The Secret Broker: You cannot be Sirius

The Secret Broker

The Secret Broker

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

Whilst everyone in Australia was fighting over toilet paper, another fight was going on in England — a drama so tense someone described it as ‘Coronation Street meets Ramsey Street at a funeral’.

I have written about Sirius Minerals PLC before and how some Australians had been running amok on the Yorkshire Dales digging a couple of 1.5km deep holes, after observing close at hand how Andrew did things his way at Fortescue Mining and giving it a go themselves.

Well, on Tuesday in London, there was a shareholders meeting so tense that news reporters were on hand to live stream observations on a meeting that went on behind closed doors, for 3 ½ hours.

Emotions were running extremely high and no virus was going to stop the agitated shareholders from donning a cloth cap and venting their anger at two former Australian war heroes (financial war heroes, that is), whose only previous sight of blood was when eating a medium rare Filetto Di Manzo at Machiavelli’s.

These two heroes had persuaded 85,000 shareholders to come on a journey with them and share in the profits that could be generated by mining fertiliser, all whilst employing 2,000 local Yorkshire bred lads and lassies. After getting support from the locals and jumping through all the local government hoops, they went off and raised U$2bn in hole digging funding, via a mixture of equity and bonds.

Well, the meeting this week was to vote on a takeover of their company by Anglo American PLC and whether they should accept the 5.5p per share offer. Most shareholders had paid 25p per share and tensions were running so high, that an action group was set up, to reject the bid and to find an alternative white knight. A local Yorkshire policeman who had invested £50,000 (A$96,000) for 200,000 shares said he would rather see it go to zero than accept £11,000 (A$19,000) from Anglo American PLC.

That is what happens when you become too emotionally invested into a company, instead of just standing back and analysing it as just another investment and that’s how 85,000 fired up, pissed off shareholders, came to be. They had thought they were shareholders arm-in-arm with their directors, but now felt let down.

A protest group even raised a dummy bond prospectus and received pledges of £46m from existing retail investors, to show the directors that maybe they should have tried an alternative solution.

Even Gina was approached, as she had earlier written out a cheque for $US200m for a 4 per cent overriding royalty and agreed to take some of the dug up muck for her South Korean sized back yard, all 9.9 million+ hectares of it. It was politely pointed out that she would get her royalty, who ever produced it, so thank you, but no thanks.

Then Rupert’s ex son in law Crispin Odey joined in and built up a 1.7 per cent stake through his hedge fund. Crispin was married to Rupert’s oldest daughter for 15 months. I’m not too sure how Rupert and his daughter get on, but rumour has it he offered her next husband a job at News Ltd behind her back. So much for family loyalty. Crispin is now punting on another bidder arriving.

In the end, shareholders did in fact vote the deal through thus saving a shareholder lemming type linking of arms walk into the sea by said emotional policeman and his fellow shareholders.

Australian Chris Fraser, the man who helped Andrew raise billions of dollars for Fortescue via the bond market, summed up the whole debacle by saying in the meeting that ‘the delivery of this project from an idea to what it has become today is “probably the greatest success of my career”, while the missed financing was “the biggest failure”.

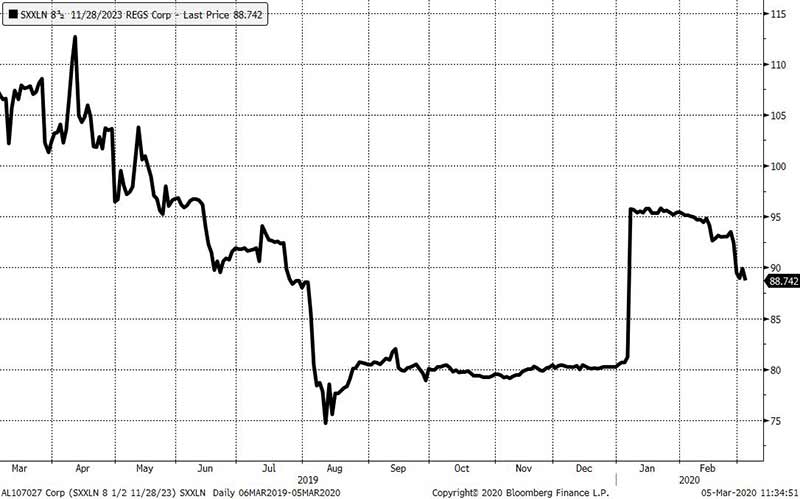

Now, the moral to this investment story is that, even though a low ball optimistic offer by the Australian ran Anglo American PLC was voted through, bond holders were cracking open the champagne and celebrating in style. For them, the vote meant that all their U$400m 8.5% 2023 Convertible Bonds could be cashed out at par.

If you see the graph, you will see what a U$300m value gain looks like and why it pays to research debt before investing.

There is now a rumour going around social media that an Australian company has been approaching crying Sirius shareholders with an offer to turn their share certificates into toilet paper and export it to Australia but, as for me, I have been up in the loft looking for my stash of Venezuelan bank notes to relieve any domestic issues, that empty Woolies shelves may bring.

At least being a Venezuelan Bolivar millionaire has its bright side and now having shared this gem with you all, I can see you all queuing up outside foreign exchange booths and changing your dollars for crap valued paper.

My stash is pre Coronavirus!

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.