The Secret Broker: Too much speculating can make a grown man cry!

The Secret Broker

The Secret Broker

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

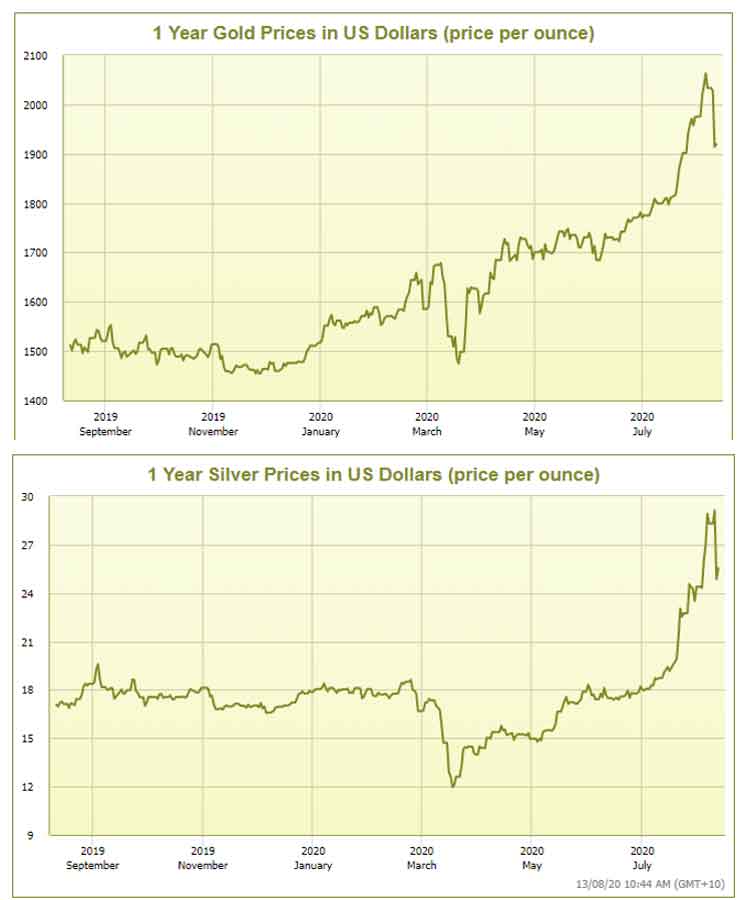

This week we saw the gold price fluctuate more than a spotty faced teenager’s Bitcoin holding, which is a bit worrying to some of us grey-haired punters.

I mean, gold is meant to be this steady rock of glittering stability which comes out every 10 years or so and gets rolled into your portfolio, when there is a bit of turmoil showing in the financial world.

You get the feeling that the traders who have been controlling the Bitcoin price for the past five years, have found that the same tactics can be used to manipulate the gold price.

Silver, which always seems to be an innocent bystander, has finally started to stir itself and behave in sync with its traditional ratio of value, when compared to gold.

Traditionally silver has always been seen as the poor relation, though as the gold price has been moving forever higher, the percentage gains have been decreasing when compared with the increasing silver price and its gains.

As I like playing the percentage game, I have always kept an eye on the gold to silver ratio and as a rule of thumb, if it moves above 80, its time to sell gold and switch into silver.

A ratio of 80 means that if you sell 1 ounce of gold, you can purchase 80 ounces of silver with the proceeds.

The higher the ratio, the more silver you can buy.

Exactly a year ago, you could sell 1 ounce of gold for $US1516 ($2122) and purchase 89.5 ounces of silver at $US16.963 a pop.

If you had done this and held on until their recent highs, your 89.5 bits of silver would have been worth $US2,606 at $US29.174 an ounce compared to gold’s recent high of $US2,033.

When gold hit the recent high of $US2033, the ratio was at 70.

I find this as something simple to follow and I used to always quickly calculate these things out on the back of a drink coaster. Though due to COVID, Mrs Broker has banned me from going to the boozer, so an envelope had to be used for this article.

The reason that I have always had a soft spot for silver is because of an American oil billionaire from Dallas, called Bunker Hunt.

In 1979, he tried to corner the silver market, using billions of dollars that his family inherited from his father’s oil fortune. It eventually sent him bankrupt, as his manipulation drove the price of silver so high that everyone started to melt down the family silverware, thus flooding the market.

Here is a classic look at him and his actions from the time. The TV show Dallas was based on his family and even though he doesn’t look like J.R., he half looks like Kerry Packer.

In fact, the resemblance to once Australia’s richest man is uncanny.

Now manipulation of futures markets is not a new thing, and before Bunker Hunt tried his hand at becoming the richest man in the world, there was a manipulation on the Chicago futures exchange.

It was so devious in its planning and caused so much financial devastation, that the US government to this day has banned allowing this item to ever be traded in a futures contract.

The item in question is the humble onion. That’s right. An onion.

Gerald Ford, who would later become the 40th President, introduced and passed ‘The Onion Futures Act’ of 1958.

This Act basically banned onions as ever being allowed to trade again as a futures commodity, after two canny traders managed to wreak havoc by cornering the onion market in 1955.

They accumulated such a large position, that at one point they controlled 14,000 tonnes, or 98 per cent of the onion market (future contracts), in warehouses in Chicago.

In those days, there were futures contracts in perishable goods — like onions, eggs and potatoes — and these were the precursor to today’s trading in orange juice, soybean and pork belly futures.

In true manipulation style, these two traders pushed up the price with their accumulation tactics, from 10c per 23-kilo bag to $US2.70 a bag, and then they went in for the real kill.

They turned around, sold their longs and started to buy short contracts.

This was their master stroke, because as we all know onions can go off, and even though they had to constantly adjust the warehouse temperatures, they could not stop them from starting to become mouldy.

To counter this, they had hundreds of tonnes moved out at night to be ‘refreshed’ and then returned in daylight as ‘new’ deliveries.

Seeing all these ‘new’ deliveries lined up outside the warehouses caused the price to start dropping. The two traders then persuaded onion farmers to buy back their onions to hold up the price, because if they did they would not flood the market with any remaining stock.

So, the farmers brought back their own stock from them but the price continued to fall as more trucks arrived in daylight, and eventually fell all the way back down to 10c a (23-kilo) bag.

In fact, the price fell so much that the bags to hold the onions in cost more than the onions themselves!

The two traders made millions of dollars, however the outcry from the public was such, what with farmers going bankrupt and the manipulation causing an onion shortage in other states, that the Onions Future Act was implemented as a way of reassuring the nation that this situation could never happen again.

To this day, academics have studied the effect of banning a futures market on a certain commodity and the consensus is that the onion price is more volatile today, than when there was a contract.

Now, my tip this week is intended to help market speculators from crying uncontrollably when ending up in the wrong situation, and that is to always wet your knife before cutting into an onion.

This small act will trap their sting on your knife and not in your eye, thus saving you from tearing up and having to reassure the missus that everything is ‘fine, just fine’ in the trading account.

Bon Appetit!

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.