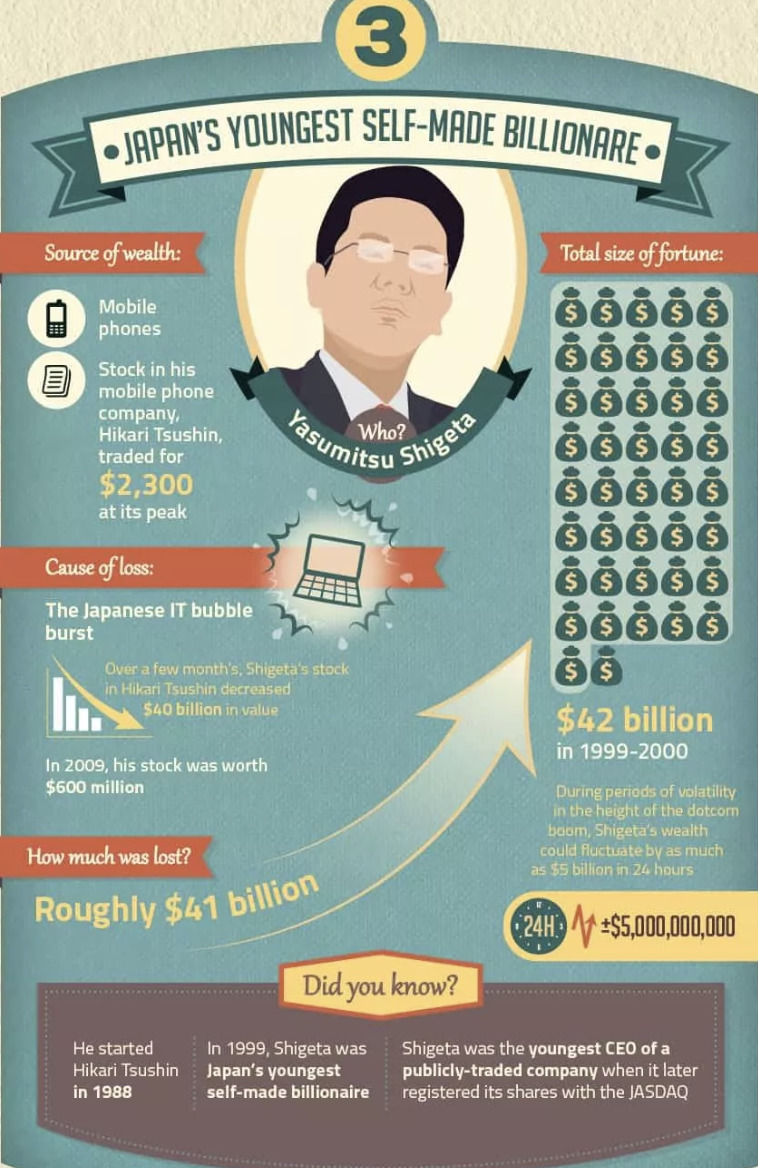

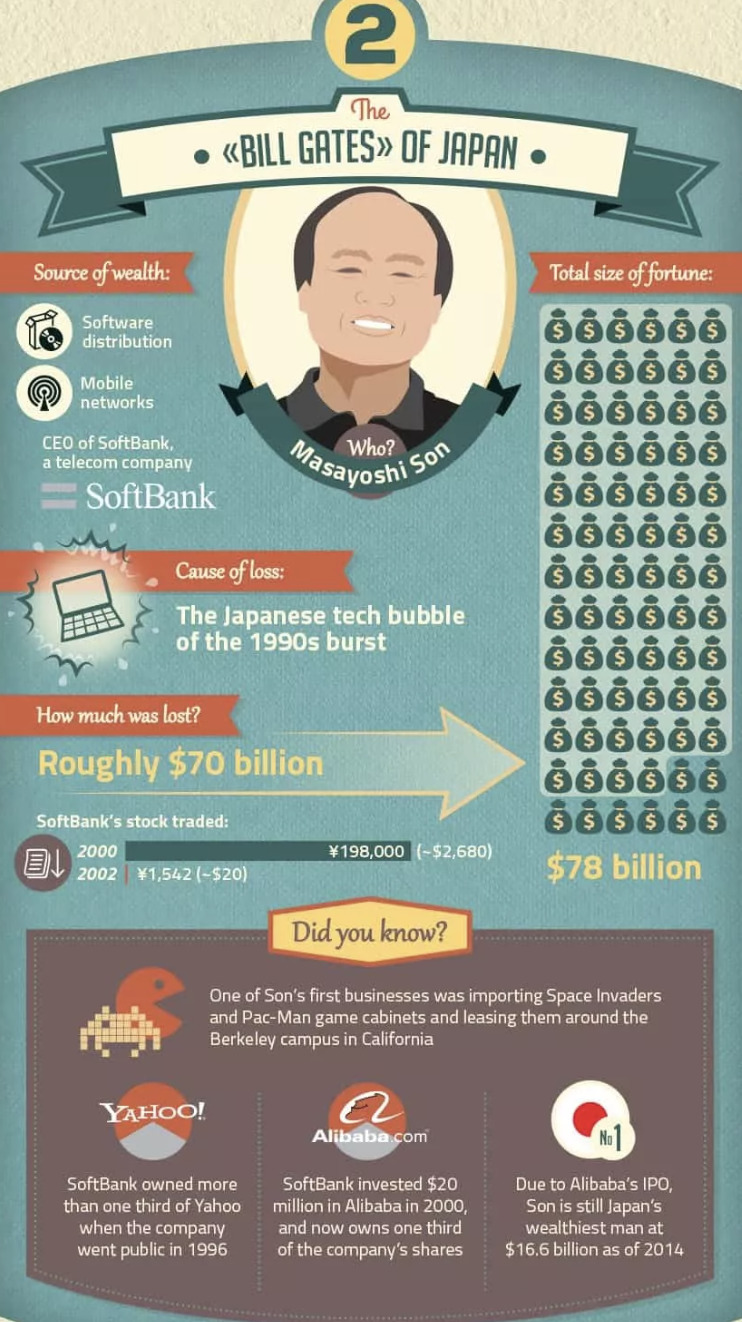

I’m not above walking the world’s greatest savant entrepreneurs – Yatsumistsu Shigeta, Elon Musk, SBF and Nathan Tinkler et al – through their greatest missteps, so lemme just say that thinking they couldn’t greatly misstep pretty much covers it I think.

Not hubris, per se. Just the confidence which comes of getting a few things right.

A lot is happening in these fab drawings (below) made by the quite fascinating forum commodity.com.

There’s a few identifiable patterns worth noting, even in this “Top 5 Greatest Personal Losses”:

…beyond the rise and fall of value – one’s likely to look the right idiot for much of the time. It’s one of the many qualities which initially caught the eye of my stunning, scientifically minded Straw-woman. Sure there’ll be no shortage of people – or factions of your own heart – which will be happy to dunk on your “mistakes”.

It was the way I ignored those too, which won over Mrs Strawman. (Ach, but that’s another story.)

Take it instead from a man who knew what it was like to be on the spot and under its light.

I particularly admire:

It is not the critic who counts; nor the one who points out how the strong person stumbled, or where the doer of a deed could have done better.

The credit belongs to the person who is actually in the arena; whose face is marred by dust and sweat and blood who strives valiantly; who errs and comes short again and again, because there is no effort without error and shortcoming; who does actually strive to do deeds; who knows the great enthusiasms, the great devotion, spends oneself in a worthy cause; who at the best knows in the end the triumph of high achievement; and who at worst, if he or she fails, at least fails while daring greatly.

Far better it is to dare mighty things, to win glorious triumphs even though checkered by failure, than to rank with those timid spirits who neither enjoy nor suffer much because they live in the gray twilight that knows neither victory nor defeat.

Safe exploring, brave exploring and happy exploring!

Andrew ‘Husband of the Straw-Woman’ Page

The views, information, or opinions expressed in the interviews in this article are solely those of the interviewees and do not represent the views of Stockhead. Stockhead does not provide, endorse or otherwise assume responsibility for any financial product advice contained in this article.