The Secret Broker: The times, they are a changing

The Secret Broker

The Secret Broker

The older you get, the more time you have to look back at things through nostalgic eyes, and this week I saw lots of news that brought back loads of nostalgic memories.

The first major one was that Australia had managed to export more than it imported, for the first time since 1975.

That meant that any Australian aged 46 years and under had never seen this happen in their lifetime and probably don’t really care, even though it means their country produced its first profit since the day they were born and old photos of has-been prime ministers started to appear.

Unlike countries like Japan, where they export manufactured goods, Australia’s surplus came from exporting coal and iron ore and normally this would be a sign of letting the good times roll.

But unfortunately, the iron ore price has fallen 30 per cent this month so, just like the Rick Astley song ‘Never Gonna Give You Up’, it looks like a one hit wonder, which also explains why the Aussie dollar is not a lot stronger than 67.3 US cents.

Keating’s famous line about Australia becoming a Banana Republic still rings true.

Though I saw in the news this week that Coffs Harbour, the proud owner of the Big Banana, now produces more blueberries than bananas and was left wondering how long it will be before they remove their highway symbol of global domination and replace it with a giant blueberry.

By the time that this happens Keating will be droning on about the chic and hip-hop AfterPay Blueberry and Smashed Avocado on Toast Republic economy that we just had to have!

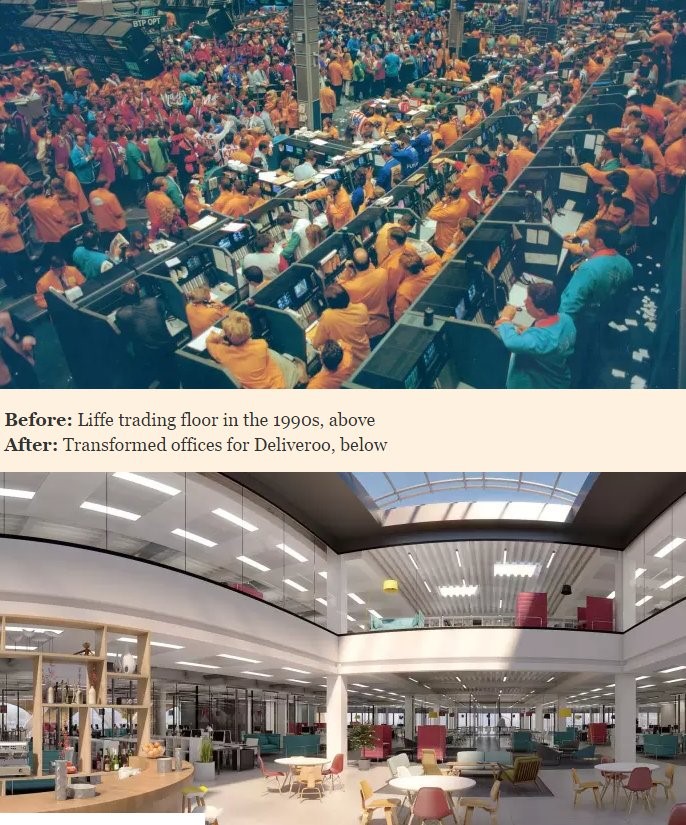

Mind you, all of this nostalgic looking back to 1975, did not move me as much as the image this week that appeared in the FT, of the old London futures exchange.

It is now the global headquarters of the seven-year-old start up Deliveroo.

Ironically, Deliveroo was originally going to be called ‘Boozefood’ and their aim starting out was to deliver late night kebabs to the very same lairy jacketed, boozed up floor traders that their new office has now replaced.

I must admit, that image of all those traders did actually bring a nostalgic tear to my eye, as I used to trade the FTSE100 futures contract with those very traders at £25 per point, per contract.

You could go long or short with them in 1,000 contracts and every one-point movement equalled £25,000 plus or minus to the old bank balance, and copious amounts of Grecian 2000 was consumed to try and keep them all looking young.

And talking of the FTSE100, this week it was announced that Marks and Spencers was going to be removed from the index, for the first time since 1984.

At their peak in 1998, they produced a pre-tax profit of £1 billion and now sadly, 21 years later, it is to be replaced by a Russian Mining Company.

The online retailers are gonna get you one way or another.

Though there’s nothing like trying to hold on to the past. Just like Bert Newton’s wig, the suburb of Morley in WA was managing to do just this, with the second last Blockbuster video store in the world, before their owners finally closed the doors in March 2019.

At its peak in 2004, Blockbuster had 9,094 stores and employed 84,300 people.

News out this week stated that by the end of the year, Australia will have seven subscription streaming services: Netflix, Stan, Amazon Prime, Hayu, Foxtel Now, 10 All Access, Disney Plus and Apple TV Plus, and not a video store in sight.

Somehow, ‘just gonna watch Disney Plus ‘n chill’ doesn’t seem to conjure up the same connotations as ‘just gonna watch Netflix ‘n chill’.

We shall just have to wait and see if the former just means ‘new age munching on avocado and toast and watching repeats of Born Free’.

PS. There is a classic 1985 BBC2 documentary which follows three FX traders trading $US1 billion around the world, pre mobile phones and smoking allowed at the desk.

If you take out all of the nostalgic bits and watch it openly, you will see why nothing has really changed at all. It’s 30 mins long, but if you have the time, it’s worth the education.