The Secret Broker: Time to check out the cheque!

The Secret Broker

The Secret Broker

After 35 years of stockbroking for some of the biggest houses and investors in Australia and the UK, the Secret Broker is regaling Stockhead readers with his colourful war stories — from the trading floor to the dealer’s desk.

I was admiring the mother-in-law’s shoes the other day and she told me that it wasn’t the fact that they were comfortable to wear or easy to slip on that impressed her the most.

It was the fact that she was able to order them out of a magazine and pay for them with a cheque.

Now, I haven’t written out a cheque for well over 20 years, but listening to her talk brought back a flood of memories of when I would use them and what you could do with them.

Her grandkids look in horror when they open up their birthday card and out falls this weird piece of paper with Nanna’s ‘running writing’ scrawled all over it. “What do I do with this?” they would ask with a grimace of pain in their face.

The fact that it is worth the latest hipster pair of jeans is completely lost on them, and the inconvenience of having to take this little piece of paper into their branch and then wait three days for it to appear in their app is like a “gross waste of my time”.

So we would all suffer from what is meant to be a moment of joy, though after a few years of complaining and explaining the cheque has been replaced with a crisp $50 note, which is promptly taken on a bus ride to the local shopping centre and proudly shown off to a waiting gang of admirers.

Now, giving the mother in law her due, she has never had a financial transaction end up in the wrong account and has never used her banks internet platform to transfer money.

Everything is done at the branch, with precise instructions containing the correct BSB number and account details and with the knowledge that no Nigerian scammer is ever going to buy a herd of goats at her expense.

My tip to anyone who is using the internet to make transactions and if you have to do the occasional large life changing transfer, is to always send a small test amount (like $1.19) and then phone up the person you are dealing with and make sure that they have received your test amount.

It is too easy these days to be caught out by scammers, and the fall out of being scammed involves a lot of finger pointing and that whole sinking feeling in the stomach and I have gotta tell you, this tip will save many a relationship or marriage.

As I said earlier, all these fond memories came back to me when I heard the word ‘cheque’.

When we were the young lads about town, we had all sorts of tricks which we would use to juggle our finances around till pay day, having either spent it on fast women, gambled it away at the casino or lost it in an ego driven bet.

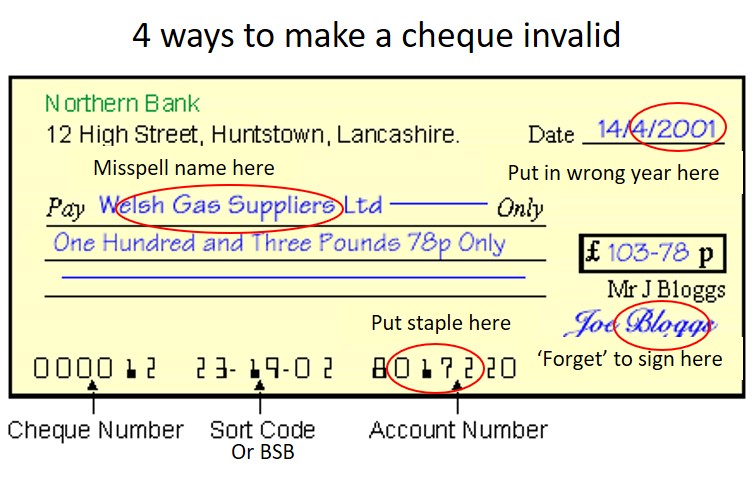

The first one, when being hassled on the phone by our gas or electric provider for a payment, was to tell them that the ‘cheque was in the post’ and when they phoned you a week later, you would tell them that ‘it must have been lost in the post’.

The next trick was to send the cheque to them unsigned and wait for the bank to contact you and ask you to come in and sign it. This normally bought you an extra month before being cut off.

My mate Simon Tomlinson once got a traffic infringement fine and decided to fight it in court and lost his case.

The judge doubled his fine for wasting his time and out of anger, when he sent in his cheque with his covering letter, he stapled straight through the electronic numbers at the bottom.

This meant that it showed up as being paid in their ledger but it could never be electronically settled by their bank.

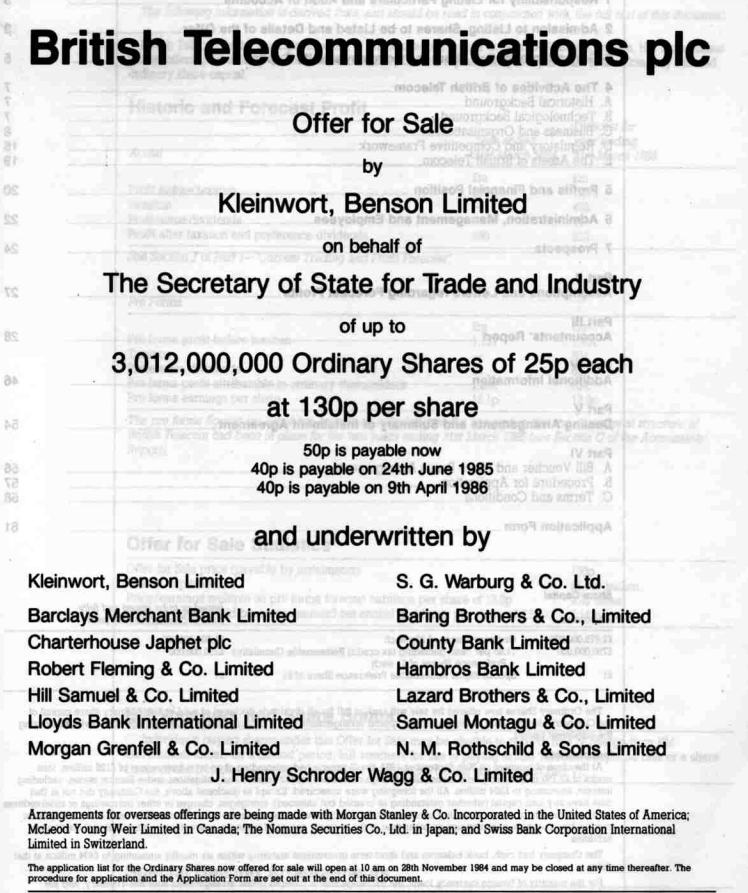

When Maggie Thatcher decided to list government owned companies — like British Telecom (raised over $5bn but prospectus only 64 pages – those were the days!), Jaguar (yes they owned it and floated it off and Robert Holmes a Court once made a bid for it before Ford out bid him), Amersham International (this was as good as CSL over here), British Petroleum, British Gas, Cable and Wireless (they started Optus), British Steel and even British Airways — at the time you were allowed to stag them and it was legally acceptable to put in multiple applications.

In true Maggie style, she wanted everyone to apply and make ‘vote winning money’. So instead of printing millions of prospectuses, single page application forms were printed in the FT and the Daily Telegraph.

My father at that time, had a £10,000 ($17,961) overdraft at Lloyd’s Bank and when a cracker of a company was being privatised, like British Telecom (think Telstra over here), we would jump in the car at 7am on the day that the application form was in the Telegraph (it was cheaper than the FT) and visit every local newsagent and buy all of their copies, under the pretence that a family member’s picture was in it.

After we had amassed 40 papers, we would head home and go through the task of cutting out 40 application forms. We would have a production line going, with Mum filling in the various names and address on the applications and Dad writing out 40 cheques for £800 each, payable to ‘BT offer’.

Each cheque had to be physically pinned to the application form in a nominated corner place, or it would be rejected.

In those 1984 days, if a share issue was oversubscribed, they would pull you out of the hat and cash your cheque, however if you weren’t lucky enough to be pulled out you would be sent back your original application with your cheque still pinned to it.

These days they take all your money and send out a refund but we were able to game the system and write out more cheques for more than what was in the bank.

As a family, we made enough money to buy a nice car from our kitchen table stagging operations. Though these days, this avenue of money-making fun has been well and truly closed, as we have moved to a world of instant debit and credits.

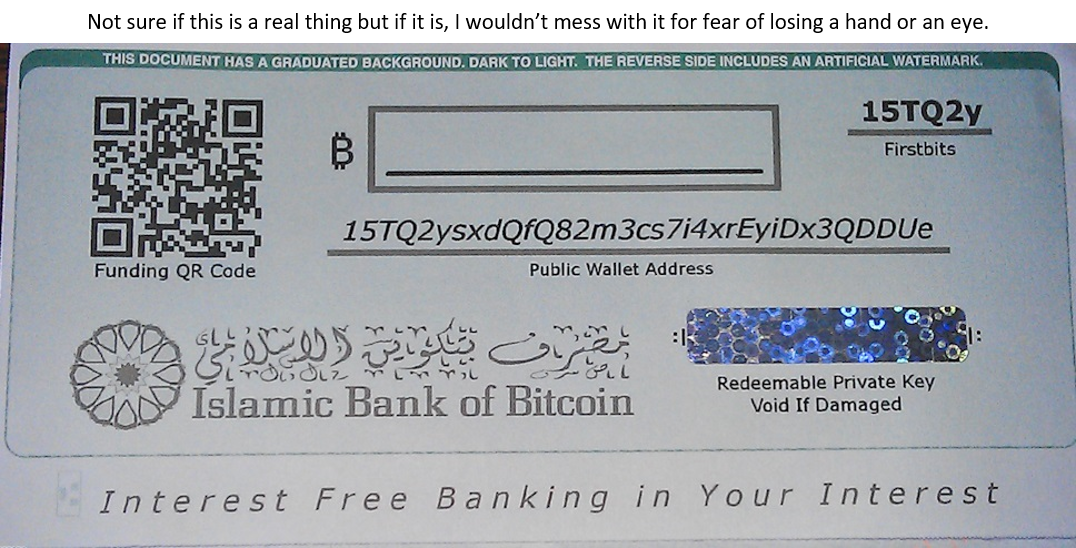

I shudder when an over 70 year old asks me to explain to them ‘this Bitcoin thing’ and how it works, as they still use cheques and passbooks and anything that is electronic and not able to be physically touched or held, they have a technology blind spot with.

I think it’s going to take the passing of their generation before the cheque book is finally buried and high street banks become a thing of the past, as every fintech is now chasing them down and they have the ‘unbanked’ as their secret weapon.

The Holy Grail of the new generation of fintechs are all the people in the world that don’t have bank accounts. It is estimated that there are 4 billion of them and by using cryptocurrencies and mobile phone apps, a bank can now be sidestepped from being the fee-taking middleman.

They reckon that by Christmas, the Chinese government will have a version of its official currency on the blockchain and Facebook will have their own blockchain coin available to WhatsApp and Messenger users, thus starting another war of words over each other’s domination.

Currently four out of five transactions carried out in China are all electronic and as it is estimated that there are 34 million Chinese living overseas, it will only take them plus a couple of African countries starting to use it as their official currency, to get the ball rolling and begin to crack the current US dollar world domination.

Maybe, if someone could have come up with a Bitcoin cheque book, it would have been easier to explain to the oldies how it all works. But hey, that could have got me back into my old tricks of stretching out bill payments, much to the annoyance of you know who!

The Secret Broker can be found on Twitter here @SecretBrokerAU or on email at [email protected].

Feel free to contact him with your best stock tips and ideas.