With its tech build done and record lending volumes in Q4, Propell is geared up to really start climbing Mount Revenue

Tech

Tech

Propell continues to deliver growth, and has notched up record lending volumes in the last quarter. With its technology build now complete, the company says it’s time to focus on revenue growth.

Aussie finance platform Propell Holdings (ASX:PHL) has been delivering growth for the past year, and the latest Q4 result was no different.

The SME-focused lender has hit every growth metrics in the last quarter, notching up record lending volumes in the process.

The number of customers on its platform increased to over 2,150 SMEs, a growth of 30% QoQ (quarter-on-quarter), and more than 320% against the pcp (previous corresponding period).

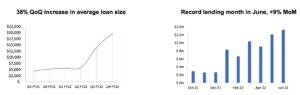

The rising number of customers has resulted in record lending volumes of $3.4 million, an increase of 35% QoQ, and more than 320% rise from the pcp.

Lending was also driven by an increase in the average loan size, a key indicator often used to gauge customer quality as well as a lender’s ability to scale the business.

During the quarter, Propell’s average loan size increased by 40% QoQ to just under $20,000, which also represents a 278% increase on the pcp.

The record growth was also underpinned by the launch and ongoing success of Propell’s new Line of Credit products (6 month and 12 month), which has received excellent feedback from customers.

The new product, called Business Loans, was launched on the back of stirring customer demand, and some strong early results following its trial deployment.

Business Loans provides a fixed dollar amount over a fixed-term that can be used by SMEs for specific business purposes like buying assets or equipment.

The product was launched initially as unsecured loans, but over time Propell says it will add secured loan options, giving customers more choice in accessing capital.

The Business Loan product leverages Propell’s existing leading credit decisioning engine, as well as its broader loan management system – two key components of the company’s proprietary financial services platform.

During the quarter, the company continued to make significant developments to the platform, completing the majority of projects outlined at IPO at or ahead of time.

Some of the platform improvements made include the simplifying of customer onboarding, streamlining customer management, and automating the lending process.

The debt collection process has also been improved, freeing the collections team to focus on high-value tasks.

The company believes that ultimately, its superior technology will enable volume growth without having to increase headcount, allowing it to focus on scaling up revenue even faster.

Propell says that its solid financial performance has been a direct reflection of the strategic investments the company has made in technology throughout its journey.

These investments have now allowed management to shift focus away from product development to driving revenue growth.

For the coming quarter, Propell wants to focus on growing its customer base through both direct acquisition and partnerships, and to further increase its loan book.

It also wants to focus on growing its Lending, Insights and Small Business Card & Account platforms.

Ultimately, the board’s strategic focus remains on becoming the go-to finance solution for small businesses – a single place where businesses can live their entire financial life in a simple, 100% digital way free from the constraints of traditional banks.

Propell says the longer term goal is to reach 100,000 clients in five years.

This article was developed in collaboration with Propell, a Stockhead advertiser at the time of publishing.

This article does not constitute financial product advice. You should consider obtaining independent advice before making any financial decisions.